Author: Jaleel Jia Liu, BlockBeats

Since the Argentine president briefly endorsed the $LIBRA coin, there has been significant discussion about the interest group surrounding the entire Solana ecosystem MEME coins, with a venture capital firm named Kelsier Ventures emerging.

On the surface, this is a venture capital firm focused on investment and marketing in the Web3 space. In reality, it has been revealed to be an insider trading team meticulously orchestrating memecoin projects. Not only is it involved with $LIBRA, but Kelsier is also deeply engaged with $MELANIA (the Trump coin). According to an investigation by The Big Whale, Kelsier Ventures is attempting to expand this model to Nigeria and has been in contact with members of the government there. According to an insider, "The project has reached a fairly mature stage." There are also indications that Kelsier Ventures is negotiating with other countries to replicate the same memecoin issuance model.

As the Kelsier Ventures scandal continues to unfold, more insider trading, fund transfers, and political entanglements are coming to light. What is the background of Kelsier Ventures? What connections does it have? Who are the key players?

Behind Kelsier Ventures: The Davis Family Network

First, let's look at the official information. Kelsier Ventures' official website (Kelsier.io) describes itself as promoting Web3 innovation through marketing expertise, in-depth research, and targeted investments. They claim to provide support at all stages of a project, from concept development to market launch, offering tailored comprehensive support.

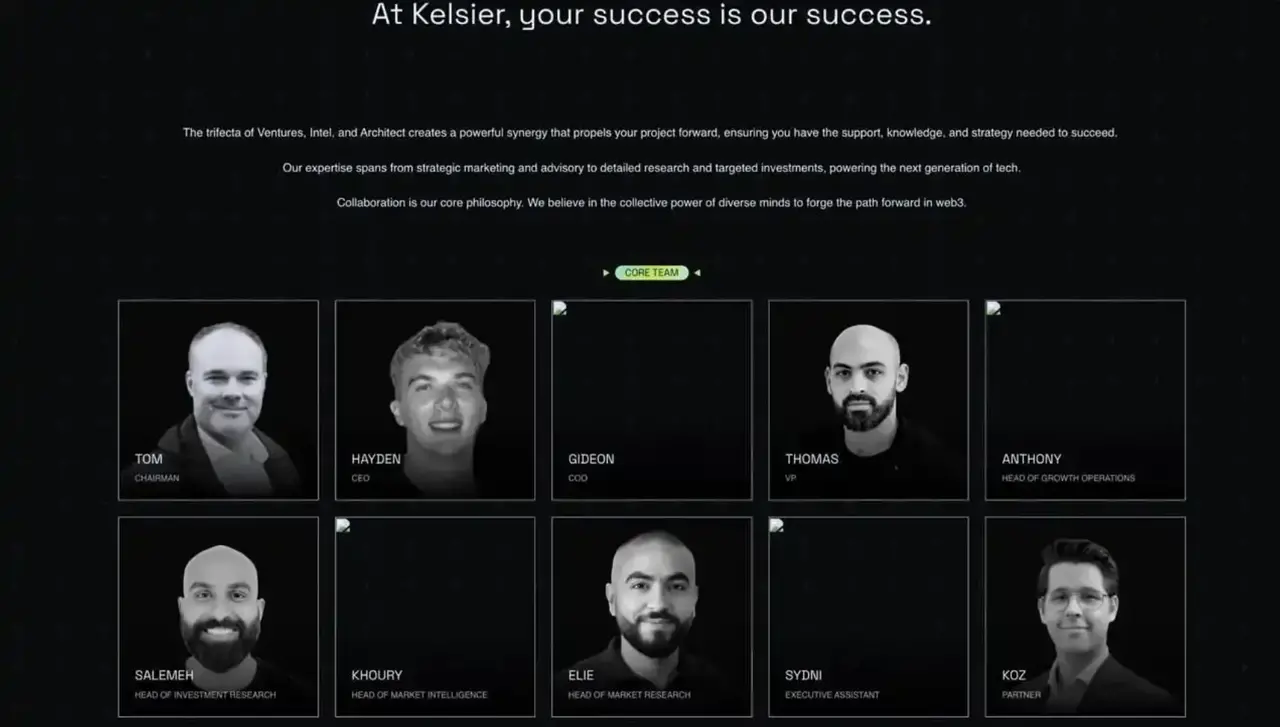

Clearly, after the scandal broke, their website has removed much of the original information, including introductions to team members. In previous screenshots provided by community members, we can see the following team members, who will be detailed later.

