The current market turmoil may be the best time to buy Bitcoin.

Written by: Daii

Since Bitcoin rebounded from $92,000, it has been fluctuating around $96,000. Of course, everyone knows that such fluctuations are temporary. The question is when it will start to break through? Upward or downward?

Most analysts have given relatively optimistic predictions, believing that Bitcoin is preparing for the next phase of a bull market. I agree with this, as the long-term upward trend of Bitcoin has not been reversed.

However, there is also a possibility that Bitcoin could drop significantly again, which we cannot ignore, as last week saw the first net outflow from Bitcoin ETPs.

You might ask, the Bitcoin ETP market is not the entirety of the Bitcoin market, so why should we care about the capital flow in this market?

1. Why is this indicator important?

In short, ETPs are the main channel for institutional participation, reflecting the movement of "smart money."

"Smart money" typically refers to funds from institutional investors or experienced market participants, who usually possess strong market judgment and risk control capabilities.

Bitcoin ETPs (especially spot ETFs) have become the primary tool for traditional financial institutions to enter the market compliantly. These products are widely adopted by large institutions such as hedge funds and sovereign wealth funds, and their capital flow directly affects market liquidity and price stability. If ETPs continue to see net outflows, it may indicate that institutions are seeking short-term hedges or reallocating their portfolios, which serves as a forward-looking signal for market direction.

Data shows that ETP capital inflows are significantly positively correlated with Bitcoin prices (for example, Bitcoin ETPs dominated the bull market cycle in 2024).

Outflows from ETPs mean that there is less capital available for buying in the market, which may put pressure on prices. Especially in cases where institutional funds are withdrawing, it could exacerbate selling pressure in the market, thereby amplifying price volatility. This liquidity contraction may magnify short-term fluctuations and even trigger retail investors to follow suit and sell.

Having understood the importance of this indicator, the next question is to figure out the reasons behind the capital outflows.

2. Why the net outflow?

The net outflow is due to concerns over interest rate hikes and tightening monetary policy.

