Original Author: Poopman

Translation | Odaily Planet Daily

Translator | CryptoLeo

Although the crypto market in recent months has been dominated by Memes, Memes, and more Memes, compared to the end of 2024, the hype around Memes has turned into an extremely "distorted" corner. From Trump issuing coins to the recent "Libra scandal," the Meme sentiment in the market has also declined, as shown in the figure below:

From a data perspective, since the launch of the LIBRA token, the daily trading volume on pump.fun (including purchases and trades of newly issued tokens) has decreased by 33.7% from $184 million to $122 million. Besides trading volume, pump.fun has stagnated in other areas. On Tuesday, the platform registered only 59,000 new wallets, marking a low since November 17, 2024. In comparison, on the day of President Trump's inauguration last month, the number of active wallets on the platform reached about 110,000. Looking back at the "distorted Meme" phase now, one can reminisce about the AI Agent Meme period from a few months ago, but PvP is not the end of blockchain; practicality and innovation are the enduring topics of the industry.

One of the projects I am currently optimistic about that combines practicality and innovation is the oracle project RedStone, which completed a $15 million Series A funding round in July 2024 and released its tokenomics a week ago. DeFi KOL Poopman wrote about RedStone yesterday, analyzing its advantages and potential from several perspectives, including RedStone's modular advantages, market share, and token economics. The translation by Odaily Planet Daily is as follows:

TL;DR

RedStone's modular architecture, AVS scalability, strong security, and ultra-low latency make it one of the most trusted and fastest oracles in the ecosystem.

In 2024, with a TVS of $3.8 billion and over 100 partners, RedStone has become the second-largest oracle provider in the field.

During the $2 billion liquidation and Renzo (ezETH) decoupling in 2024, RedStone outperformed other oracles in terms of price update speed, low latency, high stability, and accuracy.

Its token RED is a yield-bearing utility token that derives value from data and price feedback services. To enhance capital efficiency, RED can be wrapped as LRT and deployed in various DeFi protocols for additional yield.

Based on Pyth's $2 billion FDV, the expected trading price of RED in USD is around $2. The tokenomics focuses more on community growth, with 70% of the tokens locked in the first 12 months.

The current market cycle has deviated from fundamentals for some time, and everyone knows this is unhealthy for the long-term development of the industry. Many tokens we are familiar with today are just bubbles or Memes, while innovative protocols with real demand and large-scale adoption are still in a phase of being overlooked.

Recently, RedStone Oracle announced that their token RED is approaching TGE. Its tokenomics aims to provide more value to users or token holders.

In this article, the author will analyze RedStone's advantages and potential from 5 perspectives:

- Features of RedStone

- Market adoption of RedStone

- Comparison with other oracles

- RED token economics

- Potential valuation of RED

Why is RedStone better?

It is well known that oracles are one of the most important components of blockchain; without oracles, blockchains are just closed ecosystems that cannot access data from external sources. In today's market, every chain and dApp needs an economically efficient, secure, and flexible oracle.

And I believe RedStone has successfully filled this gap.

In recent years, RedStone has integrated and provided price oracles for hundreds of mainstream (Tier 1) protocols from day one. This includes USDe, Pendle, Morph Blue, Berachain, EtherFi, and Lombard BTC. But what makes RedStone a favorite among many projects?

The reason is simple: security and modularity.