In various financing news reported by other overseas media, BlockBeats found only three financing details for this venture capital firm:

In May 2024, Kelsier organized a round of financing, raising $3.5 million to support E Money Network, a company focused on asset tokenization and virtual wallet development.

Earlier, in November 2023, Kelsier participated in the financing of Saturn, a Bitcoin non-custodial P2P order book service provider, led by Big Brain Holdings, with other investors including UTXO Management and BOOGLE Syndicate.

The most recent investment was on January 16, 2025, when Kelsier Ventures invested $30,000 in Solana's DeFi protocol Defituna, becoming its second smallest investor. Following the Kelsier Ventures scandal, Defituna has since refunded this investment amount.

Now, looking at the team members of Kelsier Ventures, it is clearly a family business. Hayden serves as CEO, his father Tom is the chairman, and his brother Gideon is the COO.

Davis Family Portrait

According to Rhythm BlockBeats, the Davis family seems to have a deep obsession with creating a family business.

In the ninth episode of the podcast "Young Dumb & Woke," hosted by Hayden and his brother Gideon, they interviewed their father Tom, during which they mentioned how happy they were to establish a family business.

In their mother Emily Chynoweth Davis's blog, she also mentioned, "We created a family business in 2023, which allows our family to bond tightly like wolves," referring to Kelsier Ventures.

Next, let's introduce these core members in detail.

CEO: Hayden

First, there is Hayden Mark Davis, the most critical member of Kelsier Ventures and one of the main promoters of the Argentine president Milei's LIBRA coin, who has recently become the focus of public attention due to the scandal and interviews.

In a recent interview titled "YouTuber Interviews LIBRA Creator: I Am Also a Victim," Hayden admitted that the team had attempted to "snipe" and preemptively control market fluctuations. He insisted that the collapse of LIBRA was a "failed plan" rather than a "pump and dump," claiming the team did not profit directly from the MELANIA token.

Currently, Hayden still holds about $100 million in funds and stated that he is weighing how to handle this money, with options including refunds, reinvesting in the market, or donating to non-profit organizations in Argentina. However, he refused to immediately hand over the funds, believing that as a "custodian," he has leverage in negotiations with the Argentine government. He emphasized that the Milei team had not provided him with any specific instructions, so he must decide the final destination of the funds himself.

