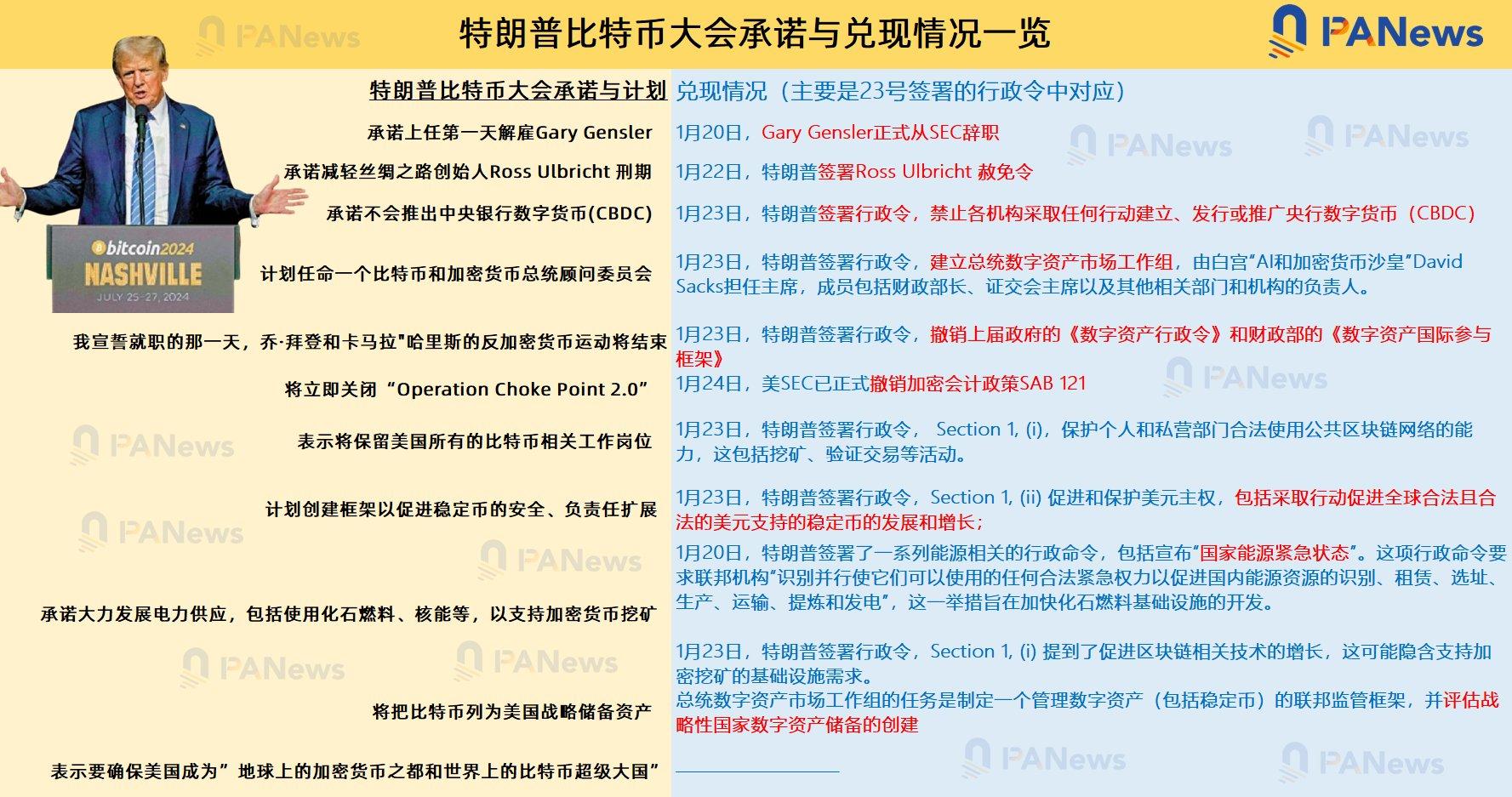

Trump has fulfilled many of his promises made at the Bitcoin conference last July, which is expected to almost completely overturn the previous cryptocurrency regulatory model.

Author: Weilin, PANews

On January 23, local time, on the third day of his presidency, Trump signed the “Executive Order to Strengthen American Leadership in Digital Financial Technology.” The order proposes the establishment of a “Presidential Digital Asset Market Working Group” to explore federal regulatory measures for stablecoins and related plans for a national digital asset reserve, and explicitly prohibits the “establishment, issuance, circulation, or use” of central bank digital currencies (CBDCs).

At the same time, the U.S. Securities and Exchange Commission (SEC) announced the withdrawal of the controversial Staff Accounting Bulletin 121 (SAB 121) for the crypto industry.

While it remains unclear whether the U.S. President's implementation of certain laws and policies through executive orders will be rejected by the courts, Trump has already fulfilled many of his promises made at the Bitcoin conference last July, which is expected to almost completely overturn the previous cryptocurrency regulatory model.

Crypto Executive Order: Establishing a Presidential Working Group to Assess National Digital Asset Reserves

The executive order begins by outlining its purpose and policy, stating that “the digital asset industry plays a key role in innovation and economic development in the United States, and is also related to America’s international leadership. Therefore, this administration’s policy is to support the responsible growth and application of digital assets, blockchain technology, and related technologies across all sectors of the economy.”