Security under AVS

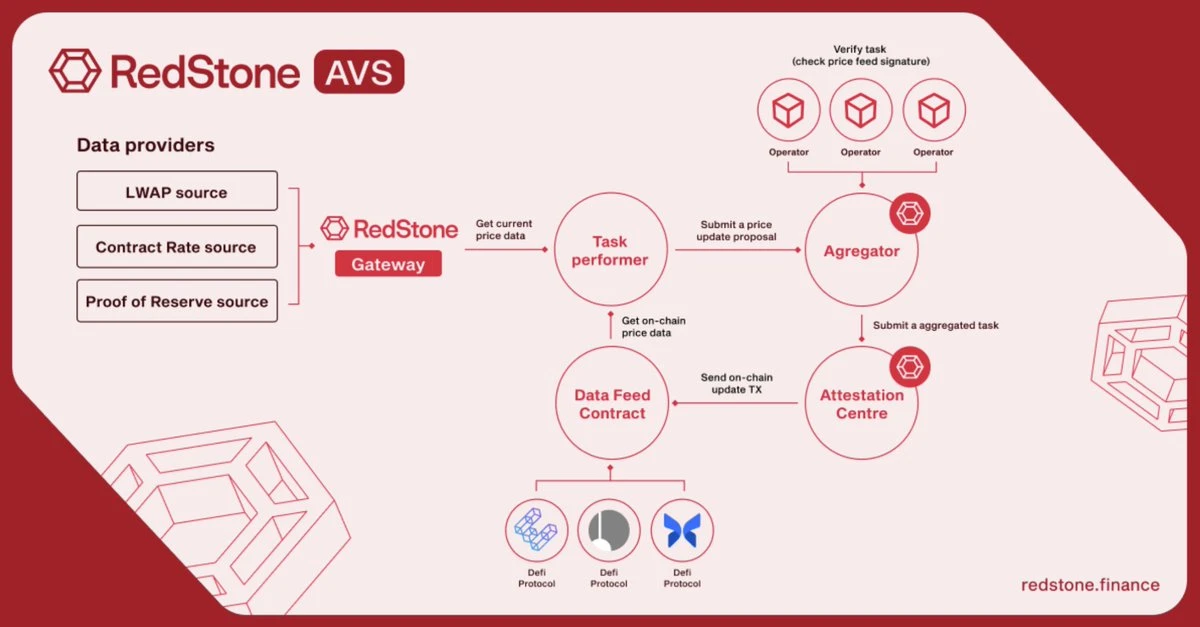

Unlike other oracles, RedStone can verify the accuracy and validity of price feedback data using the EigenLayer AVS framework, achieving more efficient gas costs and scalability.

Note from Odaily: AVS stands for Actively Validated Service, which is the most important concept in the Eigenlayer ecosystem. Simply put, AVS is a protocol, service, or system that requires collateral to validate a "task." The AVS service itself is responsible for obtaining and reporting prices, while AVS corresponds to its service management contract—Service Manager, which communicates with the Eigenlayer contract and contains states related to service functionality, such as the operator running the service and the amount of collateral used to secure the service.

Traditional oracle price push models work by collecting data from various sources and validating it through DDL (Data Definition Language) and data consumption modules. The on-chain validation process requires a significant amount of gas fees, making it quite expensive. With RedStone's AVS, RedStone can provide highly optimized validation gas by processing data off-chain.

The process is as follows: AVS operators obtain market prices and TWAP rates through data source modules, verify their accuracy, and then feed the verification results back on-chain.

Since most computational work is performed off-chain while maintaining trust and verification through AVS, RedStone offers a more cost-effective oracle solution compared to other solutions in the field.

