From Grassroots to Universality, From Chaos to Order, From Recession to Bubble, From Conservatism to Reform.

Author: @Web3_Mario

Abstract: I would like to express my sincere gratitude for everyone's support over the past year. I apologize for the delay in my year-end summary; I was occupied with various matters. I have also spent a long time contemplating the perspectives from which to share my insights from the past year. Ultimately, I believe it is more authentic to share my thoughts and feelings from the viewpoint of an ordinary Web3 entrepreneur still striving on the front lines. Overall, looking ahead to 2024 and 2025, I think it is quite fitting to summarize the year with four phrases: from grassroots to universality, from chaos to order, from recession to bubble, and from conservatism to reform. Next, I will share my reflections and outlook using some events that I consider representative.

From Grassroots to Universality: The Approval of the BTC Spot ETF Marks the Beginning of the Universal Path for Crypto Assets

Reflecting on 2024, I believe the most unusual transformation in the crypto world is the upgrade from a niche subculture product to an asset class with universal value. This journey can be traced back to two landmark events: the first was the BTC spot ETF approval on January 10, 2024, which was officially passed following three months of deliberation and the SEC's approval. The second was on November 6, 2024, when the crypto-friendly Donald Trump was successfully elected as the 47th President of the United States during this election cycle. The corresponding impacts of these events can be seen in the two significant price movements of BTC this year. The former raised BTC's price from the $30,000 range to $60,000, while the latter was instrumental in pushing BTC from $60,000 to $100,000.

The most direct impact of this transformation is on liquidity. More abundant liquidity naturally benefits the price trends of risk assets, but the process and motivation for attracting liquidity differ from the bull market of 2021. In the 2021 crypto bull market, the main driving force was the higher capital efficiency brought about by the deregulated nature of crypto assets, which allowed the crypto sector to capture the excess liquidity generated by the Biden administration's $1.9 trillion economic relief plan more effectively, resulting in extraordinarily high speculative returns.

However, in the current bull market that began in 2024, we can see a shift in the entire transmission process. The "influential capital" attracted during the 2021 bull market, along with newly established vested interests, has formed a new interest group that is actively exerting greater political influence, including numerous crypto policy lobbying groups and massive political donations. I have previously conducted a more in-depth analysis of this in my article “In-Depth Analysis of the Value of World Liberty Financial: A New Choice Amid Trump's Campaign Funding Disadvantages”.

