Overview of AI Agent Technology

AI Agent technology is an important development in the field of artificial intelligence in recent years, especially showing great potential in the financial industry. AI Agents can not only automate complex tasks but also continuously enhance their capabilities through learning and data analysis. Their applications in the financial sector include intelligent investment advisors, risk management tools, and market analysis systems. Although AI Agents have significant advantages in improving efficiency and decision support, they also face limitations such as technical risks and ethical issues.

Definition and Characteristics of AI Agents

An AI Agent refers to an artificial intelligence system with autonomous decision-making capabilities, able to perceive the environment, make decisions, and execute tasks. Compared to traditional AI applications, AI Agents have a higher level of autonomy and intelligence, capable of multi-step planning and task execution in complex environments. Their main characteristics include:

- Autonomy: AI Agents can complete tasks independently without continuous human intervention.

- Learning Ability: Through continuous learning and data analysis, AI Agents can improve their skill levels in specific areas.

- Multi-modal Interaction: AI Agents can interact with users in various ways, including voice, text, and images.

Applications of AI Agents in the Financial Sector

The application of AI Agents in the financial sector is rapidly expanding, mainly reflected in the following areas:

- Intelligent Investment Advisors: AI Agents can analyze market data and provide personalized investment advice, helping investors make more informed decisions.

- Risk Management: By monitoring market dynamics in real-time, AI Agents can identify potential risks and propose corresponding response strategies, thereby enhancing the risk management capabilities of financial institutions.

- Market Analysis: AI Agents can process large amounts of data and conduct in-depth analysis, helping financial institutions better understand market trends and customer needs.

These applications not only improve the efficiency of financial services but also provide customers with a more personalized experience.

Advantages and Limitations of AI Agents

The application of AI Agents in the financial sector brings many advantages but also has certain limitations.

Advantages:

- Increased Efficiency: AI Agents can automate the handling of a large number of repetitive tasks, significantly improving work efficiency.

- Data Analysis Capability: AI Agents possess strong data processing and analysis capabilities, able to extract valuable information from vast amounts of data.

- Personalized Services: By analyzing user behavior and preferences, AI Agents can provide more personalized financial services.

Limitations:

- Technical Risks: The complexity of AI Agents may lead to system vulnerabilities and security risks, especially when handling sensitive financial data.

- Market Manipulation and Ethical Issues: The decision-making process of AI Agents may be influenced by data biases, leading to unfair market manipulation phenomena.

- Regulatory Challenges: With the widespread application of AI Agents, financial regulatory agencies face new challenges and need to formulate corresponding regulations to ensure market fairness and transparency.

In summary, the application prospects of AI Agents in the financial sector are broad, but caution is needed to address their potential risks and challenges during promotion.

Impact of AI Agents on the Cryptocurrency Market

The impact of AI Agents on the cryptocurrency market is mainly reflected in the improvement of trading efficiency, enhancement of market analysis and forecasting capabilities, and improvement of risk management and security. By utilizing advanced AI technologies, these smart agents can optimize trading processes, provide more accurate market forecasts, and enhance risk control capabilities. Below is a detailed analysis of these three aspects.

Improvement of Trading Efficiency

AI Agents significantly enhance trading efficiency through the automation of trading processes and real-time data analysis. Traditional trading methods often require human intervention, which is time-consuming and prone to errors, while AI Agents can make trading decisions and execute them within milliseconds, thereby reducing trading delays and the possibility of human errors. For example, applications like AIXBT and DegenAI analyze market information on social media to quickly formulate trading strategies, helping users seize opportunities in a rapidly changing market. This efficient trading method not only increases the success rate of users' trades but also brings higher liquidity to the market.

Enhancement of Market Analysis and Forecasting Capabilities

AI Agents have also significantly improved their capabilities in market analysis and forecasting. By analyzing large amounts of historical data and real-time market information, AI Agents can identify potential market trends and investment opportunities. For instance, VaderAI conducts real-time market research using on-chain and off-chain data to optimize investment strategies, helping users make more informed investment decisions. Additionally, AI Agents can capture changes in market participants' emotions through sentiment analysis tools, allowing for more accurate predictions of market trends. This enhanced analytical capability enables investors to make more forward-looking decisions in complex market environments.

