And you, only when it's too late, will realize who the dealer is.

Author: Foxi (DeFi / AI)

Compiled by: Deep Tide TechFlow

My Meme trading account is currently down -60%. Am I a terrible trader? Yes, I really am. But it's not just because of poor decisions; I prefer to believe that I'm not worse than an average gambler. So, where exactly is the problem? Inspired by the data from @0xngmi (who pointed out that the returns from playing Memecoins are even worse than at a casino), I decided to delve deeper to see what the root of the issue really is.

First, I admit: I am a terrible Meme trader

Like many newcomers, I was led by the market hype and emotions, chasing highs and cutting losses, buying high and selling low, frequent trading leading to slippage, and even unknowingly handing my money over to insider traders in the market.

Although this is not my first time participating in the cryptocurrency market, this experience made me feel like I was playing an unfair game. Worse still, the rules of this game seem to change every moment and always favor those who have more information.

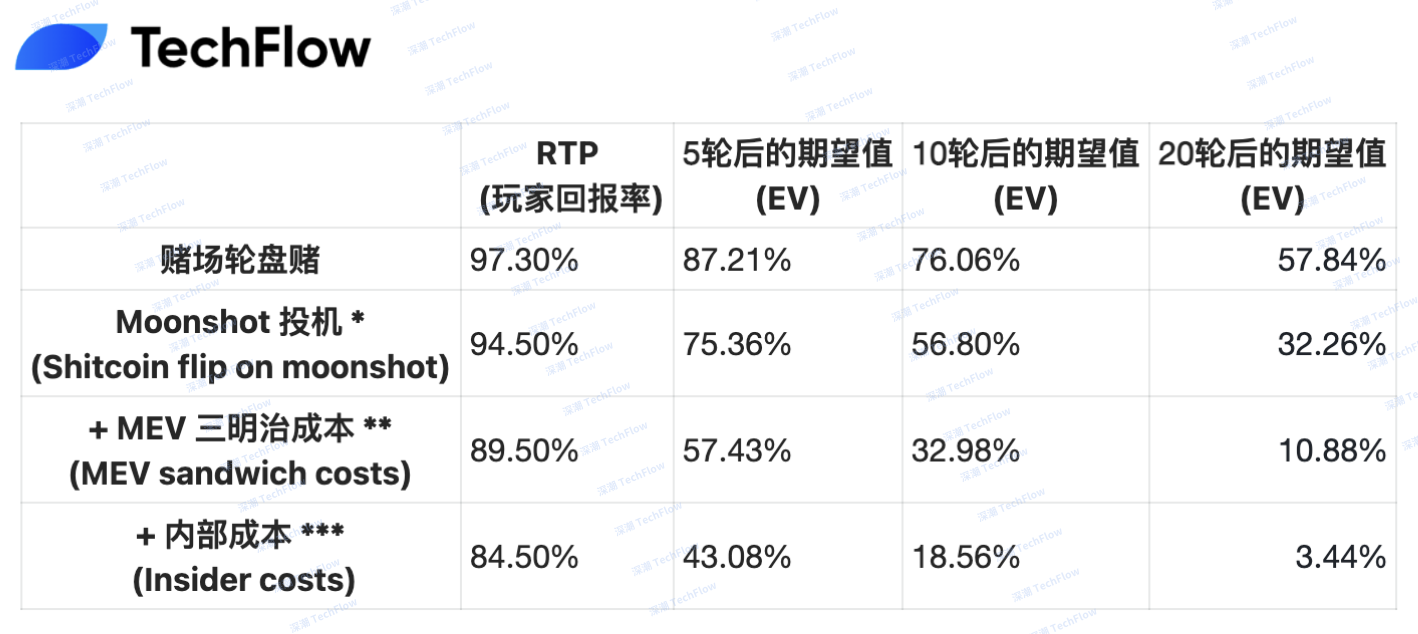

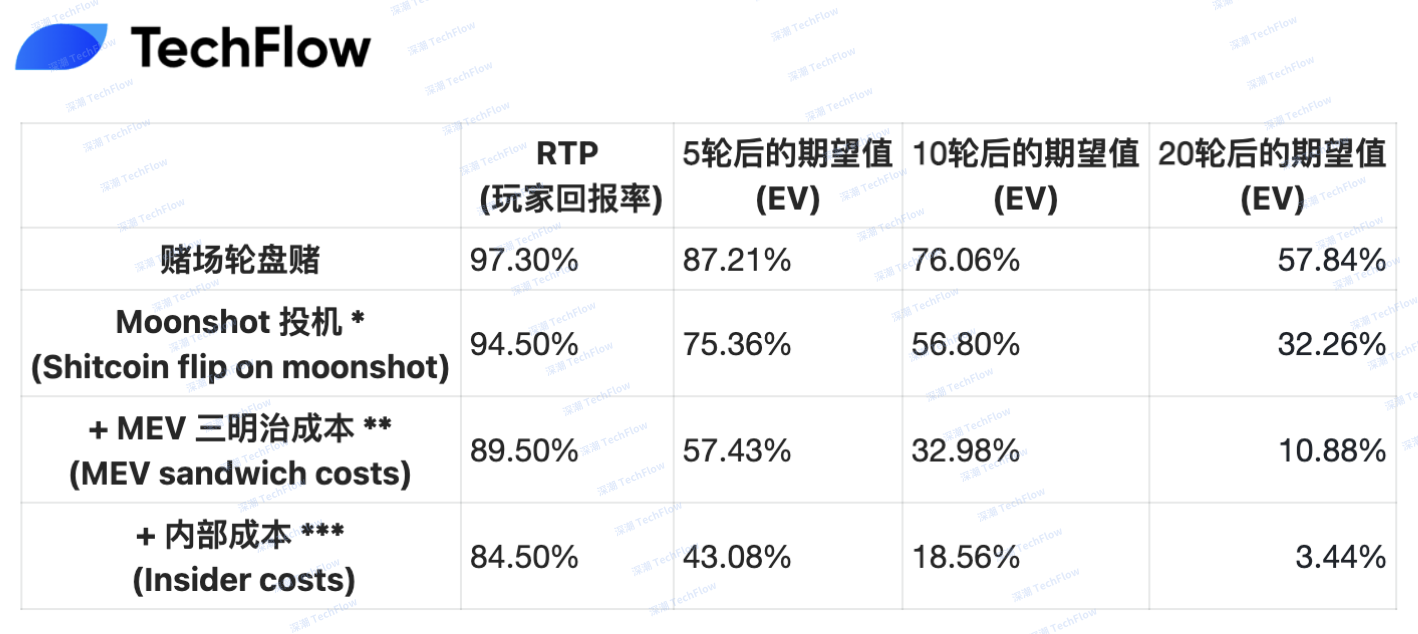

@0xngmi calculated the expected return (EV) of playing roulette in a casino compared to the expected return of Meme speculation (based solely on the fees paid).

(Original image from @0xngmi, compiled by Deep Tide TechFlow)

* Small transaction fees are 2.5%, Raydium's fee is 0.25%. A speculation requires two transactions, so the fees need to be multiplied by 2.

** Moonshot's default slippage is set at 5%, taking half of that as the average sandwich attack estimate.

*** It's hard to estimate precisely, as the differences between tokens vary greatly, assuming a cost of 2.5% per transaction.

This made me start to think: How does Meme speculation compare to actual gambling? Are their odds equally bad? Or even worse? More importantly, are Meme traders just casino gamblers disguised as "investors," or is there a more complex and hidden mechanism at play? According to @0xngmi's analysis, putting money into a casino seems wiser than playing Meme coins.

Real Odds: Memecoin vs. Casino

We need to talk about Expected Value (EV), a core concept in gambling and trading. It tells us how much you can expect to win or lose on average with each bet over time.