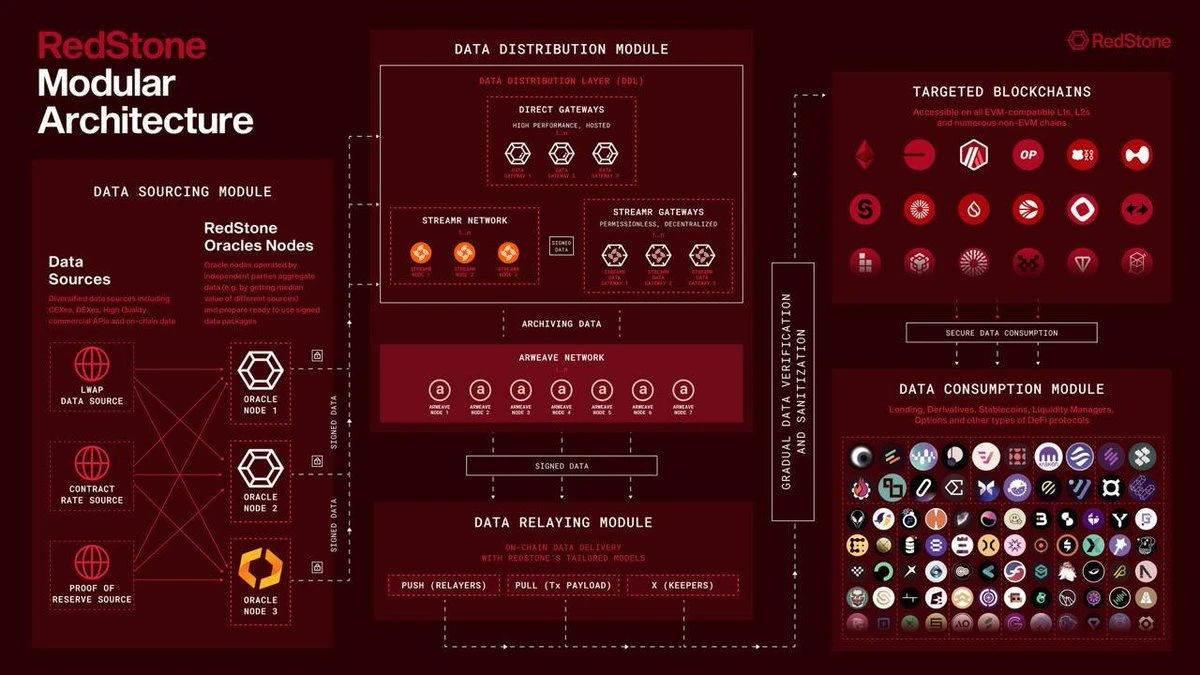

Modularity

In addition to scalability, modularity is one of RedStone's main advantages. The platform has both pull and push modes for modules. This provides projects with better flexibility, allowing them to choose managed or raw oracle data sources based on their specific needs. Projects can opt for carefully filtered and verified price feeds or customizable raw data streams to protect their assets.

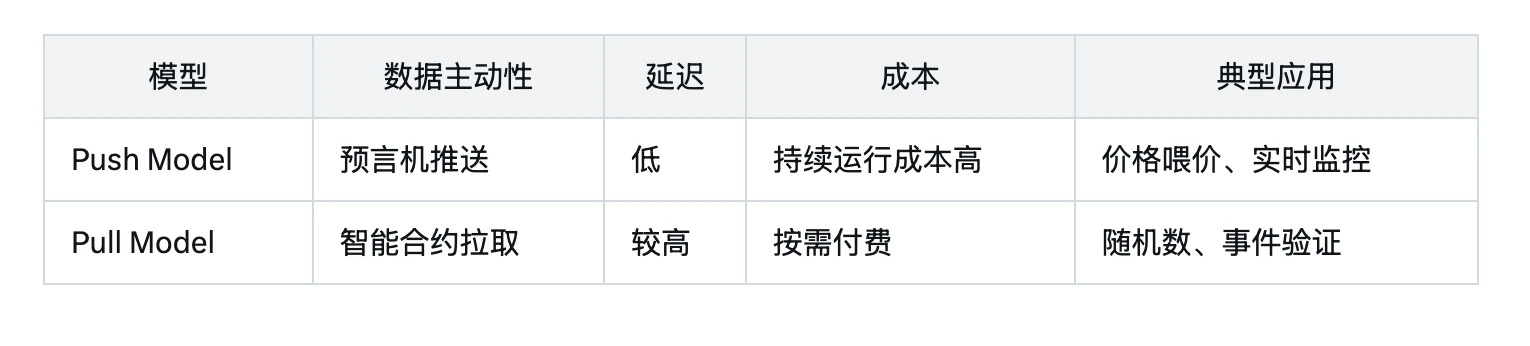

Note from Odaily: The pull model and push model are illustrated in the figure below:

Due to its modular architecture, RedStoneinfra allows for seamless swapping of components from different systems without affecting system performance or reliability. The plug-and-play nature of the modularity makes RedStone one of the most versatile oracle solutions in today's DeFi innovations and emerging chain systems.

Market Indicators

Customer Growth

RedStone's modular, plug-and-play architecture has driven user growth for its projects, making it one of the fastest-growing oracle solutions in the blockchain space.

Throughout 2024, RedStone significantly expanded its influence, establishing partnerships with over 100 new customers and launching on more than 30 chains. RedStone has over $6.8 billion in TVS, making it the second-largest multi-chain oracle provider in the industry, while Chainlink primarily focuses on the ETH ecosystem.

