Original: RVM, Compilation: Yuliya, PANews

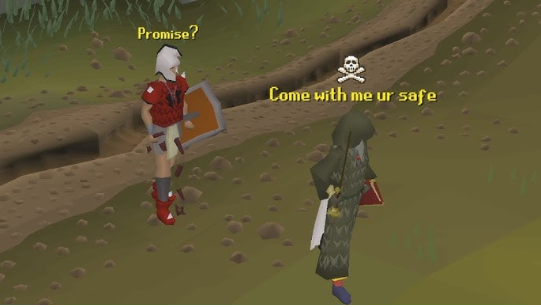

In the digital world of the RuneScape game, one of the most notorious predatory strategies in the "Wilderness" area is "luring." This technique involves exploiting the naivety and greed of unsuspecting players, enticing them into the dangerous depths of the Wilderness— a high-risk player versus player (PVP) area— through false promises of safety, profit opportunities, or goodwill.

This mechanism is simple yet effective. The lure will disguise themselves as a helpful ally, offering enticing rewards or assistance, carefully constructing narratives to build trust and lower the victim's guard. Once the victim enters the Wilderness area, the illusion shatters, and the predator reveals their true intentions— ambushing the target, stripping them of their belongings, leaving them with nothing.

This age-old strategy rooted in psychological manipulation and opportunism illustrates how social dynamics and trust can be weaponized in a zero-sum environment to extract value from others. It serves as a profound warning: promises of safety or guaranteed returns often mask an asymmetric setup designed for the initiator to profit at the expense of the participants.

Market Status

Liquidity Fragmentation and Fleeting Narratives

Overabundance of projects and blockchains: The cryptocurrency ecosystem is rapidly expanding, covering multiple blockchains, protocols, and tokens. This explosive growth severely fragments traders' attention, with a plethora of new projects and "hot narratives" constantly emerging, competing for capital inflow. Each project and narrative attempts to capture a share of the limited market, but this competition results in an overall fragmented market state.

Rapid liquidity rotation: Liquidity in the market is shifting from one "hotspot" to another at an unprecedented pace. Once a narrative loses its appeal, participants quickly abandon it in favor of the next opportunity. This pattern leads to short-term price surges and rapid declines, creating "short-lived trends," from which most traders fail to realize profits.

Key conclusion: Due to the influx of numerous projects and frequent liquidity rotations, any single narrative struggles to sustain long-term price increases, requiring traders to pay closer attention to liquidity dynamics.

Interest Overlap and Market Sentiment Divergence

Incentive-driven opinion leaders: In the crypto market, key opinion leaders (KOLs) often promote projects based on personal interests. They leverage social media to guide market sentiment, driving short-term hype for projects. This behavior results in a lack of consistency in market narratives, further exacerbating the division in market sentiment.

Divided market signals: Current market sentiment is filled with contradictions. On one hand, some macroeconomic indicators seem to herald the arrival of a "bull market"; on the other hand, retail traders are generally losing money, and market sentiment appears extremely pessimistic. This inconsistency in signals increases market volatility, leaving traders more confused.

Key conclusion: The interest-driven rhetoric in the market and the contradictory signals complicate the trading environment, requiring traders to be wary of seemingly "authoritative" opinions.

Bitcoin Trading and the Illusion of Altcoin Season

Capitalizing on Bitcoin's rise: In this market cycle, the most profitable traders concentrated on the early stages of Bitcoin's rise. They seized the upward opportunity earlier than retail traders by timing their positions accurately. However, many retail investors felt disappointed by Bitcoin's "low return expectations," leading them to shift their funds to altcoins in search of higher returns.

Misjudgment by retail traders: Retail traders often avoid Bitcoin, perceiving its market cap as too high and potential for growth as limited. They seek the "next Bitcoin," investing in lower market cap altcoins with high potential. However, this strategy often ends in failure, as the anticipated "altcoin season" fails to materialize, leaving many deep in losses.

Key conclusion: Professional traders have reaped significant rewards during Bitcoin's rise, while retail traders missed opportunities by attempting to bet on altcoins.

Solana and Ethereum: Meme Tokens and Liquidity Traps

Short-lived meme frenzy: The popularity of meme tokens is epitomized by platforms like Pump.fun. These platforms have spawned a series of new tokens reliant on hype and viral spread, lacking actual value support, yet attracting substantial retail funds. This phenomenon is essentially a speculative cycle: early participants aim to profit from subsequent capital inflows rather than based on the project's long-term development prospects.

Public Ponzi scheme? The survival of meme tokens relies on sustained attention and increasing liquidity. Market participants generally recognize their speculative nature—building positions before others buy at higher prices, creating a temporary pump cycle.

