Author: Andy; Eureka Partners

TL;DR

What is the endgame of DeFi, and why do some projects end up in dead ends?

The essence of DeFi's endgame is the beginning of the next DeFi. Most projects ending up in dead ends simply align with the natural lifecycle of the market, reaching the main elements of their collapse, while other projects take over their liquidity. From a higher-dimensional perspective of the entire Web3 industry, it remains "everlasting," indicating that the relationships constructed within the Web3 ecosystem align with a healthy ecology. Observing various ecosystems, projects, and protocols through this logic, we can find that their lifecycles tend to shorten as the dimensions decrease, which is a reasonable phenomenon. Therefore, the "turnover rate" of a market represents the health of a project, while the "turnover rate" of a project represents the health of the ecosystem. Next time, refrain from hastily saying "no one is taking over," and instead, approach each project's collapse with caution, abstractly decoupling business logic, and not being misled by seemingly grand concepts.

Can Berachain achieve "sustainability"?

The main collapse point of Berachain lies in: BGT staking rewards converting BGT into Bera's rewards. This also assumes that the on-chain ecosystem can no longer support more bubbles, meaning that as long as there is no systemic risk, Berachain's native assets (BGT, Bera, Honey) have ecological support. However, in practice, this situation is more complex, as not all participants have sufficiently clear global information and make absolutely rational judgments, and not all participants are investors; some project teams may purchase BGT to vote for BGT release rewards to gain potential liquidity. Therefore, this collapse point should be modified to: In a rational market, project teams bribe for rewards, purchasing liquidity costs (bribery, direct purchase of BGT) / BGT staking rewards converting BGT into Bera's rewards.

Does Berachain fundamentally change anything in the liquidity game of DeFi?

Has Berachain fundamentally broken through the technical bottleneck of the liquidity market? The answer is clearly no; it is merely a partial improvement. However, Berachain has chosen the right application scenario—public chains. If we only focus on the mechanism, we may misjudge this potential as being limited to the protocol level, but in reality, the bribery rewards of the BGT token can activate other projects within the ecosystem and can even be considered a grand narrative on par with Restaking.

What is happening with Berachain, and what is the best way for users to participate?

The author observed 103 projects and summarized the following characteristics of Berachain:

- Strong project nativity, varied GTM strategies: Most projects deployed on Bera are not multi-chain compatible but are native to Berachain, with a ratio of native to non-native projects approximately 10:1 (note: some products may originate from the same team). Contrary to intuition, not all non-NFT native project teams tend to issue NFTs for cold starts; most still follow a more traditional approach.

- Economic flywheels are diverse but fundamentally unchanged: Most projects deployed on Berachain achieve economic flywheels through Infrared, while some projects further build multi-layer VE(3,3) on the original BEX foundation, such as Berodrome. However, the core idea remains that any incentive is coin-based, so users only need to understand the fundamentals of the project behind the token + market-making ability. The flywheel between projects should be coupled, but this does not mean that the flywheel effect of a project will collapse due to the collapse of a single project; as long as the tokens being relinquished can yield excess returns, users will be willing to continue supporting the market and allow other projects to fill the gap in the flywheel.

- High-funding projects mostly issue NFTs: Among the top 10 projects by funding, 7 are Community/NFT/Gamefi, all of which issue NFTs.

- Community enthusiasm varies, but there is mutual traffic: The average Twitter viewership for native Berachain ecosystem projects is 1,000-2,000+ people, with some project teams showing underestimated reading numbers (followers/average reading number ecosystem average). For example, Infrared has over 7,000 followers, with an average post view count of over 10,000; many native ecosystem project teams collaborate with each other in various forms, such as participating in economic flywheels, token relinquishment, etc.

- Projects are still innovating, but not in a disruptive narrative: In the NFT space, some project teams choose to leverage BD capabilities to gain user attention rather than merely boasting about utility, such as HoneyComb and Booga Beras. In the DeFi space, some project teams continue to research liquidity solutions, such as Aori, while others attempt to optimize past VE(3,3) models, such as Beradrome. In the Social space, some project teams try to audit the quality of ecosystem projects through peer-to-peer methods, such as Standard & Paws. In the Launchpad space, some project teams attempt to achieve Fair Launch through token rights slicing and LP distribution, such as Ramen and Honeypot. In the Ponzi/Meme space, some project teams attempt to implement "sustainable economics" through Floor price pools, such as Goldilocks.

- Where should Berachain's breakout point be, and which ecosystems are potential stocks?

The author believes that LSDFI and token assets are the breakout points for Berachain. The former constructs a more diverse economic flywheel, creating a larger economic bubble and safety net for Berachain. The latter splits more liquidity for project teams and gains more users through participation in the economic flywheel.

Introduction

Recently, after experiencing Berachain's products, I discussed product experiences and project development judgments with a few friends. Here are some core viewpoints I heard:

- The POL mechanism of Berachain is not strictly innovative and will raise the user participation threshold, but it does not affect the FOMO sentiment of early users.

- The rise and fall of Berachain is reflected in a single token, rather than a "three-token model."

- Berachain's NFTs are the shovels, not the tokens.

- Berachain is the endgame of DeFi.

The first three viewpoints are not particularly impactful, but I reserve my opinion on the fourth point, hoping to leave more imaginative space for DeFi, rather than being confined to the prosperity of a single ecosystem. I do not wish to make baseless claims, hence this article, leaving it for readers to decide.

What is the endgame of DeFi, and why do some projects end up in dead ends?

First, we need to reach a consensus on the essence of DeFi, which is a market—one that repeats itself. If the market is roughly understood as "new money covering old money," it overlooks some pivotal aspects that truly initiate DeFi. I believe that the understanding of the market has good reference value in the three-market theory proposed by @thecryptoskanda.

https://x.com/thecryptoskanda/status/1702031541302706539

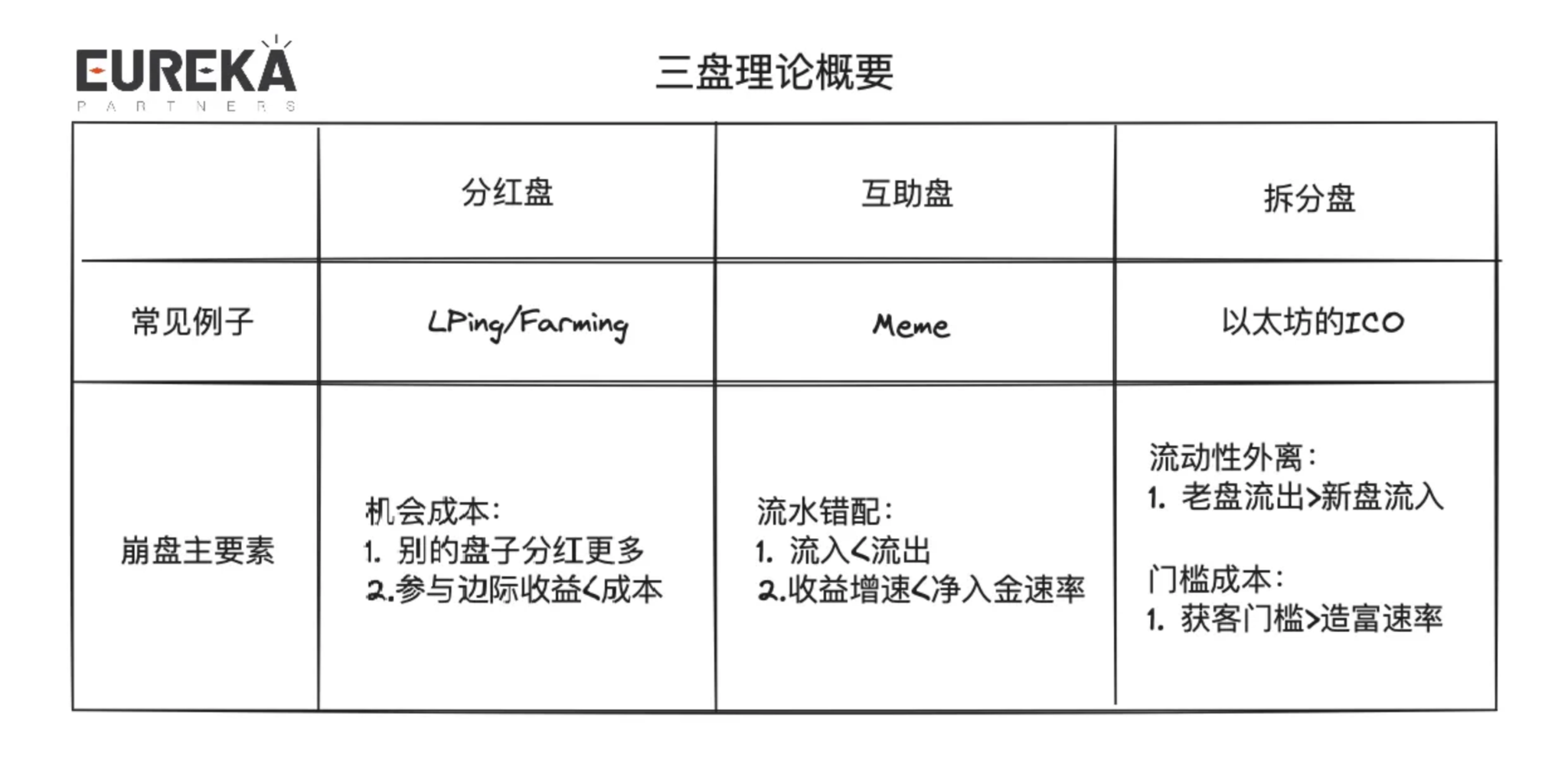

The three markets refer to:

- Dividend market: Earn interest after deposits, such as Bitcoin mining, Ethereum POS, LP rewards.

- Mutual aid market: P2P model, focusing on cash flow mismatches, such as memes.

- Split market: Reducing entry costs by splitting principal chips, thereby multiplying market value, such as Ethereum ICO.