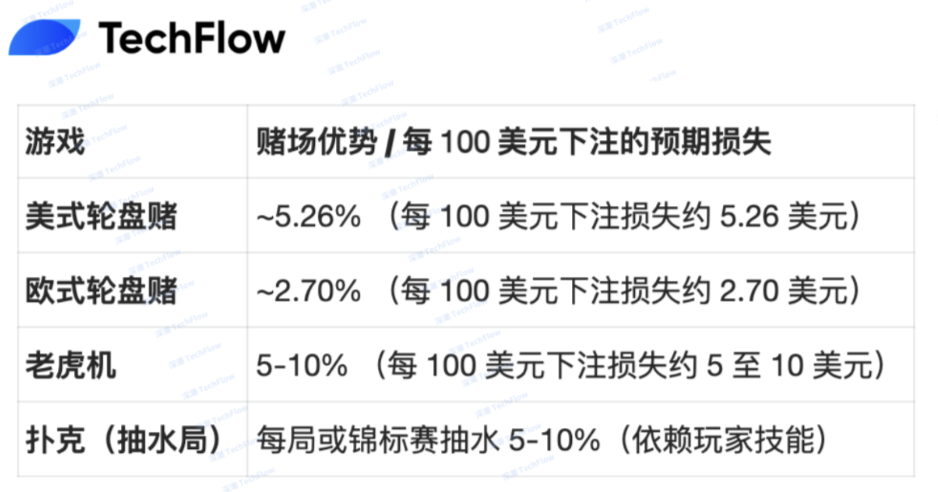

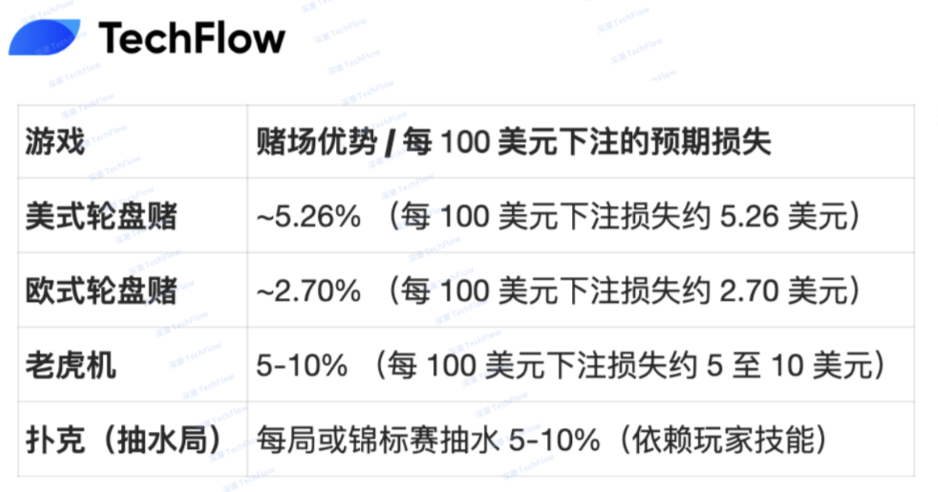

Casino games mathematically have a kind of "fair unfairness." In the long run, you can always predict how much you will lose. Let's take a closer look:

(Original image from Foxi (DeFi / AI), compiled by Deep Tide TechFlow)

In traditional gambling, casinos extract profits in a slow and predictable manner. Whether it's each spin of the roulette wheel or each pull of the slot machine, they follow a known probability model. For example, in American roulette, if you bet on red, you have a 47.37% chance of winning and a 52.63% chance of losing. Over time, the casino always wins, but it does not cheat—it simply uses probability to gain an advantage. However, to protect gamblers, some jurisdictions mandate a minimum return percentage. For instance, in Ontario, the RTP (Return to Player) of slot machines must be at least 85%, meaning the casino's edge (the dealer's cut) is at most 15%.

Why 99% of People Lose in Memecoin Trading

Unlike casinos, Memecoin trading appears to be a "game of chance," but the problem is that you don't even know who the real players are. While the Memecoin market doesn't have a clear "house edge," your funds are still slowly consumed through trading fees, slippage, insider trading, and market manipulation. Moreover, this loss is often hidden and difficult to quantify.

Here are the three main reasons why Memecoin investors generally lose money:

Trading fees

Slippage

Market manipulation

1. Trading Fees: The Hidden "Dealer's Cut"

Every transaction incurs a fee. Whether you are on a centralized exchange (CEX, such as @bitgetglobal or @MEXC_Official), a decentralized exchange (DEX, such as @RaydiumProtocol), or using trading bots (such as @gmgnai, which most people are using), these fees gradually erode your profits.

