From a realistic perspective, exploring the actual ecology on-chain.

Author: Berachain

Translation: Deep Tide TechFlow

It's finally here.

After two years of waiting, Berachain's Mainnet launch event was held last Thursday, and Beras has been cooking. There is a lot to do, and it’s hard to get a comprehensive understanding of everything happening on-chain - but this article will provide you with a thorough overview of almost everything you can do on Berachain right now.

Berachain itself needs no introduction, but its consensus mechanism - Proof-of-Liquidity (PoL) - is at the core of driving economic innovation on Berachain. Initially, when the idea of this brand new consensus mechanism was proposed, Berachain was just a community, not an L1. But now, the situation is very different. After attracting over $3 billion in deposits through the Boyco program, Berachain has officially launched, started block production, and attracted a large number of dApps and users.

This blog typically focuses on the fundamentals of Berachain, exploring its future potential, but this time we will take a realistic approach to explore the actual ecology on-chain. Let’s get started!

Exploring Berachain's DeFi Ecosystem

First, we start with an overview of Berachain's DeFi ecosystem. Most of the functions in this ecosystem rely on assets deposited through Boyco, and dApp teams are working hard to launch new strategies and on-chain features.

According to data from DefiLlama, Berachain's total value locked (TVL) is slightly above $1.9 billion, but this does not include all Boyco assets. Captain Jack Bearow wrote an excellent summary of how the Boyco market operates and where these assets flow, which you can read here.

Let’s briefly explain how Boyco operates before diving into the mainnet dynamics.

The Boyco program selected 12 applications and over 20 asset issuers. Boyco assets are divided into three categories: primary assets, third-party assets, and mixed assets. Different multipliers and terms are applied based on asset categories, and each team submitted application scripts explaining how these assets would be used once the mainnet goes live.

From Berachain's TVL data, we can see that not only is the distribution among dApps even, but the distribution among pools, assets, and strategies is also very healthy. Next, we will list some activities on-chain and highlight specific strategies and pools to showcase their possibilities.

Starting with BeraHub, we can see how the PoL magic works.