Improvement of Risk Management and Security

The application of AI Agents in risk management and security has also positively impacted the cryptocurrency market. By monitoring market dynamics and user trading behavior in real-time, AI Agents can promptly identify potential risks and take corresponding measures. For example, AI Agents can detect abnormal activities by analyzing trading patterns, thus preventing fraud and market manipulation. Furthermore, AI Agents can help users develop personalized risk management strategies, automatically adjusting investment portfolios based on market changes to reduce investment risks. This intelligent risk management approach not only enhances users' sense of security but also strengthens the overall stability of the market.

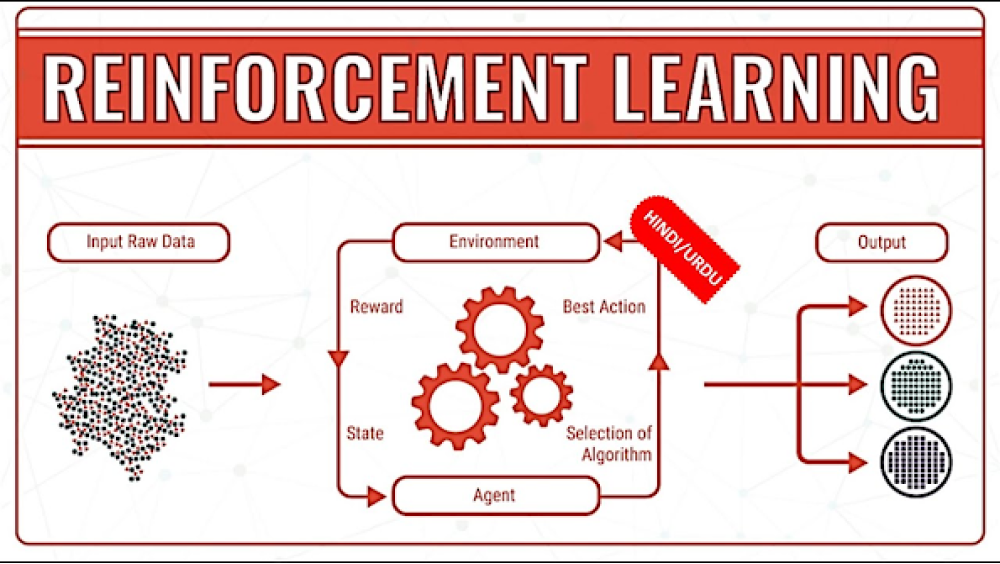

Reinforcement Learning

Reinforcement Learning (RL) is a technique that learns the best strategies through trial and error. In a dynamic market, price fluctuations and changes in trading volume are uncertain factors. AI agents can simulate different market environments, repeatedly train and optimize their decision models to:

- Adjust strategies in real-time: Dynamically update investment portfolios based on market changes.

- Identify potential risks: Avoid overly aggressive or conservative operations.

- Maximize long-term returns: Learn how to profit under complex conditions through a reward mechanism.

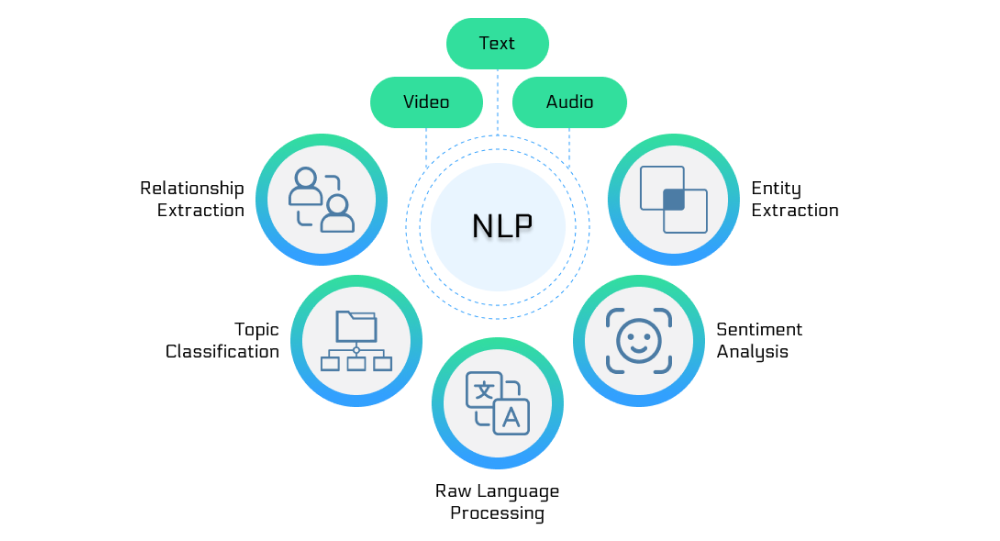

Natural Language Processing

Market sentiment is often reflected through unstructured data such as news and social media, and Natural Language Processing (NLP) technology enables AI agents to:

- Quickly analyze public sentiment: Scan platforms like Twitter, Reddit, and news reports to identify hot topics and potential trends.

