Trumpcoin may have reached the peak of the Memecoin craze; should we shift our focus to SocialFi?

Author: Tulip King

Translation: Deep Tide TechFlow

Alpha Priority

The overall market is healthy but shows signs of overextension; the next mainstream investment direction is still unclear.

Trumpcoin may have reached the peak of the Memecoin craze—should we shift our focus to SocialFi?

Emerging hotspots: SocialFi, AI, Dinocoins, etc., are vying for market attention.

Market Conditions

Despite recent market volatility, I believe the market remains in a healthy state. From the three core indicators of the crypto market, the performance is very positive.

- ### Bitcoin's Strong Consolidation at High Levels

Bitcoin continues to consolidate near the top of its range, indicating a strong market sentiment rather than weakness. In the current situation, around $105,000 seems to be a key price level for Bitcoin. This level reflects the market's confidence in the long-term development of cryptocurrencies while avoiding the risks of excessive optimism.

Bitcoin is consolidating at high levels, showing healthy market signals.

Although we have not seen some major news—such as strategic Bitcoin reserves (BSR) or comprehensive tax incentives for cryptocurrencies—the market has still made some small progress. For example, Ross Ulbricht's pardon is a low-key but significant signal indicating that the Trump administration has not completely abandoned support for cryptocurrency policies. While the progress in regulatory transparency is slow, the overall trend is positive.

