Author: Samuel|OKG Research

Two days after Trump was sworn in as the 60th President of the United States, he signed the executive order "STRENGTHENING AMERICAN LEADERSHIP IN DIGITAL FINANCIAL TECHNOLOGY" on January 23, 2025. This policy is seen as a strong support from the U.S. for innovation in crypto assets and economic freedom, marking a policy adjustment in the field of digital financial technology. In particular, the document explicitly mentions the importance of maintaining the self-custody rights of digital assets, demonstrating the U.S.'s determination to lead in the Web3 and crypto economy.

At the same time, the memecoin launched by the Trump family on the eve of his inauguration became a market sensation. Among them, $TRUMP was first issued on the Solana chain, which was not just an ordinary cryptocurrency issuance but an "experiment" in transforming personal influence into capital, defining a new way of playing on-chain. This token quickly sparked a phenomenal craze by combining identity, community, and market demand.

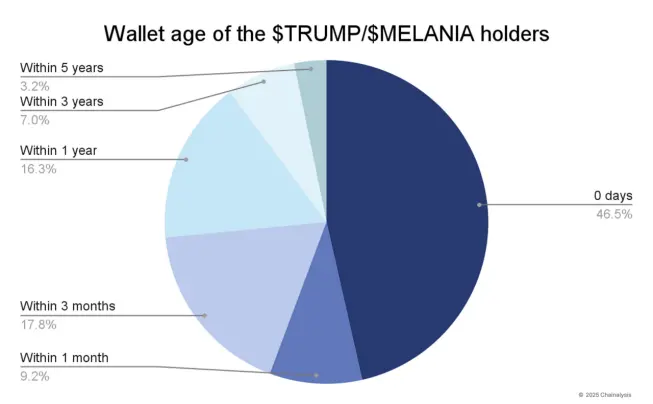

Interestingly, on-chain data shows that nearly half of the wallet addresses purchasing the Trump family memecoin were newly created wallets. Additionally, this sale not only supported cryptocurrency trading pairs but also allowed users to purchase directly with bank cards, significantly lowering the participation threshold. For many new users who had not previously engaged in on-chain trading, this provided an opportunity to enter the crypto space with a lower understanding cost.

Pic Source: https://x.com/JasonYanowitz/status/1882238816507089220

However, whether this craze truly injected new liquidity into the crypto market remains debatable. From the market performance perspective, in a short period, almost all other on-chain projects experienced varying degrees of decline. In contrast, Solana surged against the trend due to strong trading demand, with its price breaking historical highs. Meanwhile, the number of active wallets on-chain peaked on January 19, reaching a near-month high. This polarization phenomenon reveals the fragility of market liquidity when faced with a single hotspot and exposes some deep-seated issues within the on-chain ecosystem.

Pic Source: https://solscan.io/analytics

This memecoin craze is not only an opportunity for the Web3 ecosystem but also a "stress test" that reveals three core contradictions currently existing on-chain: liquidity barriers, ecological fragmentation, and the conflict between user behavior and market structure.

In this context, whether Web3 can transition from "bubble frenzy" to "sustainable value creation" depends not only on the evolution of technology and protocols but also on how to reconstruct the rules of user participation and the internal logic of the ecosystem. The answers to this transformation will determine the future direction of Web3.

On-Chain Liquidity: From Craze to Crisis

The Trump coin event not only ignited the market but also revealed the fragility of the on-chain liquidity system. In the short term, a massive influx of funds drove a surge in on-chain wallet activity and trading volume, but the ensuing "localized overheating" phenomenon exposed structural issues on-chain.

- Concentration of Liquidity and Market Fragility

The lack of a decentralized mechanism for on-chain liquidity means that when phenomenon-level opportunities like $TRUMP arise, funds quickly concentrate on popular assets, leading to significant declines in other projects due to capital outflows, rendering the market pricing mechanism almost ineffective in the short term.

- CEX's "Control Effect"

Despite the gradual popularity of DEX, CEX still controls the main liquidity. Once CEX restricts withdrawals (as was the case during the Trump coin issuance when Solana withdrawals were limited), the efficiency of on-chain asset allocation drops sharply, exposing the dependence of decentralized ecosystems on centralized liquidity.

- Cross-Ecological Liquidity Islands

The barriers between EVM and non-EVM ecosystems like Solana further amplify the concentration effect of hotspots. Although some cross-chain protocols are working to improve this issue, the current cross-chain experience remains fragmented, with high user operation costs.

Future Outlook

The on-chain ecosystem needs richer asset-bearing forms and diversified channels. Self-custody wallets and their derivative functions will become an important part of the liquidity system, supporting applications such as trading, cross-chain, and wealth management, allowing on-chain wallets to upgrade from security tools to core hubs of the Web3 ecosystem.

