Have you ever encountered the meme where chasing the rise leads to zero, and cutting losses results in a surge? How do market makers operate? Is there insider information regarding the addresses holding the top 100 positions? What strategies can be employed to avoid being cut by the market makers? This article will deeply analyze market maker addresses and trading data through several types of coins.

What is the main purpose of market manipulation?

Before analyzing the methods of market manipulation, we must clarify the main purposes of pump and dump. The purpose of a market maker's pump is to prevent low-priced tokens from falling into the hands of others, allowing them to sell at a higher price for greater profit. The purposes of a dump are varied: one is to wash out other low-priced tokens while accumulating them for themselves, quickly selling off high-priced tokens; the other is simply "I'm done!" and running away with the money.

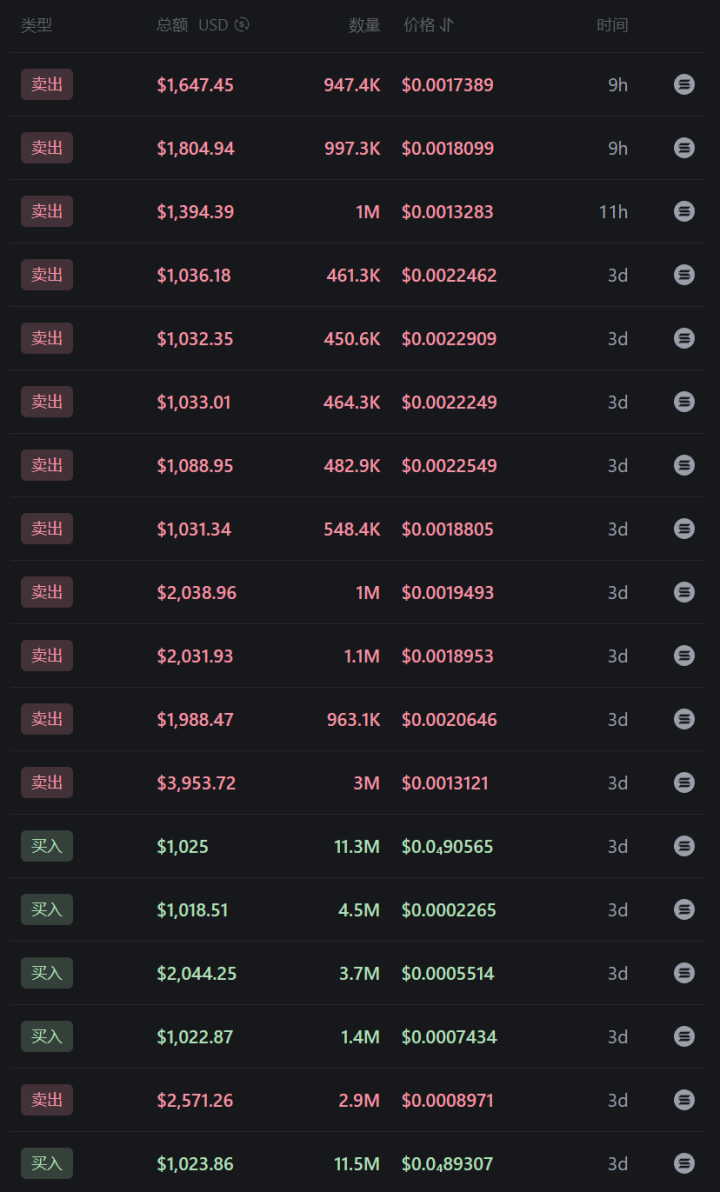

Given this purpose, the pump must be rapid. How can a rapid pump be achieved? Only large buy orders can facilitate a swift rise. Therefore, during a pump, there will definitely be one or more addresses making significant purchases. If you see two addresses each buying for at least over a thousand dollars continuously, that is called a pump. Thus, when looking for market maker addresses, you can filter buy order records greater than $1K, and if the main trading token of that address is the one in question, you can identify which address is the market maker's pump address.

Similarly, how can market makers collect the initial low tokens? They must quickly strike at the very beginning, at the lowest point, to extract most of the tokens. Therefore, by examining the earliest trading records, you can see all the actions of the market maker collecting low tokens.

Types of Memes

Now that we understand the main purposes of meme pumps and dumps, we can differentiate between different memes based on the market maker's mindset.