The platform's reputation for reliability continues to attract mainstream participants in DeFi. Notable partners include those who secured $3 billion in TVS for Spark (Maker's lending protocol) and provided price feedback for DeFi leaders like Pendle and Ethena, as well as various BTC staking, yield stablecoins, LSTs, and LRTs. Its client list reflects the industry's confidence in RedStone's reliable and customizable oracle solutions.

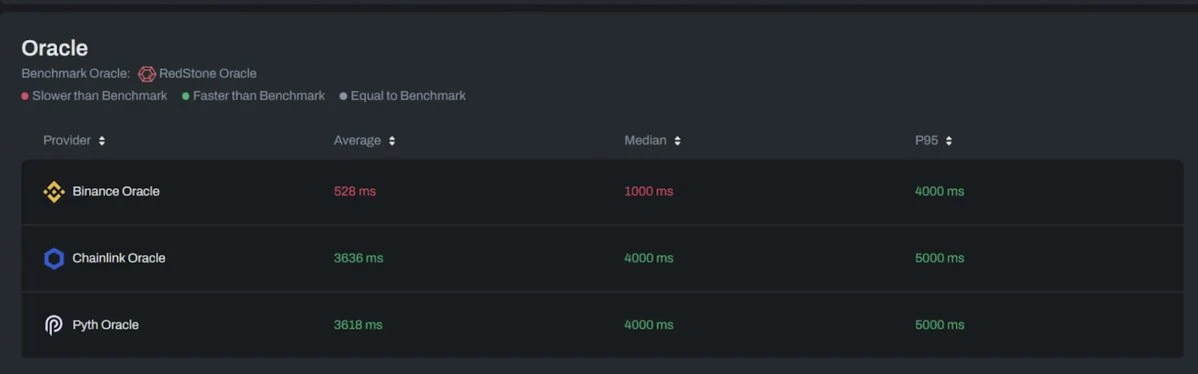

Price Feedback Time (Low Latency)

RedStone is one of the fastest and most reliable oracles in the field while maintaining decentralization, which is considered a trilemma. In terms of speed, RedStone's update rate surpasses that of most centralized oracles (only Binance's speed is slightly faster than Redstone). RedStone manages to remain decentralized while competing with CEX, which is impressive.

Stability

RedStone has also demonstrated reliability amid market volatility, maintaining consistent and accurate price feedback at critical moments. During the $2 billion liquidation event in February 2024, Redstone successfully pushed 119,000 updates within 24 hours, with the update frequency of the ETH/USDC price exceeding Chainlink by 30 points, providing more accurate price updates.

It has been proven that during the Renzo (ezETH) decoupling in April 2024, RedStone was able to keep up with price changes better than Chainlink. During this period, RedStone published approximately 40 price updates within just 3 blocks, while Chainlink pushed out only about 20 updates in the same timeframe. This indicates that RedStone is actually faster than the market-leading oracle provider. For more details, refer to the Chaos Labs report.

Comparative Advantages: Each oracle project has its own strengths, but RedStone draws on the best of all, integrating all functionalities together.

