In the foreseeable future, we will see a larger scale of U.S. Treasury bonds on-chain, and more projects based on tokenized U.S. Treasury bonds will emerge in the DeFi ecosystem, gaining favor from users and the market, gradually changing the way wealth management and investment are conducted on-chain.

Author: HedyBi, JasonJiang|OKGResearch

Introduction

Trump's return to power has pushed the close intertwining of politics and economics to unprecedented heights. This "Trump phenomenon" is not just a reflection of his leadership style but symbolizes a comprehensive reshaping of economic interests and political power. In the context of economics, this complex structural transformation is referred to as "political economy intertwining." As the world's largest economy and the issuer of the reserve currency, every policy adjustment by the United States serves as a barometer for global capital flows. Looking ahead to 2025, with the Trump administration's acceptance of the crypto space, the chain reaction of "Trump economics" will extend more rapidly into the on-chain world, as the crypto market quickly rises from the fringes of innovation to become one of the important markets in global finance.

OKG Research has specially planned the "Trump Economics" series to analyze the core logic of this process and future trends in depth. The first article, "Trump's Return: Bitcoin, Oil, and Gold in the New Economic Era," focuses on the impact of Bitcoin on the international financial landscape. This article delves into the traditional financial core asset of U.S. Treasury bonds, analyzing how the $36 trillion U.S. Treasury market can leverage blockchain technology and tools from the crypto space to further consolidate and expand the dollar's dominant position in the global financial system.

Coinbase CEO Brian Armstrong recently stated in an interview during the World Economic Forum in Davos, Switzerland, that the upcoming U.S. stablecoin legislation may require issuers to be fully backed by U.S. Treasury bonds for dollar-denominated stablecoins. While we believe that unless there is a requirement for over-collateralization, the likelihood of requiring 100% U.S. Treasury backing is low due to the role of cash reserves, Armstrong's statement still reflects the crypto market's demand and preference for U.S. Treasury bonds.

The "growth rate" of the U.S. Treasury market is astonishing: it took over 200 years to reach the first trillion-dollar scale, but it took only 40 years to grow from $1 trillion to $36 trillion. The root of this astonishing change lies in the Nixon administration's abandonment of the gold standard in 1971, which decoupled the dollar from gold and ushered in an era of unlimited money printing, leading to an uncontrollable debt problem in the United States.

As U.S. Treasury bonds rapidly "inflate," OKG Research observes that investors who have long been accustomed to "footing the bill" for this $36 trillion U.S. Treasury market are gradually losing their investment interest, and the on-chain space may become a new market to revitalize U.S. Treasury bonds in the future.