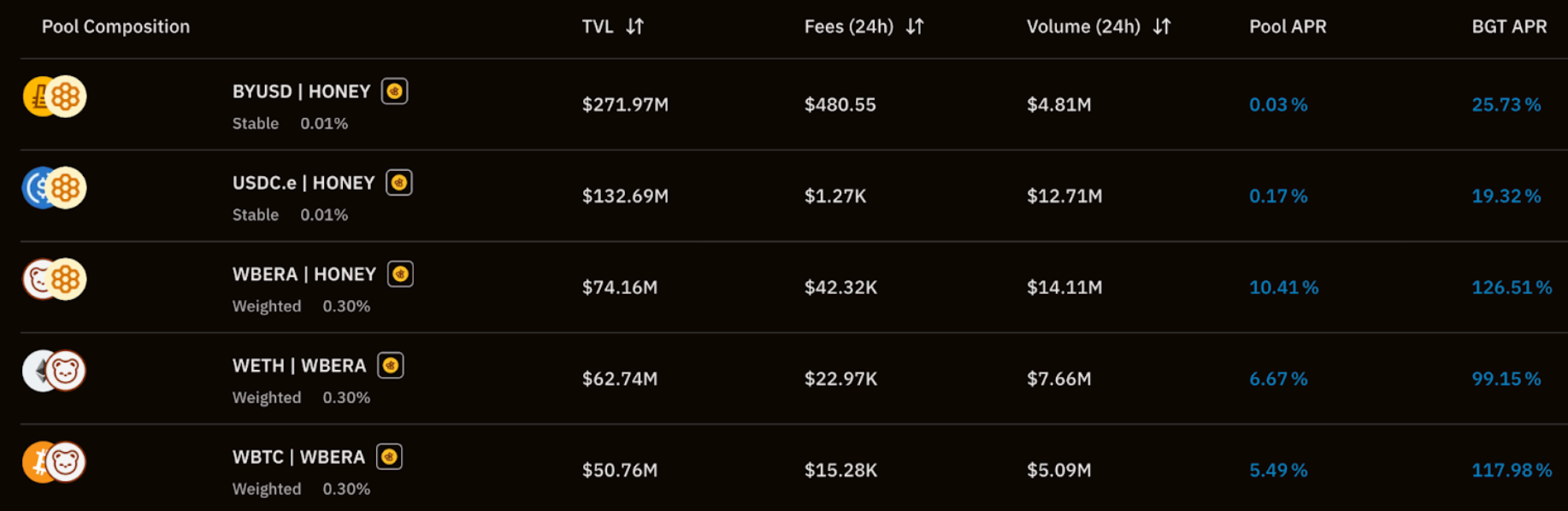

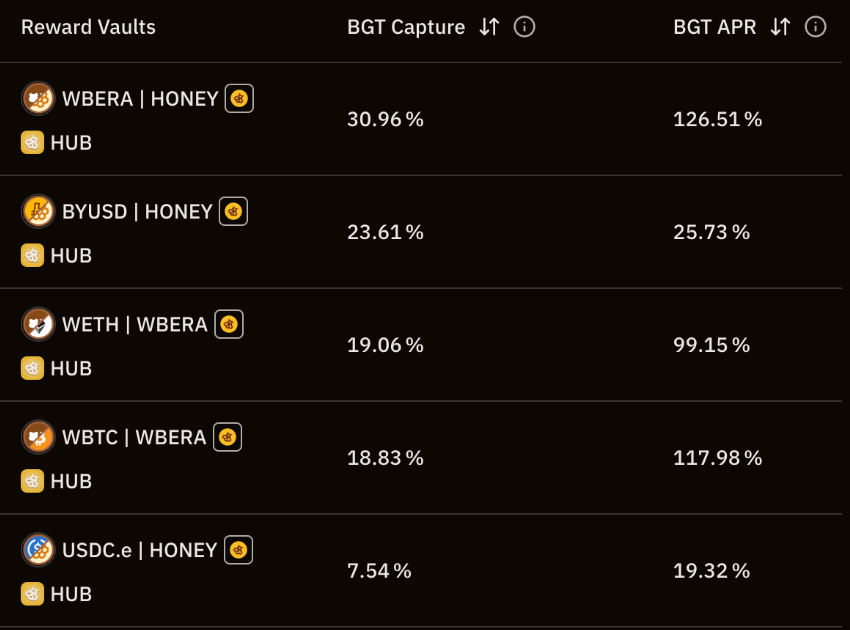

Upon opening the website, you will see several different tabs, but let’s start with the liquidity pools. The top five liquidity pools by TVL allow you to deposit HONEY or WBERA, with paired assets including BYUSD, USDC.e, WETH, and WBTC, depending on your risk preference.

These liquidity provider (LP) token certificates can be staked in reward vaults, which is the main way to earn BGT rewards on Berachain. Currently, there are five reward vaults—corresponding to these five liquidity pools—that have been whitelisted and opened for deposits, with varying BGT capture rates and annual percentage yields (APY).

As of the time of writing, Kodiak's TVL has exceeded $690 million—so where is this funding coming from? How are LP users utilizing Kodiak's infrastructure?

