Author: Momir, IOSG

Schrodinger's cat is a very interesting thought experiment—simply put, this law summarizes that in quantum mechanics, a macroscopic object can exist in multiple states until you observe it. In the Schrodinger's cat experiment, the cat is placed in a sealed box, and until the box is opened, the cat can be in a superposition of being alive and dead. It is only when you open the box that everything "collapses" into one outcome: either alive or dead.

This experiment is quite similar to the current cryptocurrency market. Just like the cat in the box having two states simultaneously, the current crypto industry is also in an uncertain phase, with many possibilities coexisting for the future. Only when market fluctuations or external factors intervene will these possibilities turn into a clear reality.

The "Superposition" of Leading Assets

BTC

- Survival

BTC has the potential to solidify its position as a global reserve asset, truly realizing its vision of "digital gold." However, achieving this vision heavily relies on several key factors:

The U.S. government incorporates BTC into national reserves and begins purchasing BTC (low probability).

Multiple governments or central banks from the top 20 economies adopt BTC as a reserve asset (low to medium probability).

An increasing number of global publicly listed companies, influenced by MicroStrategy's success, begin converting large cash reserves into BTC (medium to high probability).

Systemic shocks (such as the collapse of governments or banks) enhance BTC's appeal as a hedge against risk, further strengthening its role as a "safe-haven asset."

- Death

If the above key scenarios are not realized, BTC's future momentum may be weakened:

Government indifference: If major economies show no interest in BTC, market sentiment may turn pessimistic, shifting attention from chasing new highs to whether large holders like MicroStrategy will cash out or even sell off.

MicroStrategy's risk: Currently, MicroStrategy is a strong supporter of BTC, but if its leveraged operations lead to significant market sell-offs, it could become a "burden" for BTC. Remember how giants like Alameda Research and Three Arrows Capital (3AC) were wiped out by the market? Once the liquidation line is triggered, shorts will smell blood and pursue targets, triggering wave after wave of sell-offs. If MicroStrategy follows this path, the situation could spiral out of control.

Technical issues: Whether BTC can cope with the challenges posed by quantum computing is also a major concern. If BTC cannot adapt to this new risk, it will not be able to serve as a secure, immutable store of value.

BTC is currently in a kind of quantum superposition, either becoming the cornerstone of the crypto economy or being seen as outdated technology—everything depends on market sentiment, ultimately leading to which outcome it will "collapse" into.

ETH

- Survival:

ETH is expected to dominate the blockchain space in the future and further strengthen its position as a "programmable BTC alternative." So why might institutional investors focus more on ETH next? There are many reasons:

Institutional interest: ETH has a very high level of decentralization. Apart from BTC, it may be the only blockchain asset that governments and institutions are willing to accept.

Quantum resistance: In the long run, ETH is more likely than BTC to transition smoothly to a quantum-resistant phase. We expect ETH's transition to be much smoother than BTC's.

Sustainable economy: ETH has a large amount of on-chain activity, generating natural fees that provide a stable income stream for validators and miners. Its flexible tokenomics can adjust between inflationary and deflationary models based on market demand, making it far superior to BTC in long-term economic sustainability.

Developer ecosystem: ETH attracts the most developers and has been the preferred ecosystem for development teams for seven years.

Diverse leadership: ETH has multiple teams driving its adoption, including Base (arguably the most important crypto institution in the U.S.), Arbitrum, ZkSync, Starknet, and others.

Resistance to centralization risks: ETH does not need to worry about a single entity like MicroStrategy monopolizing market discourse as BTC does.

The blockchain trilemma: ETH is the only public chain that has successfully balanced the blockchain trilemma—it achieves decentralization, scalability, and security through innovative solutions like Rollups. This makes ETH the most technologically advanced and versatile blockchain, suitable for both institutions and retail users.

Ecosystem growth: ETH has a large and active ecosystem. The momentum created by such a vast ecosystem can maximize ETH's benefits under new favorable policies and clear regulatory frameworks.

- Death:

In the worst-case scenario, ETH may miss the entire cycle due to some internal and external risks:

Leadership, leadership, leadership:

Leadership vacuum: Due to the large and decentralized ETH community, this characteristic allows some opinion leaders to create chaos among the ETH community, spreading contradictory statements and making the ETH ecosystem more fragmented.