One Wave Flow

It can be said that 90% of memes on the market belong to this category. The current market is different from a year ago; due to the introduction of Pump, issuing tokens does not require high time or monetary costs. You only need to fill in the token's name, website, Twitter, and pay 0.02 SOL to issue it. Therefore, most token issuers are merely trying to ride the wave and feel the market. In a Pump, over ten thousand tokens can be issued in a day, making it impossible for the capital to support each token rising multiple times. Thus, most memes will be one wave flow.

For example, the token "Birds" was issued and within 25 minutes, its market cap plummeted from 2.2 million to 100K, and since then, the token has shown no further fluctuations.

DEV Runs Away, Market Maker Enters

Memes are an emotional market, and a good narrative is one of the essential conditions for a hundredfold token. When a wave of DEV cashing out occurs, some market makers will secretly ambush, absorbing these tokens with low capital, and then release some positive news to revitalize the tokens.

For instance, in this token, the DEV left at the peak, and the token's market cap dropped from 2.4 million to a low of 260K. During this period, the market maker continuously absorbed tokens, established a CTO community, and kept launching activities on Twitter, ultimately revitalizing the token.

Of course, don't forget that market makers revitalize a token to make money, so there will always be a risk of a dump. For example, in the case of BOGGS, the DEV ran away on the first day, and after a few days, the market maker took over and began building the CTO community, raising its market cap to 4 million in a week, only to dump and run away a week later.

DEV is the Market Maker

These types of coins are mostly issued by large institutions or influencers, creating tokens to play with themselves. For example, the previously popular PRO and ANTI in the Desci track, where the DEV does not sell but relies on doing work, narratives, and funds to pump.

Market Maker's Manipulation Techniques

Now that we have a basic understanding of meme types, we can look at the market maker's manipulation techniques.

One Wave Flow Manipulation Technique

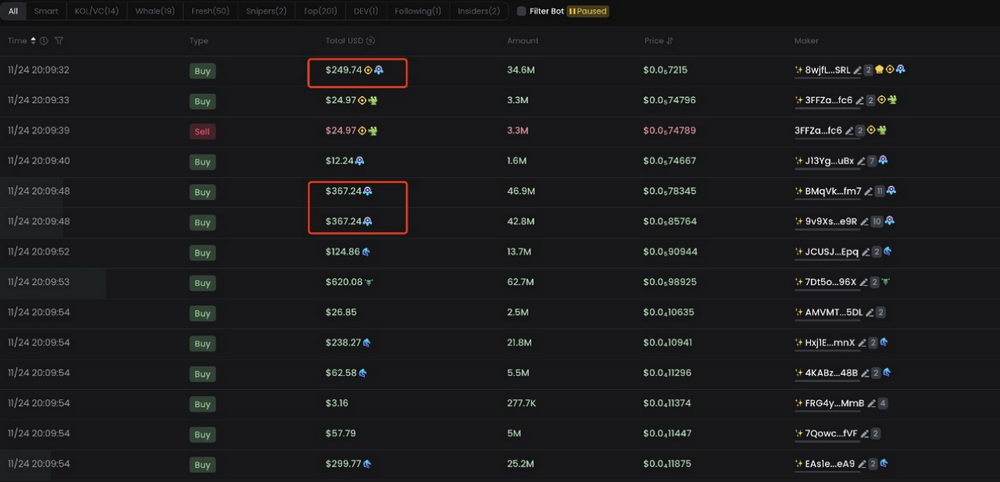

First, let's look at the one wave flow manipulation technique, using BOGGS as an example. In BOGGS, we can see that the market maker targets the token for purchase at the opening. After the token is issued for a while, two addresses simultaneously buy the token, each with a purchase value of $367.24.

