Author/Source: Nina Bambysheva, Forbes

Translation: Liam

MicroStrategy is not just a massive bet on Bitcoin; it is a revolution in corporate financing.

Most people view billionaire Michael Saylor's publicly traded company MicroStrategy as a huge and risky wager on Bitcoin. However, a closer look reveals it to be a masterpiece, a blueprint for manipulating traditional finance to harness the magical dust driving the cryptocurrency frenzy.

The New Year's Eve at Villa Vecchia was a dazzling scene of orange and gold, directly drawn from Fitzgerald's most extravagant fantasies. Over 500 people crowded on the manicured lawn of this century-old mansion, whose Versailles-style banquet hall has hosted celebrities like Margaret Thatcher, Henry Kissinger, and Mikhail Gorbachev.

The real reason for this feast was Bitcoin's recent breakthrough of $100,000 (rather than the arrival of 2025). Waiters moved around with champagne on silver trays, appetizers adorned with the ubiquitous "B" symbol, and dancers in golden bodysuits waved sparkling orange spheres in homage to Bitcoin's iconic hue. In the center of the garden, a massive playing card was faintly visible, with the king's face replaced by a shameless "B."

The water party continued aboard the Usher, a 154-foot superyacht that appeared in the 2015 film "Starz." It sparkled against the Miami skyline. Shuttle buses flowed continuously, carrying Bitcoin executives, opinion leaders, and most importantly, institutional investors, all dressed in "Bitcoin fashion" (orange suits, B logo accessories). Two giant projectors displayed clips predicting Bitcoin would rise to millions, while a DJ in a space helmet conducted bass-heavy tracks among the swaying palm trees.

"I’m getting a bit tired of the feeling of victory," joked a reveler wearing a black hat emblazoned with Satoshi Nakamoto. The attendees had cryptocurrency credentials: the person in the Nakamoto hat was David Bailey, the 34-year-old CEO of BTC Inc. and publisher of Bitcoin Magazine, who hosted a Bitcoin conference in July where Donald Trump vowed to make America the "cryptocurrency capital of the world" and establish a national Bitcoin reserve.

Michael Saylor, the 59-year-old owner and host of Villa Vecchia, moved through the crowd in his signature black blazer, blue jeans, and T-shirt (with a "B" on the front). He graciously accepted handshakes and selfie requests. Here, Bitcoin is God, and Saylor is its prophet.

Cryptocurrency is like a second rebirth for Saylor, who made and lost over $10 billion during the initial internet bubble. At that time, after graduating from MIT in 1989, he co-founded the software company MicroStrategy in Tysons Corner, Virginia. The company initially focused on data mining and business intelligence software but later clashed with the SEC over accounting practices. In 2000, the company paid fines, settled with the federal government, and restated its performance for previous years.

For the next twenty years, MicroStrategy's sales performance was mediocre, with a market cap hovering around $1 billion. Everything changed in 2020 when Saylor decided to make Bitcoin the core strategy of MicroStrategy.

Last year, after the SEC approved Bitcoin ETFs from giants like BlackRock and Fidelity, the price of cryptocurrency soared, more than doubling within 12 months and breaking $100,000 in early December. Just before Christmas, MicroStrategy joined the Nasdaq 100 index, stimulating more demand for its stock, which rose over 700% last year as it issued bonds and accumulated more Bitcoin (it now holds 471,107). Saylor's company is now the largest holder of digital assets, second only to the elusive Satoshi Nakamoto, who is said to hold 1 million Bitcoins. During 2024, Saylor's net worth jumped from $1.9 billion to $7.6 billion. A month into the new year, his fortune reached $9.4 billion.