Ethereum, the former meme king: Ethereum led market frenzy during the 2021 bull market with NFTs and achieved significant gains relative to Bitcoin again in early 2024 through tokens like $PEPE and $MOG, providing substantial returns for early participants.

However, as the Trump election approaches, the overall market gradually shifts to sideways consolidation, with substantial momentum dissipating. By mid-2024, easily profitable opportunities are scarce, and current meme traders face two major challenges:

The rise of professional market participants: Meme tokens now trading at billions in market cap are effectively competing against professional players and algorithmic market makers dominating liquidity.

High entry valuations: Meme tokens are currently generally overvalued, making it difficult to replicate exponential price increases.

Key conclusion: Both the Solana and Ethereum ecosystems are flooded with numerous micro-cap tokens, further diluting liquidity. The early phase of easy profits has passed, replaced by a riskier market environment dominated by professional traders.

Hyperliquid and the Pursuit of Excess Returns

Airdrop bonanza: Hyperliquid has attracted a large number of active traders and liquidity with its generous airdrop program and innovative product offerings. However, the influx of large capital has also fueled reckless speculation.

Current losses for traders: According to platform data (such as profit and loss charts), most users engaging in short-term trading on Hyperliquid are losing money, especially when chasing hot trends. Despite the platform's growth potential, the frequent rotation between meme coins and other high-risk assets significantly increases the probability of losses.

Key conclusion: Even on innovative platforms, the zero-sum game nature of aggressive speculation remains. Traders frequently switch between different tokens in search of excess returns, but these gains often evaporate quickly in the face of professional competition.

Comprehensive PVP: Insiders, Institutions, and VCs

Unequal information advantage: Insiders and institutional investors often have the ability to position themselves early, possessing information that ordinary investors cannot access. When retail traders follow price trends and market narratives, they often miss the biggest profit opportunities.

Listing rhythm and market impact: The "listing frenzy"—the phenomenon of tokens surging after being announced on mainstream exchanges—further exacerbates the advantage of insiders. Those in the know can accumulate positions in advance, while latecomers can only buy at inflated prices.

Key conclusion: The cryptocurrency market is essentially a high-risk "player versus player" (PVP) game. Large capital players exploit information asymmetry and early positioning advantages to maximize profits at the expense of those with informational disadvantages.

Altcoin Overexpansion and the Trump Token Incident

Dual token liquidity siphoning: The Trump and Melania tokens perfectly illustrate how new tokens can siphon the last liquidity from an already fatigued market. This phenomenon resembles a massive "liquidity black hole," consuming the remaining funds in the market.

Retail investors as the last bag holders: Like most frenzy-driven token issuances, insiders reap most of the profits, while ordinary traders entering later find themselves deep in losses, further exacerbating market pessimism and confidence crises.

Key conclusion: The depletion of market liquidity and the continuous issuance of new tokens intensify losses for ordinary participants, creating a "no one to take over" market dilemma.

Where Does the Market Go from Here?

Rebound potential analysis: Despite the bleak outlook for the altcoin market, Bitcoin's continued institutional adoption keeps the market optimistic. At the $105,000 price point, Bitcoin maintains a strong upward trend. Positive news from the government or major regulatory bodies could reignite overall bull market sentiment.

Caution for future trends: Even if liquidity returns and market frenzy reemerges, participants must remain highly vigilant. The market is still dominated by professional trading institutions and insiders, creating an exceptionally competitive environment.

Shortening trading cycles: In a fully competitive PVP market, quick in-and-out trades are often safer than relying on long-term trends. The era where simply buying and holding meme coins could yield profits (as in previous cycles or early 2024) seems to have temporarily ended.

Key conclusion: If macro conditions align and new participants enter the market, a positive atmosphere may reemerge, but caution remains paramount. Traders should recognize the current PVP nature of the market and avoid overcommitting to fleeting market narratives.

In the wilderness - Proceed with caution

Final Thoughts

The ongoing theme in today's crypto ecosystem is the decentralization of capital and attention. This dynamic characteristic, combined with the strong influence of insiders and rapidly shifting market narratives, places ordinary retail investors at a disadvantage. While there remains potential for significant gains in a favorable macro environment for Bitcoin, market participants must approach any rally with strategic and risk-controlled thinking.

Practical advice:

Set realistic expectations - The era of easily achieving 10x returns may have temporarily passed.

Invest wisely and diversify - Avoid over-diversifying funds across multiple hyped tokens.

Maintain flexibility - Shortening holding periods and actively taking profits can help navigate the PVP environment.

Pursue quality - Focus on projects with real value and strong fundamentals rather than merely chasing hype.

Ultimately, the era of "everyone wins" may have ended—market games are becoming more brutal, and information asymmetry indeed exists. However, as long as one remains highly vigilant and adept at identifying genuine opportunities, savvy market participants can still profit in this "Wilderness."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。