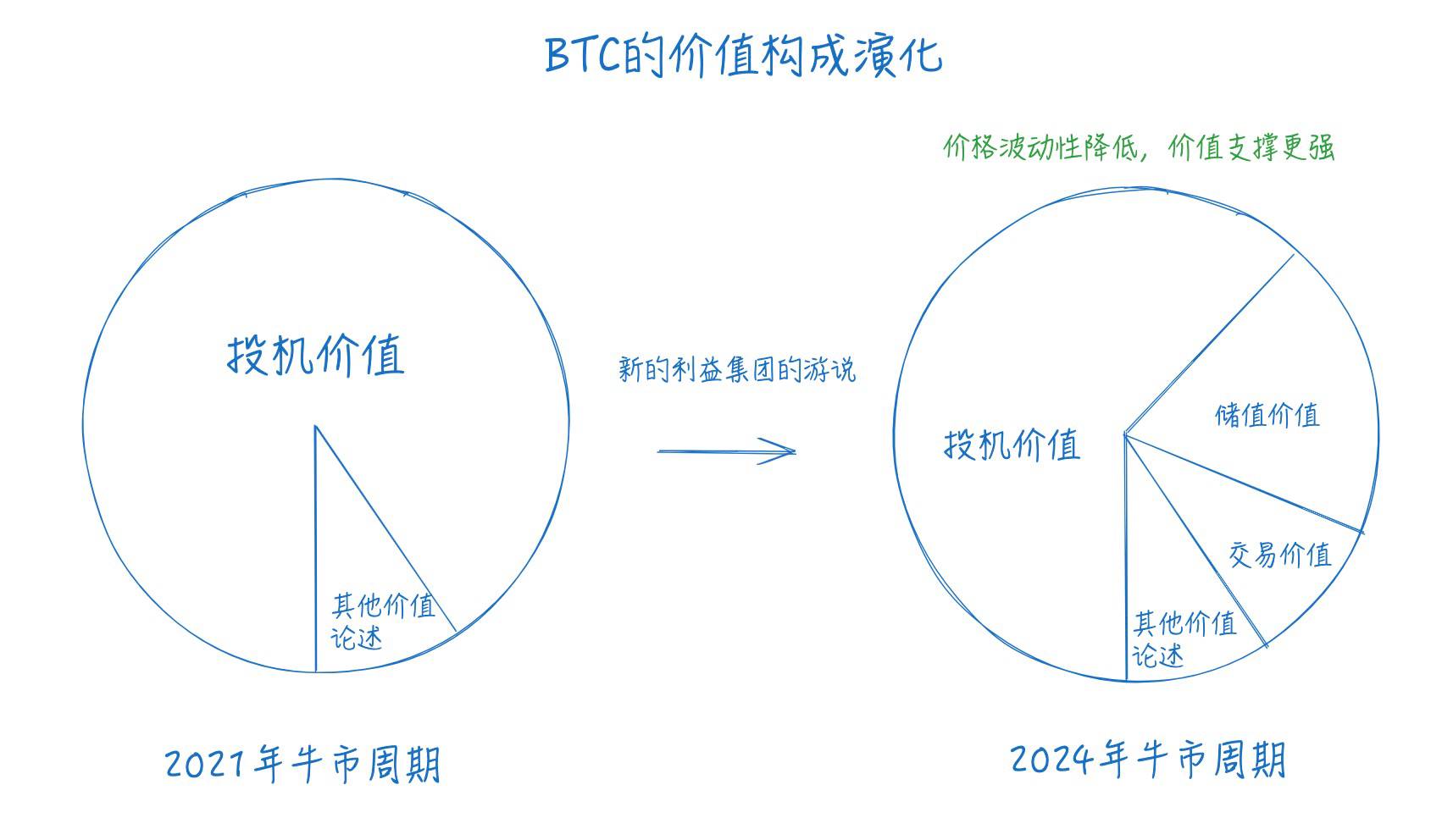

The most direct benefit of this is that it has become possible to efficiently promote the universal value of cryptocurrencies through political means. Therefore, in this cycle, you will see iterative discussions about the value of crypto assets emerging, with more traditional elite classes and mainstream media labeling themselves as "crypto-friendly." This transformation from "grassroots" to "universality" has also profoundly influenced the motivation for attracting liquidity, regardless of whether the viewpoints are sufficiently substantiated (as discussed in previous articles, “In-Depth Analysis of the Underlying Reasons for Current Crypto Market Volatility: Value Growth Anxiety After BTC Hits New Highs”). In this round, the purchasing power for BTC, aside from speculation, indeed includes more terms like "store of value" and "anti-inflation," which will reduce the cyclical and volatile nature brought by speculative attributes in crypto assets, making the value support more robust. Currently, the only crypto assets benefiting from this positive change appear to be a few blue-chip assets, including BTC, but the transmission effects brought by the multiplier effect will benefit the entire crypto asset market to some extent. A diagram may illustrate this transformation more intuitively.

In addition to the impact on the upper class, this evolution has also brought a significant positive mindset shift for many practitioners, including myself. The most direct example is that when friends and family outside the industry inquire about your field, you no longer have to nervously explain that you are not a criminal or a nouveau riche, but can now proudly introduce your profession or career. This shift in mindset will also make the influx of talent more positive, significantly reducing friction costs in processes such as seeking partners for entrepreneurship, recruiting talent, and collaborating with traditional industries. Therefore, I am very confident about the future development of the industry.