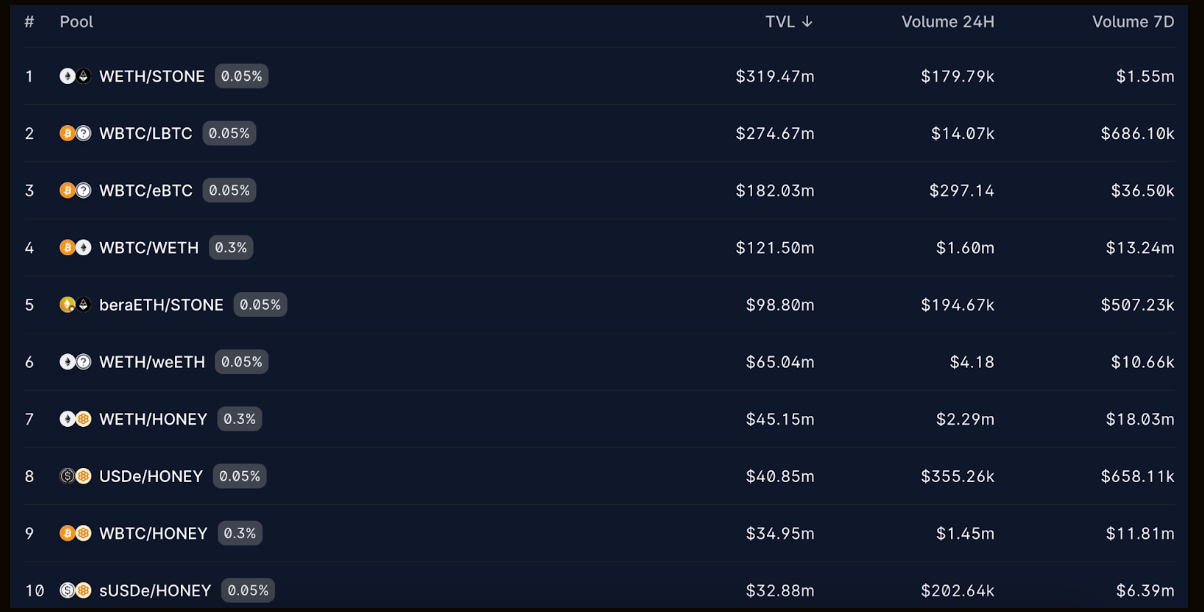

If we look at the top ten liquidity pools by TVL, we can see that Kodiak has quite deep liquidity across multiple trading pairs, which are distributed among the three asset categories mentioned earlier. Among these trading pairs, WETH pairs occupy three of the top five, with the others including STONE, WBTC, HONEY, and beraETH.

Over $375 million in WETH has been deposited in the Boyco program, most of which is now deployed on the Berachain mainnet.

Kodiak not only provides rewards for depositing more standardized assets but has also launched "sweetened islands," products designed specifically for BERA/HONEY, BERA/WETH, and YEET/BERA pairs, currently offering annual percentage yields in the triple digits. Whatever your needs, Kodiak can meet them, with asset scale growing to over $1.1 billion and continuously launching new features and farms, such as the "sweetened island" for WBTC/BERA, integration with Zapper, and the ongoing launch of new tokens in the Berachain ecosystem.

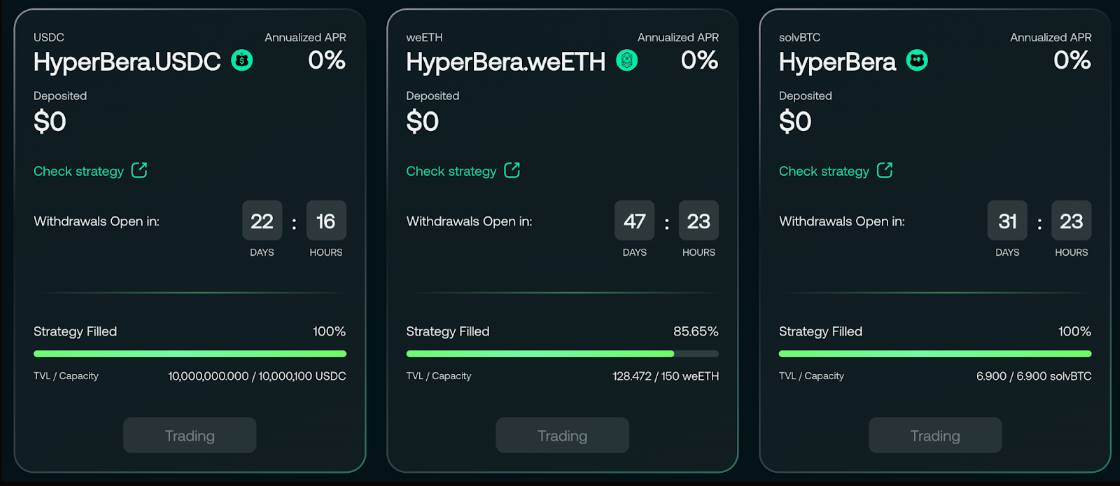

D2 Finance currently offers some unique strategies for Berachain, such as Hyperbera.usdc, Hyperbera.Weeth, Kodiak++, Dgnberaland, and Hyperbera. At the time of writing, the protocol's TVL has exceeded $10 million and has been working hard to provide differentiated products leveraging the broader Berachain ecosystem.