The HARD Mode of U.S. Treasury Bonds Begins in 2025

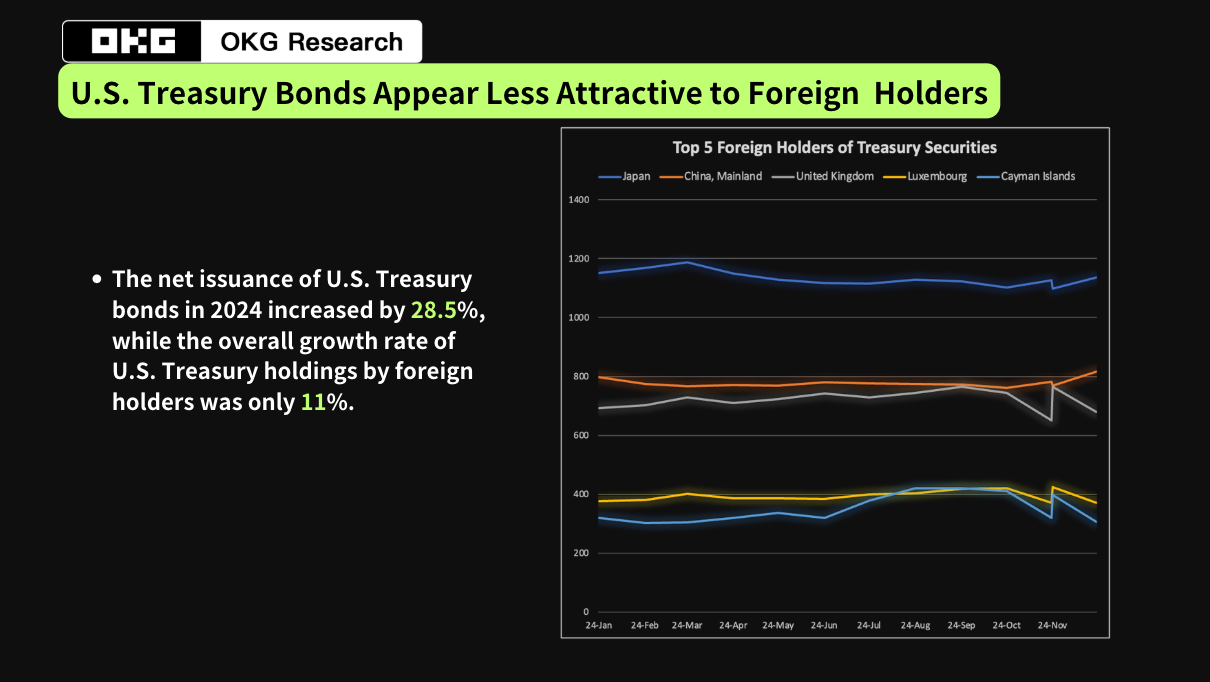

In 2025, the U.S. Treasury market will enter HARD mode, with nearly $3 trillion in Treasury bonds maturing, most of which are short-term bonds. The net issuance by the U.S. Treasury in 2024 has already reached $26.7 trillion, a year-on-year increase of 28.5%.

Especially in the context of Trump's return to the political stage, his inclination towards loose monetary policy may exacerbate market uncertainty. During his previous term, Trump repeatedly pressured the Federal Reserve to cut interest rates, viewing interest rate policy as a core tool for stimulating the economy and boosting market confidence. If he successfully pushes for rate cuts, it could significantly lower U.S. Treasury yields, weaken the attractiveness of U.S. Treasury bonds to overseas investors, and exacerbate the pressure on the dollar's depreciation, thereby impacting the global foreign exchange reserve allocation pattern. At the same time, Trump's policy inclination towards economic growth may drive the government to increase fiscal spending, further expanding the fiscal deficit and putting pressure on the supply side of U.S. Treasury bonds.

However, on the demand side, especially among foreign central banks, the attractiveness of U.S. Treasury bonds seems to be diminishing. According to the latest statistics from OKG Research, the growth rate of foreign central banks' holdings of U.S. Treasury bonds is only 11%, which does not exceed the growth rate of U.S. Treasury bond issuance (28.5%). Among the top 20 countries holding U.S. Treasury bonds, only France (35.5%), Singapore (31%), Norway (40%), and Mexico (33%) have increased their holdings at a rate that exceeds the issuance rate of U.S. Treasury bonds over the past 24 years.

Moreover, some foreign central banks are actively reducing their holdings of U.S. Treasury bonds. Since April 2022, China's holdings of U.S. Treasury bonds have remained below $1 trillion, with a further reduction of $2.6 billion to $772 billion in September 2024. In the same month, Japan reduced its holdings by $5.9 billion to $1.1233 trillion, and although it remains the largest foreign holder of U.S. Treasury bonds, its holdings have again declined. As the demand for diversification of foreign exchange reserves increases, the demand for U.S. Treasury bonds from overseas has significantly weakened.

The rapid growth of debt scale combined with the continuous weakening of overseas demand will pose dual challenges to the U.S. Treasury market, and an increase in risk premiums is almost inevitable. In the future, if the market fails to effectively absorb this debt, it may trigger larger-scale financial volatility.

The crypto market may be providing innovative answers on how to effectively absorb this debt.

Stablecoins May Become the Top 10 Holders of U.S. Treasury Bonds Globally by 2025

As one of the safest assets globally, U.S. Treasury bonds are playing an increasingly important role in the crypto market. Among them, stablecoins are the main vehicle for the penetration of U.S. Treasury bonds into the crypto market. Currently, over 60% of on-chain activities are related to stablecoins, and most mainstream stablecoins choose U.S. Treasury bonds as their primary collateral.