Below is a summary of the main elements of collapse for different markets:

The lifecycle of an ordinary market inevitably faces death spirals and lack of buyers, but a good market's lifecycle is cyclical, possibly composed of different markets interlinked, like an ouroboros. Therefore, understanding a project should be "modular," breaking it down by market categories; otherwise, after the FOMO narrative period ends, one may misinterpret the project's future trajectory.

The saying goes, "one gives birth to two, two gives birth to three, and three gives birth to all things." The three-market theory is not limited to "three markets," but rather the coupling relationships between markets, truly achieving sustainability.

I will briefly explain what kind of cases different combined markets may have:

- First dividend - then dividend: LRT. Users' ETH is first staked in POS (earning the first layer of dividend rewards), and then authorized to AVS (earning the second layer of dividend rewards).

- First dividend - then mutual aid: Peer-to-pool lending protocol. Users first stake tokens to earn initial collateral rewards, and then other borrowers lend out collateral, boosting users' collateral rewards.

- First dividend - then split: ICO on POS chains. Participate in the P2P network with native tokens to earn block rewards, and deploy non-native/shitcoin token contracts on that network to capture liquidity from other users.

- First mutual aid - then dividend: OHM/Reserve Currency. OHM theoretically anchors at $1, and after purchasing at a premium, other stakers can earn more dividend rewards.

- First mutual aid - then mutual aid: Hybrid lending. Borrowers can prioritize matching with peer-to-peer lenders, and if liquidity is insufficient, then match with pool lenders.

- First mutual aid - then split: Runestone. Users first speculate on Runestone, and then Runestone holders can receive airdrops from various projects.

- First split - then dividend: On-chain non-native income-generating assets. Non-native assets are generated from ICO and pay dividends in other tokens/native tokens.

- First split - then mutual aid: frend.tech. Users can establish new targets with low thresholds, and still conform to the principle of new money covering old money.

- First split - then split: Bong Bears. Bong Bears is a continuously evolving NFT, where Bong Bears give birth to Bond Bears, Bond Bears give birth to Boo Bears… and then there are Baby Bears and Band Bears.

It is evident that the combinations and judgments regarding different markets mentioned above are relatively subjective. In reality, a project may encompass a combination of markets that is not limited to 1-2 types, but could be as many as 4-5 types. But does more necessarily mean better? This relates to a project's allocatable resources, or more bluntly—its operational capabilities. Allocatable resources also determine how the relationships between markets can be managed, whether in parallel or serially (here, the concept of computer thread processing is referenced).

Parallel: The relationships between different markets within a project's business do not conflict with each other, allowing multiple logics to be realized separately. For example, in a public chain ecosystem with a plethora of protocols, there exists non-essential business coupling between protocols.

Serial: The relationships between different markets within a project's business may conflict, requiring a sequence in business logic. For instance, the LRT protocol logic adopts serial processing, where users' ETH is first staked in POS, and then authorized to AVS to earn two layers of rewards.

Having understood the essence of DeFi, let us return to the question: What is the endgame of DeFi, and why do some projects end up in dead ends?

The essence of DeFi's endgame is the beginning of the next DeFi. Most projects ending up in dead ends simply align with the natural lifecycle of the market, reaching the main elements of their collapse, while other projects take over their liquidity. From a higher-dimensional perspective of the entire Web3 industry, it remains "everlasting," indicating that the relationships constructed within the Web3 ecosystem align with a healthy ecology. Observing various ecosystems, projects, and protocols through this logic, we can find that their lifecycles tend to shorten as the dimensions decrease, which is a reasonable phenomenon. Therefore, the "turnover rate" of a market represents the health of a project, while the "turnover rate" of a project represents the health of the ecosystem. Next time, refrain from hastily saying "no one is taking over," and instead, approach each project's collapse with caution, abstractly decoupling business logic, and not being misled by seemingly grand concepts.

Does this mean that memes are the healthiest, after all, the cost of starting is low, and the turnover rate of projects is also high? From this understanding, technological breakthroughs may not be important; as long as someone recognizes this narrative, it can continue indefinitely. Is it really so?

If we only consider the dimension within the meme space, then the continuous new markets covering old ones can be understood as a healthy operation. However, if we elevate the dimension to view the entire public chain ecosystem, can the meme space alone sustain itself? Can this truly represent that the public chain is healthy? You may find it somewhat strange; although in practical terms, we often see a particular space booming, we jokingly say that a certain chain is about to rise, viewing its boom as a sufficient but unnecessary condition. However, upon further reflection, this boom may lead to a sharp decline in liquidity for other ecosystems of that chain, even binding the fate of the native chain's token price to a particular space, which is not what most project teams building chains hope to see (excluding Appchains). Therefore, in most cases, the boom of a particular space should be seen as a necessary but insufficient condition, meaning that the traffic of a certain space cannot infer the development of the entire chain, while the chain's trajectory should be able to reverse infer its ecosystem's traffic.

Can Berachain Achieve "Sustainability"?

After reading the above, I believe many readers have begun their preliminary interpretation of Berachain. Let us not rush to interpret the project; instead, let’s take a step back and think about what is core to a chain?

Yes, liquidity. Liquidity, as the nutrient of all things, determines the subsequent development of the ecosystem and represents the popularity of the chain. Past public chains of the traditional faction have overlooked this key point, blindly engaging in marketing, attempting to "siphon liquidity" from other chains, and then what? Nothing; they did not prepare to consider how to better manage users' funds.

"Isn't it the project team's job to retain liquidity? What should the public chain do? We can only provide the best development toolkit; the rest depends on favorable conditions."

In the ideal state, public chains can create narratives that allow the ecosystem to absorb this liquidity, but the scale is never at the public chain level. Currently, the most ideal narrative capable of supporting public chain-level liquidity is LRT+AVS, while other chains struggle to break free from reliance on narrative at the space level, being limited by the development of a particular token, such as BTCL2 being constrained by the explosion of inscriptions and runes.

At this moment, we can reposition Berachain. I believe the best way to understand Berachain is as "the navigator of liquidity." For readers unfamiliar with Berachain, you can find many colleagues online who have written extensively about the three-token model + POL interpretations, so I won’t elaborate too much; I will simply introduce Berachain's token model:

- Three tokens: BGT (governance), Bera (Gas), Honey (stability).

- Key process: BGT can be obtained in Berachain's native applications (the mainnet may release on more protocols later), and BGT can be used to "guide" the release amount of BGT in different LP pools; BGT is non-transferable but can be exchanged 1:1 for Bera. Friends familiar with DeFi can basically understand this as a variant of ve(3,3).

- Note: BGT can currently only be obtained from officially deployed protocols (BEX, BERPS, BEND), but will be open to all protocols deployed on Berachain after the mainnet launch.

I believe that Berachain's token model should be viewed in conjunction with the ecosystem, rather than hastily regarded as a product. Here, I will explain the positive ecological development process of Berachain using the three-market theory:

- Dividend market: Users/ecosystem project teams stake assets as LPs to earn BGT release rewards.

- Split market: BGT can be staked to become a governor or authorized to other governors; BGT governors can decide the release amount of BGT in different LP pools.

- Mutual aid market: Ecosystem project teams provide bribery rewards to attract BGT governors, and ecosystem project teams can obtain potentially more liquidity from higher BGT release amounts.

- Split market: Users purchase tokens from different project teams in the LP pool.

- Dividend market/split market/mutual aid market: Users' assets flow in and out among different ecosystem project teams.

Thus, the main collapse point of Berachain lies in: BGT staking rewards converting BGT into Bera's rewards. This also assumes that the on-chain ecosystem can no longer support more bubbles, meaning that as long as there is no systemic risk, Berachain's native assets (BGT, Bera, Honey) have ecological support. However, in practice, this situation is more complex, as not all participants have sufficiently clear global information and make absolutely rational judgments, and not all participants are investors; some project teams may purchase BGT to vote for BGT release rewards to gain potential liquidity. Therefore, this collapse point should be modified to: In a rational market, project teams bribe for rewards, purchasing liquidity costs (bribery, direct purchase of BGT) / BGT staking rewards converting BGT into Bera's rewards.

It is not difficult to see that this is a seesaw mechanism. When the implied value of Bera/BGT is high, the potential selling pressure on BGT will be high. Once the number of BGT stakers decreases, the absolute yield of BGT staking should increase, thereby boosting the willingness to stake BGT. The implied value of Bera/BGT decreases, but when there are more stakers, the yield space will also decrease, leading to the implied value of Bera/BGT rising again… and so on. A healthy Berachain ecosystem should maintain a long-term positive premium for Bera/BGT, meaning the ecosystem has more trading volume and "should" be willing to offer more bribery rewards to return to BGT stakers. However, considering the actual situation, the amount of bribery rewards for purchasing liquidity is not a "dark forest"; rational project teams can price based on competitors' bids or collude to price, thus leaving it to the free market to determine liquidity attractiveness, ultimately returning to a "market equilibrium" average yield line.

Additionally, another hidden collapse point of Berachain lies in the LP staking yield being lower than that of other DEXs' self-formed LPs, meaning users may be lost due to "vampire attacks." In practical terms, this issue is not significant for two reasons:

- Berachain's native DEX should have the most trading pairs and is the DEX that small projects should choose for cold starts/IDOs. Therefore, in terms of user experience, it can provide the widest trading routes, and there will not be a massive outflow of liquidity.

- Berachain's native DEX has the strongest brand power, making it difficult for other DEXs to compete. One can refer to Uniswap's rapid rebound after being vampire attacked by Sushiswap, which demonstrates the significant impact of brand power on users' trading psychology.

The Liquidity Game of DeFi: Has Berachain Fundamentally Changed Anything?

For DeFi, despite the various forms, the core element remains liquidity. Therefore, how to attract and allocate liquidity in product structure has become a measure of sustainable development, especially for public chains. Below, I will briefly review some liquidity solutions that emerged in previous years and compare whether Berachain's solution has fundamentally addressed the liquidity issue.