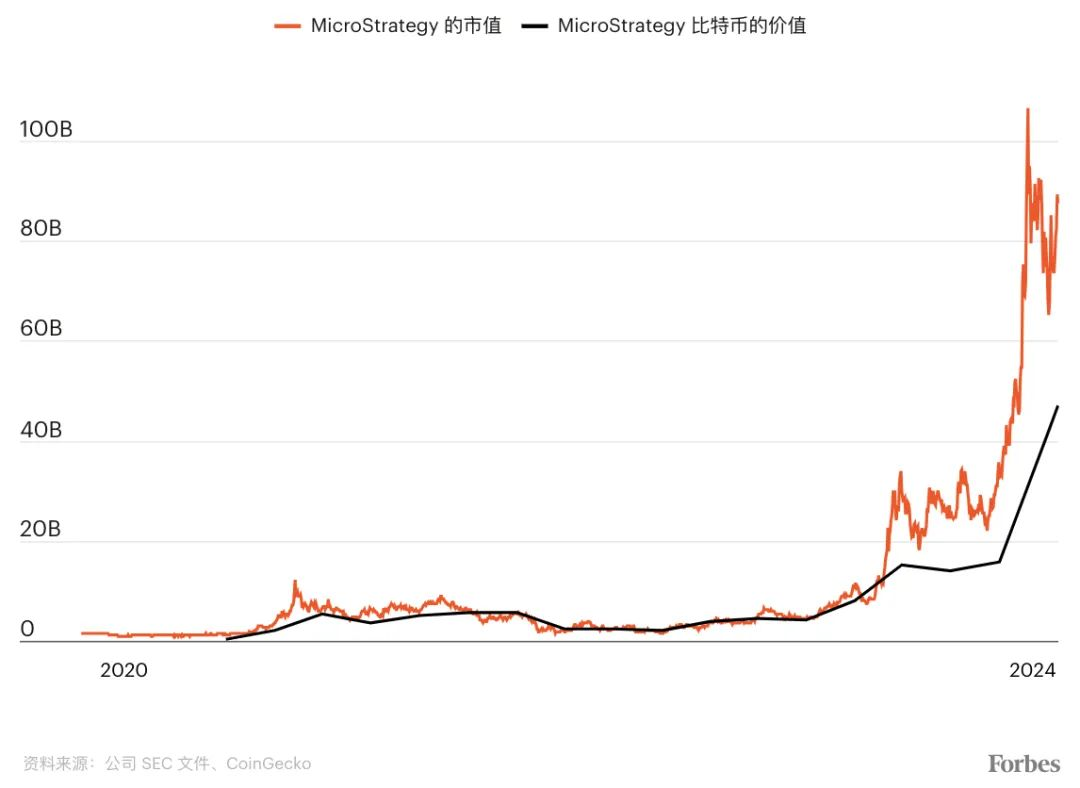

MicroStrategy's astonishing profits have sparked discontent among critics and short-sellers who cannot understand why a small software company holding $48 billion in Bitcoin has a market cap of $84 billion. But what Saylor's critics fail to grasp is that MicroStrategy cleverly straddles two realms: one constrained by traditional financial rules, where companies issue debt and stock traded by hedge funds, traders, and other institutions; the other dominated by loyal, steadfast believers who believe Bitcoin will bring a better world.

