This article provides an in-depth analysis of the key states and trends in the cryptocurrency industry, covering important market dynamics such as the rise of AI agents, the development of decentralized exchanges, and Bitcoin consolidation.

Author: @arndxt_xo

Translation: Baihua Blockchain

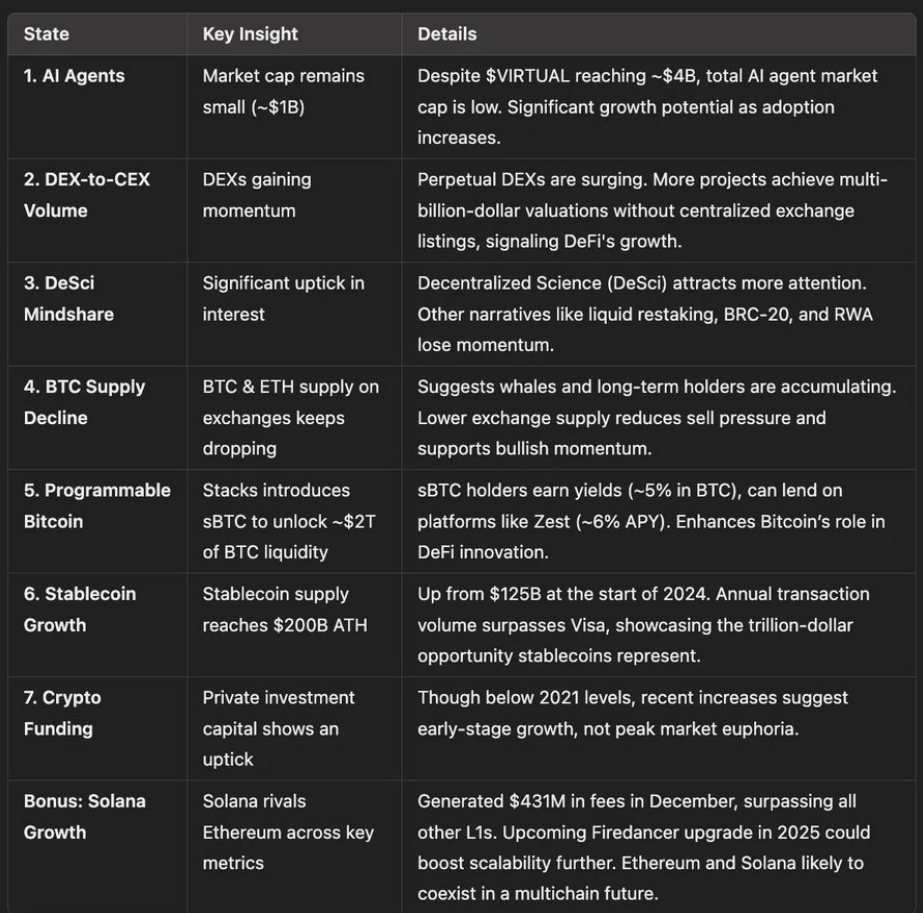

In this article, I will analyze 8 key states of the cryptocurrency industry, distilling important insights into market development and exploring 6 trends that are shaping the future trajectory of the crypto industry.

We will discuss the rise of AI agents, the resurgence of memecoins, the consolidation of Bitcoin, and the explosive performance of Solana.

Next, we will break these down into 8 important observations and 6 eye-catching trends, revealing key changes in the market.

1. 8 States of the Cryptocurrency Industry

The following image summarizes the table of contents.

1) The Market Size of AI Agents Remains Relatively Small

Despite the market capitalization of Virtuals (an AI agent launch platform) soaring to about $4 billion, the total market capitalization of AI agents themselves is only about $1 billion. Although AI agents have recently been one of the hottest topics, there is still significant room for growth in the market as adoption and attention continue to rise.

2) Surge in Trading Volume on Decentralized Exchanges (DEX) vs. Centralized Exchanges (CEX)

Perpetual DEXs are particularly popular, with an increasing number of projects achieving billion-dollar valuations without relying on centralized exchanges for listing. This marks a significant step towards a truly decentralized trading ecosystem, showcasing the broader prospects of DeFi.

3) Rising Interest in Decentralized Science (DeSci)

Interest in decentralized science (DeSci) has significantly increased, attracting more developers and researchers. While some narratives (such as liquid staking, BRC-20, modularity, L2, and RWA) have weakened, the rapid rise of DeSci may signal new innovation opportunities.

4) Declining Bitcoin Supply on Exchanges

The proportion of BTC (and ETH) on exchanges continues to decline, indicating that large holders and long-term investors are increasing their positions. A reduction in supply on exchanges typically alleviates selling pressure, thereby driving bullish momentum in the market, especially for Bitcoin.