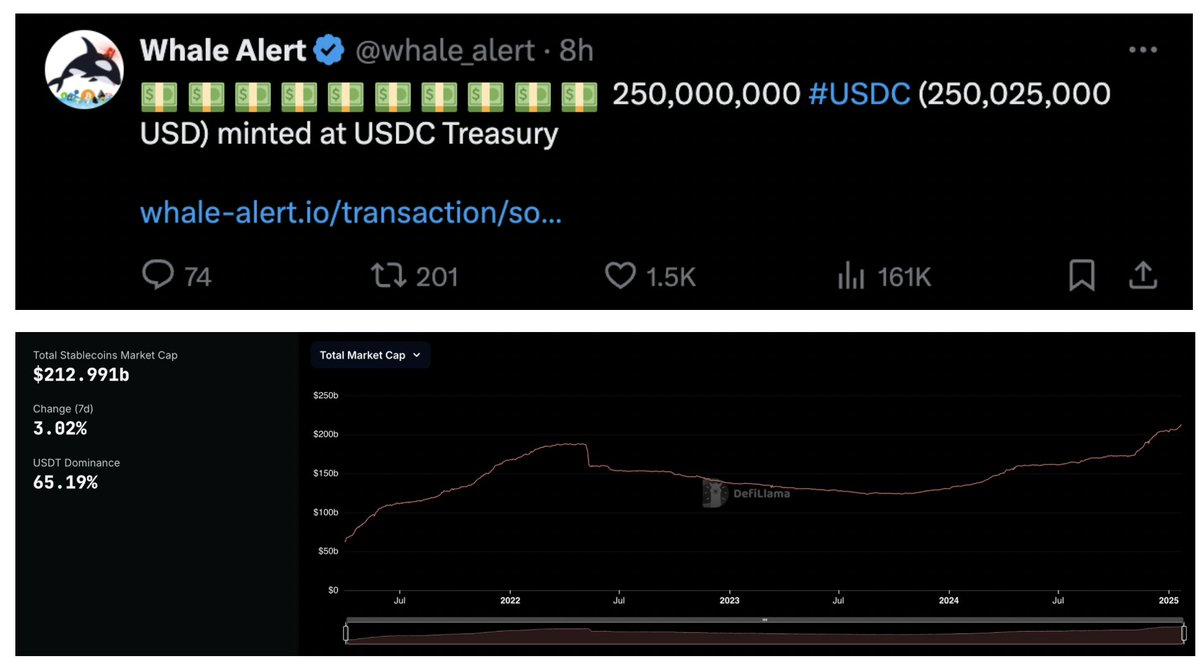

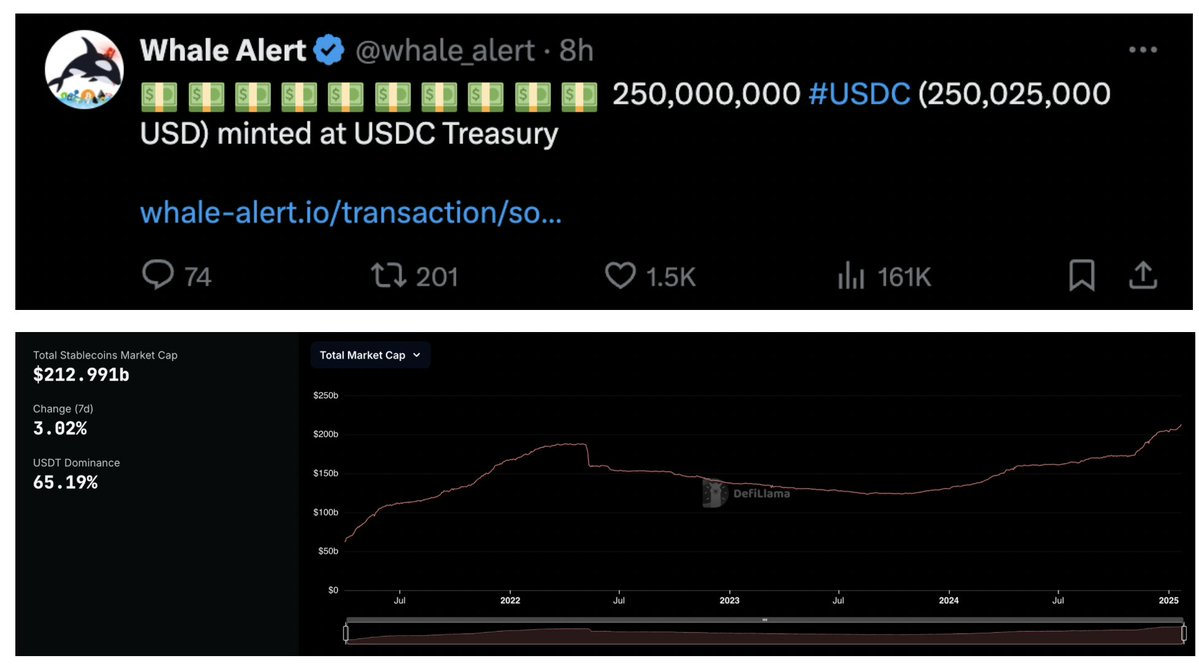

- ### Steady Growth in Stablecoin Supply

Another positive signal is the continuous growth in stablecoin supply. Historically, an increase in stablecoin supply is often a reliable precursor to increased institutional interest and market liquidity. It is worth pondering: who is minting these stablecoins on such a large scale?

The continuous growth in stablecoin supply releases bullish signals.

From the scale of minting, institutions are indeed entering the market. If you have doubts about this, you can check the data from @whale_alert and other on-chain monitoring tools. Although this has not yet been clearly reflected in the performance of altcoins, capital is flowing into the market.

- ### Expansion of Total Market Capitalization in the Crypto Market

The total market capitalization of cryptocurrencies continues to grow.

Finally, the total market capitalization of the crypto market is still expanding. This growth, combined with Bitcoin's strong performance and the increase in stablecoin supply, further indicates that the market is not on the brink of collapse. On the contrary, the market is consolidating its foundation, preparing for the next phase of growth, regardless of how this phase may manifest. The current market does not resemble an impending apocalypse.

Narrative Risk: Loss of Market Direction

One significant reason for the current lack of significant volatility in the altcoin market is the lack of a clear narrative direction. This is known as "narrative risk"—as the market loses its direction, funds may flow into the wrong investment themes, increasing risk.

Take the recent Memecoin craze as an example. Although Trump did not announce strategic Bitcoin reserves (BSR) or other major news, he did launch a Memecoin. Subsequently, Melania also launched a similar token, and there are even rumors that Barron might be involved. Traders have shown great enthusiasm for these opportunities, and I am no exception.

However, this sudden Memecoin craze has filled the market with uncertainty, leaving more questions than answers. Is this a super cycle for Memecoins, or a top signal? Should we refocus on AI tokens? Why does XRP's price chart look so strong? It seems that no one, including the market itself, can clearly point out where funds should be concentrated at this moment.