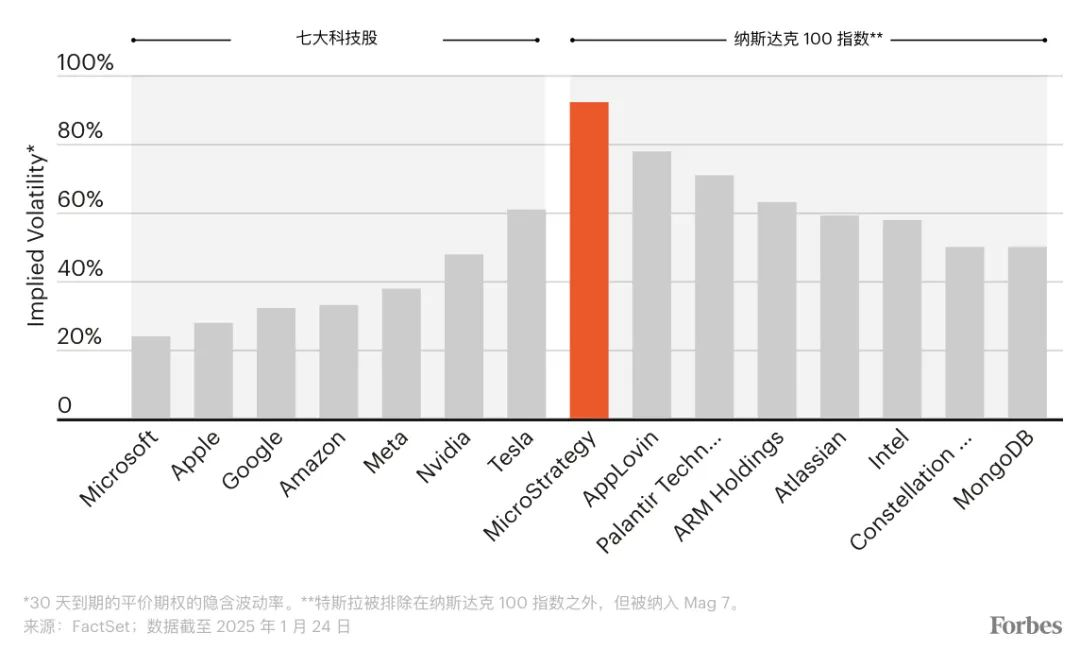

The driving force behind MicroStrategy's success is embracing and cultivating volatility, a hallmark of its core asset. Volatility is the nemesis of traditional investors but a friend to options traders, hedge funds, and retail speculators, making MicroStrategy one of the most actively traded stocks in the market. While its annual revenue is relatively modest at $496 million, its daily trading volume rivals that of the seven tech giants (Meta, Apple, Alphabet, Microsoft, Amazon, Tesla, and Nvidia).

"People think this is crazy," Saylor said, "how can such a small company have such high liquidity? It's because we placed a crypto reactor in the middle of the company, attracting capital and then spinning it. This increases stock volatility, making our options and convertible bonds the most interesting and best-performing products in the market."

Michael Saylor is 100% correct about the popularity of the $7.3 billion in convertible bonds issued by the company since 2021. Every minute of trading day, MicroStrategy's stock price is magnified in real-time by the constant fluctuations of Bitcoin, increasing the implied volatility of the inherent call options in its convertible bonds. Unlike regular bonds, convertible bonds provide security to debt holders, allowing them to convert their bonds into MicroStrategy stock at a predetermined price before maturity. Every trader trained in the Black-Scholes options pricing formula knows that high implied volatility increases the value of options. Thus, Saylor can issue convertible bonds with almost no interest cost.

So far, MicroStrategy has issued six convertible bonds maturing from 2027 to 2032, with interest rates ranging from 0% to 2.25%. In the public bond market, liquidity has been shrinking due to the boom in private credit, with institutional investors eager for excess returns. MicroStrategy's bonds are not only one of the few ways for large investors like Allianz and State Street to invest in digital assets but also among the best-performing bonds in the market, with returns exceeding 250% since issuance. Even the $3 billion five-year bond issued by MicroStrategy in November, with a 0% coupon rate and an exercise price of $672 (80% higher than MicroStrategy's current stock price), rose 89% in just a few months.

Volatility is Vital

This is the three-word mantra that MicroStrategy co-founder Michael Saylor tweeted last March, revealing the magic formula driving the strong performance of its stock and bonds: the implied volatility of company options, driven by the Bitcoin he has accumulated. Many traders crave volatility, expecting MicroStrategy's stock price to fluctuate over 90% in the coming month, while Tesla and Amazon's volatility is 60% and 30%, respectively.