D2 recently shared their thoughts around Berachain and PoL, but the team aims to bring tokenized derivative strategies to Berachain, which not only offer attractive yields but also benefit from the reflexivity and incentive structure of PoL. If you want to passively farm BGT rewards through a series of actively managed strategies, D2 might be your ideal destination.

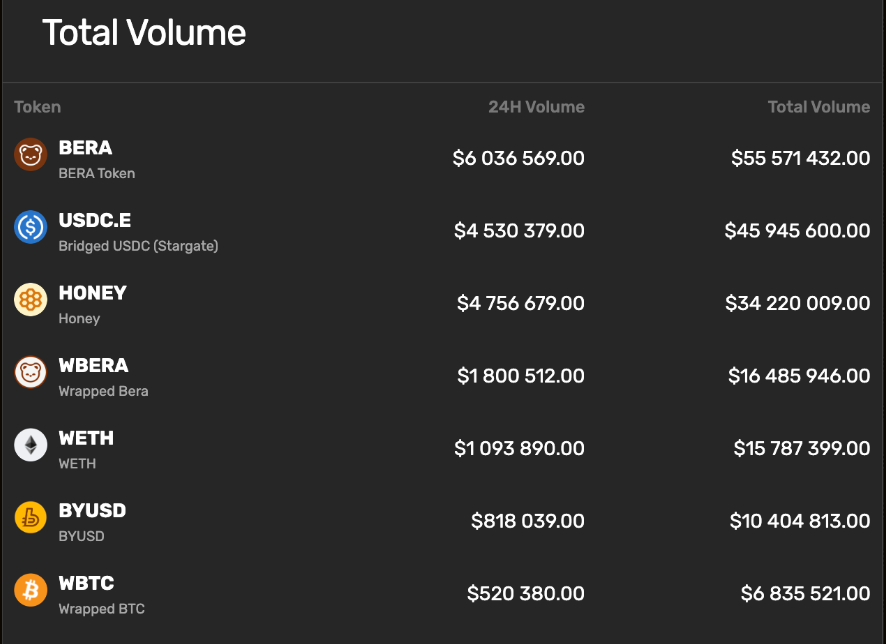

Ooga Booga is a native liquidity aggregator that has completed nearly $200 million in trading volume since its launch. This trading volume comes from various tokens, primarily including BERA, HONEY, and USDC.e.

In addition to trading volume, Ooga Booga is continuously listing new tokens and allowing users to trade assets across multiple DEXs, providing a streamlined user experience while continuously launching new partnerships and integrations.

In addition to trading volume, Ooga Booga is continuously listing new tokens and allowing users to trade assets across multiple DEXs, providing a streamlined user experience while continuously launching new partnerships and integrations.