Cultural challenges: The new U.S. government advocates a cultural shift—from "woke culture" to "down-to-earth." This shift means society is moving from political correctness and moral discussions to more straightforward communication. ETH's culture is often seen as more "woke" than other ecosystems. It emphasizes inclusivity, political correctness, and community-led moral discussions. While these values contribute to diversity, they can sometimes bring challenges (inefficient communication, moral judgment, hesitation in making bold decisions). Some vocal members of the community often act as moral arbiters, which can limit direct dialogue and create friction when adopting a more assertive leadership style.

Competitive chain challenges: Competitors like Solana continue to challenge ETH's dominance. Many public chains outside the ETH ecosystem have thrived. If this trend continues, ETH's position as the preferred platform for attracting top developers will face further challenges.

In the future, ETH may be hailed as an upgraded version of BTC, becoming the king of blockchain; or it may find itself in trouble due to some inherent characteristics.

Solana

- Survival:

Solana can shine with its flexibility and active community:

The combination of Meme and AI: In 2025, Meme will still dominate the economic attention of the crypto world. Solana is leading a new trend under this Meme trend—responding to the rapid growth of AI Agents in the industry, the forward-thinking Solana team has quickly introduced the Agent SDK.

DePIN: Solana's years of layout in the DePIN track are finally bearing fruit. With a large number of DePIN solutions finally landing, Solana has the opportunity to become a leader in integrating blockchain with DePIN.

Developer leadership: Solana focuses on cutting-edge verticals and rapid innovation in the industry, challenging ETH's dominance among developers. Solana's focus on the developer community makes it a disruptor among many ETH challengers.

Institutional recognition: If a Solana ETF is approved, it will be a crucial milestone. This indicates that Solana's ecosystem is recognized by institutions, further enhancing its position among institutional and retail investors.

- Death:

From hunter to prey: Solana has experienced a stunning turnaround in the past 18 months. Its alternative roadmap and calm response to the FTX collapse have allowed it to reclaim a place among leading blockchains. However, Solana is no longer the dark horse; it has become a player with a bit of a "big shot" aura. As a result, speculative investors' attention is starting to shift to its competitors, such as Sui, Hyperliquid, Aptos, Monad, etc. In contrast, these emerging chains all claim to offer fast, integrated solutions, each challenging Solana's position.

Over-reliance on Meme: Solana's rise is inseparable from Meme and speculation. While this strategy successfully attracted market attention, it also brings the risk of declining speculative enthusiasm for Solana. Without sustainable on-chain activity (such as a thriving DeFi ecosystem or other lasting narratives), the decline of Meme could severely impact Solana's on-chain economy. The attention economy is inherently very transient, and a long-term growth ecosystem cannot overly rely on market attention.

Developer stickiness: In 2022, Solana experienced the largest developer exodus in blockchain history, and public concerns about the long-term growth of Solana's ecosystem stem from this. Solana's success in the past 18 months can be attributed to speculators, but we remain skeptical about whether Solana has cultivated a loyal and resilient developer community during this time. As competition intensifies in the coming years, a strong developer community will be a moat for Solana to maintain its leading position.

Solana stands at the crossroads of survival and death: its flexibility, active community, and innovative capabilities give it the potential to break through ETH. However, whether Solana can maintain momentum in the face of increasing competition, speculation, and developer stickiness issues will determine whether it can continue to dominate the market.

Investment Institutions View the Track

2.1 Crypto x AI

Crypto x AI is one of the most innovative and dynamic fields in the industry recently. It has attracted almost out-of-the-box market attention and provides a very broad space for imagination. Sovereign AI (AI systems driven by decentralized crypto infrastructure) represents a revolutionary opportunity (but granting such power to AI also carries many risks). These systems can achieve true autonomy, interacting on-chain with other agents and humans using non-custodial wallets. We may even see AI agents purchasing human services for off-chain tasks in the future.