Saylor understands that institutional investors, who measure performance on a quarterly basis, will continue to buy his high-risk stock to enhance portfolio returns. Issuing a large number of convertible bonds like MicroStrategy typically dilutes company stock, but in this case, the convertible bonds create a bullish effect, as these bonds represent future demand for increasingly higher-priced stock. Through secondary offerings and convertible bond issuances, MicroStrategy's shares outstanding have grown from 97 million to 246 million since 2020. During the same period, its stock price increased by 2,666%. At the end of January, its shareholders voted to significantly increase the company's authorized shares to 10.3 billion. This cycle is self-sustaining: issuing billions in low-cost or no-cost debt and stock, driving up Bitcoin prices through massive purchases, and significantly increasing MicroStrategy's stock volatility. Round and round it goes.

"They discovered a monetary loophole in the financial markets and exploited it," marveled Richard Byworth, a former convertible bond trader at Nomura Securities and managing partner at Swiss Zurich Alternative Investments, Syz Capital.

Saylor does not hide his admiration for Bitcoin, which is understandable. Last August, he invented a brand new financial metric called Bitcoin Yield or BTC Yield. This "yield" has nothing to do with any income generated but simply measures the percentage change over time of the ratio of Bitcoin held by the company to the fully diluted shares of the company. His initial goal was to grow it by 4% to 8% annually, but data released by MicroStrategy in January showed that the Bitcoin yield for the fourth quarter was 48%, and for the entire year of 2024, it was 74.3%—these numbers, while large, are meaningless, as he dangles them like bait to his adoring followers.

Ben Werkman, a former commercial banker, consultant, and early investor in the company's Bitcoin strategy, stated that trying to value MicroStrategy using old-fashioned methods will only drive you insane. Saylor "shut down the profit and loss mindset, saying 'we're going to start from the company's net asset perspective, focusing on leveraging our balance sheet advantage,' which in this case means acquiring more Bitcoin."

This is precisely what MicroStrategy is doing. In October, Saylor announced a plan called "21/21" to raise up to $42 billion over the next three years (half through equity financing and half through debt financing) to purchase more Bitcoin. In just November and December, the company acquired nearly 200,000 Bitcoins worth about $18 billion.

As long as Bitcoin prices continue to rise, everything will go smoothly, but what if Bitcoin crashes like it has many times before?

"Scale is everything because liquidity is everything. MicroStrategy is the single source of liquidity for trading Bitcoin-related risks, including the spot market and the options market, the latter being more important."

Unless the apocalypse truly arrives, MicroStrategy should have no problems. Bitcoin would need to drop over 80% from its current level of over $100,000 and remain there for at least two years for MicroStrategy to be unable to repay its current debt. Saylor once again demonstrates his talent for leveraging capital markets and the behavior of bond investors.

The $7 billion in debt issued by MicroStrategy is all unsecured, meaning that technically, none of the Bitcoin in its treasury can be used as collateral. Furthermore, at the company's current stock price of $373, its over $4 billion in debt has already become "worth something," or in effect, equity.

"In reality, MicroStrategy has very little debt on its balance sheet," says Jeff Park, head of alpha strategies at Bitwise, a San Francisco-based crypto asset management firm. He believes that MicroStrategy's Bitcoin holdings are unlikely to be forcibly liquidated because institutional bondholders have a high tolerance for refinancing, even in the worst-case scenario of bankruptcy.

What is stopping other companies from emulating Saylor's Bitcoin financial engineering? Nothing at all. Many companies have already begun to follow suit. According to Park, Bitwise has tracked about 90 publicly traded companies, including well-known firms like Tesla and Block, that have incorporated Bitcoin into their balance sheets. In March of this year, his company will launch the Bitwise Bitcoin Standard Company ETF, which will include a market-cap-weighted index of 35 publicly traded companies holding at least 1,000 Bitcoins (approximately $100 million). MicroStrategy will dominate this index.