Key contents of the executive order include:

- Protecting and promoting the ability of citizens and private sector entities to legally access and use open public blockchain networks, including the ability to develop and deploy software, participate in mining and validation, transact with others without illegal censorship, and maintain self-custody of digital assets.

- Promoting the legitimate and compliant development of dollar-backed stablecoins globally.

- Protecting and promoting the rights of all law-abiding citizens and private sector entities to fairly and openly access banking services.

- Providing regulatory clarity and certainty based on technology-neutral principles, building a framework that adapts to emerging technologies, transparent decision-making processes, and clear boundaries of regulatory authority.

- Prohibiting any institution from taking action to establish, issue, or promote CBDCs within or outside the United States, except as required by law. Immediately terminating any existing plans or actions related to the creation of CBDCs by any institution.

- Revoking the executive order “Ensuring the Responsible Development of Digital Assets” issued on March 9, 2022; directing the Secretary of the Treasury to immediately revoke the “Framework for International Engagement on Digital Assets” issued by the Treasury on July 7, 2022.

- Establishing a Presidential Digital Asset Market Working Group within the National Economic Council. The working group will be led by special advisors in artificial intelligence and cryptocurrency. In addition to the special advisors, members will include the Secretary of the Treasury, the Attorney General, the Secretary of Commerce, the Chair of the SEC, the Chair of the Commodity Futures Trading Commission (CFTC), and others.

Additionally, the order requires that within 30 days of its issuance, the Treasury, Justice Department, SEC, and other relevant agencies identify all regulations, guidance documents, etc., that affect the digital asset industry. Within 60 days, these agencies must submit proposed amendments to the special advisors. The working group must submit a report to the President within 180 days, proposing regulatory and legislative recommendations to advance the policies of this order, including: (i) recommending a federal regulatory framework for the issuance and operation of U.S. digital assets (including stablecoins); (ii) assessing the potential for creating a national digital asset reserve and proposing standards for establishing such reserves.

Trump Has Fulfilled Most Crypto Promises

Currently, Trump has fulfilled most of his crypto promises. The order for federal agencies to stop any potential CBDC development was one of Trump's commitments made to the crypto industry during his presidential campaign. Recently, Trump also fulfilled his promise to pardon Ross Ulbricht, the founder of Silk Road. On January 20, Gary Gensler officially stepped down, effectively fulfilling Trump’s promise to “fire Gary Gensler on the first day in office.”

However, since taking office, Trump has not commented on fulfilling the promise that “all Bitcoin should be ‘Made in America.’”

Although Trump is advancing policies through executive orders, their effectiveness may also face procedural impacts. For example, on January 20, Trump signed an executive order that effectively abolished birthright citizenship under the Fourteenth Amendment of the U.S. Constitution, but this move was subsequently blocked by a federal judge on the grounds of “obvious unconstitutionality.”

U.S. SEC Officially Withdraws Crypto Accounting Policy SAB 121

At the same time as the White House issued the executive order, the SEC is also working to reverse the previous cryptocurrency regulatory model.

On January 24, the U.S. Securities and Exchange Commission (SEC) released a new Staff Accounting Bulletin, announcing the withdrawal of the controversial SAB 121. “Staff reminds all entities that they must still comply with existing disclosure requirements to inform investors of the obligations entities have for safeguarding crypto assets for others,” the announcement stated.

SAB 121 required banks and other public companies to include customer crypto assets on their own balance sheets. SAB 122, on the other hand, “rescinded previous interpretive guidance” and directed companies to follow the rules of the Financial Accounting Standards Board (FASB) or relevant provisions of International Financial Reporting Standards.

Since its introduction in March 2022, SAB 121 has been controversial, having been supported by former SEC Chair Gary Gensler, who stated that this regulation could protect investors in bankruptcy cases. “We have repeatedly found in bankruptcy court that bankruptcy courts have ruled that crypto assets are not assets that can avoid bankruptcy risk,” he said in a 2023 interview with Reuters.

SAB 121 was released at the end of March 2022, aiming to better protect investors and detailing how companies should account for custodial services for crypto assets. Due to the unique risks associated with crypto assets, staff believed that companies should record a liability and corresponding asset on their balance sheets at fair value.

In simple terms, if a bank holds $1 billion worth of Bitcoin for clients, they must hold $1 billion in cash to offset this “liability” on their balance sheet. The cryptocurrency industry has been generally concerned that it could prevent banks from holding digital assets, effectively excluding banks from the crypto market.

Last year, SAB 121 became the subject of a Congressional Review Act resolution, which passed Congress but was vetoed by then-President Biden. Now, the SEC's withdrawal of the SAB 121 policy marks a significant change in the regulation of the crypto industry.

Currently, with Trump signing the crypto executive order and the SEC announcing the withdrawal of SAB 121, the U.S. cryptocurrency regulatory landscape has reached a milestone. This series of measures brings more regulatory clarity to the industry and instills new expectations for the future in the market. The transition will still take time, and it remains to be seen whether the Trump administration can continue to implement its commitments and how it will further advance the digital asset reserve plan, which is still worth close attention from the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。