Comparison of RedStone with Other Oracles

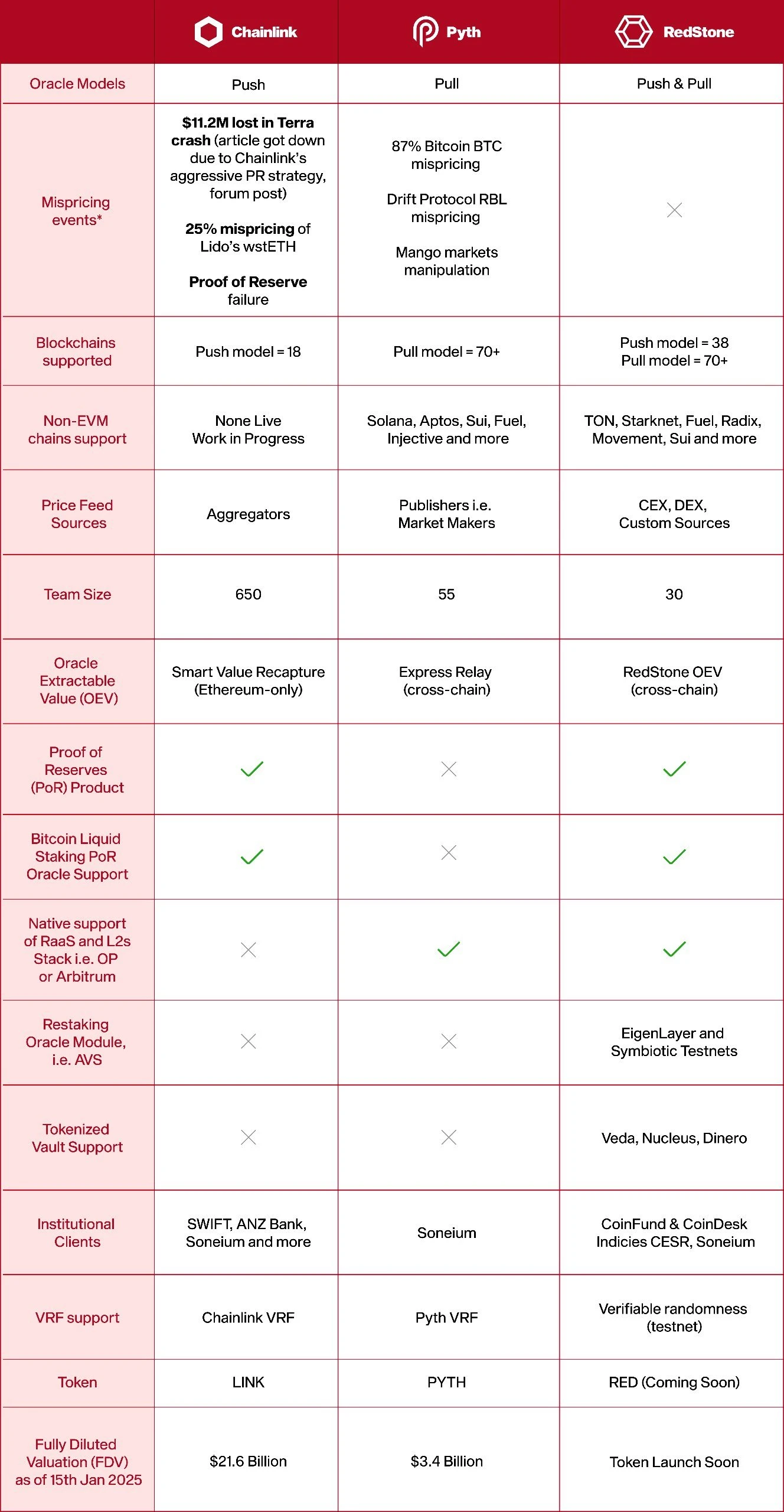

Here is an overview of the mainstream oracle projects currently in the market:

Chainlink: Primarily targets EVM and OG DeFi, mainly adopts a push model, providing reliable data through bridging with CCIP and expensive integration setups, supporting only a limited number of blockchains;

Pyth: Primarily targets non-EVM and Perps markets, mainly adopts a pull model, using Wormhole as a cross-chain relay, focusing on the quality of data push;

RedStone: Any chain, any market, offers both push and pull models, uses Eigenlayer AVS for cost-effective on-chain validation, and has proof of reserves for wrapped BTC assets.

The following image compares the differences among three major oracle providers in the market:

Upcoming TGE and RED Token Economics

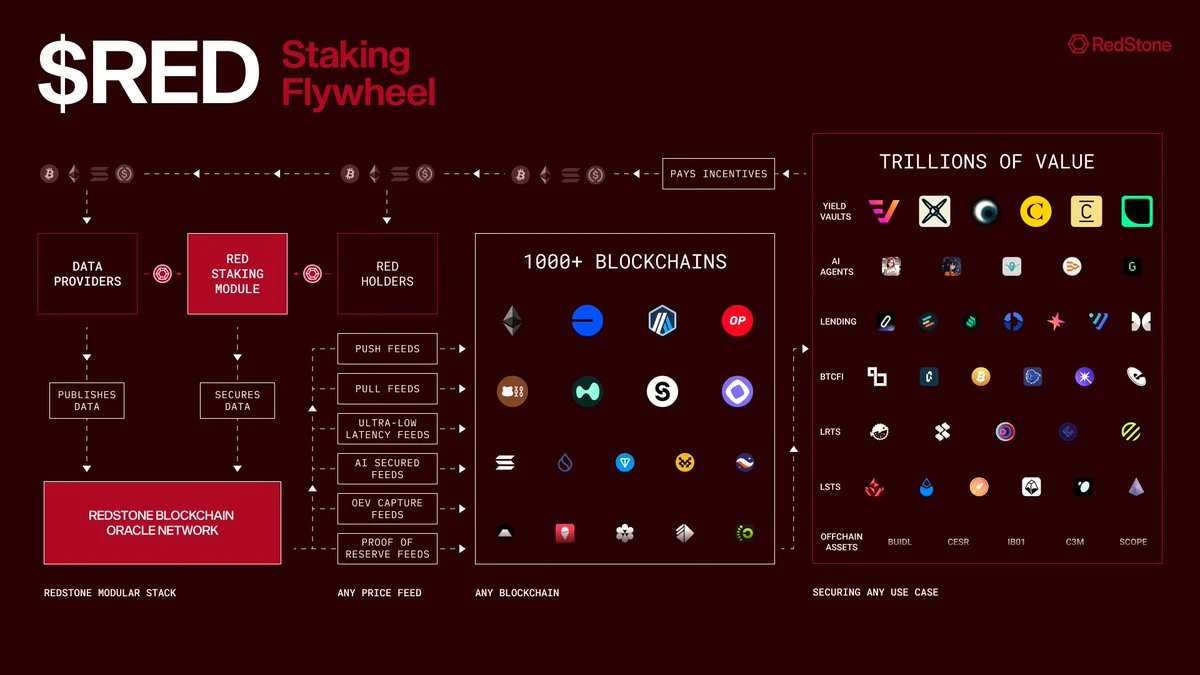

As RedStone expands to thousands of on-chain protocols, the RED token will play a key role in decentralized oracles and in deriving value from all integrated projects. RedStone's data providers (operators) have complete flexibility; they can set any collateral, charge any fees (in any token), or establish any requirements they desire.

RED will serve as a utility token, allowing holders to stake and delegate it to data providers for a share of fees and rewards.

In addition, RED will allow for re-staking versions, enabling its LRT to be used in any DeFi protocol to unlock additional economic value (similar to stETH).