Imitators are providing ammunition for MicroStrategy's detractors. Miami-based investment firm Kerrisdale Capital released a short report on the stock in March, stating that MicroStrategy's stock represents a rare and unique way to acquire Bitcoin, but that situation has long since passed. However, Park believes that, much like Netflix in the streaming space, MicroStrategy's first-mover advantage and scale set it apart.

"Scale is everything because liquidity is everything. Whether in the spot market or the options market, they are the most liquid sources for trading Bitcoin-related risks," Park says. "MicroStrategy's options market is the deepest single-name options market in the world to date." The fervor around MicroStrategy's options has even spawned a fund called the YieldMax MSTR Options Income Strategy ETF, which generates income by selling call options. The fund, which has been established for a year, has an annual return of 106% and has accumulated $1.9 billion in assets.

Sitting by the pool at Villa Vecchia, with his three parrots Hodl, Satoshi, and Max chattering behind him, Saylor dismisses his critics. "For the past 40 years, conventional business wisdom has viewed capital as a liability and volatility as a bad thing. The Bitcoin standard dictates that capital is an asset and volatility is a good thing—it's a feature," he insists. "They live in a flat world, in a pre-Copernican era. We are sitting on a train going 60 miles an hour, spinning a gyroscope that weighs 30 tons, while people elsewhere stand by the tracks, motionless."

This is not Michael Saylor's first flight close to the sun.

Born in 1965 at an Air Force base in Lincoln, Nebraska, he was steeped in military discipline from an early age. His father was a chief master sergeant, and the family moved between Air Force bases around the world, eventually settling near Wright-Patterson Air Force Base in Ohio—the site of the Wright brothers' aviation school.

He entered MIT on a full scholarship from the Air Force Reserve Officer Training Corps, studying aeronautics and astronautics, and wrote a computer simulation paper on Italian Renaissance city-states. In his spare time, he enjoyed playing guitar in a rock band and flying gliders. He graduated with highest honors in 1987 and was commissioned as a second lieutenant in the Air Force, but his dream of becoming a fighter pilot was grounded due to a heart murmur, which later turned out to be a misdiagnosis.

When 1 + 1 = 3, by doubling down on Bitcoin, MicroStrategy's market value still grew 60 times over four years, even in a depressed Bitcoin price environment.

At 24, he co-founded MicroStrategy with MIT fraternity brother Sanju Bansal. At the time, few understood the potential of data analytics, but the company was a pioneer in the field. Riding the internet boom, the company went public in 1998, and by 2000, its market cap soared to over $24 billion. Saylor's net worth peaked at nearly $14 billion, and he became a tech evangelist, predicting a world where data would flow like water. "We will use our technology to eliminate the entire supply chain," Saylor told Forbes magazine at the end of 1998. "We are doing everything we can to win a permanent victory for the entire global industry."

Then, the company faced a collapse. On March 10, 2000, MicroStrategy's stock peaked at $313 per share, more than 60 times its IPO price. Two weeks later, the company announced it needed to restate its financial results, and the stock plummeted to $72. The SEC charged Saylor and others with accounting fraud, and MicroStrategy later settled those charges for $11 million. Within two years, the company's stock price fell below $1. Saylor's $13 billion fortune evaporated.

"This was the darkest moment of my life; it was terrible when people lost money because they trusted you," he said.

In 2020, after years of government quantitative easing and trillions of dollars in COVID-19-related stimulus measures, Saylor became convinced that the remaining $530 million in cash and short-term investments on MicroStrategy's balance sheet was best used to invest in Bitcoin. The U.S. government can print dollars at will—and it is working hard to do so—but Bitcoin's design has a hard cap: the number of Bitcoins will never exceed 21 million.

If Bitcoin prices crash, the decline in MicroStrategy's stock price will be more severe and rapid than that of Bitcoin itself. But don't underestimate Saylor's intelligence. Many other companies are also following MicroStrategy's lead—the company now calls itself "the world's first and largest Bitcoin treasury."