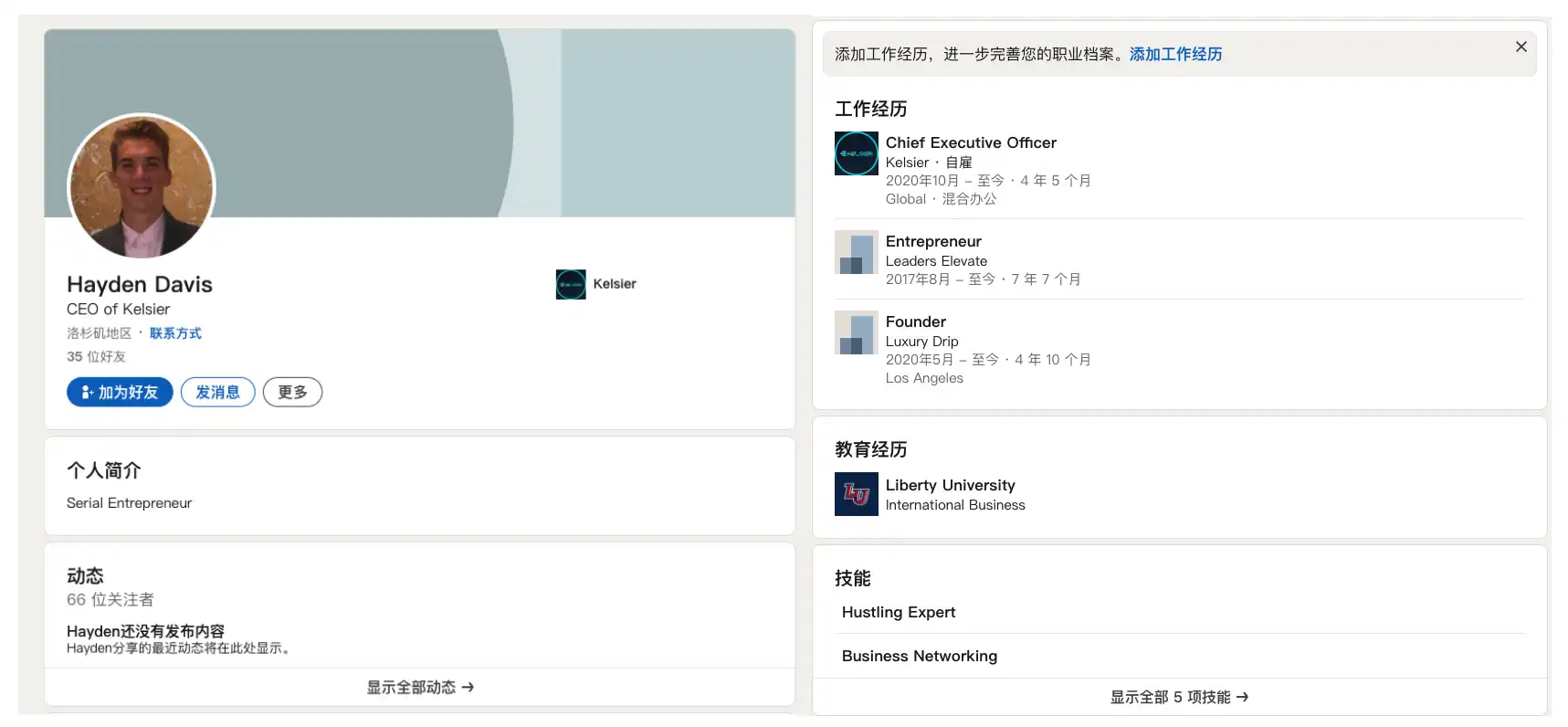

Despite calling himself a "serial entrepreneur," Hayden is relatively unknown online, with only 35 contacts on his LinkedIn account.

According to his LinkedIn profile, he has been the CEO of Kelsier since October 2020 and has long resided in Los Angeles, California. Since May of the same year, he has been the founder of Luxury Drip, a company of unclear industry (although there is an Italian brand of the same name in the urban fashion sector).

According to Davis, he began his entrepreneurial journey in August 2017, running a company called Leaders Elevate. This appears to be another family business of the Davis family, with his father as the main mentor, selling courses and private coaching on leadership topics.

Although the difference in appearance in the photos is striking, it does seem to be the same person:

After Javier Milei uploaded a photo with Hayden Davis, many questions arose about this relatively unknown entrepreneur. Searching for the full name Hayden Mark Davis yields results primarily focused on the news surrounding the LIBRA collapse.

Hayden with Milei

The only other social media activity related to him is a photo from February 2022, where he appeared with two individuals named Thomas Davis and Gideon Davis, who are identified as co-founders and CEO of Kelsier Ventures, respectively. There is also little known about these two.

Currently, his private social media accounts have been set to private visibility.

Chairman Dad: Tom

In contrast, their father Tom Davis has a more dramatic life story and can be found more easily online.

In more of Tom's own writings, he describes a not-so-ordinary childhood, with his biological father absent and his stepfather being an alcoholic military man, often living in an abusive environment. At 18, Tom experienced a severe suicide crisis. Later, Tom was targeted by the FBI for identity fraud, and when faced with charges, he chose to come clean, even voluntarily confessing to some crimes that the FBI had not yet uncovered. This level of candor shocked the agents, and ultimately, he was sentenced to one year in federal prison instead of the expected 60 to 70 years of heavy sentencing.

After serving his time, Tom restarted his life. He became a youth pastor and actively engaged in charitable work. Tom Davis presents himself in multiple roles—an entrepreneur, speaker, author, humanitarian, and he served as CEO of Children’s HopeChest for 15 years, a charity focused on helping orphans and widows worldwide. However, he later stepped away from this role to create an online course called Leaders Elevate, aimed at developing leadership, personal growth, and development for CEOs.

In addition to his charitable work, he has authored five published books, including "Fields of the Fatherless," "Red Letters," "Confessions of a Good Christian Guy," and two novels, "Scared: A Novel on the Edge of the World" and "Priceless." Furthermore, he has published articles in 25 national publications and is currently writing a doctoral thesis on the impact of positive psychology on dynamic team structures.

In the ninth episode of the podcast "Young Dumb & Woke," hosted by Hayden Davis and his brother Gideon Davis, the brothers interviewed their father Tom Davis, during which he shared how he entered the cryptocurrency industry:

As one of the three partners in a chain restaurant on the East Coast of the United States, his chain brand operates 34 restaurants in that region. In search of a broader market, he decided to expand the business to the Middle East and registered a company in Dubai.