Memecoins: The Craze May Be Nearing Its End

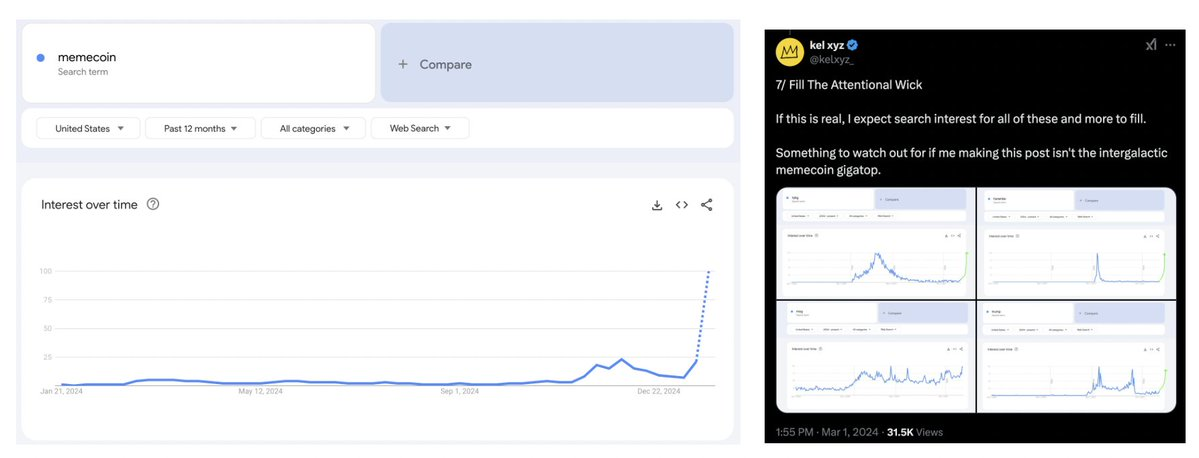

Regrettably, it seems that trading in Memecoins may have entered its final wave. Trump's involvement has captured overwhelming attention and market share in this field, an influence that cannot be underestimated. The question now is: who else can launch a Memecoin on a similar scale? The answer is likely "no one."

As Kel puts it, we have exhausted our "attention resources."

The essence of Memecoins is to convert attention into tokenized assets. They rely on attracting public attention and transforming it into speculative funds. Over the years, this model has driven explosive growth in the Memecoin market. However, with Trump's involvement, this model may have peaked. Trump is not just an ordinary celebrity or influencer; he represents the vast majority of attention globally. No other figure or event can rival his dominance in culture and media.

Therefore, Memecoins as an asset class may have reached their peak. The growth potential for attention tokenization has been fully tapped. Of course, Trumpcoin may still see further increases, and it could even drive other Memecoins for one last parabolic rise. But this feels more like an epilogue rather than a new chapter.