Solution One: Liquidity Mining

Subsidizing LPs with project native tokens that only have fee income. This is suitable for early DeFi when users have not yet been dazzled by various product models. This simple and effective subsidy helps quickly capture liquidity. The classic case is Sushiswap's vampire attack on Uniswap, capturing $1.4 billion in liquidity in a short time with LP mining subsidizing $SUSHI tokens. However, the problems are also evident; this kind of dividend is not U-based, and the more liquidity there is, the less the dividend. Therefore, the tokens early users mined will quickly exit in the secondary market, accelerating the likelihood of the project's collapse. Nansen's report in 2021 already pointed out that among LPs who entered on the day liquidity mining started, 42% exited within 24 hours. About 16% of LPs exited within 48 hours, and by the third day, 70% of users would exit. Looking at it today, this data is equally unsurprising; one must ask, if not diamond hands or project team believers, which user would be willing to stay?

Solution Two: CLMM/Other AMM Variants

Gathering liquidity by changing the ordinary AMM (i.e., CPMM, constant product market maker) model. The most famous algorithm is CLMM, which can be understood as numerous independently existing liquidity pools at different price ranges, providing a seamless user experience. This approach seeks a balance between order books and CPMM, improving capital efficiency while ensuring sufficient liquidity to absorb trades. For further explanation, readers can directly look at Uniswap V3 or the V3 forks available in the market; I won’t elaborate further. This solution iteration does not harm the platform token, so it is basically a standard for everyone.

Solution Three: Dynamic Distribution AMM

Through passive/active methods for liquidity range adjustments, the core idea is to ensure that liquidity achieves the highest capital efficiency. For more detailed information on this solution, you can refer to the Maverick Protocol. It is similar to manually redeploying CLMM ranges repeatedly. This approach allows users to experience lower slippage in trading, but the trade-off is the establishment of a "price buffer zone," which increases the potential costs for project teams in market cap management (for example, making it harder to pump the price), so the correlation of token pairs using this dynamic distribution AMM is relatively high, such as LST/ETH.

Solution Four: VE Model

The classic VE model proposed by Curve allows users to obtain some certificates, called VE tokens, after staking governance tokens. These can be used to determine the yield distribution of liquidity mining in different LP pools, i.e., the dividend income from governance tokens. In short, governance tokens can be used to decide the release distribution of governance tokens in LP pools. Since governance tokens can determine the allocation of liquidity mining, it leads to a demand from project teams to guide liquidity, aiming to provide deeper trading depth to ensure sufficient liquidity. Therefore, project teams are willing to offer more rewards to "bribe" relevant governors, mostly using the project's native tokens as rewards. Early projects would choose to outsource bribery platforms, but now more new solutions are adopting built-in bribery modules.

Solution Five: Reserve Currency/OHM Imitation

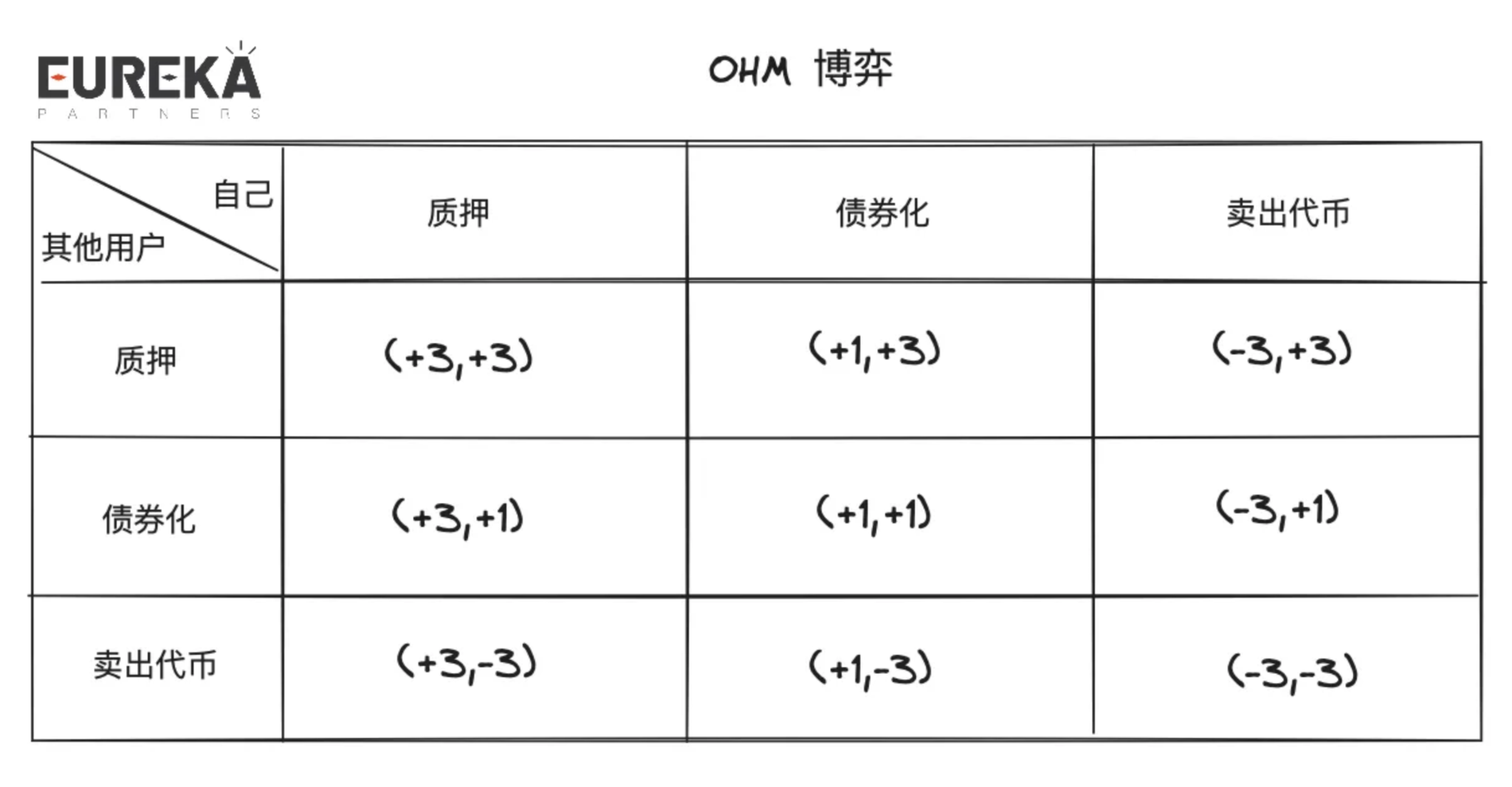

By selling bonds at a discount to collect liquidity and issuing stablecoins with that liquidity, since stablecoins should be pegged to $1, any excess purchases would treat the remaining liquidity as profit, distributed to the stakers of that stablecoin. Theoretically, this method can operate sustainably, but in practice, users do not treat these tokens as stablecoins; instead, they choose to over-purchase the stablecoin and stake it to obtain treasury surplus income. Under the combination of staking, bonding, and secondary market purchases, the value of the stablecoin can be pushed to a level it should not reach. If there is a massive profit-taking liquidation, it will only lead to further runs on the bank, ultimately even returning to below the $1 level. The game situation of OHM is also referred to as the (3,3) model; from the above, it can be seen that users choose to stake, thus in a 3x3 matrix, it is expressed as (3,3).