During his time in Dubai, Tom stumbled upon an article about Dubai's plan to establish the world's third "Crypto Valley." Previously, similar crypto valleys had been set up in Switzerland and Malaysia, aimed at attracting businesses in the blockchain, digital assets, and cryptocurrency sectors through tax incentives and innovative policies. The article inspired him, leading him to conceive the idea of starting a blockchain company in Dubai, which he quickly put into action.

Before long, Tom delved deeply into the cryptocurrency industry. He not only actively participated in relevant conferences but also successfully launched his own cryptocurrency project (Tom did not disclose the specific project name). At the same time, he began to connect with top figures in the field, building a network and getting involved in venture capital funds, investing in several early-stage projects. Today, these investments have not only made him a part of the industry but also secured him a place in the leadership of some projects.

Although Tom has also deleted much of his information related to Kelsier Ventures, we can still find some traces from the past. Initially, Tom referred to himself as the CEO of Kelsier Ventures.

More direct evidence comes from the last 10 minutes of this podcast episode, where Tom finally mentioned Kelsier Ventures: "What excites me even more is that this venture is not just mine; it is a family business."

This has always been his vision—to build an "empire" with his sons, much like the character Ding Xie. Now, this dream is gradually coming to fruition. He and his family are involved in the cryptocurrency industry. Although their fund has not yet reached the scale of the world's top hedge funds, they have already been able to participate in some significant projects in Dubai. Tom has now officially become a resident of Dubai.

COO Brother: Gideon

Next is Hayden's brother Gideon Davis. In the family business Kelsier Ventures, Gideon Davis serves as the Chief Operating Officer (COO), responsible for the company's daily operations and investment management.

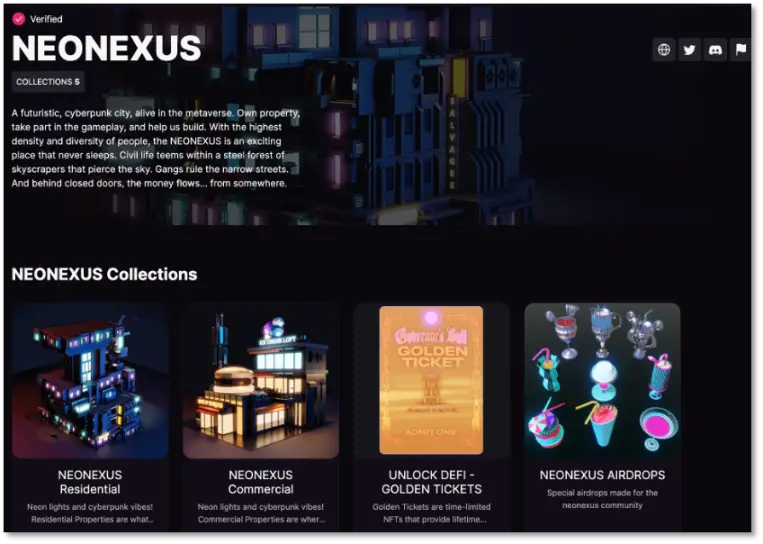

Although his public information is relatively scarce, clues from social media and past podcast records can outline the projects he has participated in within the cryptocurrency industry. In 2022, while still a junior in college, Gideon began to get involved in the cryptocurrency sector, working on the DeFi project Unlock and its metaverse project NeoNexus.

NeoNexus NFT Series

NeoNexus is a metaverse project built on the Solana blockchain, planning to offer virtual real estate, characters, vehicles, and accessory NFTs, along with a governance token system. The project once claimed to have sold 4,000 "virtual real estate" NFTs, with plans to release another 6,000 real estate NFTs and launch corresponding governance and utility tokens.

However, on March 21, 2022, NeoNexus founder Jack Shi suddenly announced the cessation of operations due to "insufficient funds," laying off all employees and expressing a willingness to hand the project over to the community.

This "soft rug" incident raised significant doubts within the cryptocurrency community at the time: it is estimated that NeoNexus raised approximately 25,000 SOL through NFTs since September 2021, which, based on the SOL price at that time, amounted to between approximately $3.425 million and $6.475 million. Yet, the project suddenly claimed to have run out of funds in March 2022 and could not continue operations.

Rumors of Political Connections

At this point, while the Davis family has experience and resources in the cryptocurrency industry, their ability to launch coins for the First Lady of the United States and the President of Argentina seems to lack some "strength."