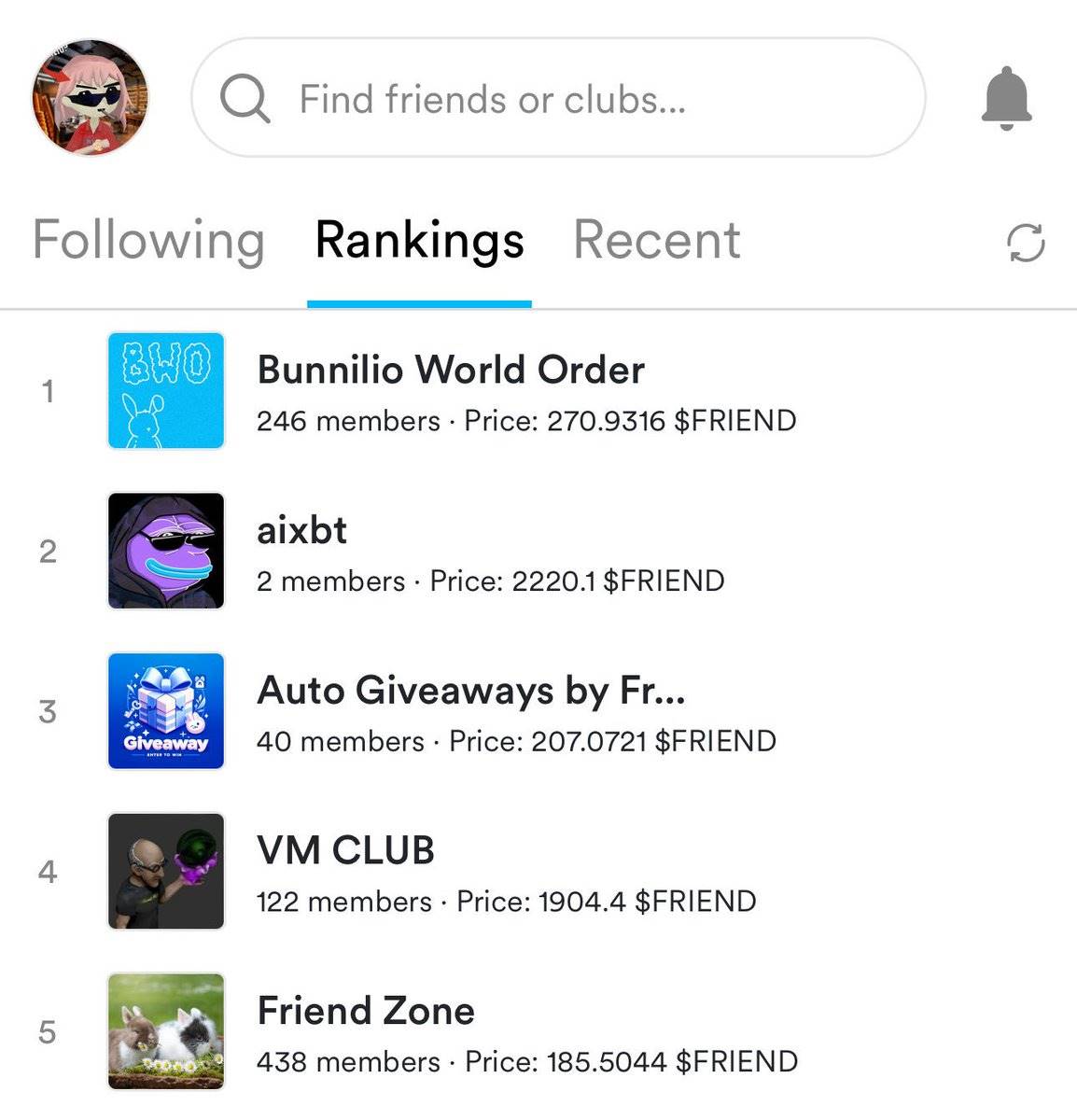

SocialFi (Clout and Yapster)

If the narrative of Memecoins is to continue evolving, it needs to shift towards a more sustainable and scalable model. This is where the potential of SocialFi lies. By combining speculative enthusiasm with deeper, more personalized interactions, SocialFi has the potential to extend the story of Memecoins. Rather than betting on cultural phenomena or celebrity tokens, SocialFi offers an opportunity to invest in personal relationships and community dynamics. From this perspective, it is a natural evolution of the Memecoin concept—moving from mere attention conversion to more meaningful interactions and long-term value creation.

Why SocialFi is Worth Watching

SocialFi is a potential hotspot worth paying attention to. Successful projects in this field may integrate elements of social media and online gaming to create a platform that is both engaging and profitable. It can be imagined as a combination of "social platforms and online entertainment," with significant potential for mass adoption.

Currently, there are two projects worth noting:

Clout: Clout focuses on tokenizing social influence, allowing users with a large following (over 10,000) to create personal tokens. Built on Solana, it combines the monetization features of Friend.tech while simplifying token issuance and integrating with decentralized exchanges like Raydium. Clout has already achieved early success, with its first token $PASTERNAK reaching a market cap of $80 million in just a few hours. The seamless registration process through credit cards and Apple Pay significantly lowers the entry barrier for Web2 users. However, its open structure may dilute liquidity across multiple influencers, potentially weakening community cohesion.

Yapster: Yapster is another innovative SocialFi project that combines social media, gaming, and cryptocurrency, also built on Solana. In contrast, Yapster's approach is more centralized, focusing on uniting the community around a common goal rather than dispersing liquidity across multiple influencers. Users can participate in daily game shows, paying a registration fee of 0.25 SOL to create and vote on Memes. Winning Memes can even be minted into tokens, with distribution linked to participants' scores. This model focuses on a single Meme rather than numerous influencers, creating a stronger and more unified flow of liquidity. Yapster's invite-only beta testing further fosters a closely-knit, actively engaged community. A notable example is that its first token reached a market cap of $25 million in just 10 minutes, demonstrating its strong user engagement and value creation capabilities.