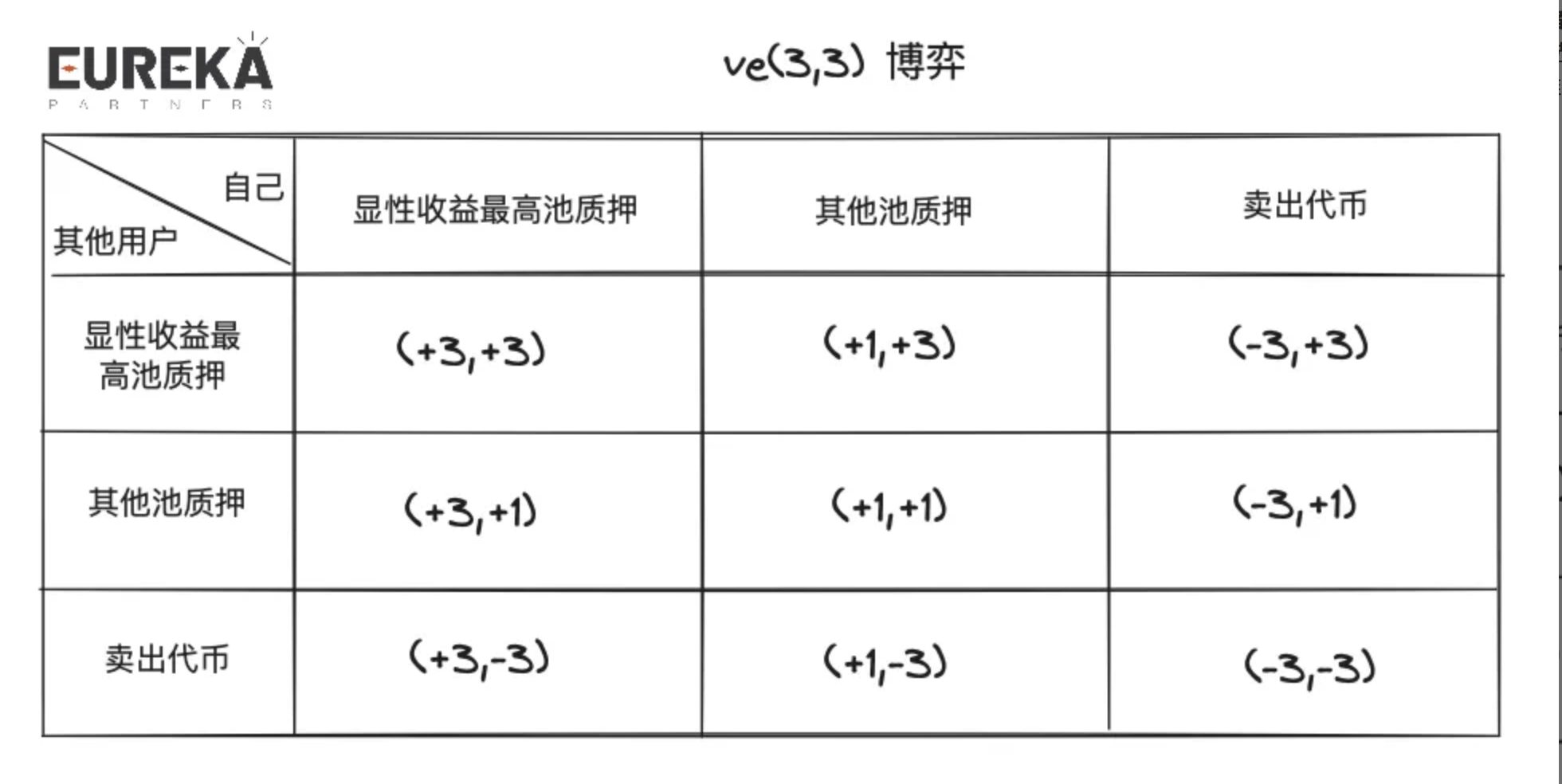

Solution Six: VE(3,3) Model

Unlike the ordinary VE model, VE(3,3) places more emphasis on local optimal consensus. Therefore, project teams create an environment to guide governance token holders to choose towards local optimal directions. The LP fees mentioned in the previous VE model are actually global dividends, meaning all governance token stakers benefit. However, the LP fees in VE(3,3) mostly only appear for the governors voting for that pool, and stakers need to estimate the subsequent distribution of different LP fees before choosing to vote. Thus, in a sense, bribery platforms also provide a local consensus that allows users to actively obtain the most rewards. Therefore, whether it is the isolation of LP fees or the bribery market, both further create internal competition in the liquidity market and attempt to attract liquidity under "single-blind" conditions, meaning it is uncertain how much liquidity providers will actually provide, which remains opaque. Additionally, the biggest difference between the bribery market and LP fees lies in the way returns are priced; the former is priced in project tokens, while the latter is often in U-based pricing. Thus, the former can serve as a buffer for the entire DEX, maintaining the price of governance tokens before the end of the yield bubble.

Solution Seven: Inverse VE(3,3) Model

The forward (3,3) emphasizes the global optimal solution for returns, while the inverse (3,3) increases the cost of user unstaking/holding tokens through a loss mechanism. Readers may understand that holding tokens carries a risk of depreciation, but such projects are often seen in community-driven markets, euphemistically called a native deflation mechanism. The conventional approach of projects in the market using this model is somewhat conservative, such as GMX; it does not mean that not staking leads to capital depreciation, but that unstaking may result in a portion of dividend losses. Readers can look up GMX interpretations online. Using this model requires project teams to have a thorough understanding of their business and to comprehend the lifecycle & design logic; otherwise, it will only accelerate the project's demise, whether the token value is too high or depreciates rapidly, neither of which is what a long-term development project hopes to see.

Solution Eight: Liquidity Guidance

Liquidity guidance generally involves two roles: LP & LD (Liquidity Director). LP still provides liquidity, while LD is responsible for deciding where that liquidity will go. Tokemak is one of the few liquidity solutions on the market that employs this scheme, and v2 has iterated to use internal algorithms to obtain optimal liquidity guidance routes, allowing LPs to achieve optimal staking returns, while liquidity purchasers can clearly know how much they can "rent" in liquidity. The liquidity marketplace has not yet been opened, but it has already accumulated over $8 million in liquidity. From past price performance, this narrative only gained attention during the last DeFi Summer; in the bear market and this bull market, it has not shown much performance. Whether the liquidity market needs market transparency is still to be validated. I believe that a certain degree of "clear pricing" is needed in the liquidity market because blind spots lead to inefficiencies in bidding, and there are many potential idle rewards that cannot be correctly allocated to incremental funds. Such schemes will serve as terminators in the liquidity game, similar to how MEV-boost relates to the MEV dark forest.

Solution Nine: VE-LP / Proof of Bond (POB)

Finally, we arrive at the key introduction of this chapter, which is why I believe Berachain's POL is not the core reason for innovation.

The core idea of VE-LP/POB is to introduce liquidity as an entry ticket & a backstop for the project. The former can be seen in Balancer, while the latter can be seen in THORchain. Balancer allows users to LP in BPL/WETH, and the LP certificates obtained can be further staked to earn veBAL for fee sharing and governance. THORChain's POB requires node operators to stake their native tokens as collateral, and in the event of LP losses, 1.5 times the collateral will be deducted for compensation. The total liquidity hard cap supported by the entire network will be one-third of the governance tokens. When the network becomes unsafe/inefficient, it will seek a balance through liquidity mining > node operator yield distribution. For example, when the network's node collateral is insufficient to cover on-chain liquidity losses, the release of the next node yield (governance tokens) will be increased. Regardless of how the details of these schemes change, the core issue will always be the entry barrier, so how to set a reasonable entry difficulty to maintain sufficient liquidity is key.

Thus, when we look back at Berachain's POL + three-token model, it is essentially a variant of the VE(3,3) + VE-LP model. According to the previous introduction, the market for BGT bribery is an application of the VE(3,3) model, while POL is an application of VE-LP. The former's core lies in the market cap management of governance tokens, while the latter's core lies in the entry barrier. Generally, the governance tokens of VE models in the market are freely traded in the secondary market, allowing ecosystem project teams to easily acquire liquidity. However, for VE model project teams, they face the risk of token volatility. In contrast, the POL approach slows down the acquisition of governance tokens (BGT), providing more time and space for control, while POL allows for multiple types of tokens to be staked, lowering some entry barriers in exchange for more potential liquidity.

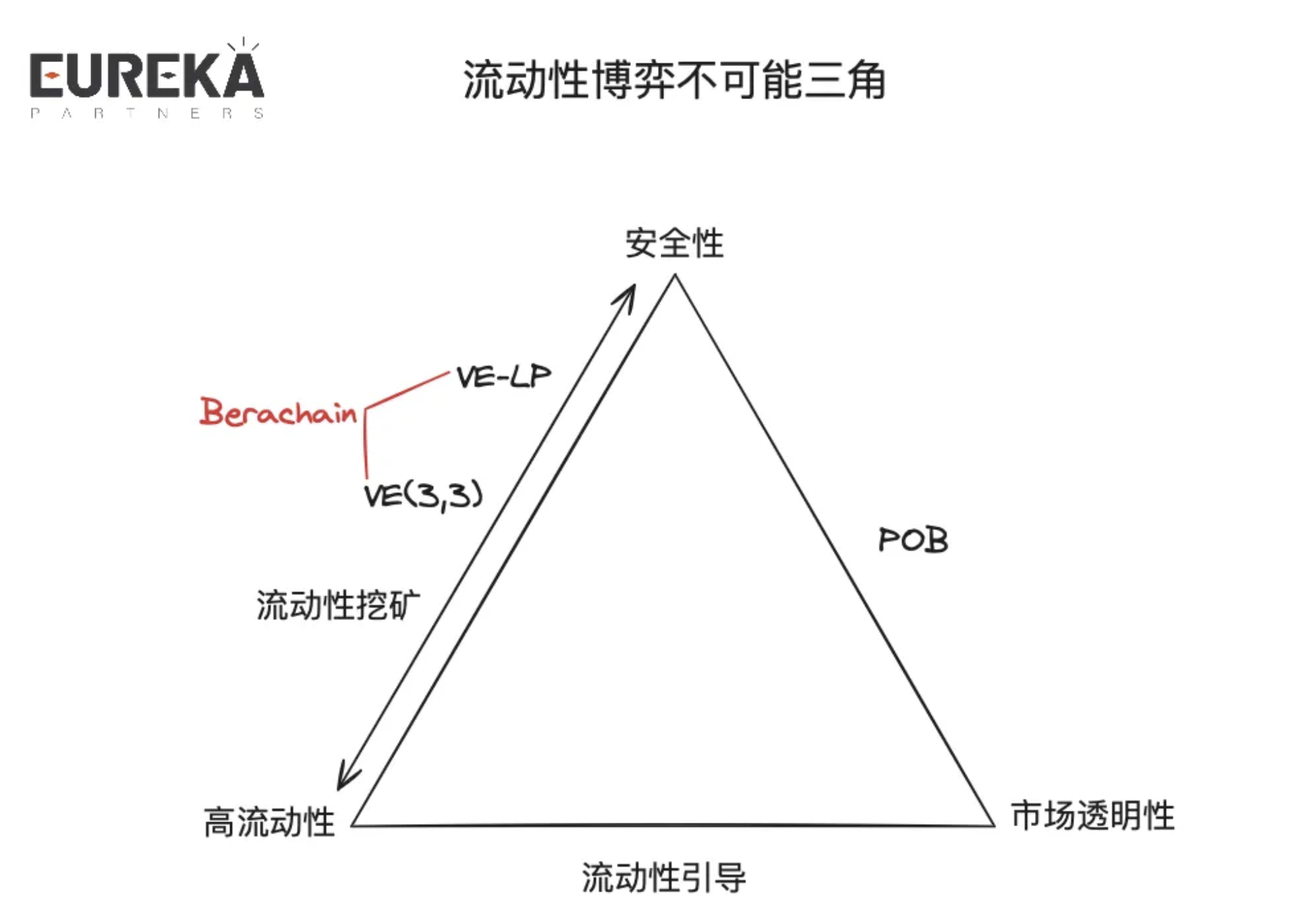

From the above series of liquidity solutions, we can summarize the impossible triangle of liquidity games: security, high liquidity, and market transparency.

Security: Refers to whether the scheme can provide a backstop of liquidity for project teams. For example, the bribery rewards in the VE(3,3) model may lead to a bubble burst, increasing the likelihood of VE project teams collapsing.

High Liquidity: Refers to whether the scheme can attract absolutely high-value liquidity. For instance, if project teams are willing to give up a large portion of governance tokens, this yield will attract a batch of short-term liquidity.

Market Transparency: Refers to whether the scheme can make the demand for liquidity in the market transparent. For example, the liquidity that POB project teams can support is determined by the total amount of node assets.

