This article analyzes the landscape of Bera from the perspective of previous activities and the future mainnet ecosystem.

Written by: Pzai, Foresight News

On February 4, Berachain officially announced that the mainnet would be launched on February 6, a news that quickly sparked widespread attention and discussion in the market. This article analyzes the landscape of Bera from the perspective of previous activities and the future mainnet ecosystem.

Activity Review

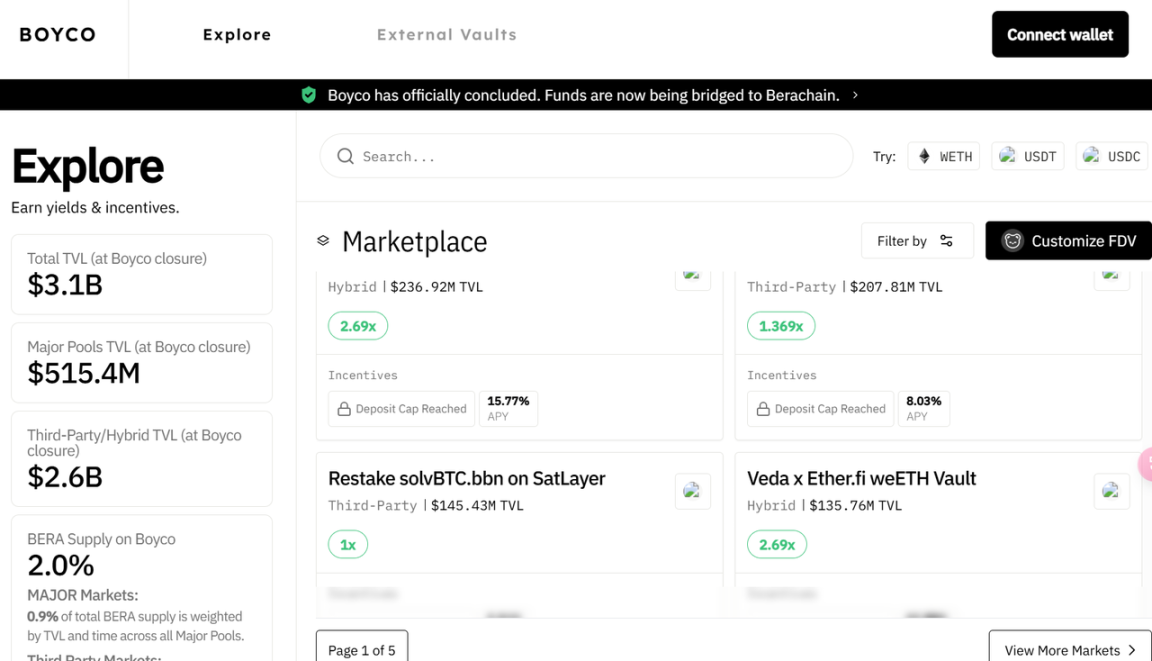

As a liquidity public chain, the accumulation of liquidity requires certain preliminary preparations. Previously, Berachain launched the Boyco mainnet liquidity pre-deposit activity, allowing users to pre-deposit liquidity to Berachain's DeFi protocols on Ethereum through partnerships with protocols such as Ethena, Etherfi, and Lombard. The activity attracted over $3.1 billion in assets, which will be transferred to the Boyco dApp after the mainnet launch.

In terms of airdrop allocation, 2% of BERA will be distributed to all liquidity pools, and users can earn APY returns from the liquidity. Airdrops are also expected to be distributed among ecological projects.

In addition to the Boyco mainnet liquidity pre-deposit activity, Berachain attracted a large number of developers and users to participate in testnet interactions through its EVM compatibility. Users accumulated on-chain interaction records by trading in DEX (such as exchanging BERA for STGUSDC), minting the stablecoin HONEY, participating in liquidity mining, and engaging in lending protocols.

Since the launch of the second testnet v2 Bartio in June 2024, the number of Berachain addresses has surged from 6.4 million to 240 million, with daily active address peaks reaching 7 million, attracting over 270 ecological projects to participate.