@yapsterxyz: We understand that many users have encountered lag and other issues during the game! We are working day and night to fix these problems and hope to resolve them as soon as possible. Thank you very much for your understanding and patience while experiencing the beta version.

Over-demand leading to stability issues is often a bullish signal for the market.

While Clout offers many advantages in scalability and operational simplification for influencers, I prefer Yapster's centralized mechanism and community-driven design. It focuses on converting public attention into real value, making this model more sustainable and appealing compared to dispersing liquidity among numerous individuals.

Dinocoins (XRP, HBAR, XLM)

- “Things that are dead never die, but rise again stronger.” — George R R Martin

Dinocoins (including XRP, HBAR, and XLM) are typical "hated trades" in this round of the cryptocurrency cycle. This trading model is effective because it reveals the emotional biases of market participants. The skepticism and disdain towards these assets often mean that investors are under-allocated to them, leaving a significant amount of capital on the sidelines. When these assets begin to rebound, investors are often forced to buy in, further driving up prices.

Price charts of Bitcoin and XRP.

Twitter users in the crypto community have long viewed Dinocoins as outdated antiques, believing they have lost competitiveness in the face of newer, more appealing narratives. However, it is this very disdain that creates opportunities for their unexpected resurgence.

Why is it important to pay attention now?

Despite their poor reputation on Twitter, Dinocoins have shown significant strength in price performance and institutional adoption. Here are the reasons they are worth watching:

- Institutional Recognition: These tokens have reinforced a "more formal" positioning in the cryptocurrency space, focusing on real-world applications and partnerships. For example, Ripple's new stablecoin RLUSD demonstrates its efforts to integrate into mainstream finance. The partnership between XRP and Santander, as well as HBAR's collaboration with the World Gemological Institute, further prove their commitment to institutional adoption.

(An atypical XRP Army account—this is a bullish perspective from an excellent research team)

- Regulatory Landscape: With expectations of a more favorable regulatory environment for cryptocurrencies, these tokens are well-positioned. The ISO 20022 compliance of XRP and XLM (a standard closely related to compatibility with traditional financial systems) enhances their credibility. Additionally, rumors surrounding ETFs (exchange-traded funds) for XRP and HBAR add another layer of appeal, even though Bitcoin ETFs remain the primary focus of the market.

This contrast is striking: on one hand, many cryptocurrency enthusiasts scoff at them; on the other hand, institutions may be quietly embracing these tokens. Whether you like them or loathe them, Dinocoins are taking action that could redefine their role in the market. Their focus on compliance, partnerships, and real-world applications may ultimately become a winning strategy, especially if they can win favor with regulators.

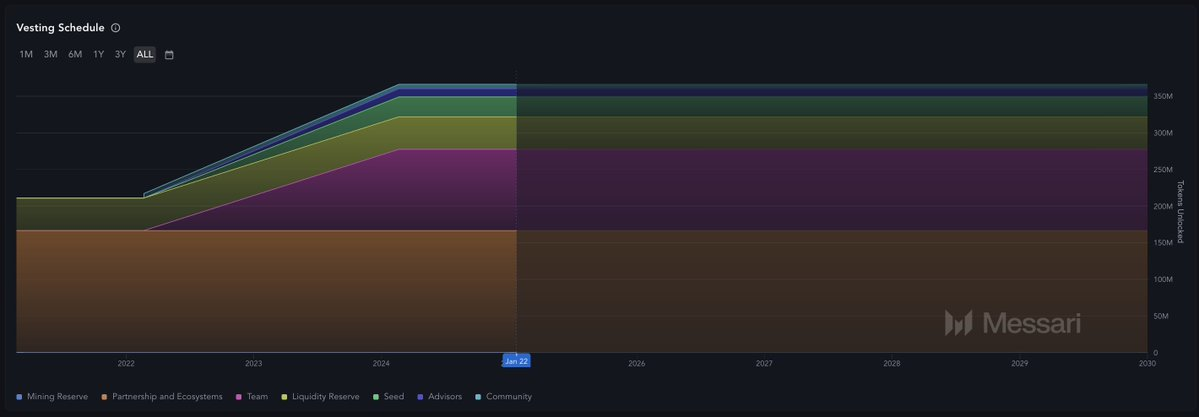

Hedge Fund Liquidity Token Operations

If you still believe in the concept of "fair launches," you need to face a reality: the lifecycle of most tokens is not as democratic as it appears on the surface.