Returning to the question itself: Has Berachain fundamentally broken through the technical bottleneck of the liquidity market? The answer is clearly no; it is merely a partial improvement. However, Berachain has chosen the right application scenario—public chains. If we only focus on the mechanism, we may misjudge that this potential is limited to the protocol level, but in reality, the bribery rewards of the BGT token can also activate other projects in the ecosystem, and it can even be regarded as a narrative of the same level as Restaking. Imagine now that you are a project team without sufficient capital reserves for liquidity mining as early rewards, but you have still set up a trading pair on BEX (Berachain's native DEX) with a certain amount of liquidity. At this point, the project team can obtain BGT rewards from this staked liquidity, and BGT can determine the subsequent release amount for that pool. Since the pool is relatively small, even a small amount of BGT release will yield higher LP returns compared to other blue-chip tokens, thereby indirectly attracting liquidity. From this logic, Berachain's POL mechanism is somewhat akin to the Restaking track. Because the Restaking track integrates part of ETH's security, Berachain's small projects also integrate part of BGT's "security," providing more sufficient liquidity for the subsequent development of project teams.

What is Happening with Berachain, and What is the Best Way for Users to Participate?

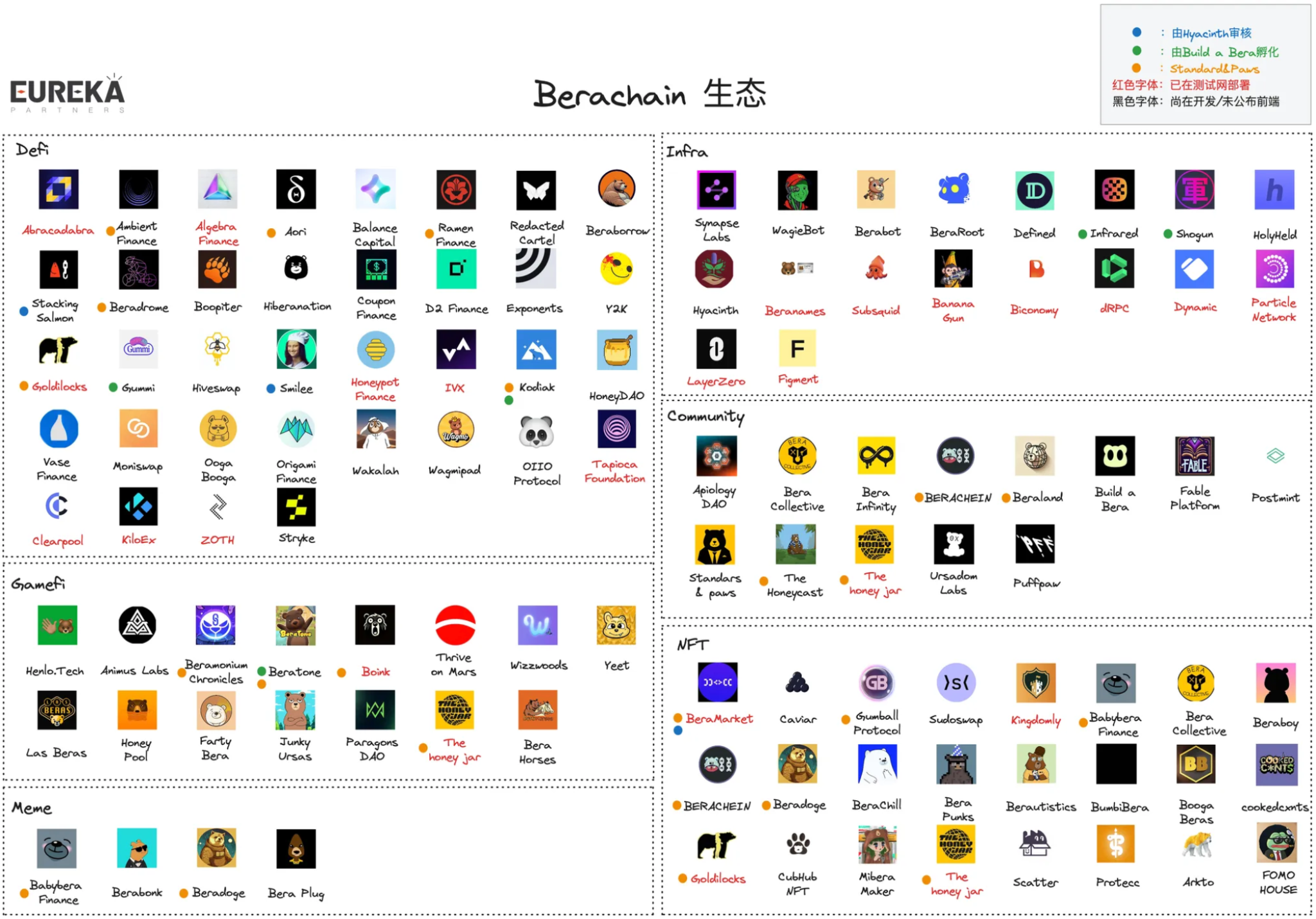

As of May 3, 2024, according to Beraland and my own compilation, there are currently about 103 projects, with DeFi and NFTs occupying the majority. Since projects may have multiple businesses, I have categorized these projects according to their business types. The specific ecological distribution is as follows:

- DeFi: 36

- GameFi: 15

- Meme: 4

- Infra: 18

- Community: 13

- NFT: 24

Currently, most projects are DeFi and NFT products. The Berachain ecosystem is quite complex, and I will only select some key projects for introduction (relatively subjective).

The Honey Jar (THJ)

“The Honey Jar is an unofficial community NFT project, situated at the heart of the Berachain ecosystem, which hosts a number of games.”

The above is the official positioning, which can basically be understood as a hodgepodge project of NFT + Gamefi + Community + Gateway + Incubator. Its NFT is called Honeycomb, which can be used for governance within the project. Currently, all Honeycombs have been minted, with a floor price of 0.446 ETH, and the initial minting price was 0.099 ETH. NFT holders can participate in the platform's games and receive potential mysterious rewards from other projects in the Berachain ecosystem (as of February 22, 2024, HJ has accumulated 33 project collaborations, with about 10 projects offering airdrop rewards), while the Berachain ecosystem can "locate" valuable high-net-worth users through these NFT holders, potentially increasing the project's future participation (high-net-worth users may be willing to invest more). In short, this is an NFT that requires "project teams to take action."

Additionally, every quarter, The Honey Jar will release new mini-games and allow users to mint a new round of NFTs, totaling 6 rounds. These NFTs are different from Honeycomb and are named Honey Jar (Gen 1-6), with the round determining the Gen number for that round. Users who purchase these NFTs can participate in games, which can be understood as NFT lottery games, and a lottery will be held after all NFTs of the current round have been minted, with winners able to claim rewards from the prize pool (NFT + cash). Two rounds of games have already been conducted, and the remaining four rounds will be announced in Q2 2024 and deployed on four different EVM chains.

THJ has incubated 6 organizations:

First, Standard and Paws. This project is a rating system aimed at avoiding the emergence of junk projects in the ecosystem.

Second, Berainfinity, which can be understood as Berachain's Gitcoin, helping developers/projects achieve sustainable development.

Third, ApiologyDAO. Positioned as the investment DAO of the Berachain ecosystem.

Fourth, Mibera Maker. Positioned as the Milady of the Berachain ecosystem.

Fifth, The Apiculture Jar. Positioned as THJ's Meme/Artist department.

Sixth, Bera Baddies. Positioned as a female community on Berachain.

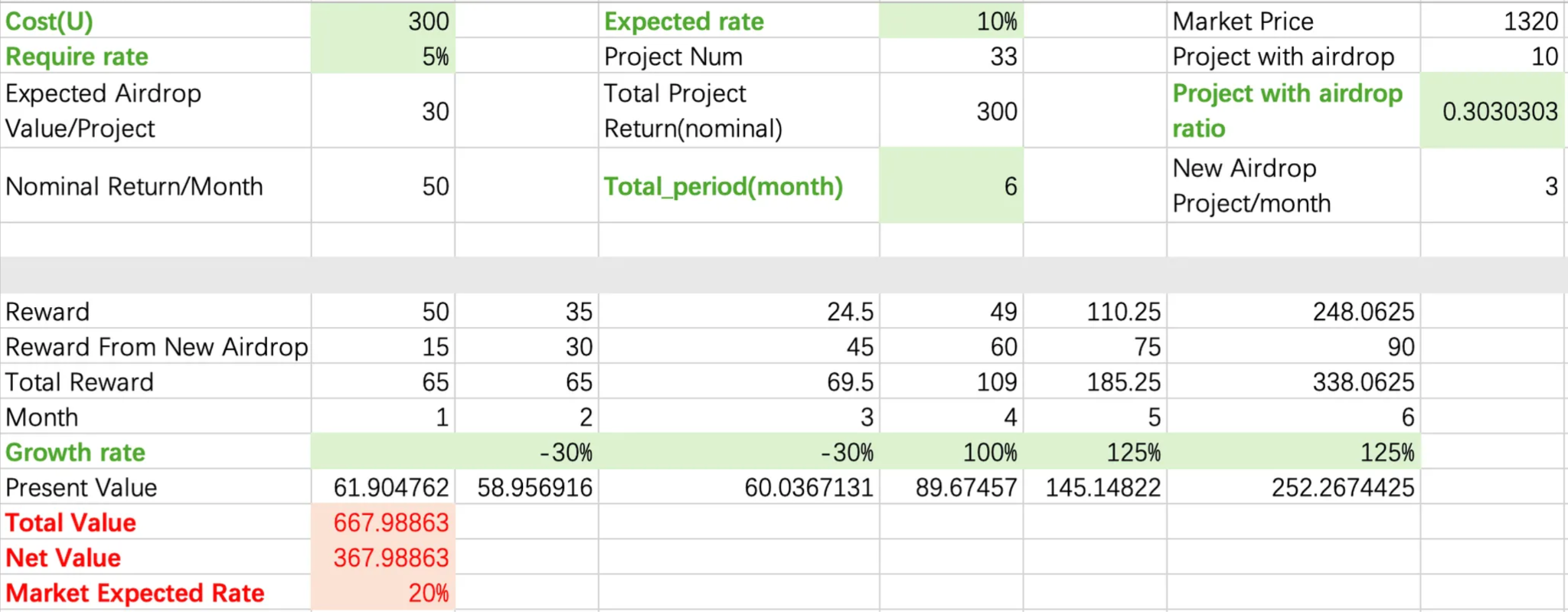

Evaluation: I believe the early participation value of this project is relatively high; no one would dislike a "shovel." However, this narrative generally has the opportunity to be priced in early, so we need to be clear about other core collapse/risk points aside from systemic risks (the subsequent performance of the Berachain mainnet):

First, the project team must have sufficient bargaining power, BD capabilities, and be able to "leverage OGs to influence project teams." If it is proven that Honeycomb cannot truly capture high-net-worth users, then no subsequent project teams will be willing to provide high-value benefits to NFT holders.