- Quantify sentiment: Convert market sentiment towards a particular asset (optimistic, pessimistic, neutral) into trading signals.

- Capture sudden events: Anticipate the impact of major news on the market.

Large-scale Computing

The trading market is ever-changing, and the efficient operation of AI agents relies on large-scale computing capabilities:

- Rapid data processing: Millisecond-level analysis of vast market data, including prices, depth charts, order books, etc.

- High-frequency trading support: Processing thousands of trading requests per second under complex algorithms to seize market opportunities.

- Optimizing computational models: Distributed computing clusters ensure real-time updates of AI models, continuously improving performance.

In summary, the application of AI Agents in the cryptocurrency market not only enhances trading efficiency but also strengthens market analysis and forecasting capabilities, and improves risk management and security. These changes provide investors with a safer and more efficient trading environment, promoting the healthy development of the entire market.

Case Studies of AI Agents in the Cryptocurrency Market

In the cryptocurrency market, the application of AI Agents is continuously expanding, mainly reflected in automated trading systems, the integration of smart contracts and blockchain technology, and market sentiment analysis tools. The following will explore specific application cases in these areas.

Automated Trading Systems

Automated trading systems are one of the most prominent applications of AI Agents in the cryptocurrency market. These systems utilize algorithms and machine learning technologies to execute trades within milliseconds, capturing opportunities brought by market fluctuations. By analyzing market data in real-time, automated trading systems can automatically buy or sell cryptocurrencies based on preset strategies, significantly improving trading efficiency and accuracy.

For example, AIXBT, as an AI analysis agent, can track the dynamics of over 400 cryptocurrency influencers to predict market trends and provide actionable investment insights. This real-time data analysis capability allows traders to respond quickly in a rapidly changing market, thereby increasing the likelihood of profitability.

Integration of Smart Contracts and Blockchain Technology

Smart contracts are a core component of blockchain technology, and the introduction of AI Agents makes the application of smart contracts more intelligent and automated. With AI Agents, users can more easily create and manage smart contracts, lowering the technical barrier. For example, Clanker is an AI Agent based on the Base blockchain that allows users to deploy ERC-20 standard tokens and set up liquidity pools with liquidity locking by simply interacting with it on social platforms. This simplified process not only enhances user experience but also encourages more users to participate in the creation and trading of cryptocurrencies.

Moreover, the automatic execution feature of smart contracts combined with the decision-making capabilities of AI Agents can implement more complex trading strategies and condition triggers, further enhancing market liquidity and efficiency.

Market Sentiment Analysis Tools

Market sentiment analysis tools are another important application of AI Agents in the cryptocurrency market. These tools assess the emotions of market participants by analyzing social media, news reports, and other online content, providing valuable market insights for investors. For example, VaderAI focuses on DAO asset management, utilizing real-time on-chain and off-chain data analysis to provide 24/7 market research, helping users optimize their investment strategies. By monitoring market sentiment in real-time, investors can better grasp market trends and make more informed investment decisions.

Project Features: Numerai is a decentralized hedge fund that leverages the wisdom of global data scientists to optimize trading models. Through its unique "Numerai Signals" platform, users can submit machine learning-based predictive models and receive rewards based on their predictive performance.

AI Application Highlights:

- Denoised Data: By using encrypted decentralized data, personal biases are eliminated, focusing on pattern mining.

- Model Integration: Aggregating thousands of models globally, using AI for weighted and integrated predictive results, ensuring a more comprehensive trading strategy.

- Incentive Mechanism: Utilizing its native token $NMR to encourage data scientists to contribute high-quality predictions.

Real Impact: Numerai has built a more flexible and powerful hedge fund through crowdsourced predictive models, significantly enhancing the return potential of cryptocurrency investments.

Autonomous Next: AI-Driven Asset Management Tools

Project Features: Autonomous Next focuses on providing intelligent management solutions for cryptocurrency assets using AI technology. Its platform integrates market trend analysis, automated portfolio adjustments, and other functions to help investors optimize asset allocation.

AI Application Highlights:

- Asset Allocation Optimization: Adjusting investment portfolios based on real-time market data, reducing the risk of human intervention.

- Strategy Automation: Built-in algorithms can identify market opportunities and execute trades promptly.