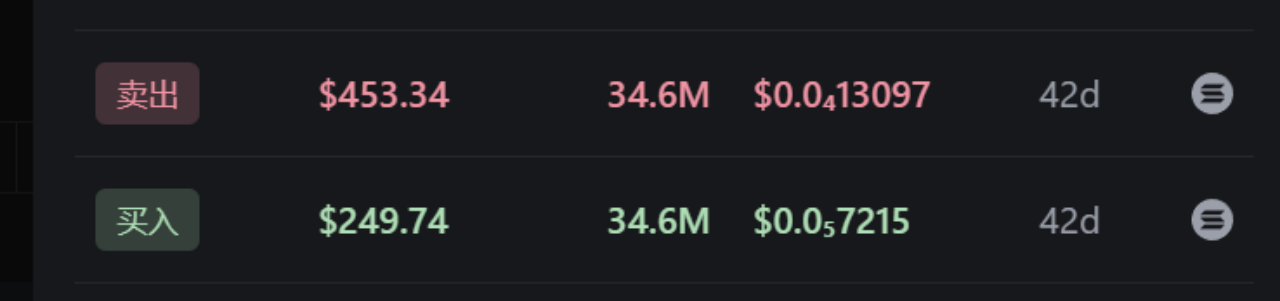

Following these addresses, we find that the targeted purchase was made by the DEV address. Upon checking the DEV address, we find that it has only one buy and one sell.

However, when we focus on the two addresses below, we discover that these are the true market maker addresses, buying immediately after the opening and continuously buying and selling, accumulating at low points and selling at high points, ultimately profiting $3000.

At this point, we see that the DEV seemingly only made $200, but in reality, they made $3000.

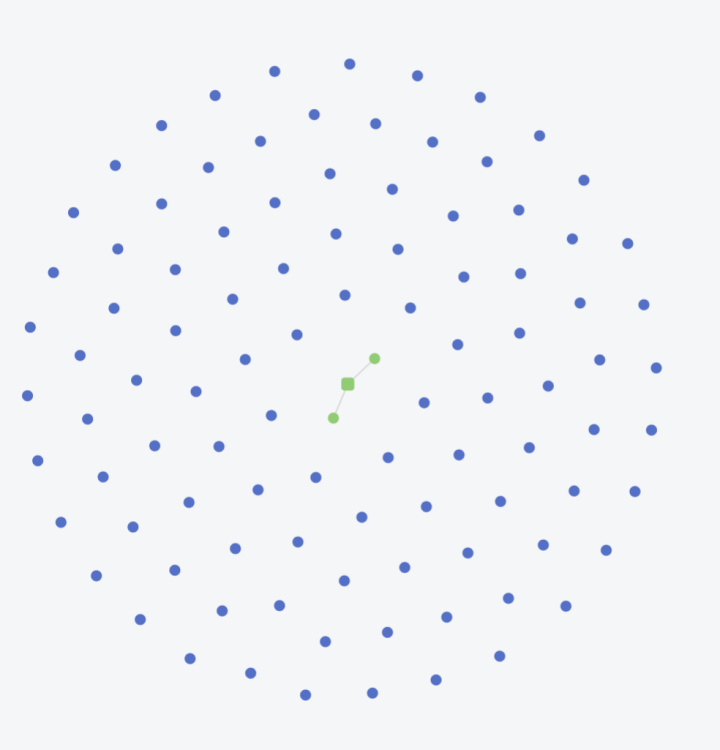

If we analyze this using our meme-catcher analysis tool, we will find that the three addresses have a strong correlation.