According to the completion of NFT tasks on platforms like Galxe, testnet contributors are expected to receive 2%-5% of the total token supply, with early NFT holders (such as the Bong Bears series) potentially enjoying higher weight.

Ecological Outlook

The core competitiveness of the Berachain mainnet lies in its Proof of Liquidity (PoL) consensus mechanism and its tri-token economic model (BERA, HONEY, BGT, etc.). Among them, BGT is the core token of the Berachain ecosystem, primarily used to incentivize liquidity providers and validators. Users earn BGT by providing liquidity in Berachain's native DeFi applications. BERA and HONEY serve the functions of network transaction fees and stablecoins, respectively, ensuring the diversity and practicality of the ecosystem. The PoL mechanism closely integrates liquidity provision and network validation, avoiding the problem of liquidity dispersion found in traditional PoS networks. Validators have the right to vote on the distribution of rewards from liquidity pools, further enhancing the incentives for liquidity providers.

In the ecosystem, liquidity providers can earn BGT token rewards by providing liquidity to protocols within the ecosystem. Validators participate in network validation by staking BGT tokens, earning block rewards and transaction fee shares. Applications built on the Berachain network can enhance their liquidity pool rewards by incentivizing liquidity providers.

Kodiak, as Berachain's native DEX, not only supports Uniswap V3-style concentrated liquidity (CLAMM) but also developed the "Island" feature, which optimizes returns by dynamically adjusting liquidity ranges and standardizing LP tokens to be compatible with other protocols (such as Infrared's liquidity staking). Users providing liquidity through CLAMM pools can earn BGT rewards and delegate BGT to validator nodes operated by Kodiak, forming a compound strategy of liquidity mining and governance rewards. The project has accumulated over 100,000 interactions during the testnet phase and will launch the "Panda Factory" no-code token issuance tool to further lower project startup barriers.

Dolomite, as a lending protocol on Berachain, allows users to stake BGT as collateral, amplifying liquidity mining returns by up to 5 times, while enabling users to hedge against market volatility risks, forming a sustainable leveraged mining ecosystem. Additionally, the platform will distribute 20% of DOLO tokens through airdrops to long-term lending users and community contributors, enhancing governance participation through the veDOLO locking mechanism.

Infrared Finance, as a liquidity staking protocol on Berachain, allows users to convert BGT into tradable iBGT tokens, which can be staked for node rewards or invested in other DeFi protocols (such as Kodiak's iBGT/BERA pool), achieving liquidity release and yield stacking for BGT. As the protocol with the highest delegated BGT amount in the testnet, Infrared repurchases and burns governance tokens IRED through node operation income, forming a deflationary model.

Berps (Berachain Perpetuals), as a native perpetual contract platform, utilizes HONEY stablecoin as collateral, combined with the deep liquidity of BEX under the PoL mechanism, reducing trading friction through dynamic price oracles and supporting leverage of up to 100 times. The project also employs batch order processing (Batch-A2MM) and off-chain matching solutions to avoid sandwich attacks, enhancing the trading experience for retail users.

Honeypot Finance, as the core DeFi protocol of Berachain, provides full-cycle token services. The project includes three sub-protocols:

Henlo DEX: An MEV-resistant DEX that supports limit orders and batch trading, reducing slippage through liquidity aggregation.

Dreampad: A Launchpad using a fair token offering (FTO) model, with project tokens 100% sold to the market, with no team allocation.

Pot2Pump: A meme coin issuance platform that prevents bots, supporting a 24-hour refund mechanism to reduce fraud risks.

The project repurchases and burns HPOT tokens through node operation income while distributing rewards to BGT delegators, forming a governance flywheel and value capture loop.

Conclusion

Berachain reconstructs the interest alliance among validators, developers, and users through Proof of Liquidity, with its economic model directly linking on-chain activities to token value. After the mainnet launch, if core protocols like Boyco can continue to attract external capital, Berachain may become the first public chain to realize "liquidity as security," injecting a new narrative into the Layer 1 track. However, challenges remain—how to balance the risks of concentrated governance power of BGT and maintain the stability of HONEY will be key to the long-term health of the ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。