Second, the total value of potential rewards provided to NFT holders by other project teams needs to be greater than or equal to the floor price of the NFT. Let's conservatively estimate the price of Honeycomb:

1) Honeycomb cost price: 0.099 ETH is approximately 300 USD.

2) Predicted returns: The on-chain risk-free return is about 5% (POS); currently, 10 projects are willing to pay airdrops, and each project's airdrop is distributed over approximately 6 months, with an initial value of 30 USD (10% Expected rate), meaning a theoretical total value of 300 USD (30 USD * 10), which implies a monthly distribution of 50 USD; assuming 3 new projects are willing to airdrop to NFT holders each month.

3) Return growth rate: Assuming in the first three months, the project team is washing the market, waiting to buy low and then pump, and in the last three months, they pump 1x, 1.25x, and 1.25x respectively; assuming institutional prices recover on TGE day at 5-10 times the price point, with a release period of 12 months, it means the project team needs to pump 2.5-5 times within 6 months (approximately equivalent to pumping 1x, 1.25x, and 1.25x in the last three months).

The final estimated net value of the NFT is 367 USD. If we estimate based on the current floor price (0.446 ETH), then the market's predicted return value for a single project needs to maintain at 20%. The above estimates are for fun; the actual reference value is not high.

Build a Bera

“Build-a-Bera is a results-driven partner with the Berachain Foundation designed to provide Bera-oriented founders with the tools, mentorship, and resources needed to thrive in a competitive market.”

According to the official definition, Build-a-Bera is a partner of the foundation and helps the project's teams in the ecosystem develop, simply put, it is an incubator. Each session recruits 5 project teams for a duration of 12 months. Currently, the 5 project teams clearly listed on the official website are: Infrared, Gummi, Kodiak, Shogun, Beratone.

Evaluation: I believe these selected project teams have a high probability of receiving more support from Berachain, and the various projects within the incubator are more likely to form collaborations (which is indeed the case). Therefore, I will introduce the various selected projects mentioned above later.

Infrared Finance

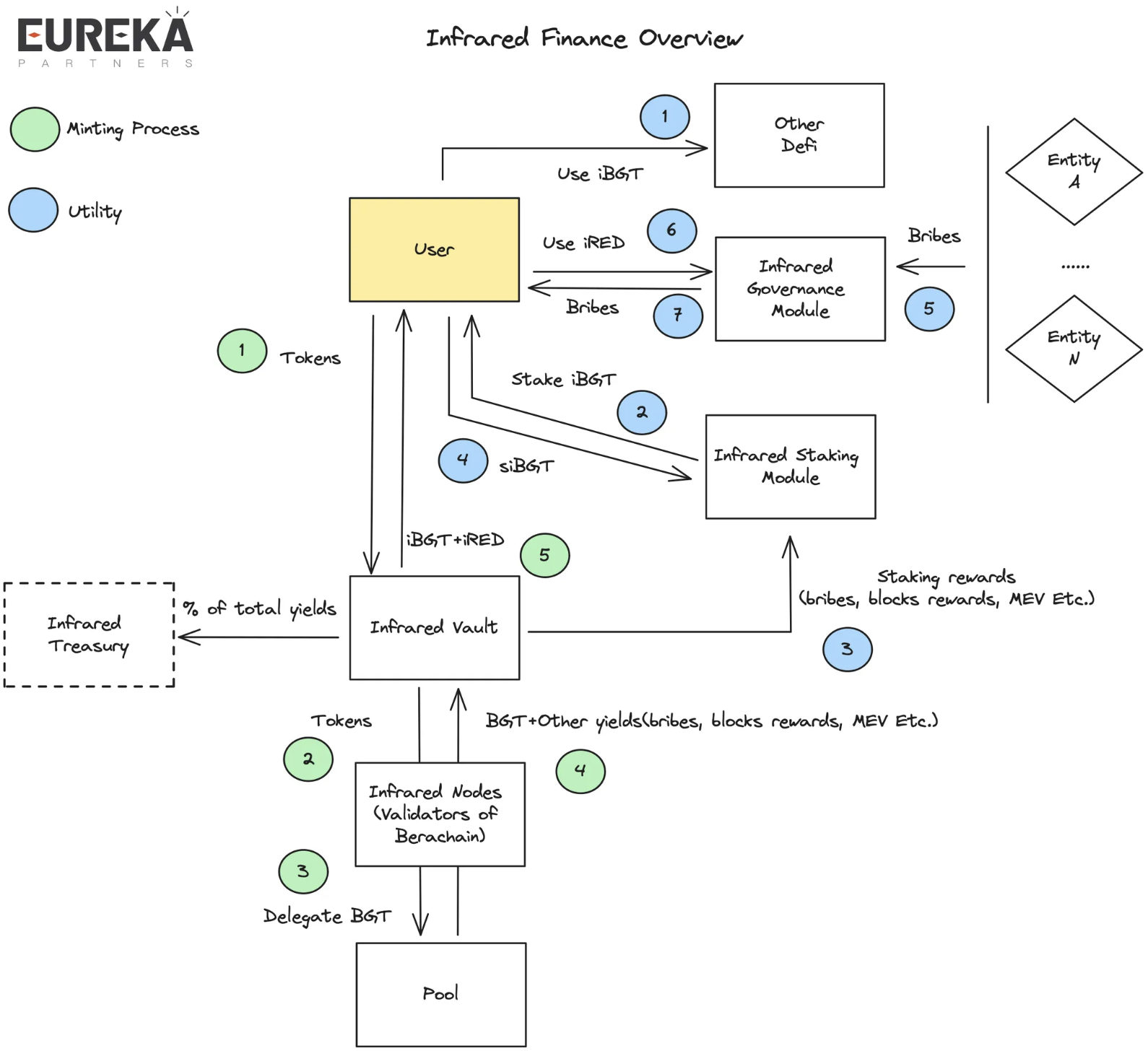

Friends familiar with DeFi can view it as a combination of Frax (frxeth + sfrxeth) and Convex. In short, Infrared Finance is an LSD project aimed at solving the liquidity problem of BGT.

General process: Users stake tokens in Infrared Finance, which are then staked in the BEX liquidity pool, while the received BGT rewards are authorized to Infrared's validators. Infrared validators will return the subsequent BGT release rewards + other rewards (block rewards, bribes, MEV, etc.) to the Infrared Vault. Infrared will treat part of the other rewards as treasury income and mint the accumulated BGT rewards in the pool as iBGT + iRED to return to users.

Token model: iBGT is staked 1:1 with BGT; users can use iBGT in other products on Berachain; users can stake iBGT to obtain siBGT, which can earn BGT rewards from Infrared validators, such as bribes, block rewards, etc.; iRED can be used for platform governance, such as guiding Infrared validators to increase the release amount of BGT to a certain LP.

Evaluation: Another project that "leverages the emperor to command the world." On the surface, it solves the liquidity problem of BGT, but in reality, it shifts the bribery competition from BGT to iRED. For example, if Infrared Finance occupies 51% of the LP, it means it has absolute say over the distribution of BGT releases, and naturally, iRED becomes the "imperial seal" that commands the world. On this basis, if the liquidity demand of the project team remains unchanged, the bribery rewards received by Infrared will theoretically be higher than those of other validators, further intensifying Infrared's control over Berachain. In practice, this may resemble a fact; for example, in the past, Convex's influence over Curve once approached 50%. Additionally, since Berachain currently has no other LSD projects supported by Build-a-Bera, and there are many collaborations in the ecosystem, if users' demand is for relatively stable BGT returns + some excess returns, it can be expected that after launch, the priority portal for users to stake tokens will be Infrared. Furthermore, the dual-token "seesaw" mechanism adopted by the project also further amplifies the returns for siBGT holders, as not all users wish to sacrifice liquidity, so the staking returns should be higher than those of general BGT LSD products, and the sources are all "real returns." While it seems like a win-win product for multiple parties, we also need to understand some of its collapse points/core risks:

First, the depreciation risk of iRED. Each release of iRED will increase the total circulation, thereby indirectly lowering the value of iRED. The implied value of iRED represents the bribery rewards; if potential projects prefer to provide high bribes directly at Berachain BGT Station for some reasons (e.g., pursuit of decentralization), then the implied value of iRED will decrease, accelerating its depreciation. If Infrared can control the majority of liquidity, it essentially returns to Berachain's POL mechanism, which, in strict terms, counts as systemic risk.

Second, the centralization risk of Infrared. Although Infrared currently has multiple supports, including the incubator in collaboration with the foundation, the potential risks of malfeasance cannot be ignored. Currently, Infrared has not explicitly stated the participation threshold for their validators. If it is entirely run by insiders, it will have a higher risk of single points of failure compared to Lido.

Kodiak

“An innovative DEX that brings concentrated liquidity and automated liquidity management to Berachain.”