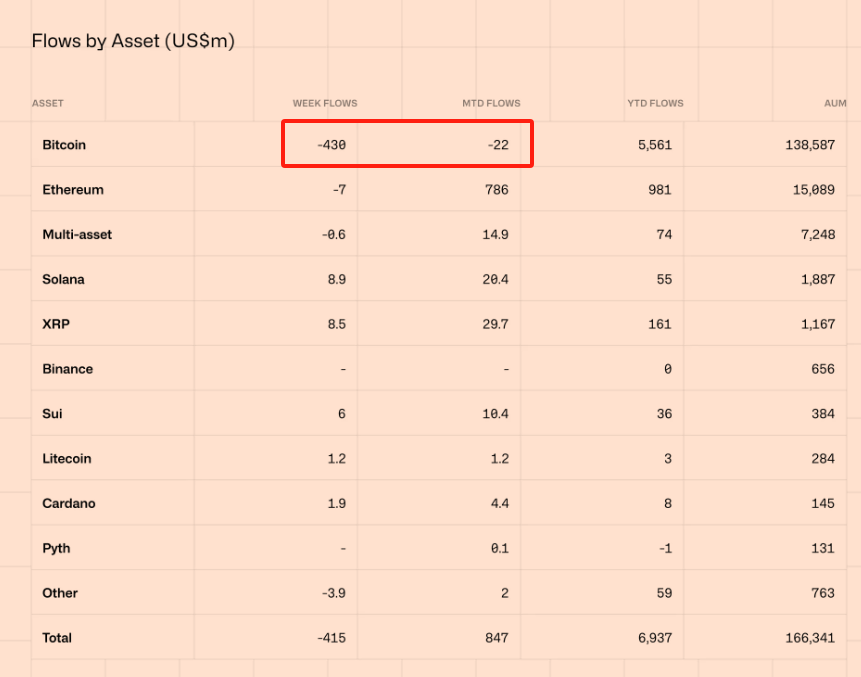

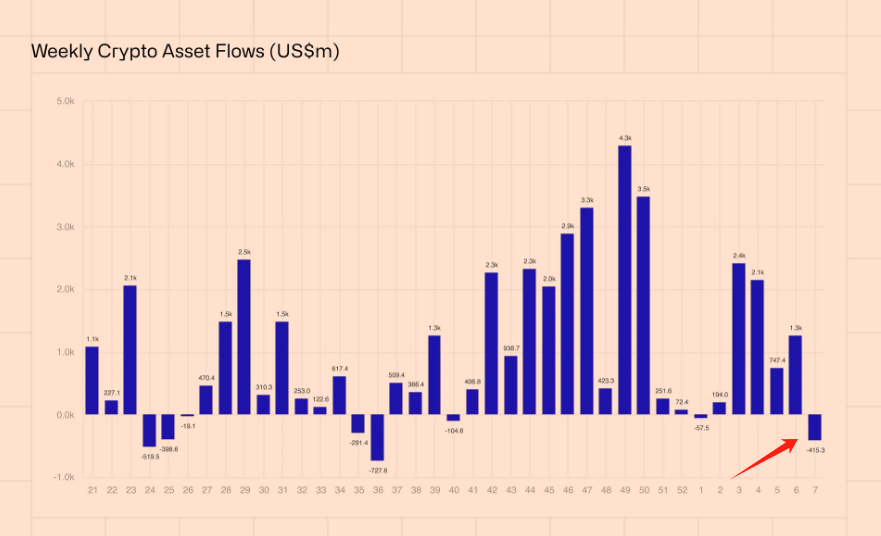

From the table above, you can see that the main outflow is from Bitcoin. A one-time net outflow of $430 million ended five consecutive weeks of net inflows, turning this month's net inflow into a net outflow of $22 million. Of course, the global crypto ETPs also ended their net inflow and turned into a net outflow of $415 million due to Bitcoin's net outflow.

The reasons for the net outflow are not hard to find. First, Federal Reserve Chairman Powell's hawkish remarks during his congressional testimony; second, the latest U.S. CPI (Consumer Price Index) data exceeded market expectations. Combined, these triggered market concerns over interest rate hikes and tightening monetary policy. Because:

Bitcoin itself is extremely sensitive to changes in interest rates.

Why is that?

The reasoning is simple: the opportunity cost of capital. Bitcoin, as an asset, is influenced by the cost of capital just like traditional stocks, bonds, and other financial products. When interest rates rise, borrowing costs increase, capital flow is restrained, and investors' risk appetite declines. For high-volatility, high-risk assets like Bitcoin, investors often choose to temporarily withdraw and shift to more stable investment options, especially when there are expectations of interest rate hikes.

So, the next question is, since smart money has made its choice, what should you do?

3. Should you learn from smart money?

Of course, you should. There are only wrong buys, not wrong sells. For short-term operations, you can act as you wish.

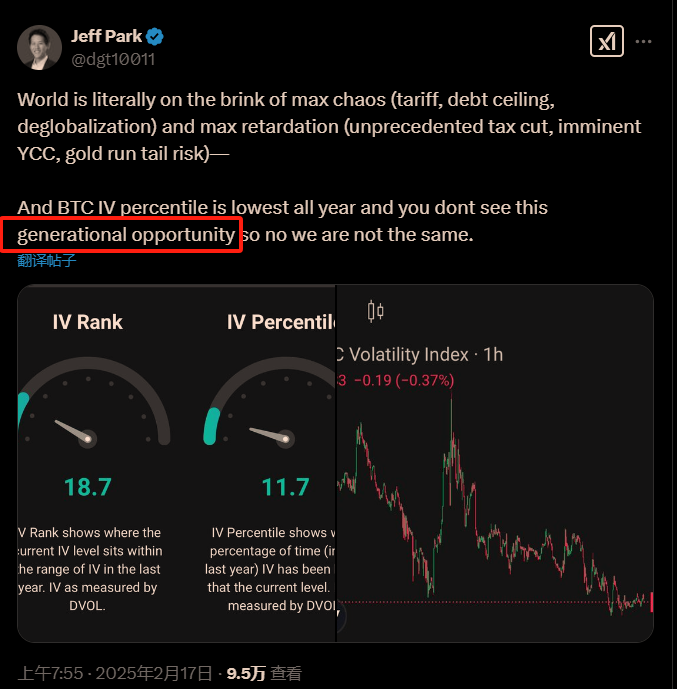

However, you should realize that you may be facing an opportunity referred to by Bitwise executives as a "generational opportunity."

Bitwise is a leading crypto asset management company.

A "generational opportunity" refers to a rare chance that changes the course of history, usually having a profound impact on individual or societal wealth and investment trends. It is not just about short-term profits; it touches on fundamental changes in the global economic structure or wealth distribution.