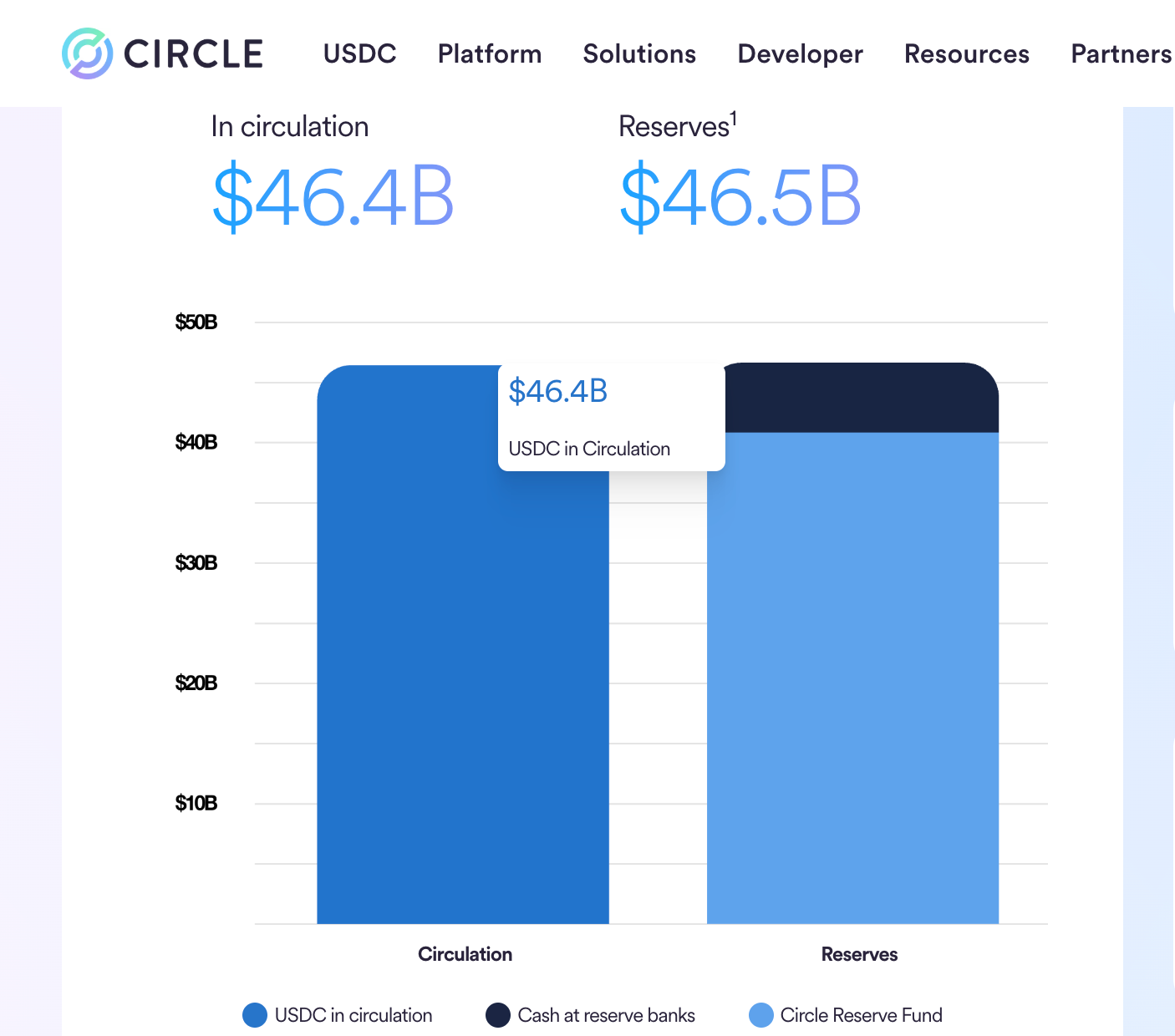

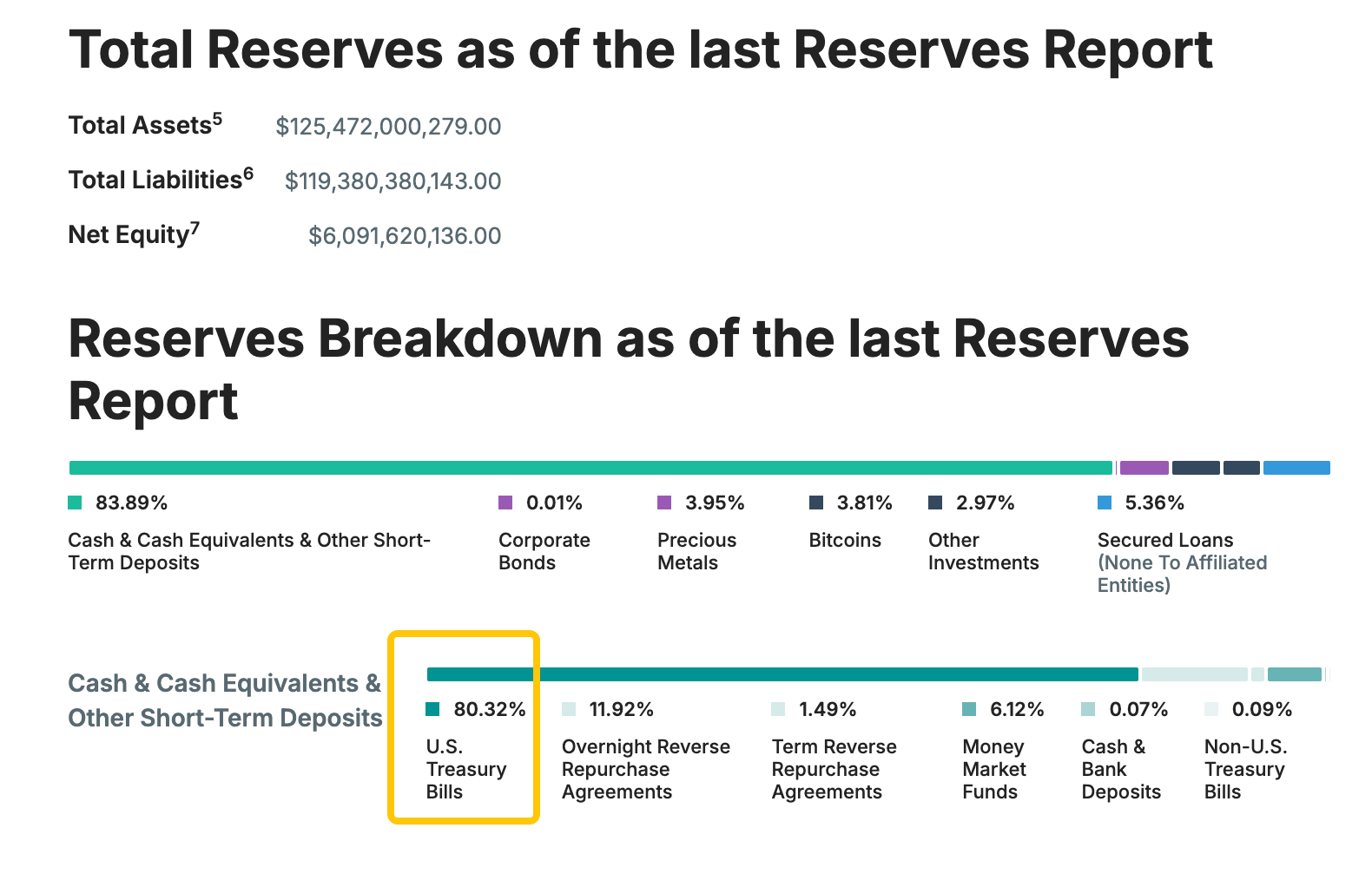

Taking the two largest stablecoins, USDC and USDT, as examples, their issuance mechanisms require a 1:1 collateralization of high-quality assets, with U.S. Treasury bonds occupying a major position. As of now, the amount of U.S. Treasury bonds collateralized by USDC has reached over $40 billion, while the collateralized amount for USDT has exceeded $100.7 billion. The existing scale of stablecoins alone has absorbed about 3% of the upcoming maturing short-term U.S. Treasury bonds, a proportion that has surpassed that of Germany and Mexico, enough to rank 19th among foreign central banks holding U.S. Treasury bonds.