In the months leading up to AI agents becoming the market focus, we had already written about the potential of this field: The Agent Wars: Silicon Valley Titans vs. Crypto Challengers (Link: https://x.com/momir_amidzic/status/1825895123315458281)

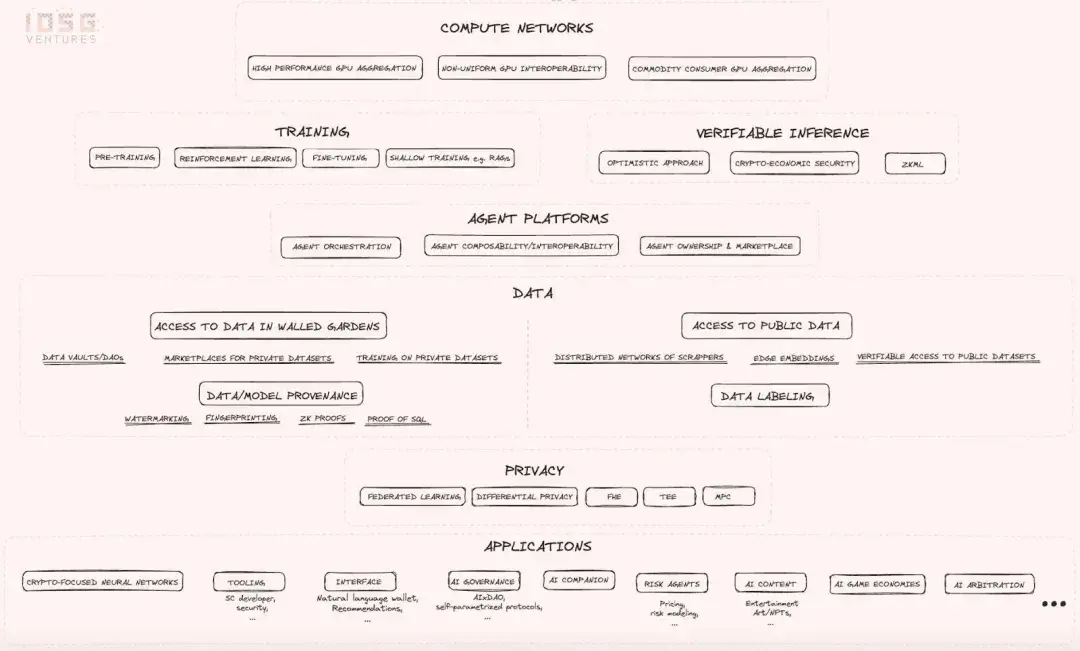

In addition to AI Agents, several other areas within Crypto x AI are also worth our attention, which we have showcased in the Crypto x AI industry map from June 2024:

2.2 DePin

DePIN is a highly innovative and diverse field. It combines crypto economic models with off-chain hardware to address many challenges in traditional industries.

Core Target Industries and Application Scenarios

DePIN projects cover multiple industries:

In edge computing, DePIN provides distributed processing capabilities for latency-sensitive applications.

In energy and power infrastructure, DePIN can incentivize the adoption of renewable energy.

In the wireless network sector, DePIN focuses on community-driven 5G and IoT connectivity, bypassing the limitations of traditional telecom providers.

DePIN supports decentralized crowdfunding solutions for other important industries (such as mapping and high-precision positioning services).

In computing and storage, DePIN offers decentralized alternatives to traditional cloud services, providing secure data storage and processing.

CDNs can achieve cost-effective and scalable digital content distribution through DePIN.

Data scraping projects like Grass can build a network of millions of nodes through token incentives. It can utilize the internet bandwidth contributed by participating nodes to scrape massive amounts of data.

While DePIN is a very promising field, not all DePIN projects are equally promising; the success of specific projects highly depends on their own merits.

We are particularly excited about DePIN projects that can provide clear and measurable value (such as reducing costs, improving efficiency, or entering untapped markets). The success of DePIN often stems from its realization of new business models that centralized systems cannot replicate. This advantage allows projects to achieve better market penetration, distribution, and accessibility. DePIN can also drive cost efficiency and better unit economics by lowering operational costs or improving resource utilization, making its decentralized model more competitive and sustainable. Additionally, capital expenditure optimization is a significant advantage of DePIN projects, as it distributes infrastructure costs to the community through token incentives, enabling faster scaling and broader participation.

On the other hand, we should avoid DePIN projects that misuse tokenization. Their failed token economics often lead to unsustainable ecosystems. Some projects' tokens do not bring actual efficiency improvements or enhancements over traditional methods but rely solely on token incentives to mask potential inefficiencies and subsidize usage costs in the short term. Relying solely on tokenization does not justify decentralization, and sometimes the outcomes are worse than existing centralized models.