- Risk Management: AI assesses potential risks and provides defensive strategy recommendations.

Real Impact: This tool helps investors achieve dynamic management of assets in the volatile cryptocurrency market, lowering the barriers to market entry and improving investment efficiency.

AlphaSense: AI-Powered Financial Intelligence Platform

Project Features: AlphaSense is an AI-based search and intelligence platform designed to help financial institutions and investors quickly access key market information.

AI Application Highlights:

- Intelligent Search: Quickly locate relevant information among millions of documents using Natural Language Processing (NLP) technology.

- Market Insight Generation: Analyze financial reports, news, social media, and other data to provide trend forecasts.

- Decision Support: Provide real-time market intelligence to institutional investors, improving decision accuracy.

Real Impact: AlphaSense, with its precise intelligence analysis capabilities, helps investors filter information more efficiently, optimize trading strategies, and mitigate risks.

Overall, the application cases of AI Agents in the cryptocurrency market demonstrate their tremendous potential in improving trading efficiency, simplifying smart contract management, and analyzing market sentiment. The combination of these technologies not only drives market development but also provides investors with more opportunities and tools.

Potential Risks of AI Agents in the Cryptocurrency Market

Technical Risks and System Vulnerabilities

AI Agents rely on complex technologies and algorithms, which pose the following technical risks:

- System Vulnerabilities: The cryptocurrency field highly depends on security, but AI Agents may become targets for cyberattacks due to code defects or unpatched vulnerabilities. For example, hackers may exploit vulnerabilities to tamper with data or steal funds, further triggering a crisis of trust.

- Data and Model Bias: If the training data for AI models is biased or insufficient, it may lead to prediction errors, such as misestimating market trends or investment risks, thereby exacerbating market volatility.

- Maintenance and Update Challenges: The rapid iteration of technology requires AI Agents to be continuously updated. However, frequent updates may introduce new vulnerabilities or compatibility issues, especially in a rapidly changing market environment.

Market Manipulation and Ethical Issues

The powerful capabilities of AI Agents may be misused, leading to market manipulation and ethical risks:

- Market Manipulation: High-frequency algorithmic trading and data manipulation are major concerns. Some institutions may use AI Agents to influence market prices in a very short time, disrupting the decisions of other investors. For example, behaviors like "wash trading" or "painting the tape" may be automated through AI, further disrupting market fairness.

- Lack of Decision Transparency: The "black box" nature of AI Agents makes it difficult to trace their decision-making basis, leading to doubts about their reliability among investors. This lack of transparency may undermine the trust and confidence of market participants.

Regulatory Challenges and Legal Risks

The widespread use of AI Agents presents new requirements for global regulatory agencies, with the following key issues and international comparisons:

Legal Liability Definition:

Currently, the liability of AI Agents is not clearly defined. For instance, when AI decisions lead to significant economic losses, who is responsible—the developer, the operator, or the user? This issue is difficult to clarify within the existing legal framework.

International Regulatory Policy Comparison:

- United States: The U.S. Securities and Exchange Commission (SEC) has strict regulations on algorithmic trading and the cryptocurrency market. For example, the SEC requires trading algorithms to be publicly filed and imposes severe penalties for market manipulation. AI Agents may need to meet higher transparency and compliance requirements.

- European Union: The proposed AI Act by the EU imposes strict compliance requirements on high-risk AI systems. Particularly in the financial sector, AI Agents must undergo risk assessments and possess traceability features to prevent market abuse.

- China: China has strengthened its regulation of financial technology and blockchain, focusing on data security and technology review. For example, the People's Bank of China requires higher scrutiny standards for algorithm-driven financial products and adopts a more cautious regulatory strategy for AI Agents involved in cross-border transactions.

Future Development Trends and Investment Opportunities

Future Development Directions of AI Agent Technology

Market Size and Technological Upgrades: According to forecasts, the AI Agent market is expected to grow at a compound annual growth rate of 44.8%, reaching a market size of $47.1 billion by 2030. In the future, AI Agents will achieve stronger autonomous reasoning capabilities, self-learning abilities, and multi-task collaboration capabilities, enabling them to make more complex decisions in challenging environments.

Integration of Blockchain and AI: The combination of AI Agents and blockchain technology will promote the efficient governance of decentralized autonomous organizations (DAOs). By introducing AI agent roles, DAOs can achieve automated proposal analysis, voting mechanism optimization, and resource allocation decision-making. For example, AI Agents can assess the potential impact of proposals, helping communities reach consensus quickly. At the same time, AI Agents can adjust contract execution conditions based on real-time market changes, making smart contracts more flexible and further improving efficiency.