Some publicly traded companies, like Metaplanet, even rely on Bitcoin for survival. This Tokyo-based hotel chain faced a survival crisis during the pandemic when Japan closed its borders to tourists. The small hotel operator sold nine of its ten hotels and issued stock and bonds to purchase hotels for $70 million in Bitcoin. Metaplanet's stock trades on the Tokyo Stock Exchange and over-the-counter markets, rising 2,600% in 2024, despite its Bitcoin holdings being worth only $183 million, its current market cap is $1 billion. The company's homepage now states, "Securing the future with Bitcoin," with little mention of hotels. "We are very grateful to Michael Saylor for providing us with a business plan for the world to follow," said Metaplanet CEO Simon Gerovich, who was a guest at Saylor's New Year's party.

"I invented 20 things and tried to make them successful, but none of them changed the world. Satoshi created something, gave it to the world, and then disappeared. It has made me more successful than any of my ideas."

While many companies are unlikely to go to extremes like Metaplanet, the number of Bitcoin holders will certainly continue to grow. In January of this year, the Financial Accounting Standards Board in the U.S. amended a rule that previously only allowed companies to recognize declines in the value of cryptocurrencies as losses in quarterly reports. Now, holding cryptocurrencies will be valued at market value, allowing for simultaneous profit and loss hedging. For MicroStrategy, which lobbied for the rule change, this could mean profits in multiple future quarters and the potential to be included in the S&P 500 index.

According to YCharts, there are now hundreds of large publicly traded companies holding cash that is more than twice what is needed for their current operations and liabilities. The most notable among them is Berkshire Hathaway, which currently holds $320 billion in cash.

Given the $35 trillion (and growing) national debt, Saylor's mantra has been "cash is trash." "Financial repression is an eternal phenomenon," insists Park of Bitwise, a necessary result of the government lowering interest rates. We live in a highly developed financial world, where the real economy and the financial economy have become largely disconnected. Without printing more money, you cannot realistically repay debt. If you believe you must continue printing more money, you better believe that the yield curve will be suppressed.

In Saylor's view, Villa Vecchia itself is the best example. This 18,000-square-foot mansion on Miami's "Millionaire's Row," built in 1928 for the president of F.W. Woolworth, was purchased by Saylor in 2012 for $13 million. "This house was worth $100,000 in 1930. A few years ago, it was valued at $46 million," Saylor said in a 2023 podcast interview. "Do the math—it’s on track to be worth $100 million, which means the dollar will have depreciated by 99.9% over 100 years. The most important thing is: money in the bank is not money."

Trump's future presidency could be a good thing for MicroStrategy and Bitcoin. Despite his grand proclamations of "government efficiency," he was a big spender during his first term: according to the Committee for a Responsible Federal Budget, the national debt increased by $8.4 trillion during Trump's first four years. Although he once publicly called Bitcoin a "scam" that would compete with the dollar in 2021, Trump is now fully invested in cryptocurrency. In fact, his son Eric recently posted a photo with Saylor at Mar-a-Lago, captioned "Two friends, one passion: Bitcoin."

Not only is the value of the dollar likely to depreciate further in the next four years, but Saylor's relentless promotion aligns perfectly with a dystopian MAGA worldview. "The human condition has always been plagued by toxins: toxic food, toxic liquids, and the human economy has been plagued by toxic capital. My mission is to promote non-toxic capital to the world," he proclaims.

But even Michael Saylor occasionally steps down from his podium to reflect on his corporate journey. "We adopted Bitcoin out of necessity and desperation, then it became an opportunity, then a strategy, then an identity, and finally a mission. The irony of my career is that I invented 20 things and tried to make them successful, but I really didn't change the world with any of them. Satoshi created something, gave it to the world, and then disappeared; now we are just carrying on that spirit. Ironically, this has made me more successful than anyone trying to commercialize every one of their own ideas. It’s a lesson in humility."

This also reminds us that lightning can indeed strike the same place twice, especially when there is a savvy and opportunistic manager at the helm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。