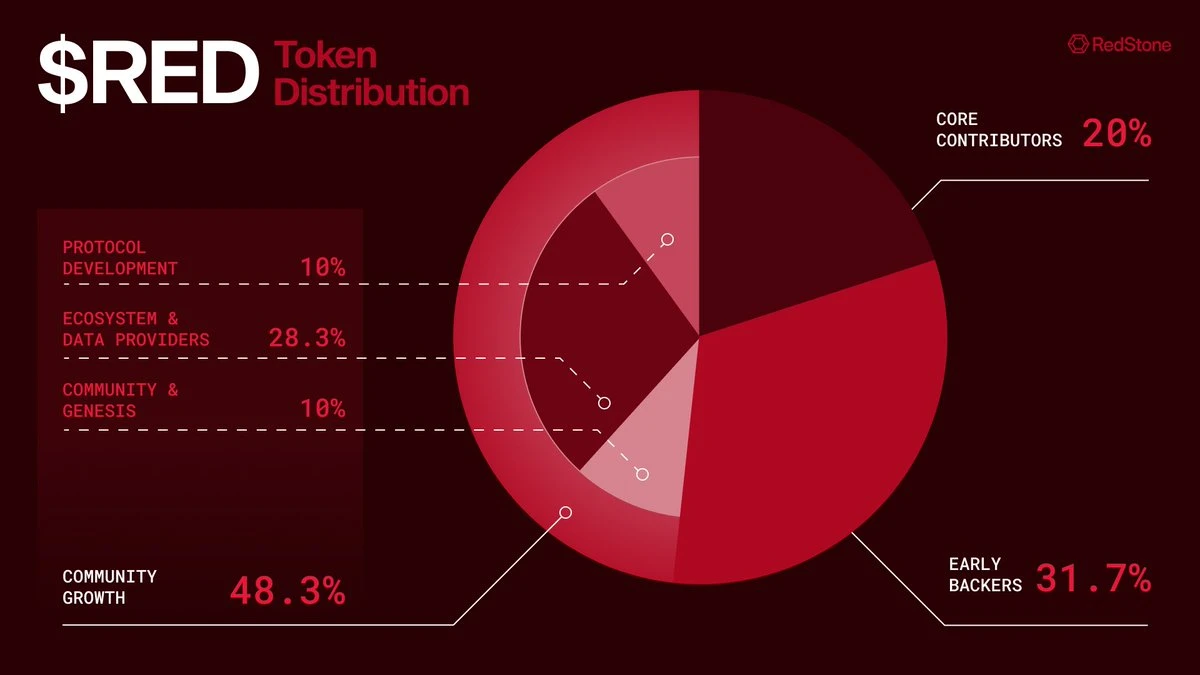

Official data shows that the total supply of the RED token is 1 billion. Of this, 30% will be in initial circulation, and RED will be issued as an ERC-20 token, but can later be bridged to Solana, Base, and all other supported networks through the Wormhole native transfer standard.

The design of RED is community-centric: a large portion of the token supply (48.3%) will be allocated to community growth programs, including airdrops, future donation programs, and incentives, while 20% will be allocated to core contributors.

To ensure the long-term sustainability of RED, 70% of the RED tokens will be fully locked for the first 12 months after TGE, with gradual unlocking over the subsequent 36 months.

As RedStone's customer base grows, operators will earn more fees, which will also increase the earnings of RED token holders. Higher yields will lead to higher token staking rates, ultimately forming a positive feedback loop.

RED Token Valuation

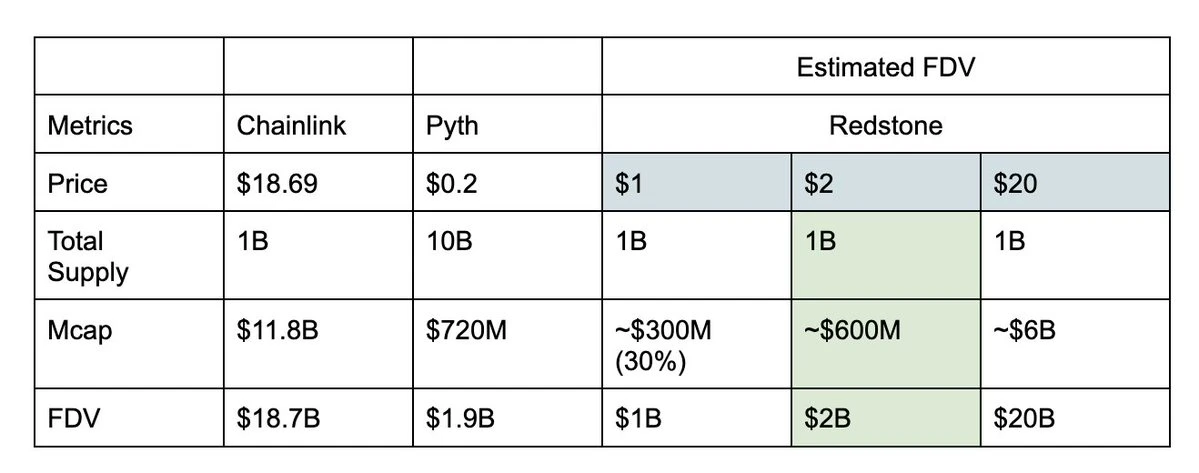

Leading oracle projects in the market have FDVs reaching billions of dollars. Comparing RedStone with Chainlink and Pyth, both leading oracle protocols, can better estimate the price of the RED token:

With a total supply of 1 billion tokens, an initial price of $1 would give RedStone an FDV of $1 billion, but considering the project's current market positioning, $1 seems somewhat conservative.

A better valuation estimation method is to compare it with Pyth's $2 billion FDV. Considering the 30% initial circulating supply, the price per token would be $2, which is also the expected price for the RED token.

Considering that if market conditions improve, RED may reach Chainlink's FDV, the token price could rise to $20 each.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。