2.3 Payments

Stablecoins have become the mainstream payment medium in the crypto industry. Due to their programmability, cross-border usability, and increasingly clear regulatory frameworks, stablecoins are expected to become the standard settlement currency for global payments.

While stablecoins have clear advantages over fiat currencies in terms of programmability and cross-border liquidity, broader applications are still constrained by regulatory challenges and inefficient on-chain and off-chain mechanisms. However, a pro-crypto U.S. government may provide regulatory clarity, creating a healthier environment for efficient, liquid, and low-cost crypto-to-fiat transactions.

Short-term (1–3 years): Remittances and Consumer Applications

Stablecoins will first dominate cross-border remittances, providing a faster and cheaper alternative to SWIFT. Crypto-related debit/credit cards (Visa/MasterCard) will also simplify consumption and build a bridge between on-chain wealth and real-world transactions. This will benefit those outside the U.S. dollar banking system, individuals who have difficulty obtaining traditional payment cards, and cryptocurrency holders who wish to conveniently spend their assets.

Medium-term (3–7 years): Business Adoption

Businesses will increasingly adopt stablecoins due to their low fees, instant settlement, and programmability. Companies will be able to seamlessly convert between cryptocurrencies and fiat currencies, offering customers two payment options. This dual-track approach will enhance efficiency and further integrate stablecoins into mainstream commerce.

Long-term (7 years and beyond): Paying Taxes with Stablecoins

Stablecoins will become mainstream legal tender, widely accepted for tax payments, eliminating the need to convert them into fiat currency. At that point, stablecoins will disrupt traditional financial infrastructure, promoting low-cost P2P transactions between consumers and merchants, significantly reducing reliance on banks and credit card companies.

2.4 Consumer Applications

The consumer applications field is highly exploratory but also more difficult to define, often overlapping with other areas such as AI, DePIN, and payments. This field encompasses a wide range of applications, including but not limited to AI-driven consumer solutions, consumer-facing DeIN projects, and payment solutions designed for consumers.

In addition to practical application scenarios, consumer applications in the crypto space also involve speculation and gamification. A very important category here is blockchain games. They incorporate speculative economic elements and memes, and remain one of the most successful consumer interaction experiments in the industry. These speculative applications often blur the lines between entertainment, finance, and utility, creating unique opportunities for innovation.

Looking ahead, new experiments that combine crypto with consumer applications will bring more opportunities. Game mechanics integrated with economic incentives show tremendous potential, providing new ways to attract users and drive adoption. The design space in this field is vast, and we expect it to yield breakthrough innovations by 2025.

IOSG's Portfolio

1. Usual

2024 has been a very successful year for Usual, achieving $1.5 billion in TVL in just six months and successfully entering the top five stablecoins. The governance token has also been listed on Binance, the largest CEX globally. Their momentum shows no signs of stopping, and Usual is expected to break into the top three in the stablecoin market in the next 12 months, standing shoulder to shoulder with giants like Circle and Tether. Usual's scalability is on par with its competitors, and their ambitious goals seem within reach.

In DeFi, Usual's strategic partnerships with Ethena, Ondo, and M0 will drive the next phase of growth. Notably, the yield products between Ethena and Usual can adapt to various market conditions—offering high crypto-native yields in bull markets while providing stable RWA-backed returns in bear markets. Meanwhile, in CeFi, Usual's integration as collateral is just beginning. Usual assets will be deeply embedded in the foundations of both CeFi and DeFi ecosystems. As these integrations progress, strong network effects will accelerate adoption and application.

Looking ahead, the Usual team remains focused on building a vibrant ecosystem around Usual assets. With their outstanding execution capabilities, we can fully believe that Usual's innovations and breakthroughs are just around the corner.