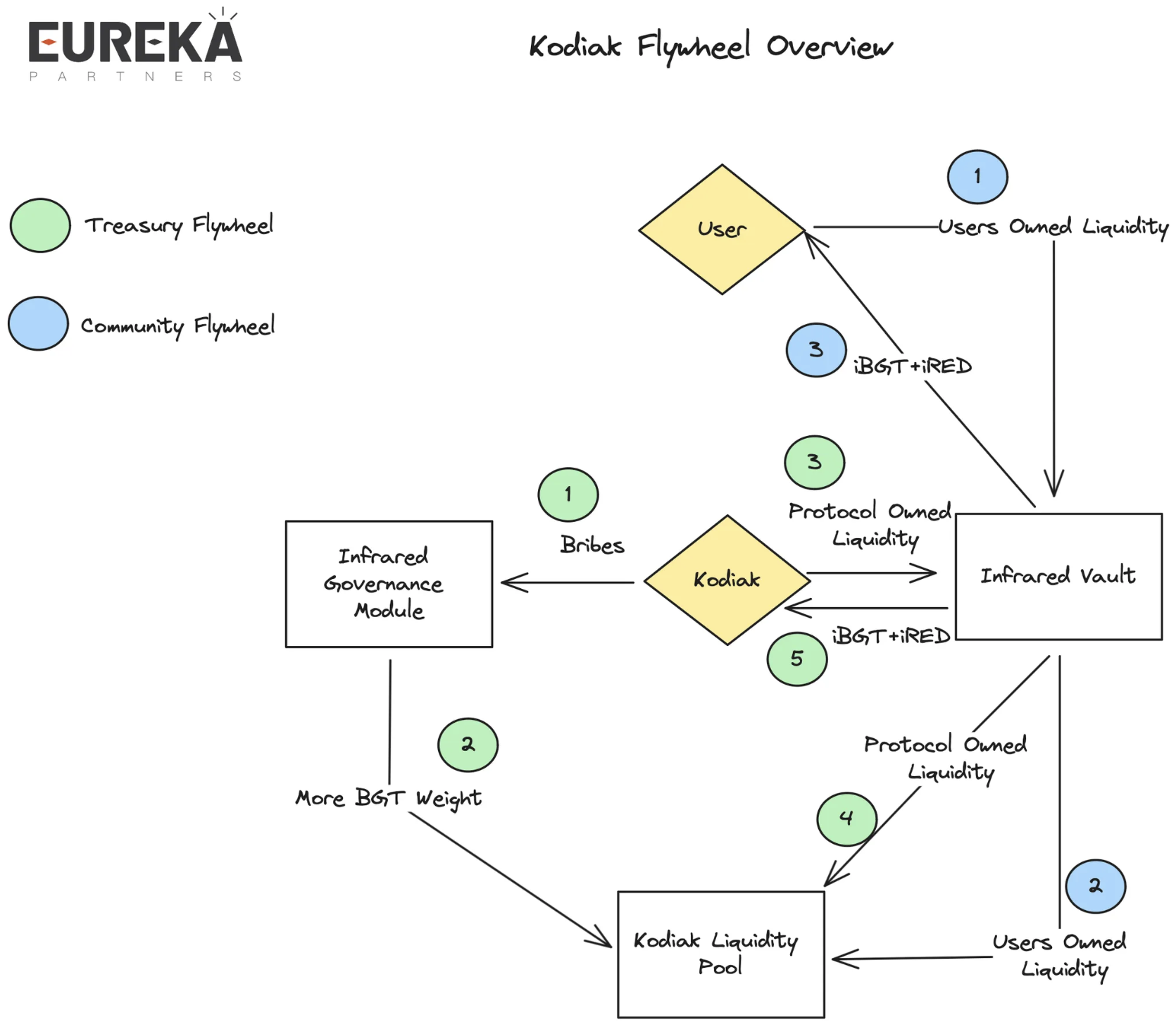

Kodiak is positioned as a DEX that provides automated liquidity management services (refer to the dynamic AMM overview in the liquidity solutions above) and also offers a one-click token issuance feature. According to the official statement, Kodiak is not a direct competitor to BEX but rather a supplement to its ecological niche, as BEX does not provide concentrated liquidity functionality. Additionally, it is worth noting that Kodiak collaborates with Infrared and proposes two economic flywheels:

First, the treasury flywheel. Kodiak will first bribe Infrared to increase the BGT release amount for Kodiak LP. Subsequently, Kodiak will stake the treasury's liquidity in the Kodiak LP pool and pledge the LP tokens to Infrared, allowing Infrared to gain control over that LP, which will then stake in the Kodiak LP pool to earn Infrared's iBGT + iRED rewards.

Second, the community flywheel. Users can stake their Kodiak LP tokens and receive iRED + iBGT rewards returned by Kodiak.

Evaluation: This is suitable for trading pairs of interest-bearing assets and native assets, but may not be applicable to siBGT & iBGT scenarios. Additionally, this flywheel requires a high level of control capability in the later stages of the project. The dynamic distribution AMM mentioned above is suitable for highly correlated token pairs. For example, LST/ETH, where LST (non-rebasing token) accumulates validator rewards, should theoretically be priced higher than iBGT, but since the rewards are stable returns, there will not be extreme volatility. Therefore, dynamic AMM will more easily form a price buffer zone, preventing significant price discrepancies between the two. However, the native yield of siBGT differs from POS, has a more diverse source, and is not low in volatility, so the price buffer zone may actually reduce the efficiency of price discovery, potentially underestimating the true market yield value of siBGT. Moreover, the core collapse point of the project is: the bribery rewards (iBGT + iRED + liquidity stability) are lower than the bribery costs (most likely Kodiak's native token). This is essentially a common issue for all bribery projects, which also implies that the implied value of the Kodiak token should be less than or equal to the bribery rewards; otherwise, the project team would face a deficit (similar to Lido's current situation). Conversely, if the value of the Kodiak native token is not high enough to attract sufficient liquidity, there will not be enough BGT release. In the early stages, most LP thinking should be coin-based, which is a bullish signal, as the bribery costs are greater than or equal to the bribery rewards. However, in the later stages, as the ecosystem weakens, LPs will naturally need to think in USD terms. At that point, Kodiak will only have two choices: maintain the bribery amount in USD terms or continue bribing in coin terms. The former accelerates potential selling pressure in the market, while the latter reduces the platform's liquidity attractiveness, both of which are at the critical point of collapse. Without other narratives, it would signify the end of the lifecycle.

Gummi

“A sweet treat for those sers interested in something a little stronger than honey.”

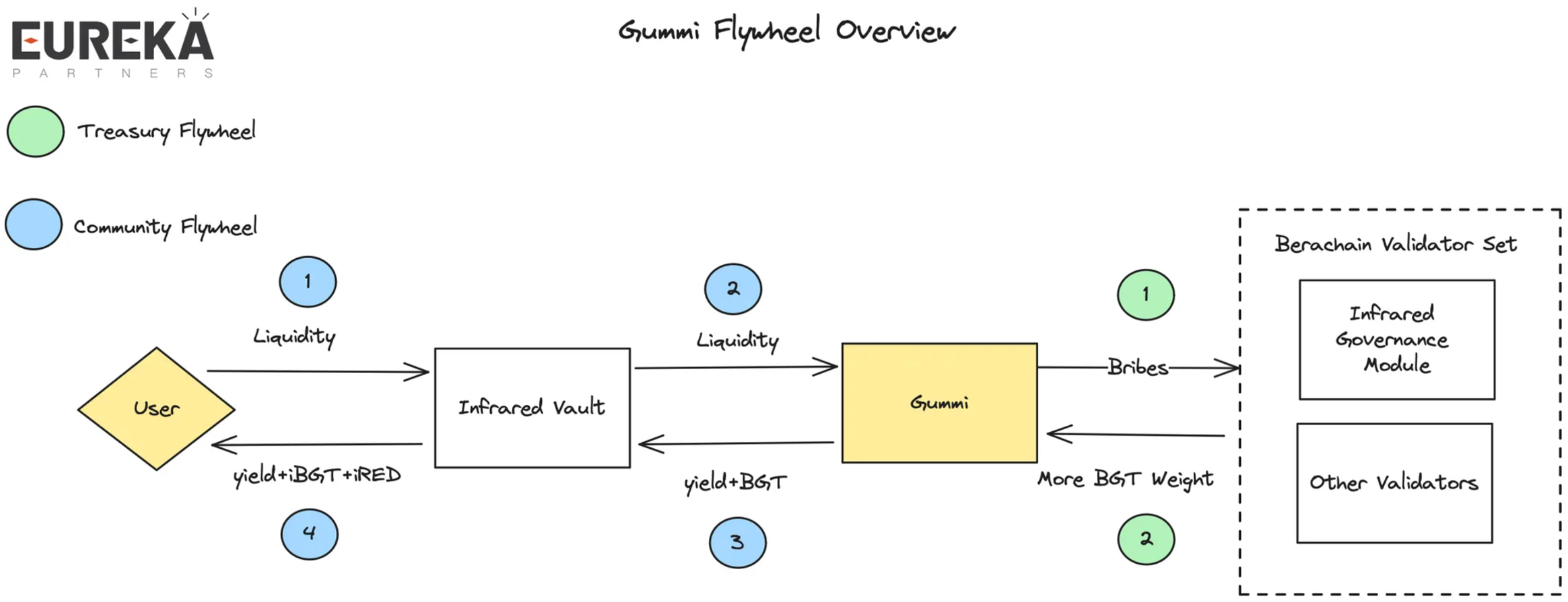

According to the official description, Gummi is positioned as a money market. Currently, there is not much information available, but it is likely a lending protocol that supports leveraged lending.

Their collaboration with Infrared is similar to that of Kodiak. Although Gummi has not explicitly stated that it will bribe Infrared validators or all validators, it is likely the former.

Evaluation: This project currently does not have much room for discussion, as the product details remain unclear. However, it is mentioned here because it is a Build-a-Bera incubated product and an Infrared ecosystem partner.

- BeraBorrow

“BeraBorrow is a decentralized protocol at the forefront of the Berachain ecosystem, providing interest-free loans using the iBGT token as collateral.”