In further investigations by BlockBeats, we uncovered two unverified rumors regarding political connections:

Hayden's uncle, Glen, who is Tom's brother, is a close friend of Trump. Due to this relationship, the Davis family has established a connection with Trump.

Another claim is that Hayden's mother, Emily Chynoweth Davis, who is Tom's wife, is a close friend of Melania Trump, the First Lady of the United States. The Davis family, through Kelsier Ventures, has previously issued card NFTs and the $MELANIA coin for Melania.

Other Interest Chains

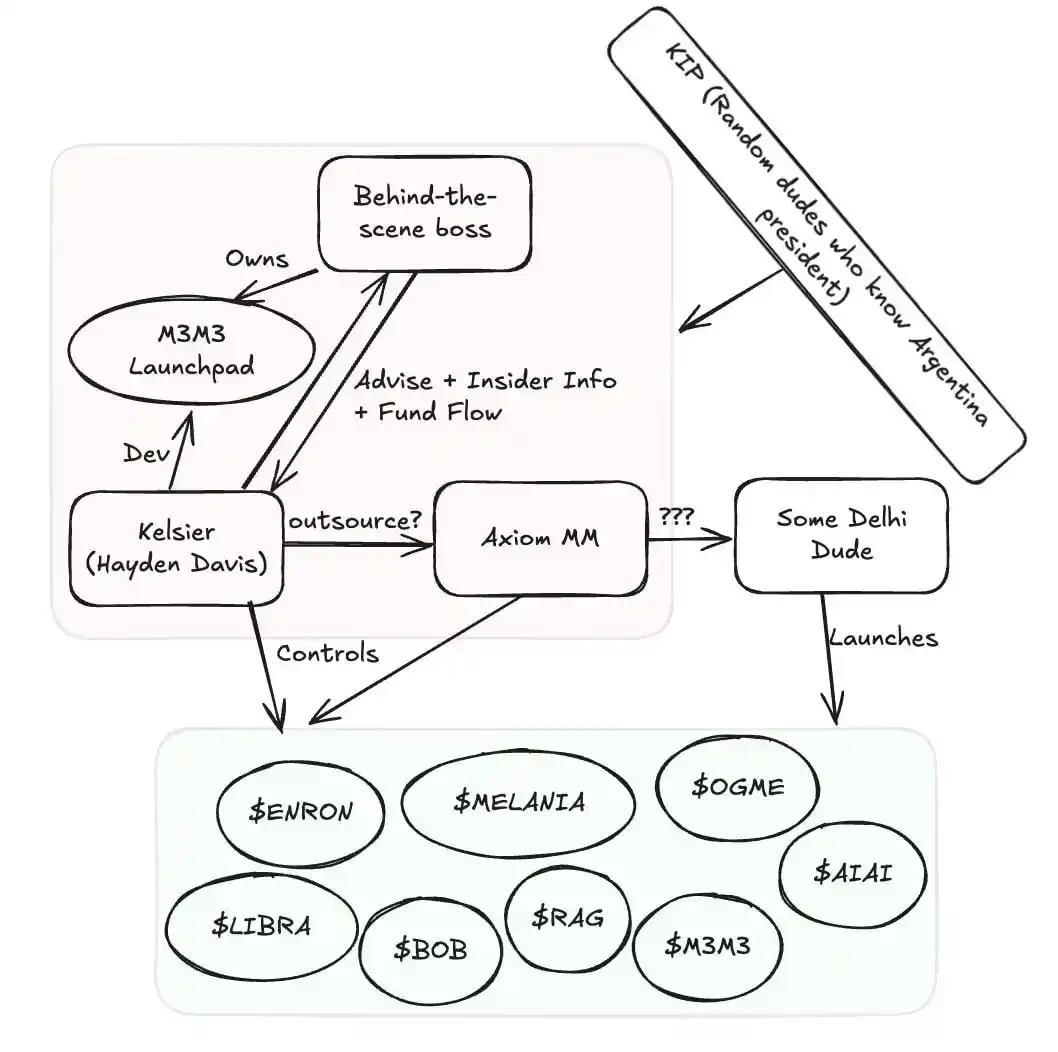

Kelsier Ventures does not act alone; it is entangled in a deeper interest group. Some whistleblowers in the incident have revealed many truths to us.