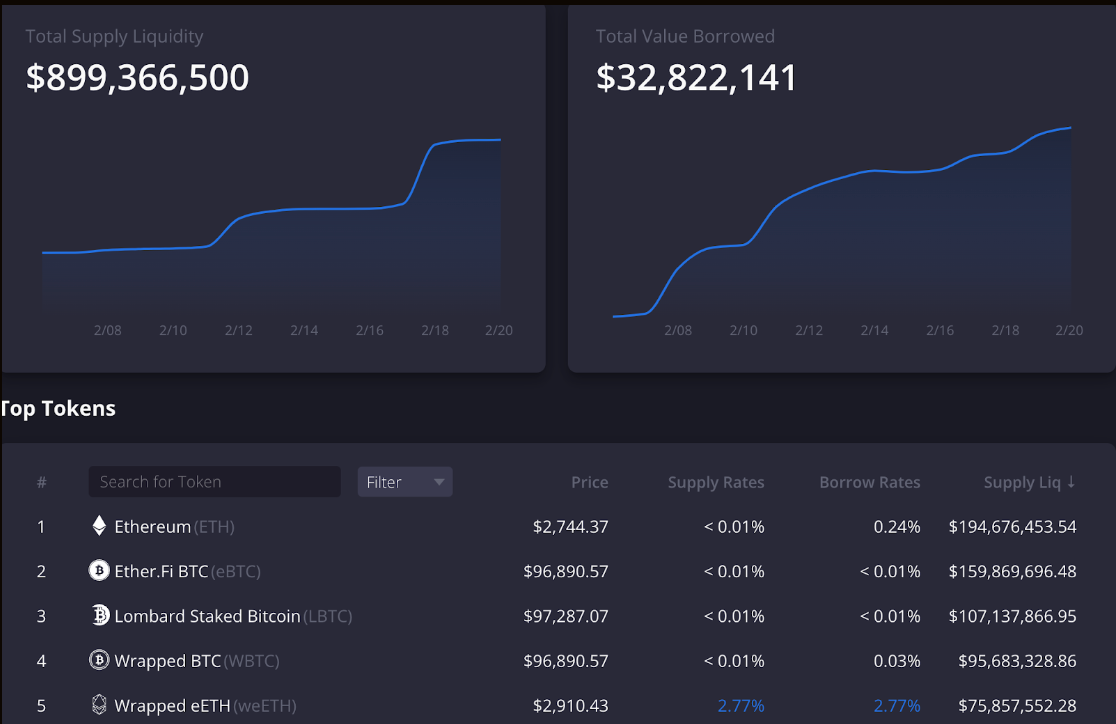

The Dolomite protocol has attracted nearly $1 billion in assets to the platform, with over $32 million already borrowed. Dolomite is building a money market and margin trading protocol to serve Berachain and users looking to make the most of their assets.

For users looking to stake BGT or BERA, Infrared is key.

This platform is a user-friendly liquidity staking solution focused on PoL. Infrared has attracted over 180 million BERA, allowing users to stake BERA and receive iBERA, a liquidity token (ERC-20) backed 1:1 by BERA. The deposited BERA tokens are staked through Infrared's validator network, allowing users to earn staking rewards without any action required.

One major advantage of liquidity staking tokens is not only the easily obtainable staking yields but also their additional capital efficiency. In the Berachain ecosystem, you can use iBERA to provide liquidity, borrow, or serve as collateral without giving up staking rewards. Infrared will also launch iBGT, a liquidity variant of its BGT for users looking to maximize PoL rewards; more information can be found here.