Friends familiar with DeFi can understand it as a clone of Liquity. According to the official description, BeraBorrow is a collateralized debt protocol (CDP) that allows users to borrow NECT stablecoins using iBGT at a 0% interest rate and a 110% collateralization ratio, with the stablecoin theoretically pegged to 1 USD.

Why interest-free: There cannot be a truly "interest-free" protocol. Therefore, our focus should be on where the protocol extracts value. BeraBorrow will charge fees each time a user borrows NECT and redeems it. The redemption fee is dynamically adjusted based on the frequency of redemptions within 12 hours; the more NECT is redeemed (indicating that its value is overestimated), the higher the fee.

Pegging mechanism: It is divided into hard pegs and soft pegs. The former provides a 1:1 redemption mechanism between iBGT and NECT. When NECT is overestimated (greater than 1.1 USD), it can be exchanged for NECT worth 1 BGTi on the platform at a 110% collateralization ratio, and then sell NECT to gain the price difference as profit. When it is underestimated (less than 0.9 USD), it can be purchased on the secondary market and redeemed for iBGT on the platform at a 1:1 ratio, with the price difference being the profit. The latter refers to the theoretical pegged value of NECT, which equals 1 USD, and the platform adjusts the overestimated NECT through dynamic redemption fees.

Maximum leverage: 11 times. Since the platform's collateralization ratio is 110%, it theoretically allows for 11 times leverage (1 + 1/0.1 = 11).

Other risk controls: A stable pool will be launched later for platform liquidation, and the profits from liquidation will be given to the LP of that stable pool.

**Evaluation: Stablecoin projects are essentially still bonds; users care about APY rather than the use cases of stablecoins (more trading pairs). If one truly wants to use a stablecoin, why not use Honey? From the current product's sources of income, only the stable pool is a potential source of income, but it does not rule out the possibility that **the iBGT collateralized on the platform may later be further collateralized in the Infrared vault to obtain potential returns. Therefore, for users, if they are bearish on iBGT in the short term, they can amplify leverage and wait for the collateral to be liquidated to gain potential liquidation spreads.

The maximum value of Liquity's liquidation = debt value - (collateral asset quantity * current price * 10% * user’s share in the stable pool).

To estimate simply with an example, suppose a position has 500 iBGT and 10,000 NECT debt, with a current collateralization ratio of 109%, meaning the price of iBGT is 21.8 USD (109% * 10,000 / 500). If the user occupies 50% of the stable pool, it means the user can gain a profit of 450 USD (500 * 50% * 21.8 - 10,000 * 50%). According to the above example, the user's key profit point lies in the current share in the stable pool + frequency of liquidation.

Additionally, if users are bullish on iBGT in the medium to long term, they may amplify leverage to obtain up to 11 times the siBGT yield, although this has not been indicated in the official documents of BeraBorrow. For such users, the key risk point lies in the downward volatility risk of BGT.

- Beratone

“BeraTone offers an intricate life-sim and farming system, reminiscent of beloved classics like Stardew Valley, allowing players to cultivate and manage their dream farmstead.”

According to the official introduction, Beratone belongs to the MMORPG genre, where players will play as a bear in a simulated world, farming alongside other bears. Friends familiar with the game can refer to Stardew Valley. One of the creators of Beratone is PixelBera, who is also the artist for Bit Bears (the fifth-generation derivative NFT of Bong Bears NFT). Thanks to the explosive popularity of Bit Bears, PixelBera hopes to provide some "utility" for Bit Bears, leading to the birth of Beratone. The game demo is expected to be released in Q2 2024, with the official version of the game launching in Q1 2025. The NFT sale will take place in Q3 2024, and the Founder’s Sailcloth NFT has already been sold, which will provide various buffs in the game, such as increased backpack space. It is worth noting that the game will be accessible to everyone without any entry barriers, so the NFTs sold in Q3 are not admission tickets, but may be similar to the Founder’s Sailcloth NFT.

Evaluation: The art style closely follows Web2 games, but to be honest, Web3 users are still pursuing APY; the game is essentially a massive DeFi. However, as a GameFi project, one of its rare advantages is that the economic model can be designed as a single-blind mode, meaning users are unclear about the returns. Coupled with a suitably long-term economic system and an in-game purchase system, the lifecycle of a game can be longer than we imagine. Additionally, GameFi's returns are calculated based on NFTs, which can create an inflated market cap through lower turnover rates, thereby attracting user participation in mining and volume generation, but it is more challenging to control compared to USD/token-based models. In short, if you are a fan of Bera, you might consider participating; the game's odds are relatively high, and you need to estimate the turnover rate in the secondary market, using pre-market trading or OTC for hedging if necessary.

The introductions to the various projects above are relatively introductory and may not provide readers with ecological-level insights. Therefore, I have conducted some research on all the projects in the ecological map mentioned above, spending anywhere from 1 hour to as little as 5-10 minutes on each. Here are some of my summaries:

Projects have strong native characteristics, and GTM strategies vary: Most projects deployed on Bera are not multi-chain compatible but are native to Berachain. The ratio of native to non-native projects is approximately 10:1 (note: some products may come from the same team). Contrary to intuition, not all non-NFT native projects tend to use NFT issuance as a cold start; most still follow a more traditional approach.

Economic flywheels are diverse but fundamentally consistent: Most projects deployed on Berachain achieve economic flywheels through Infrared, with some projects further building multi-layer VE(3,3) on the original foundation of BEX, such as Berodrome. However, the core idea remains unchanged; any incentive is token-based. Therefore, users only need to understand the fundamentals of the project behind the token and its market-making ability. The flywheels between projects should be coupled, but this does not mean that the flywheel effect of a project will collapse due to the failure of a single project. As long as the tokens being relinquished can yield excess returns, users will be willing to continue supporting and allow other projects to fill the gap in the flywheel.

High-financing projects mostly issue NFTs: Among the top 10 projects by financing amount, 7 are Community/NFT/GameFi, all of which issue NFTs.

Community enthusiasm varies, but they are hot for mutual traffic: The average Twitter viewership for native Berachain ecological projects is 1,000-2,000+ people, with some projects showing underestimated readership (followers/average views ecological average). For example, Infrared has over 7,000 followers, with an average post view count of over 10,000; many native ecological projects collaborate with each other in various forms, such as participating in economic flywheels and token relinquishment.

Projects are still innovating but do not belong to disruptive narratives: In the NFT space, some project teams choose to leverage their BD capabilities to attract user attention rather than merely boasting about utility, such as HoneyComb and Booga Beras. In the DeFi space, some project teams continue to delve into liquidity solutions, like Aori, while others attempt to optimize past VE(3,3) models, such as Beradrome. In the social space, some project teams try to audit the quality of ecological projects through peer-to-peer methods, like Standard & Paws. In the launchpad space, some project teams attempt to achieve Fair Launch through token rights slicing and LP distribution, such as Ramen and Honeypot. In the Ponzi/Meme space, some project teams try to implement "sustainable economics" through Floor price pools, like Goldilocks.

Where Should Berachain's Breakthrough Point Be, and What Ecologies Are Potential Stocks?

I believe that by the time readers reach this point, they will have a relatively comprehensive understanding of Berachain, so it is not difficult to imagine two potential development paths: LSDFI and tokenized assets.

First, LSDFI refers to all economic flywheels related to Infrared, which essentially constitutes Berachain's economic moat. As mentioned above, many projects have already established cooperation with the Infrared Finance ecosystem and have entrusted that LP to Infrared to obtain excess returns. Therefore, the subsequent ecology is likely to replicate Ethereum's old path, such as stablecoins using siBGT as collateral, interest rate swap agreements, etc. However, unlike Ethereum's staking threshold, Berachain's threshold lies in the size of liquidity. Therefore, LSD protocols like Puffer Finance that lower the participation threshold for stakers may also be replicated in another form on Berachain—amplifying liquidity, such as through leveraged lending.

Second, tokenized assets do not necessarily refer to a specific protocol, such as ERC404, but rather all potential NFT assets and NFT fragmentation solutions. The reason tokenized assets are suitable is that Berachain natively provides liquidity bribery, which is the lifeblood of all ecological projects that want to issue tokens and also serves as Berachain's own defense line. NFT project teams can attract a wave of new buyers through the conversion of tokens to coins, which is also a rebasing mindset (splitting the market), while simultaneously participating in the economic flywheels of other ecological projects, such as the Infrared finance mentioned above.

Readers can explore these two directions on their own; I have already discovered some individual cases during my research, but since this article is only for research analysis and not investment advice, I will not mention them here.

Postscript

I later discussed Berachain with friends and talked about whether the project could succeed.

One person said, “Berachain has strong community support, and the current data is also good; many NFTs have sold, so it should be able to run well.”

Another person said, “Berachain is just a massive DeFi; after this narrative ends, it will quickly run out of steam. Without fundamental ecological-level narratives, it is impossible to succeed.”

I have always believed that the definition of a "successful project" is complex and differs from "What is the endgame of DeFi/projects?" It is not a single metric.

If the community response is good, but VCs do not make money, is that a good project?

If VCs make money, but the community is in an uproar, is that a good project?

If everyone enjoys the benefits, but some individuals become casualties, is that a good project?

If you are the landlord and everyone else becomes your crops, is that a good project?

If the project talks to you about the future, but you talk to it about the present, is that a good project?

If the project talks to you about technology, but you talk to it about narratives, is that a good project?

Acknowledgments: The "Three Market Theory" referenced in this article comes from @thecryptoskanda, for which I express my gratitude. I also thank Arthur, a partner at Eureka Partners, for his valuable guidance and suggestions on this article.

Source:

https://www.youtube.com/watch?v=LDS2Baz0RQM

https://www.youtube.com/watch?v=aawQAF6YzlI

https://twitter.com/thecryptoskanda/status/1760118631869096160?s=20

https://0xhoneyjar.mirror.xyz/soVN56Jla_Y9x2USB9UO2Pw3T0ALiHwAbI0oxC5AA0M

https://medium.com/@KodiakFi/introducing-kodiak-berachains-native-liquidity-hub-63c3e7749b30

https://medium.com/@beratonegame/the-evolution-of-beratone-b7aacae86e9f

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。