Image source: Chaofan Shou

According to information exposed by Chaofan Shou, M3M3 Launchpad is actually an important platform used by Kelsier Ventures to manipulate memecoins, becoming a breeding ground for a series of token launches. In the entire operational structure, the behind-the-scenes operator Kelsier Ventures is responsible for fund allocation, information leaks, and deciding when to launch projects, while its CEO Hayden Davis plays the role of developer and executor. Additionally, Axiom MM may act as a market maker or intermediary, ensuring that market liquidity is manipulated to create price fluctuations, while M3M3 Launchpad serves as a "front" platform, assisting numerous memecoin projects such as ENRON, MELANIA, BOB, M3M3, AIAI, LIBRA, etc., in token issuance. Notably, KIP (a group associated with the Argentine President Milei's government) may provide political support, offering protection for the organization's operations in the Argentine market.

M3M3 Launchpad

M3M3 Launchpad is a memecoin launch platform that assisted in the issuance of tokens during the incident. The founder of DefiTuna, Moty, and the Solana community exposed that M3M3 Launchpad pretended to be an independent platform but was actually fully controlled by Meteora co-founder Ben and was used by Kelsier Ventures as a tool to manipulate memecoin prices.

Thus, it is not surprising that on December 5, 2024, a blog from Meteora suddenly introduced the M3M3 Launchpad project.

The first token launched by M3M3 Launchpad was $M3M3. Its trend closely mirrored that of $MELANIA and $LIBRA.

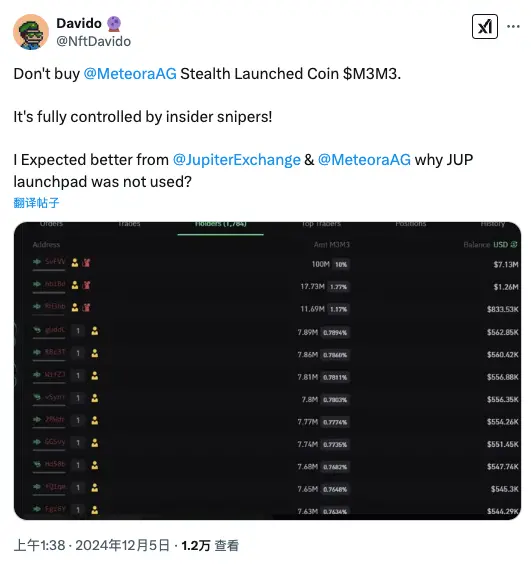

"Do not buy $M3M3! It is completely controlled by internal snipers!" Before the interest group was exposed, some community members had already issued warnings.

In addition, the founder of DefiTuna, Moty, revealed that over $200 million in funds were siphoned off by insiders across multiple memecoin projects, including several tokens launched on M3M3 Launchpad: $AIAI, $MATES, $ENRON, etc. The $AIAI and $MATES projects are particularly noteworthy, as their prices plummeted by 95% shortly after launch, leaving community investors with significant losses. Meanwhile, $M3M3, as one of the first projects on the memecoin issuance platform, also fell by 95%.

Including these multiple project tokens, Kelsier Ventures and its manipulation team earned over $200 million in profits, as revealed by Moty.

DefiTuna was initially a DeFi platform, and on January 16, 2025, Kelsier Ventures invested $30,000 in it, hoping that DefiTuna could provide liquidity for M3M3 through employee Thomas.

Among the Kelsier Ventures team members mentioned earlier, Thomas is also included and is only ranked after Hayden, Tom, and Gideon, indicating his importance and level of involvement.

Under pressure from Kelsier, projects on M3M3 allocated token supplies to DefiTuna, with DefiTuna co-founder Vlad passively participating without realizing the issues. Kelsier further demanded that DefiTuna manage the liquidity on M3M3, which included the MATES project, whose token plummeted by 95% after its launch.

However, as DefiTuna discovered more and more suspicious activities during its operations, they realized that M3M3 was not a true "decentralized launch platform," but rather a tool used by Kelsier for market manipulation. The most controversial events occurred during the MELANIA token issuance:

Kelsier leaked insider information

Before the MELANIA token issuance, Kelsier informed DefiTuna that Melania's official X account would release related tweets, and that Trump would retweet them to help hype the token price.Secretly transferring 1% of tokens

Kelsier sent DefiTuna 1% of the MELANIA token supply (valued at $100 million at its peak), requesting it for "liquidity management."Hayden Davis instructed Vlad to conduct anonymous sales

Hayden Davis further requested Vlad to anonymously sell these tokens to evade on-chain tracking. However, after discussing with DefiTuna founder Moty, Vlad ultimately decided to return all the funds.