We previously published Usual's Thesis: Link, as well as our story with the Usual team titled "Unusual": Link

2. BTC Ecosystem

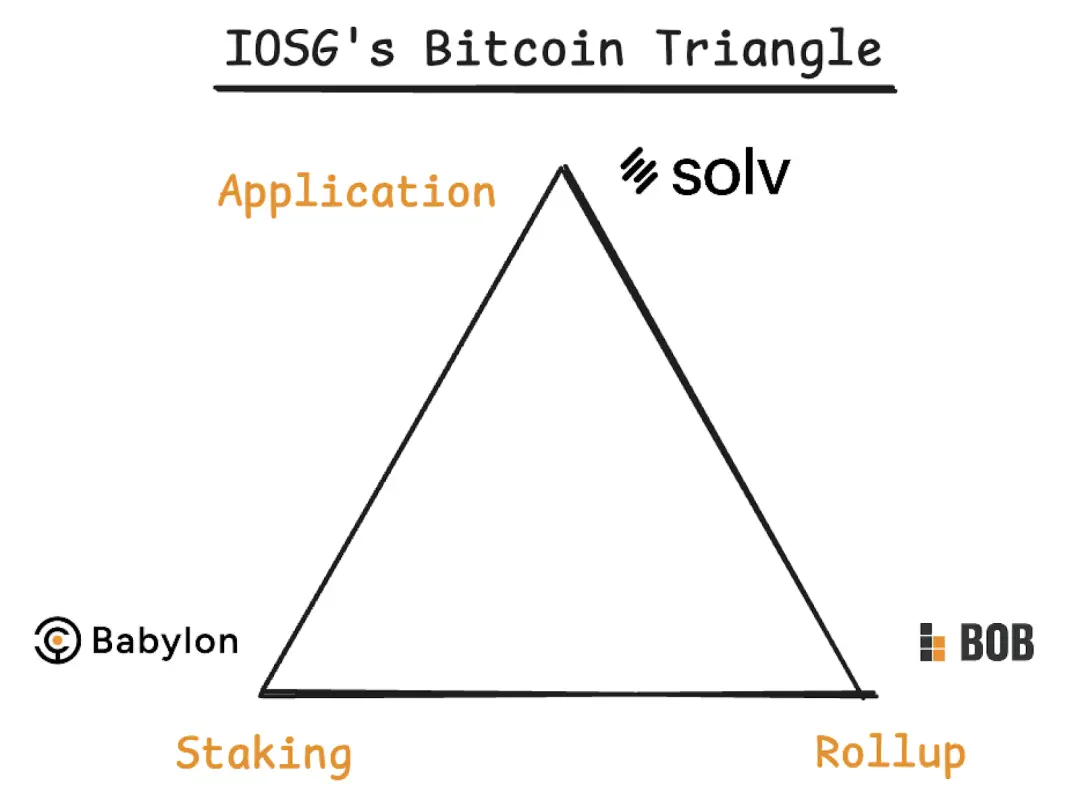

Although BTC is the oldest and most mature cryptocurrency, its existence is still in a very early stage. We support a range of pioneering projects around the BTC ecosystem that are shaping the next frontier of BTC development:

Babylon: A cryptographic breakthrough that allows trustless BTC staking, enabling BTC holders to secure external networks and earn rewards without relying on intermediaries.

BoB: A hybrid Rollup that utilizes BitVM v2 for trustless BTC bridging. BoB creates a secure hub by combining Babylon's rapid finality with ETH's data availability, allowing BTC to freely integrate with ETH's DeFi ecosystem.

Solv: The largest BTCfi application, redefining BTC's role in decentralized finance by unlocking yields for BTC holders and driving the development of BTC-based financial products.

2025 is a critical year, as the innovations and developments in the BTC ecosystem over the past few years will translate into practical applications. This is one of the real demands we can test for the prosperity of the BTC on-chain economy. We are confident in BTC's evolution from a store of value tool to a trustless staking, DeFi, and cross-chain interoperability ecosystem.

3. AI Track: Theoriq, Phala, Hyperbolic

Theoriq is an AI DePIN project that is redefining the future of AI collaboration. Within Theoriq's framework, AI agents can not only work independently but also collaborate as a dynamic collective. This forward-thinking framework enables AI agents to collectively solve complex problems that a single agent system cannot address. Theoriq introduces memory-enabled agents, advanced evaluators, and user-friendly tools, ensuring that human feedback remains central to agent development, thereby driving compound growth in value. This creates a virtuous cycle: agents continuously learn, adapt, and self-organize while effectively collaborating, creating a self-improving ecosystem.