Team Development Projects: Project teams typically develop projects with a vision for decentralized finance or infrastructure and create a token as part of the ecosystem.

VCs Provide Funding in Exchange for Locked Tokens: Venture capital firms (VCs) fund projects in exchange for locked or phased-release tokens. This arrangement theoretically ties the interests of VCs to the long-term success of the project, as the tokens cannot be sold immediately.

VCs Sell Unlocked Tokens OTC to Liquidity Funds: When tokens begin to unlock or are released in phases, VCs typically sell these tokens to liquidity funds through over-the-counter (OTC) transactions. These liquidity funds are usually well-capitalized institutions that buy these tokens in bulk at discounted prices.

Liquidity Funds Dump Tokens When Market Volume is High (You are in this phase now): After acquiring these tokens, liquidity funds will attempt to create or capitalize on market hype. They promote narratives through platforms like Twitter to attract market attention and increase trading volume, allowing them to sell the tokens at a high price under favorable conditions.

Actual Situation

Taking Raydium as an example, its tokens now seem to be mostly unlocked.

Between 2021 and 2023, venture capital poured into the crypto market, particularly in DeFi and infrastructure projects. These investments typically took the form of locked or phased-release tokens. However, as most tokens are now unlocked, VCs need to liquidate these assets to deliver returns to their limited partners (LPs). Starting in mid-2024, many well-known VCs began calling for more liquidity. These liquidity funds purchase these illiquid tokens through OTC transactions, providing VCs with a market to liquidate unlocked tokens.

Rather than blaming the participants, it is better to understand the rules themselves. VCs are pushing people to raise liquidity to take over their tokens through OTC transactions, thereby starting to distribute profits from the previous cycle to LPs.

The relationship between VCs, liquidity funds, and the market is not malicious but a natural phenomenon of capital flow in the crypto ecosystem. VCs need to rely on well-capitalized liquidity funds to take over their tokens, which are often sold at low prices due to lack of liquidity. In turn, liquidity funds will attempt to create or amplify market narratives through platforms like Twitter to attract market attention and increase trading volume, allowing them to profit by selling these tokens at high prices when market conditions are favorable.

The alignment of market narratives and timing.

This is not necessarily a malicious act; I have even bought some of these tokens myself. But you need to understand your counterparties and have a clear understanding of the lifecycle of the tokens.

AI Agents and DeFAI

DeFAI may replace many existing crypto tools. If enough functional integration is achieved, a DeFAI router could simultaneously serve as a yield aggregator, decentralized exchange (DEX), perpetual contract aggregator, portfolio management tool, and more.

However, I am cautious about those claiming to be "able to help you make money" with AI agents. Market dynamics dictate that excess returns (alpha) will gradually diminish over time. Even so, DeFAI still has the potential to provide significant support for individual investors by simplifying personal trading strategies and portfolio management.

Currently, AI is at a critical development juncture. The AI hotspot has gone through several phases: initially, infrastructure projects like Bittensor, followed by agent projects like AIXBT, then agent launch platforms (like Virtuals) and frameworks (like AI16Z). Today, the latest trend revolves around DeFAI.

An Important Trend in Formation

AI is undoubtedly one of the most important market hotspots in this cycle, but its long-term development direction remains unclear. The rise of DeFAI is particularly noteworthy because it does not promise magical "money-making AI" but focuses more on practical functions, such as streamlining yield optimization, trading, and portfolio management processes.

What sets DeFAI apart is its potential to integrate the fragmented ecosystem of current crypto tools. Imagine a router that can seamlessly integrate various financial tools, significantly reducing user friction. While the idea of "money-making AI agents" may sound unrealistic, DeFAI's advantage lies in helping users execute their strategies more efficiently.

Evolving Market Trends

Like all major market hotspots, the AI field is rapidly evolving under the influence of hype and experimentation. From the initial promise of AI bringing financial freedom to the practical functions offered by DeFAI today, this shift reflects the market's gradual transition from fantasy to real-world applications. It is foreseeable that AI will continue to be a core theme, but the ultimate winners will be those projects that can meet actual needs and avoid overpromising.

The crypto market remains full of unknowns. Market hotspots change rapidly, and future winners will be those participants who can anticipate the flow of public attention. Stay sharp and flexible while keeping an eye on the bigger picture, and do not be misled by short-term fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。