Currently, DefiTuna has completely severed all cooperative relationships with Kelsier Ventures, refunded Kelsier's $30,000 investment, and publicly accused Kelsier of manipulating the market through the M3M3 launchpad, siphoning off large amounts of funds.

Fund Flow: Connections of Axiom MM and Cube Exchange

In Kelsier Ventures' insider trading network, the flow of funds is particularly crucial, with Axiom MM and Cube Exchange playing roles in market manipulation, money laundering, and channel delivery. Although these projects do not appear to have direct affiliations with Kelsier on the surface, on-chain data and community revelations have uncovered their intricate connections of interest.

Axiom MM is a market maker in the Solana ecosystem, and according to accusations from DefiTuna founder Moty and community revelations, Kelsier Ventures may have utilized Axiom MM for insider trading and market manipulation: during the issuance of $LIBRA, $MELANIA, $M3M3, $AIAI, and $MATES, Axiom MM may have been responsible for creating false trading volumes, causing token prices to surge in a short period, attracting retail investors to FOMO in; when the behind-the-scenes team decided to cash out, Axiom MM might adjust trading strategies to quickly drain market liquidity, accelerating price crashes.

On-chain data shows that several associated wallets of Axiom MM conducted a series of "abnormal trades" around the issuance of $LIBRA: minutes before the token went live, they bought large amounts of $LIBRA, pushing the initial price up; during the peak of market FOMO, they sold off for profit; just before the token crash, they stopped providing liquidity, causing market depth to vanish instantly.

These actions are highly consistent with typical market manipulation strategies, leading the community to question whether Axiom MM has a relationship of interest with Kelsier Ventures.

Cube Exchange is also implicated; community investigations revealed that Cube Exchange is a client of Kelsier. Kelsier provides consulting, marketing, and KOL resources for it; Hayden Davis (Kelsier CEO) was an early investor in Cube Exchange; multiple Kelsier-associated wallets have conducted large transactions on Cube Exchange.

"Most of the people in the photo have worked at Cube Exchange or have connections to it. Cube Exchange is a client of Kelsier, responsible for consulting, marketing, KOLs, etc. But I'm not sure if they have directly participated in any wrongdoing," a community member revealed.