Impact of Quantum Computing: With the development of quantum technology, traditional encryption methods may face security challenges, and AI Agents need to quickly adapt to these changes, such as developing quantum-resistant encryption protocols. The combination of quantum computing and AI may further enhance algorithm efficiency, promoting the application of AI Agents on larger datasets.

Innovation and Transformation in the Cryptocurrency Market

Precise Market Analysis and Forecasting: AI Agents, combined with Natural Language Processing (NLP) technology, can analyze social media, news updates, and on-chain data in real-time, providing investors with high-precision market sentiment analysis and trend forecasts. For example, AI can monitor community sentiment fluctuations to alert potential market changes.

Cross-Chain Collaboration in a Multi-Chain Ecosystem: In the future, the rise of multi-chain ecosystems will require AI Agents to support cross-chain technologies, such as managing assets and executing transactions across different blockchain networks. For instance, AI Agents can act as intelligent nodes in cross-chain bridges, optimizing transaction paths and reducing cross-chain operation costs.

Case Scenario: Investors can use AI Agents to optimize asset allocation across multi-chain networks like Ethereum and Solana with a single click, automatically tracking the highest-yielding DeFi protocols.

Enhancing Trading and Market Efficiency: High-frequency trading systems will be further optimized, with AI Agents using machine learning to identify short-term arbitrage opportunities while reducing trading latency. In the NFT market, AI Agents can also assess artwork value and predict trends, providing investors with precise recommendations.

Opportunities and Challenges for Investors

Opportunities: Emerging Markets and Tool Innovations: Investors can gain long-term returns by supporting AI-driven DAO projects that will reshape decentralized governance models. The intelligent analysis tools provided by AI Agents, such as automated asset allocation and real-time risk assessment, enable investors to diversify risks more efficiently.

Challenges: Competition, Regulation, and Technological Uncertainty: As AI Agents become more widespread, market competition intensifies, requiring traditional investors to possess stronger adaptability and technical knowledge. The regulatory landscape for cryptocurrencies and AI technologies varies across countries, and investors need to closely monitor policy dynamics in different regions to avoid compliance risks. The emergence of new technologies like quantum computing may alter the existing cryptocurrency market landscape, prompting investors to prepare in advance to address potential impacts.

Conclusion

The impact of AI Agents on the cryptocurrency market is profound. With continuous technological advancements and widespread applications, AI Agents not only enhance trading efficiency but also improve market analysis and forecasting capabilities, as well as risk management and security. Through in-depth research on the cryptocurrency market, we can observe the positive roles of AI Agents in various aspects, while also facing issues such as technical risks, market manipulation, and regulatory challenges. In the future, the technological development of AI Agents will bring more innovations and transformations to the cryptocurrency market, presenting new opportunities and challenges for investors.

Overall Impact of AI Agents on the Cryptocurrency Market

The introduction of AI Agents has significantly improved trading efficiency in the cryptocurrency market. Through automated trading systems, AI Agents can quickly respond to market changes and execute trading strategies, thereby reducing human errors and delays. Additionally, the capabilities of AI Agents in market analysis and forecasting have been enhanced, allowing for more accurate predictions of market trends through big data analysis and machine learning technologies. These advantages enable investors to better seize market opportunities and increase investment returns.

However, the application of AI Agents also brings potential risks. For example, technical risks and system vulnerabilities may lead to trading losses, while market manipulation and ethical issues could affect market fairness and transparency. Furthermore, regulatory challenges are also increasing, and how to promote technological innovation while protecting investor interests is an important issue that needs to be addressed in the future.

Future Research Directions and Recommendations

Future research should focus on the following areas: First, delve into the application cases of AI Agents in the cryptocurrency market, analyzing the factors behind their successes and failures to provide references for subsequent technological development. Second, pay attention to innovations in risk management and security related to AI Agents, exploring how to reduce potential risks through technological means. Additionally, study the integration of AI Agents with blockchain technology, examining their application prospects in smart contracts and decentralized finance (DeFi).

Investors should remain vigilant while focusing on the opportunities presented by AI Agents, keeping an eye on market changes and potential risks. Through reasonable asset allocation and risk management strategies, investors can achieve better returns in this rapidly evolving market. At the same time, policymakers and regulatory agencies should strengthen oversight of AI Agents to ensure market fairness and transparency, promoting the healthy development of the cryptocurrency market.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。