Theoriq operates in a self-regulating environment by integrating crypto economic incentive mechanisms. Specifically, agents are rewarded for good behavior and penalized for mistakes, maximizing the reliability and accountability of the framework. We led the seed round for Theoriq in 2022 when Crypto x AI was still a non-consensus idea. Two years later, we are very pleased to see Theoriq enter production.

Phala has always been one of our long-term investment projects. Recognizing Phala's immense potential in shaping the future of Crypto x AI, we recently increased our investment in it. As a pioneer in TEE technology, Phala has a unique advantage in meeting the security infrastructure needs of AI agents.

AI agents rely on TEE technology to securely manage critical assets (such as wallets and social accounts) to ensure privacy, trust, and efficiency without sacrificing performance. In an environment where almost all Infra projects are exploring how to integrate TEE technology, Phala's superior solution is chosen by many developers for its reliability and scalability.

Hyperbolic is revolutionizing the AI infrastructure space. As a leading GPU network, Hyperbolic focuses on inference and provides verifiable inference tools. Additionally, they have pioneered a GPU layer that allows AI agents to rent GPUs through an SDK. This innovation enables GPU-rich AI agents to easily access the computational resources they need, driving more complex and efficient workflows.

Hyperbolic Inference Cloud is a platform where anyone can contribute GPU resources; it completely abstracts the non-uniformity of GPU hardware, making GPUs truly interchangeable. Hyperbolic's execution is outstanding and has become the first project to offer some of the most advanced open-source AI models on its platform.

4. Gelato

Five years ago, we recognized Gelato's immense potential early on. We led the seed round investment in Gelato and continued to follow up in subsequent funding rounds. Over the years, Gelato has quietly evolved into the AWS of Web 3.0. Today, if you randomly think of three crypto projects, at least one will be using Gelato's tech stack in the backend. Gelato has achieved success in its products, with a powerful and versatile tech stack that includes RaaS, Functions, Relay, VRF, account abstraction, RPCs, bridging, and oracles. Its solutions cover multiple areas, from payments, DeFi, infrastructure, consumer applications to AI agents.

2025 will be the year Gelato transitions from quietly supporting the ecosystem to telling its story, effectively marketing itself, and building attractive token utility. It is not only expected to be recognized as a critical infrastructure layer but will also become a pillar of reliability and innovation in the Web 3.0 space.

5. Staking and Re-staking

We have been actively investing in the two major themes of the ETH ecosystem—staking and re-staking related to "The Merge" and the "Shanghai Upgrade." The projects we have laid out include EigenLayer, ether.fi, Kiln, Renzo, Babylon, and AltLayer, four of which have already been listed on Binance. EigenLayer and ether.fi rank third and fourth among all DeFi protocols with TVLs of $15.7 billion and $8.4 billion, respectively. Additionally, ether.fi and Kiln are the fourth and fifth largest staking service providers for ETH, with Kiln managing $13 billion in assets.

Looking back at the development of the ETH staking and re-staking ecosystem, we can clearly see the value of ETH as a multifunctional asset being continuously reinforced and expanded.

As the ETH roadmap progresses and the staking ecosystem matures, its importance in the blockchain industry continues to grow. Through staking and re-staking, ETH not only provides a solid foundation for network security and decentralization but also showcases its unique attributes as capital, consumer goods, and a store of value by expanding economic security and ecological richness.

In Conclusion

The fate of the crypto industry in 2025 is like Schrödinger's cat. Its success or failure is not determined by its inherent qualities but by how it is perceived by the outside world. On many levels, value is a construct shaped by collective consensus. BTC may be "digital gold," ETH may be the pillar of decentralized innovation, and Solana may be the agile disruptor, but their ultimate destinies depend on the narratives we choose to accept and the meanings we assign to their existence.

In a world of infinite possibilities but limited attention like Crypto, market perception becomes the ultimate currency. The crypto market is not only driven by technology or utility; it also relies on belief, trust, and those stories that can ignite our imagination. What we focus on determines what will survive and thrive, just as the act of observation causes Schrödinger's paradoxical cat to collapse into a single state. The collective gaze of the market, institutions, and individuals will determine which futures will prevail in the crypto space and which will fade away. Ultimately, it will be our perceptions and views—along with the stories we tell ourselves—that will shape the foundation of the future digital economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。