Finally, I would like to mention some outlooks on this narrative path. In mid-2025, discussions about the value of crypto assets represented by BTC will become more positive. In previous articles, I have analyzed BTC's value as a store of value and its potential to succeed AI as the core of growth in the U.S. stock market. Therefore, it is essential to remain sensitive to relevant information, which may include the following aspects:

- Progress on Bitcoin reserve-related legislation at the national, regional, organizational, and corporate levels;

- Statements or viewpoints expressed by key political figures with influence;

- The allocation of BTC on the balance sheets of U.S. listed companies;

From Chaos to Order: The Regulatory Framework for the Crypto Industry in Sovereign Nations Will Further Improve, Providing Evidence for Web3 Business Scenarios to Break Out

My second observation path is "from chaos to order." For a long time, a core narrative in the cryptocurrency industry has been its resistance to censorship due to decentralization and anonymity. You can find similar discussions in most Web3 applications from the previous cycle, which naturally contributed significantly to finding value support for the Web3 industry in its early stages, but it also brought considerable harm to the industry, such as fraud and money laundering.

However, I believe the industry will iterate in this direction. It is not about completely abandoning Web3 fundamentalism; rather, I think the current crypto industry will undergo a transformation from chaos to order, accompanied by the further improvement of the regulatory framework for the crypto industry in sovereign nations. We know that among the many "crypto gaming hotspots" in 2024, the change in SEC Chairman Gary Gensler has attracted considerable attention. For a long time, this crypto-unfriendly chairman oversaw the SEC's lawsuits against numerous U.S. crypto companies, such as Ripple and Consensys, creating bottlenecks for these giants' business operations and expansions. In my previous article “Buy the Rumor Series: Expectations for Improvement in the Regulatory Environment Heat Up, Which Cryptocurrency Benefits Most Directly?”, I clearly analyzed the progress in this direction using Lido as an example.

However, with Trump's presidency and his deregulatory policy preferences, combined with Gensler's departure, a more lenient, inclusive, and crypto-friendly regulatory framework is to be expected. Based on recent case rulings, such as those involving Ripple and Tornado Cash, the introduction of this framework is not far off.

The most direct benefit of this change is that it will provide a basis for Web3 business scenarios to break out without bearing many potential legal risks. In the upcoming year of 2025, I will pay special attention to the progress of such events, and everyone should remain sensitive to similar information, including the outcomes of other lawsuits, the introduction and advancement of relevant legislation, changes in SEC personnel appointments, and statements and viewpoints from key decision-makers. Regarding potential breakout businesses, I am particularly interested in two areas:

Ce-DeFi Scenarios: Connecting traditional financial tools with on-chain tools like crypto assets to solve issues of capital efficiency and reduce transaction friction costs. From the direction of capital flow, this can be divided into two categories: one is the flow from the traditional financial world to on-chain crypto assets, such as MicroStrategy's financial innovations. The other is the transmission of on-chain crypto assets to the traditional financial world, specifically referring to bond-based RWA, on-chain financing channels similar to Usual Money, and stablecoins in the TradeFi sector.

DAO in Off-Chain Entity Business Management Scenarios: This direction is somewhat speculative. Due to Trump's policies relaxing regulations related to cryptocurrencies and boosting domestic demand with "America First," will more organizations or companies leaning towards traditional businesses choose to use the DAO model for internal governance to obtain cheaper financial services? For example, if someone wants to open a Chinese restaurant, they could choose to operate through a DAO and integrate a stablecoin-based payment system, making all cash flows transparent. If regulatory policies are further relaxed, the company's financing and dividend processes could also be managed through the DAO.

From Recession to Bubble: Traditional Web3 Business Development Focuses on Three Main Axes: More Innovative Grand Narratives, More Robust Business Revenue, and More Balanced Interest Game Models

My third observation path is "from recession to bubble." We know that in 2024, traditional Web3 business hotspots underwent a significant transformation. In the first half of the year, represented by the LRT market driven by EigenLayer, the industry exhibited characteristics of a recession. Due to the lack of a general profit-making effect, in the context of stock game dynamics, capital clustered together, choosing to concentrate on a few potential markets with enormous scale but longer-term actual business implementation in the Infra sector, trading time for space, raising valuations, and employing "points strategies" to avoid dilution of shares, thus exploiting users, as analyzed in my previous article “Web3 Oligarchs Are Exploiting Users: From Tokenomics to Pointomics”.