DEV Manipulation Techniques and Secondary Surge

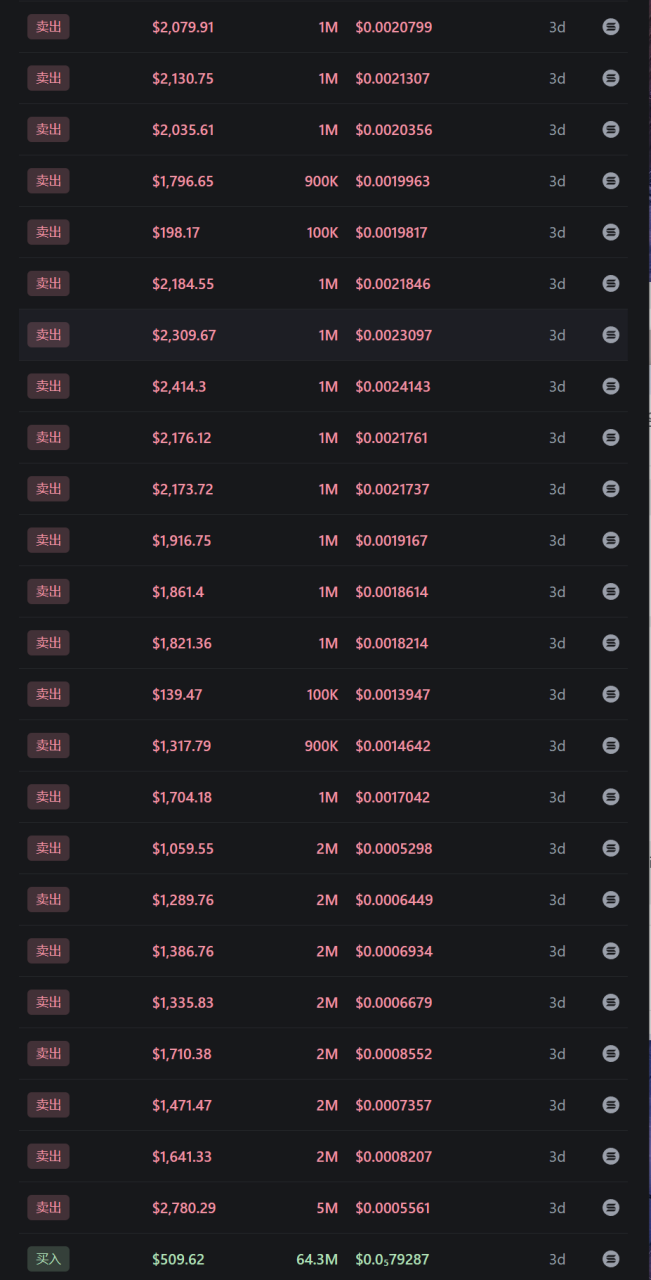

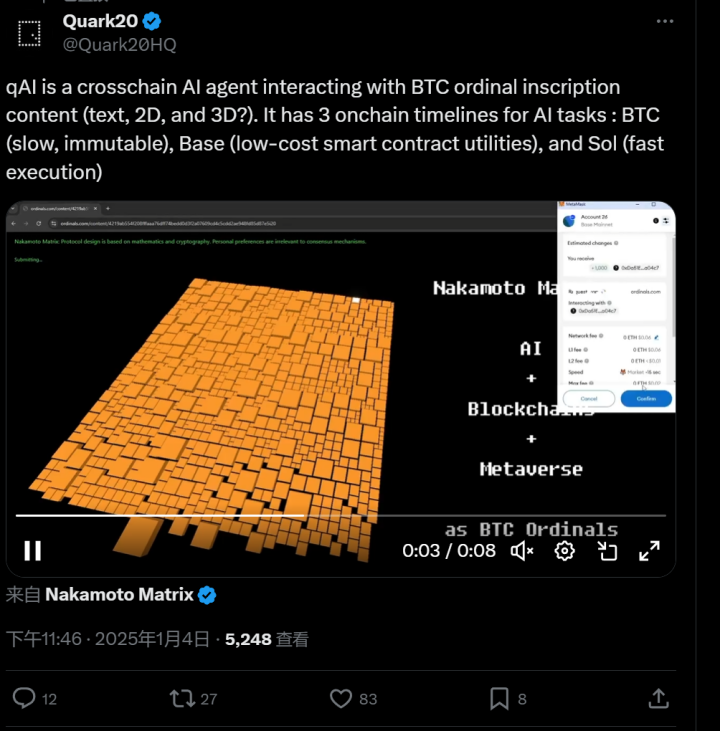

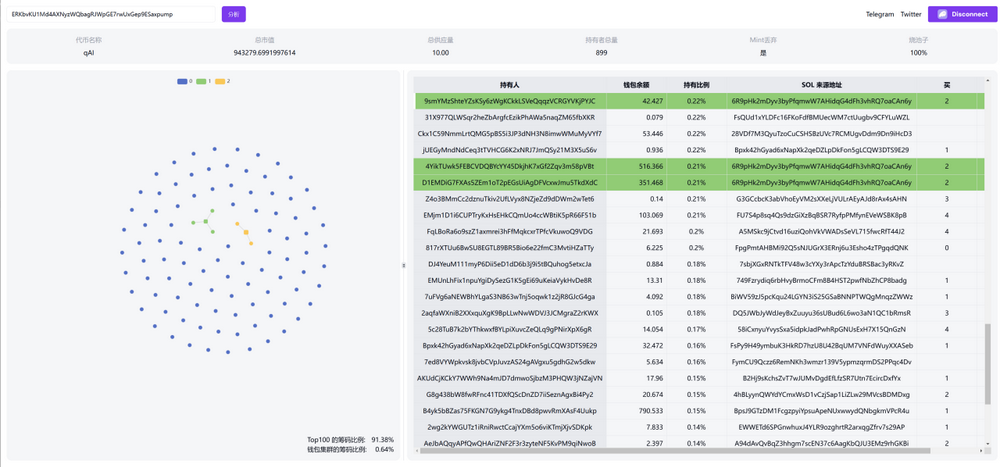

For the secondary surge, we take qAI as an example. On the surface, the DEV appears inactive, but in reality, they are fully operational. When we check the top traders by profit, we can easily find that the market maker's secondary account has been continuously selling from the first pump to the second pump.