CEX fees: Approximately 0.1% per transaction (buy + sell = 0.2% round-trip fee)

DEX fees: Approximately 0.3% per transaction, plus gas fees (which can be $5-$50+ per transaction)

Trading bot fees: Approximately 1% per transaction, plus priority fees (which can be 4 times the regular DEX fees)

Meme coin tax: Some projects take 5%-10% from each transaction as part of redistribution or burning mechanisms. For example, @aipool_tee charges a 10% fee on sell transactions.

These trading bots are making a significant amount of money from the underlying users. Although the number of people trading Memes has decreased (as of February 17), daily revenues can still exceed $700,000.

On the surface, 0.2%-1% trading fees may not seem high, but when you trade frequently every day, these fees can quickly accumulate. If you make 10 trades in a day, you could lose 2%-6% of your principal, which is even worse than losses from playing European roulette.

2. Slippage (MEV Costs)

Slippage refers to when you place an order at one price, but due to market fluctuations, the actual execution price is worse than expected. In Memecoin trading, slippage is particularly severe, especially in cases of low liquidity or high market volatility.

Example: You try to buy a Memecoin for $100, but due to low liquidity, you only receive tokens worth $95, losing 5%.

When selling, a similar situation can occur. You plan to sell for $200, but slippage causes you to only receive $190.

Total slippage loss: Approximately 10% of round-trip trading costs.

@0xngmi mentioned that about 2.5% of trading fees are consumed due to MEV (sandwich attack costs), and on the BNB Chain, this cost can exceed 5% due to its poor infrastructure.

A better blockchain infrastructure can significantly reduce MEV costs. This is also why many believe Solana is superior to BNB Chain (which I completely agree with). If @cz_binance wants to promote Meme culture on the BNB Chain, the top priority should be to reduce MEV costs to enhance the expected value (EV) for Memecoin players.

However, even on Solana, 2.5%-5% MEV costs are still more severe than losses in casino games. If you found that the dealer's cut on a slot machine was as high as 10%, you would likely be outraged. But in the Memecoin market, that's not even the worst part.

3. Insider Trading and Market Manipulation

On this point, there is almost no need to elaborate. Unlike casinos, which have clear rules, the Meme market is completely tilted towards insiders. There is no regulation to prevent team wallets, developers, or influencers from "pumping and dumping" to harvest retail traders. For example, the following cases:

$LIBRA: Scammed over $107 million worth of tokens

$MELANIA: Is it related to Meteroa?

$CAR: African Rugged incident

$CUBA: Another country's Rugged incident

$GANG: @mrpunkdoteth cashed out $10 million through fans

$Broccoli: Manipulated and profited by scammers and insiders

These are just the tip of the iceberg. It can be said that if you are not an insider like @frankdegods, you have almost no advantage in participating in these Memecoins. In a casino, you at least know what the dealer's cut is, but in the Memecoin market, you don't even know who the dealer is, yet they are definitely taking your money.

Final Comparison: Memecoin Speculation vs. Gambling's Expected Value (EV)

Casino games slowly drain your funds over time, while Memecoin speculation is much more brutal. One wrong trade can wipe out weeks of gains in an instant. The only motivation to keep participating is the occasional 100x return. But in reality, the probability of achieving a 100x return is about 1 in 25,000, which is even lower than the odds of winning the lottery.

People often believe they are "special" or "skilled" (yes, I am that self-righteous guy), but in the end, they still get harvested.

The reason Memecoins don't feel like gambling is that they give a false sense of control—the illusion that you can make money through research, timing, and skill. Indeed, some traders can profit, but they are just a minority, like professional poker players. Most traders, like most gamblers, ultimately end up losing.

Advice for On-Chain

If you want to attract users and increase on-chain trading volume, make sure the MEV costs for traders are low enough, and try to reduce trading fees through partnerships or fund subsidies. Casinos can operate long-term because gamblers are willing to keep participating.

Advice for Investors

If you are speculating in Memecoins, remember that the dealer always wins. And you will only realize who the dealer is when it's too late. If you realize you can't pull away, you may already be in a state of gambling addiction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。