From "Custody Fear" to "Self-Custody Revolution"

The trust crisis of centralized custody is reshaping user behavior. Events like the FTX collapse have triggered profound industry reflections on the CEX model. Self-custody wallets are no longer just a choice for seasoned players but are becoming "essential tools" for more users. However, challenges still exist behind this trend. Users fear the complexity of private key management, and wallet operation interfaces remain cumbersome.

At the same time, more institutions are beginning to seek the incremental middle ground created by the combination of CEX and self-custody wallets, aggregating exchange liquidity and integrating self-custody wallets to manage personal Web3 assets simultaneously has become an irresistible industry trend. Recently, OKX President Hong Fang stated in an interview with Coindesk that the total assets held in self-custody wallets on the OKX platform have reached nearly $50 billion, surpassing the total assets of its centralized exchange at $30.8 billion. This shift is not only a change in user behavior but also an industry innovation driven by market demand.

In the $TRUMP craze, the advantages of on-chain wallets are particularly prominent. Data shows that many users on the X platform shared their experiences of quickly participating in this memecoin "PVP" battle through the OKX Web3 Wallet. Achieving the exchange of exchange assets to on-chain through a single application, as well as on-chain asset management, trading, and exchange across ecosystems, not only makes the operational experience smoother but also significantly lowers the technical threshold. Tools like the OKX Web3 Wallet are becoming important entry points for users' on-chain activities.

In addition to the demand for asset autonomy, market hotspots are also driving changes in user behavior. The meme craze on Solana that began in 2024 has provided users with simpler participation paths and high return opportunities. This "yield-oriented" trend is attracting more "Risk Taker" type investors to actively engage on-chain. Unlike traditional Web3 users who focus more on long-term value, these new users place greater emphasis on the immediacy and return rates of on-chain transactions. The meme craze has made on-chain projects no longer seem high-threshold but rather accessible, further accelerating the popularization of the on-chain economy.

This transformation is not just a short-term phenomenon but a key driving force for the on-chain ecosystem to move towards mainstream adoption. Users are transitioning from "custody fear" to a "self-custody revolution," indicating a rising awareness of asset sovereignty while also reflecting that the market is seeking more efficient and convenient asset management models. With the joint promotion of CEX and on-chain self-custody tools, the future of Web3 is building a more decentralized and vibrant economic system.

AI Interaction: From Tool to Participant

Another core driving force for large-scale on-chain adoption is the introduction of AI. Compared to its past role as a simple "auxiliary tool," AI is now becoming an active participant in the on-chain ecosystem, redefining user experience and protocol functionality. It not only helps users complete complex trading operations but may also dominate decentralized governance in the future.

- Lowering User Barriers

AI is bringing unprecedented operational convenience to ordinary users through large language models and natural language interaction. For example, users only need to issue a simple command, and AI can automatically complete complex cross-chain asset transfers or LP parameter settings. This simplification not only lowers the technical threshold but also opens the door to the on-chain world for more users.

- Dynamic Optimization and Autonomy

AI's capabilities extend beyond auxiliary functions; it also demonstrates a high degree of autonomy. For instance, in liquidity pool management, AI can dynamically adjust capital deployment based on market fluctuations to maximize returns. Additionally, AI's real-time yield prediction and risk warning functions allow users to respond more calmly to market changes.

- Protocol Layer Updates

The introduction of AI not only changes how users operate but also injects more flexibility into the protocols themselves. For example, AI can dynamically adjust the parameters of DeFi protocols through in-depth analysis of on-chain data, thereby improving the adaptability and stability of the protocols. In the future, we may see fully AI-driven decentralized protocols that will become new driving engines for the on-chain economy.

From Fragmentation to Integration

Although current on-chain adoption still faces issues such as liquidity fragmentation and insufficient self-custody education, the trend is irreversible. The continuous maturation of cross-chain technology, the increasing popularity of AI tools, and users' growing emphasis on asset sovereignty are all driving the on-chain economy towards comprehensive integration.

Education and Tools: Making Self-Custody Accessible to Everyone

In the future, users will need not only tools but also knowledge. Combining education with tool availability to enable every user to easily manage on-chain assets is key to achieving large-scale adoption.

Cross-Chain Technology: Breaking Ecological Barriers

By integrating on-chain functions within wallets, users will be able to seamlessly transfer assets between different ecosystems, making full-chain liquidity smoother.

AI: Unlocking On-Chain Potential

AI will no longer be just a tool but a core component of the on-chain ecosystem. From user interaction to protocol design, AI will deeply participate in every aspect of the on-chain economy.

In this era of network transformation, on-chain is no longer just a concept but the main battlefield for the further extension of application types and scenarios. The Web3 era will not be a return to centralization but the rise of on-chain applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。