However, with the improvement of market conditions in the middle of the year and the underwhelming performance of LRT token prices, the focus gradually shifted to the application layer represented by TON Mini App. Compared to Infra, the application layer, with more target options, lower development costs, shorter implementation cycles, and more easily manipulable iterative benefits, has gained favor from capital. At this point, the market quickly emerged from the shadows of the recession.

As we entered the second half of the year, with the Federal Reserve entering a rate-cutting cycle and the FUD issues surrounding VC coins, the traditional capital exit paths were disrupted, leading the market to quickly enter a bubble phase. Capital began to chase after meme coins, which have shorter exit cycles, in pursuit of higher capital turnover rates. In addition to meme coins themselves, launch platforms represented by Pumpfun and new tools incorporating narratives like AI Agents are also being pursued by the market.

Looking ahead to the coming year, I believe traditional Web3 businesses will develop according to the patterns of a bubble cycle:

More Innovative Grand Narratives: We know that capital tends to chase high-growth sectors, primarily due to their immense imaginative potential and the tolerance for current delivery, allowing valuation bubbles to inflate further. This also makes it easier to attract market traders and new capital, enabling investors to exit through secondary markets at opportune moments. Therefore, regardless of whether one recognizes the long-term value of a particular sector, as long as it is logical, it can become a target for capital speculation during a bull market bubble. Thus, from the perspective of chasing capital gains, one should remain sensitive to these developments.

More Robust Business Revenue: For some sectors that have undergone a round of iteration, valuation models will revert to reasonable ranges, and the pursuit of real income will become the main theme of industry iteration. This raises higher demands for refining commercially viable needs, but if a particular scenario can be genuinely explored, the market potential will be limitless. Here, I specifically refer to the DeFi sector or Ce-DeFi sector. Personally, I am quite interested in the interest rate trading market, and I welcome discussions with anyone who shares similar ideas.

More Balanced Interest Game Models: We know that traditional VC coins are currently facing FUD, and many issues stem from the traditional financing model, which has created a prisoner’s dilemma in the game relationship between project parties, primary market VCs, and secondary market investors. Each "prisoner" believes the other may betray them, leading to a choice to betray (to ensure their own release or reduce their punishment). Therefore, in the new environment, finding a more optimal model is also worth attention. For example, I believe HyperLiquid may have discovered some of these secrets, which will be a key focus of my research moving forward.

From Conservatism to Reform: Rare Opportunities for Risk Assets Amidst Great Uncertainty

My fourth observation path is "from conservatism to reform." It is important to clarify that both conservatism and reform are neutral terms here; conservatism refers to compliance with existing rules, while reform implies breaking them. The main theme of 2025 will undoubtedly be significant changes in the economic and cultural fields triggered by political reform, a process filled with uncertainties arising from the collapse of the old order. Examples include uncertainties surrounding the U.S.-China government debt crisis, uncertainties in monetary policies of various countries, changes in mainstream social values, and uncertainties in international relations.

These uncertainties lead to significant volatility in the risk market. Of course, if sector rotation places the industry in a positively driven state, this volatility can be beneficial; conversely, it can be detrimental. A recent news flash piqued my interest in this direction: the FTX restructuring plan is set to take effect on January 3, allowing users to begin receiving repayments.

We know that in the previous cycle, the mainstream political spectrum in the tech industry leaned more towards the Democratic Party. Therefore, I believe many prominent figures who entered during the last bull market may not fare well after Trump's return. Thus, it is understandable that they would try to inflate related prices during the window before his official inauguration, treating their held risk assets as a hedge to escape potential losses. Here, I will indulge in a bit of conspiracy theory: some Deep State capital suffered significant losses due to the FTX bankruptcy and the collapse of the crypto industry. Therefore, after Trump's victory, they might resort to various political means to inflate crypto asset prices to an exaggerated level, thereby reviving some already devastated balance sheets and avoiding their own losses.

From the FTX case, I have also gained some insights. Therefore, in 2025, I am quite interested in the development of the NFT sector, as it seems there are some similarities between the two. Coupled with new speculative narratives like AI Agents, it is not impossible for the NFT market to experience a second spring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。