Although the Trump administration is expected to attract international capital into Bitcoin through the establishment of a Bitcoin strategic reserve, driving Bitcoin prices to continue rising and profiting through market operations to alleviate debt pressure. This method theoretically can contribute to specific fiscal plans or interest payments, but even if the price rises to $200,000, with Bitcoin's total market value exceeding $4 trillion, the potential gains from continuously purchasing 1 million Bitcoins from now would only be around $100 billion.

Unlike the indirect debt relief provided by Bitcoin, stablecoins like USDT and USDC are creating direct demand for U.S. Treasury bonds. The market capitalization of stablecoins surpassed $210 billion on January 22, reaching a new historical high. Thanks to the acceleration of U.S. legislation and the continuous increase in global stablecoin adoption, OKG Research optimistically estimates that the market capitalization of stablecoins will exceed $400 billion by 2025, leading to an additional demand for U.S. Treasury bonds exceeding $100 billion, which may allow stablecoins to rank among the top 10 holders of U.S. Treasury bonds globally by 2025.

If this development trend can be maintained, stablecoins will become the most important "invisible pillar" of the U.S. Treasury bond market, with the direct demand for U.S. Treasury bonds they create exceeding the indirect returns that investing in Bitcoin can bring. A senior investment strategist at Bitwise has stated on social media that the holdings of U.S. Treasury bonds by stablecoins could quickly grow to 15%. A report previously released by the U.S. Treasury also pointed out that the continued growth of stablecoins will create structural demand for U.S. short-term Treasury bonds.

As Trump's economic stimulus policies are implemented, stablecoins and the small portion of dollars and the majority of U.S. Treasury bonds they are anchored to will also become a new form of dollar expansion. Since the dollar is the global reserve currency, foreign central banks and institutions generally hold U.S. Treasury bonds. The act of issuing U.S. Treasury bonds effectively uses U.S. credit to "export inflation," indirectly making the world pay for its debt, achieving a similar effect to "expanding the money supply." This will not only consolidate the dollar's position but also pose challenges to regulations in other countries, especially regarding taxation.