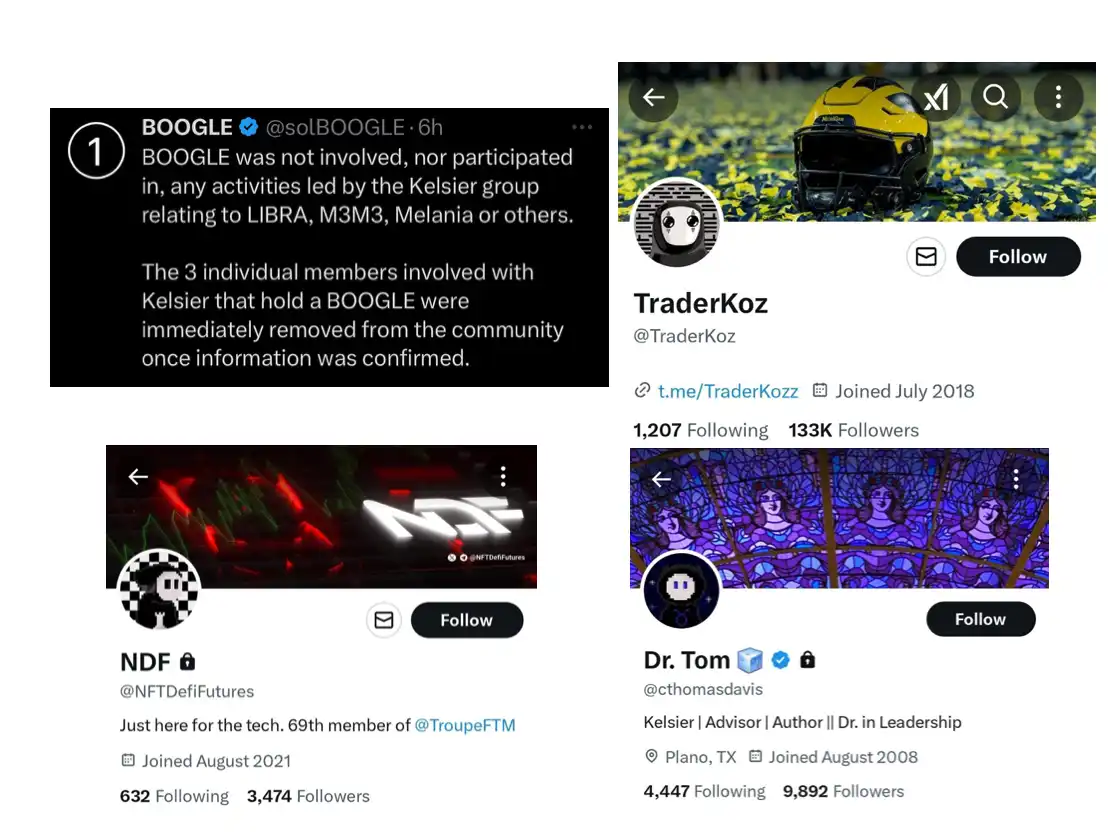

Additionally, BOOGLE, a ghost-themed NFT project built on Solana with a total supply of only 100, is also involved.

All three members in the incident own BOOGLE and use it as their Twitter avatar. Coupled with the earlier mention that Kelsier participated in financing the Bitcoin non-custodial P2P order book service provider Saturn alongside BOOGLE, community members began to question whether BOOGLE provided cover for insider trading or if there were also interests linking them.

However, BOOGLE has denied this: "Our conspiracy group does not participate in Kelsier or $LIBRA." They acknowledged that three Kelsier-related members were once NFT holders but stated they have been removed.

Deep Collusion of Meteora & Jupiter

In the accusations from DefiTuna's founder, Meteora and Jupiter are considered deeper interest groups outside of Kelsier Ventures, deeply colluding. The following content is based on revelations from DefiTuna's founder Moty and reasoning from other community members:

In a series of memecoin manipulation events, Meteora is not an innocent third party but an important partner of Kelsier.

Ben Chow himself is deeply involved in Kelsier's M3M3 Launchpad; although it is publicly claimed that the platform is "independent," actual control has always been in the hands of Meteora and its founding team.

In the $LIBRA, $MELANIA, and other memecoin projects, Meteora provided key liquidity management, technical support, and assisted Kelsier in market manipulation. For example, during the issuance of multiple memecoins on M3M3 Launchpad, Meteora was responsible for ensuring that most tokens flowed into the hands of insider traders, while retail investors became the targets for harvesting.

It is reported that Meteora was founded by Ben Chow and was later acquired by Jupiter. Public information shows that Ben Chow is also a co-founder of Jupiter, and the two are co-founders of each other.

KOL @Ed_x0101 also posted on X (Twitter) stating that he has liquidated all $JUP holdings, citing that many memecoin projects that harvest retail investors have direct or indirect connections to Jupiter; Jupiter may be involved in insider trading and market manipulation, and there may even be legal risks; after the $LIBRA crash, insiders were compensated while ordinary retail investors lost everything.

More importantly, many community members pointed out that Kelsier may just be a "front," with the real behind-the-scenes operators being the Jupiter team and liquidity management institutions.

As the scandal broke, Ben Chow announced his resignation from Meteora on February 17, 2025, clarifying that Meteora and he himself have never held, received, or managed any $LIBRA tokens; in memecoin projects, Meteora only provided IT technical support and did not participate in off-chain trading of tokens; there is no "special relationship" with Kelsier, only cooperation during M3M3.

However, this move was interpreted by the outside world as an attempt to distance from the Kelsier incident, trying to protect Meteora from regulatory and legal risks affecting the Jupiter ecosystem.

On the Jupiter side, they also hired one of the independent third-party law firms, Fenwick & West, to investigate the insider trading issues and produce a report.

However, some community members do not trust this law firm, as it was the general legal counsel for FTX and was sued for allegedly assisting FTX in fraud. A joint revelation in 2022 mentioned it as "Sun Yuchen's favorite law firm," which previously handled the restructuring of Poloniex.

Whether it is Kelsier's manipulation methods in memecoin issuance or the deep collusion with political figures, market makers, and trading platforms, it indicates that this is not just a financial scam in the cryptocurrency market, but may involve broader interests.

In this storm, the credibility of the Solana ecosystem has also faced unprecedented scrutiny. On one hand, Solana has rapidly risen as one of the most popular blockchains since 2024 due to the boom in memecoin trading. On the other hand, whether this prosperity, supported by memecoin trading, is sustainable in the long term has become a focal point of market discussion.

With a series of "airdrop" projects collapsing, is Solana falling into a trap driven by FOMO funds and lacking real application support? If market confidence completely collapses, can SOL replicate the miraculous comeback of 2023-2024, escape the crisis again, and achieve self-repair in the market? BlockBeats will continue to monitor this situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。