5) Programmable Bitcoin via sBTC on Stacks

Stacks has launched sBTC, a 1:1 Bitcoin-backed asset designed to unlock approximately $2 trillion in Bitcoin liquidity for DeFi. Holders of sBTC can earn underlying yields (around 5% Bitcoin yield) and can borrow against it on platforms like Zest, with annualized returns of about 6%, and more investment opportunities are on the horizon. This provides a practical way to "make Bitcoin work," potentially driving more Bitcoin-centric DeFi innovations.

6) Stablecoin Supply Surpasses $200 Billion Historical High

The supply of stablecoins has increased from $125 billion at the beginning of 2024 to $200 billion. The annual trading volume of stablecoins has already surpassed that of Visa, continuing to demonstrate that they represent a burgeoning trillion-dollar opportunity.

7) Monthly Growth in Crypto Funding

Although still below the peak levels of 2021, the influx of investment capital has noticeably increased. Historically, capital inflows typically occur at market tops, and the current growth trend suggests that we are still in the early stages of a growth cycle, not yet reaching a state of extreme market optimism.

8) Bonus: The Rapid Rise of Solana

In December 2024, Solana generated $43.1 billion in transaction fee revenue in a short period, surpassing the total of all other L1s combined. Solana's activity is comparable to Ethereum across multiple key metrics, and the upcoming Firedancer upgrade may further enhance its scalability and network utilization. It is becoming increasingly clear that Ethereum and Solana can (and likely will) coexist in a multi-chain future.

2. 6 Narrative Trends

1) Bitcoin Consolidation and Potential Bottom

Bitcoin has been trading in the range of $94,000 to $95,000, frequently dipping below $94,000 and touching $93,000, which has frustrated traders. Currently, Bitcoin's price hovers around $97,000. The recent accumulation near $94,000 suggests a potential bottom, but a retracement to $88,000 to $92,000 remains possible. If Bitcoin rises, altcoins are expected to perform better, similar to the bull market of 2021.

2) AI Agents Dominating Market Narratives

Key Performer: VIRTUAL, an AI agent launch platform on the Base platform, doubled its market cap from $2.5 billion to $5 billion in just 10 days. Important projects in the ecosystem: AIXBT: an agent based on Twitter, increased from $300 million to $600 million. GAME: nearing a market cap of $400 million. AI16Z (based on Solana): increased from $1 billion to $2.5 billion. Other notable projects include $ZEREBRO ($800 million), $GRIFFAIN ($470 million), and $ARC ($400 million). AI agents are leading a new wave of innovation, attracting significant attention and investment.

3) The Return of Memecoins and Murad Coin

Emerging Star Projects: $$SPX$$ and $$GIGA$$ have both reached all-time highs, with $SPX surpassing $1 billion and $GIGA reaching an $800 million market cap. KEKIUS: saw its market cap soar to $400 million after Elon Musk changed his Twitter avatar, but quickly retraced by 75%. Memecoins like WIF, POPCAT, and FWOG may be poised for a resurgence.

4) Highlights in the Altcoin Market

Dinosaur Coins: $$XRP (+15%)$$ and $$XLM (+35%)$$ continue to perform strongly. Fantom to Sonic Network: $$FTM is rebranding$$, initially plummeting to $0.66 before rebounding, possibly signaling a potential long-term opportunity. CEXToken: BGB has quadrupled since December, currently valued at $7.5 billion. GT has increased by 50% since December.

5) Notable Performers and New Issuances to Watch

Fuel Network ($FUEL): a new L2 network showing strong potential. MORPHO: continues to set new highs. Other new coins to watch: $$PEAQ$$, $$USUAL$$ (strong), VANA, XION (bouncing back).

6) Strange Price Volatility

UXLINK: extremely volatile, initially surging (+140%) before quickly retracting. MOCA: experienced a frenzy of price surges and sell-offs after being listed on BN.

3. Some Newly Launched Projects This Week

Finally, here are some emerging projects that you may be interested in following up on for further insights.

@AlwaysBeenChoze

@marvellousdefi_

@Trong0322

@YashasEdu

@0xHvdes

@defiantdegen

@meekdonald_

@twindoges

@belizardd

@0xelonmoney

@0xAndrewMoh

@thesmartape

@andrewtalksdefi

@Foxi_xyz

@0xxbeacon

@Karamata2_2

@izu_crypt

@Mars_DeFi

@TheDeFiPlug

@cchungccc

@zordcrypt

@DeRonin_

@ahboyash

@Flowslikeosmo

@CryptoStreamHub

@stacy_muur

@crypthoem

@momochenming

@nihaovand

@0xcryptowizard

@Alvin0617

@0xWatell

@wsdxbz1

@Frogling68

@jackvi810

Article link: https://www.hellobtc.com/kp/du/01/5623.html

Source: https://x.com/arndxt_xo/status/1875847733925556723

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。