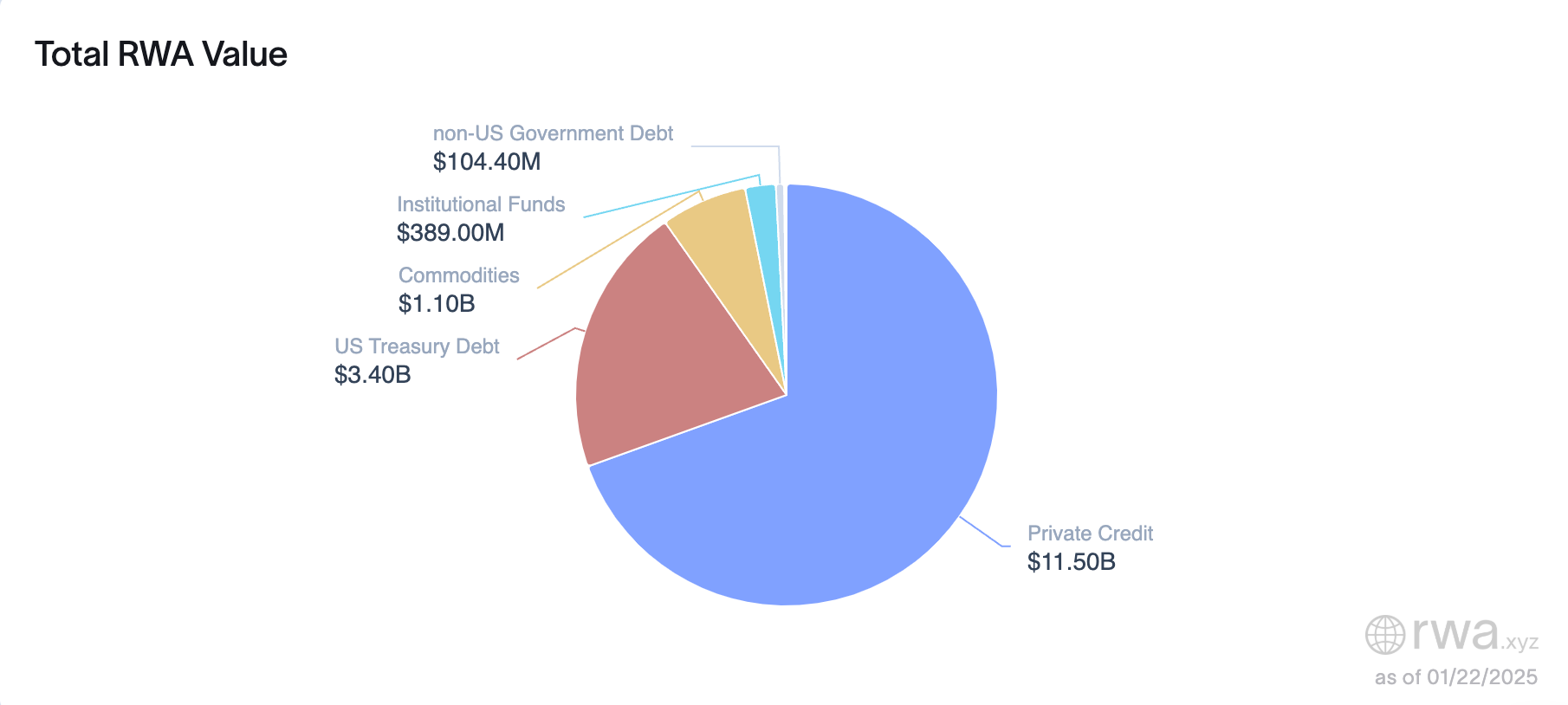

Large-scale Tokenization Brings Global Liquidity to U.S. Treasury Bonds

In addition to being the preferred underlying asset for mainstream stablecoins, U.S. Treasury bonds are also one of the most popular asset classes in the current wave of tokenization. According to data from RWA.xyz, the market for tokenized U.S. Treasury bonds was $769 million at the beginning of 2024, and by the beginning of 2025, it had reached $3.4 billion, achieving a growth of over 4 times. This rapid growth not only reflects the potential of on-chain financial innovation but also highlights the market's recognition and demand for the tokenization of U.S. Treasury bonds.

Through tokenization, U.S. Treasury bonds are rapidly penetrating DeFi. Whether using U.S. Treasury bonds as on-chain risk-free yield-generating assets or engaging in derivative trading through staking and lending, the DeFi ecosystem is becoming increasingly "down-to-earth." These tokenized U.S. Treasury bonds not only provide more reliable underlying assets but also capture stable returns from reality, directly distributing the returns to on-chain investors. The short-term U.S. Treasury bond fund (OUSG) launched by Ondo previously offered yields of up to 5.5%.

More importantly, once U.S. Treasury bonds are on-chain, they will provide traditional investors with a more familiar asset class, helping to attract institutional capital to continue flowing in, further accelerating the maturation and institutionalization of the DeFi ecosystem. Projects using tokenized U.S. Treasury bonds are often seen as "low-risk innovations," making it easier for them to obtain regulatory approval.

For U.S. Treasury bonds, tokenization provides a new tool to alleviate debt pressure. It not only allows U.S. Treasury bonds to enter the on-chain world, facilitating convenient cross-border transactions and cross-chain flows, breaking the geographical limitations of traditional financial markets; it also opens up new buyer markets for U.S. Treasury bonds, further enhancing their global liquidity and attractiveness. This new on-chain liquidity spread may propel U.S. Treasury bonds to become core assets in the global financial market.

As the market generally expects that the frequency of interest rate cuts by the Federal Reserve will slow down after Trump takes office in 2025, this further raises the yields on U.S. short-term Treasury bonds while lowering market risk appetite, making investors favor more stable investment targets. In the foreseeable future, we will see a larger scale of U.S. Treasury bonds on-chain, and more projects based on tokenized U.S. Treasury bonds will emerge in the DeFi ecosystem, gaining favor from users and the market, gradually changing the way wealth management and investment are conducted on-chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。