Moreover, when the first dump hit the bottom, another address appeared, continuously buying during the bottom formation and selling as it reached a market cap of 2 million.

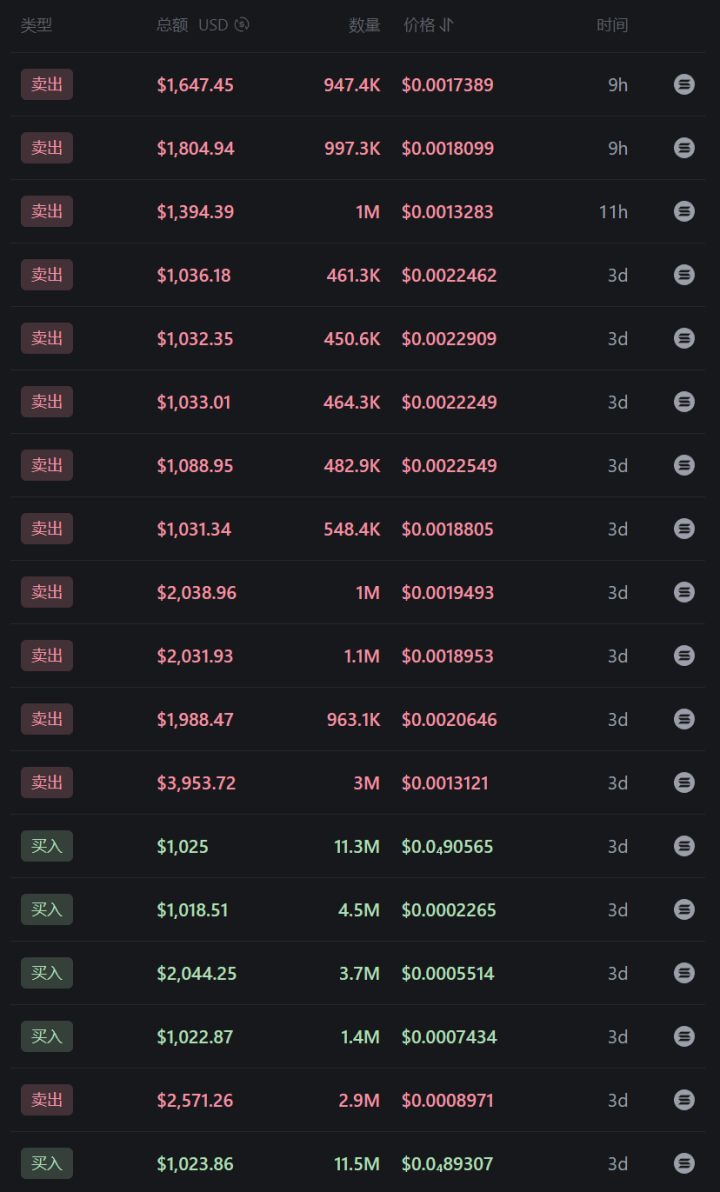

We can see that the market maker continuously built the bottom before January 3rd, and on January 4th, qAI released a video roughly outlining the concept of qAI, causing qAI to stop falling and begin a slow rise. On January 6th, it pumped.

During the pump, the qAI market maker was also continuously selling, ultimately stabilizing from a peak market cap of 2.3 million to around 1 million.

It is evident that the market maker's manipulation involves not only buying low and selling high but also coordinating with information. They release positive news to attract funds.

Using the meme-catcher analysis tool, we find that the related addresses are three and two, with the top 100 accounting for 91.38%. This shows how terrifying the market maker's accumulation is.

Conclusion

In the meme market, one must remember that memes are always an emotional market. When emotions explode, it is easy to chase the rise, while during panic, it is easy to cut losses. Market makers act against human nature, continuously selling at high points and accumulating at low points. When the tokens are sufficiently abundant, market makers will release positive news and use new addresses to pump, attracting funds to enter, and ultimately continue the cycle of selling high and buying low, achieving considerable profits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。