In the global financial market, Bitcoin has long played the role of digital gold, being both a target pursued by investors and a focus of analysts' research. In recent years, Bitcoin has gradually shown correlations with traditional financial assets, especially with the Nasdaq 100 index. In January 2025, the 30-day correlation coefficient between Bitcoin and the Nasdaq 100 index reached 0.70, the highest level since 2022. This trend not only highlights the importance of Bitcoin in investment portfolios but also sparks widespread discussion among market participants about future trends.

This article will provide an in-depth interpretation of this phenomenon from five aspects: the correlation data analysis between Bitcoin and the Nasdaq index, macroeconomic background, market behavior and psychology, the key role of Microstrategy, and future outlook.

1. Correlation between Bitcoin and the Nasdaq Index: Data Analysis

1. High Correlation Phenomenon

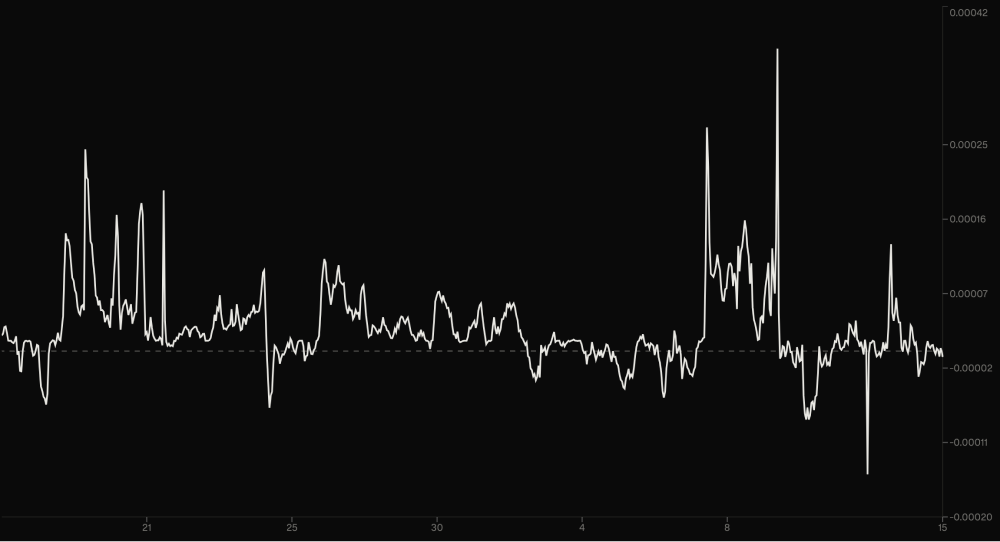

According to the analysis by K33 Research analysts Vetle Lunde and David Zimmerman, the 30-day correlation coefficient between Bitcoin and the Nasdaq 100 index has reached 0.70. This level indicates a high degree of synchronization in price trends between Bitcoin and tech stocks, approaching a perfect positive correlation (1.0).

Related article: Bitcoin and Nasdaq 100 Index Correlation Reaches Highest Point Since 2022

2. Driving Factors Analysis

- Interest Rate Sensitivity: As global central banks gradually tighten monetary policy, interest rate fluctuations have a profound impact on the flow of funds into Bitcoin and tech stocks. Recent CPI data and non-farm employment data from the U.S. have significantly influenced market sentiment, with investors' expectations of the Federal Reserve's interest rate hikes or shifts to easing policies directly driving the synchronized fluctuations of Bitcoin and the Nasdaq index.

- Risk Asset Attributes: Although Bitcoin is widely referred to as digital gold, its price volatility characteristics are more akin to high-risk assets. When market risk appetite increases, Bitcoin and tech stocks rise together; conversely, when risk aversion sentiment rises, both decline in unison.

- Increased Institutional Participation: With more institutional investors entering the Bitcoin market, Bitcoin's price fluctuations have begun to be influenced by traditional financial markets. Particularly after companies like Microstrategy incorporated Bitcoin into their balance sheets, the connection between Bitcoin and tech stocks has been further strengthened.

2. Macroeconomic Background and Market Dynamics

1. Importance of CPI Data

The CPI data released by the U.S. Department of Labor has a significant impact on the current market environment. Lower inflation data may stimulate market risk appetite, driving Bitcoin and tech stocks to rise together; while inflation data exceeding expectations may lead to market declines. K33 Research's analysis points out that the sensitivity of interest rates to Bitcoin and tech stocks makes CPI data an important market driver.

2. Market Expectations for Trump's Inauguration

As President Trump's inauguration approaches, the market is cautiously anticipating potential volatility. Data from the trading platform Derive.xyz shows a significant increase in hedging activities in the options market, with a rise in put betting ratios. Sean Dawson, research director at Derive.xyz, points out that this indicates investors are preparing for potential market turmoil, reflecting the psychological linkage between Bitcoin and tech stocks.