So, is Bitcoin really such a "generational opportunity"?

4. Is Bitcoin a generational opportunity?

Yes. Do not doubt it; Bitcoin is indeed a generational opportunity.

Circumstances create heroes. For Bitcoin, it is transitioning from a "marginal asset" to a mainstream asset, becoming an important part of the global financial system.

In the context of increasing global economic uncertainty and rising risks of currency devaluation, Bitcoin is gradually being viewed as a safe-haven asset due to its decentralized nature, limited supply, and global recognition.

First, look at the world. The global economic situation is undergoing tremendous changes, and the traditional financial system is facing unprecedented challenges. As Bitwise executives have said, the world is "almost on the brink of maximum chaos." The current trend of de-globalization and economic uncertainty is prompting governments to adopt more aggressive fiscal and monetary policies. For example, the U.S. is facing pressure to raise the debt ceiling and may implement further tax cuts and monetary easing. This economic chaos will exacerbate market instability, thereby driving more funds toward safe-haven assets like Bitcoin.

Second, look at institutions. The market potential of Bitcoin is gradually being recognized by global investors. More and more institutional funds, especially heavyweight financial institutions like hedge funds and sovereign wealth funds, are beginning to include Bitcoin in their asset allocations. Meanwhile, the U.S. government's attitude toward cryptocurrencies is becoming more positive, and it may even promote Bitcoin's value by establishing Bitcoin reserves. All of this provides strong support for Bitcoin's further rise.

Finally, look at the chart at the beginning.

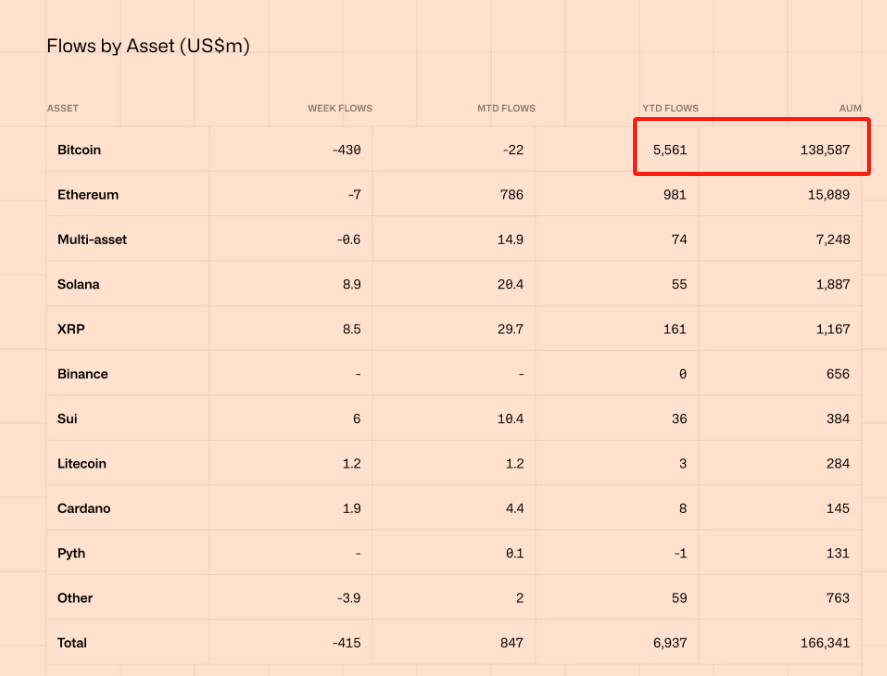

Take a look at the two numbers in the box in the image above. $138.587 billion is the current total of Bitcoin ETPs, and $5.561 billion is the total amount of funds that flowed in over less than two months in 2025. Compared to that, $430 million seems a bit insignificant.

I specifically pointed out these two data points to tell you that they represent the degree to which Bitcoin is recognized by traditional financial institutions, which may be the footnote to Bitcoin's generational opportunity. Everything is just beginning.

Conclusion

In the context of global economic instability and tightening monetary policy, Bitcoin's safe-haven attributes are becoming increasingly prominent. Whether it is the inflow of institutional funds or the government's shift in attitude toward cryptocurrencies, it all suggests that Bitcoin is gradually moving from a marginal asset to the mainstream investment arena. The current market turmoil may be the best time to enter Bitcoin, this digital gold.

Bitcoin stands at the crossroads of opportunity.

Crisis, crisis, there is opportunity within the crisis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。