3. Hedging Behavior in the Options Market

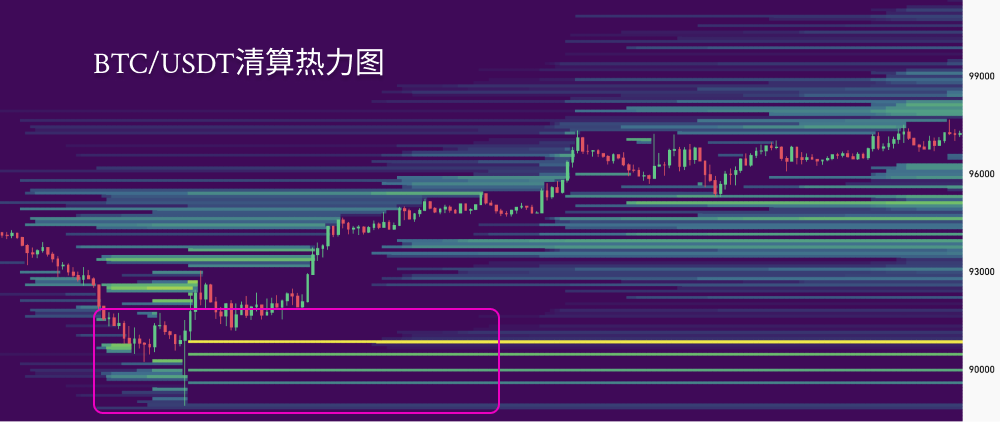

The dynamics of the options market further demonstrate the high correlation between Bitcoin and the Nasdaq index. The increase in trading volume of put options indicates that the market expects short-term volatility to rise. Additionally, the liquidation activities in the Bitcoin market reflect changes in investor sentiment. On January 13, 2025, Bitcoin's price fell below $90,000, the lowest point in two months, triggering over $500 million in liquidations of cryptocurrency long positions.

3. The Deep Connection between Microstrategy and Bitcoin-Nasdaq

1. Microstrategy's Bitcoin Holding Strategy

Microstrategy, a Nasdaq-listed company, is known for its massive Bitcoin holdings. As of the end of 2024, the company held over 150,000 Bitcoins, equivalent to about 0.7% of the total Bitcoin supply. This strategy tightly links its stock price to Bitcoin prices and provides a new driving factor for the correlation between Bitcoin and the Nasdaq index.

2. Indirect Bitcoin Exposure for Investors

With Microstrategy's announcement of joining the Nasdaq 100 index, institutional investors investing in this index effectively hold Bitcoin indirectly. This indirect exposure amplifies the impact of Bitcoin price fluctuations on the Nasdaq index.

Related article: MicroStrategy to Join the Nasdaq 100 Index

3. Transmission Mechanism of Market Behavior

Microstrategy's Bitcoin holdings also have a broader impact on the market through index funds and ETF products. The ETFs tracking the Nasdaq 100 index include Microstrategy's weight, meaning that retail and institutional investors may bear greater risks due to Bitcoin price fluctuations.

4. The Dance of Bitcoin and the Nasdaq Index: Future Trend Outlook

1. Acceleration of Institutionalization Process

With institutions like BlackRock launching Bitcoin ETFs, the institutionalization process of Bitcoin is accelerating. Since the launch of the U.S. version of the IBIT ETF in January 2024, it has attracted over $37 billion in net inflows. The recent launch of Bitcoin ETFs in Canada further lowers the investment threshold for Bitcoin.

2. Macroeconomic Uncertainty

In the future, the high correlation between Bitcoin and the Nasdaq index may change due to macroeconomic factors such as monetary policy and geopolitical events. For example, if the Federal Reserve continues to maintain high interest rate policies in 2025, the performance of risk assets may be suppressed; however, if monetary policy shifts to easing, Bitcoin may detach from traditional markets due to its independent store of value attributes.

3. Independence of Bitcoin

Although Bitcoin currently exhibits strong risk asset attributes, its original design goal was to serve as a safe-haven asset. With the popularization of blockchain technology and the maturation of regulatory policies, Bitcoin may gradually restore its hedging function, thereby reducing its correlation with the Nasdaq index.

4. Potential Risks and Challenges

The Bitcoin market remains influenced by multiple factors, such as regulatory policies, liquidity, and market transparency. Additionally, Bitcoin's high volatility makes it both an opportunity and a risk, requiring investors to remain vigilant.

5. Conclusion

The 30-day correlation coefficient between Bitcoin and the Nasdaq index has reached a two-year high, marking Bitcoin's gradual integration into the mainstream financial market. The participation of institutional investors, the driving macroeconomic background, and the key role of Microstrategy have collectively shaped the current landscape of the Bitcoin market. However, this high correlation may be cyclical, and its sustainability depends on future market conditions and policy changes.

In the future investment environment, Bitcoin is not only an important asset in the digital currency market, but its connection to traditional financial markets also makes it a crucial part of global asset allocation. Investors need to develop more comprehensive and flexible investment strategies based on the analysis of the correlation between Bitcoin and tech stocks to address potential market volatility and risks. The dance between Bitcoin and the Nasdaq is not over, and the rhythm of this dance will be determined by market participants and the macro environment.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。