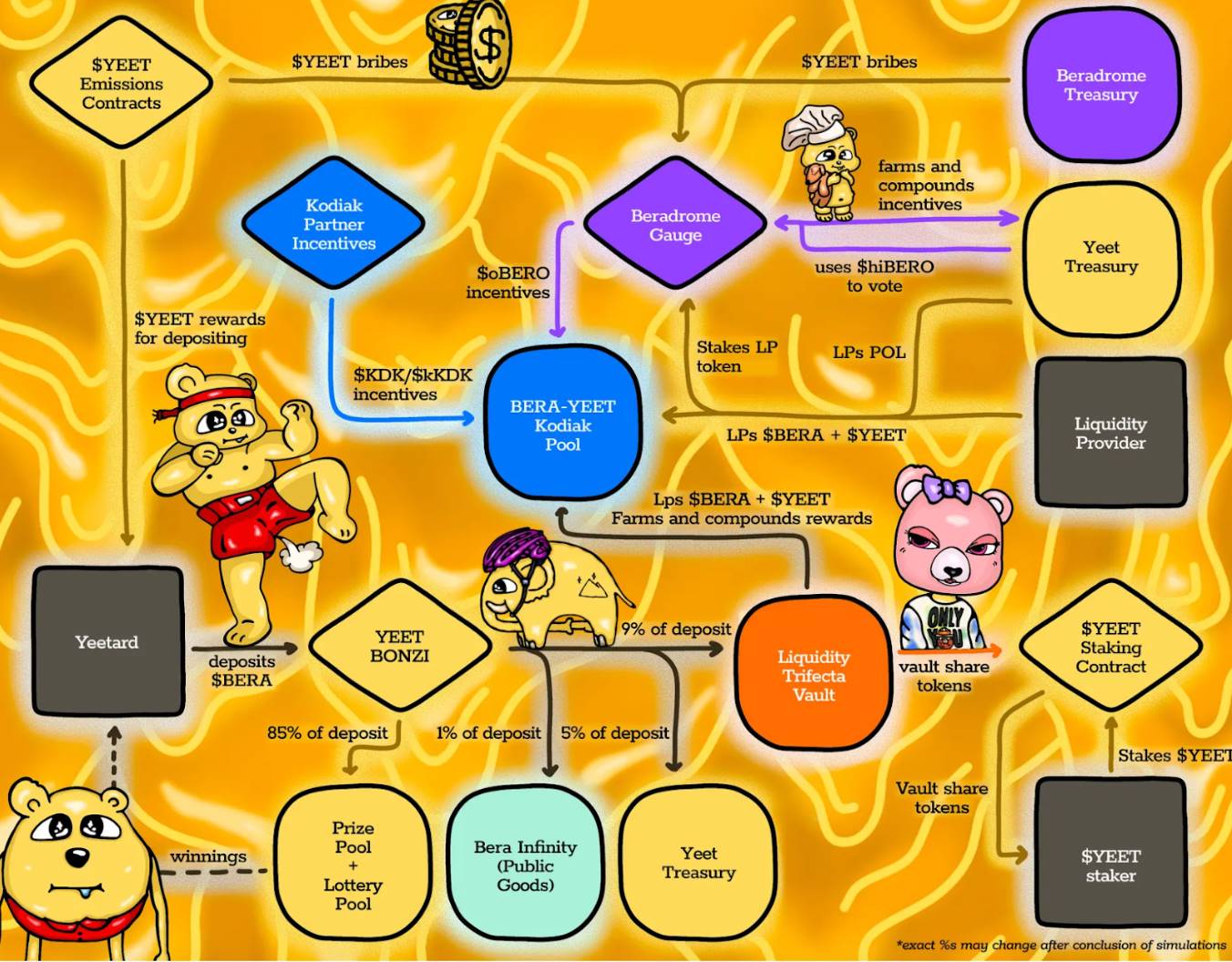

If you want to maximize your exposure to the Berachain ecosystem, you can deposit into the Yeet's liquidity Trifecta Vault (detailed here).

A TL;DR introduction is that Yeet has partnered with Beradrome and Kodiak to release very user-friendly auto-yield products that allow depositors to earn mining rewards and reinvest them into Yeet/Bera LP positions.

Compared to manually providing liquidity, staking certificate tokens to Beradrome, and routing through Kodiak's YEET/BERA "sweet island," users can now complete all these operations directly through Yeet without going through cumbersome steps. If you wish, you can even withdraw the LP certificate tokens from the liquidity trifecta vault for other uses; the choice is yours.

Beradrome officially launched on February 9, aiming to become the preferred liquidity market for any yield-bearing asset on Berachain. Although its structure is quite complex (you can see detailed explanations in their documentation), this has not deterred community users from depositing assets and initiating the "flywheel effect."

The architecture of Beradrome is inspired by observations of the Solidly model, attempting to optimize it. With the underlying operation of PoL, Beradrome can establish deeper liquidity through reward vaults and yield tokens. If this dApp continues to grow, users will be more motivated to participate in BERO, hiBERO, and oBERO, thereby leveraging the advantages of both Beradrome and PoL.

Last but not least, Smilee Finance has launched gBERA, a unique liquidity staking token designed to automatically rebalance and accumulate rewards through Berachain validators. Unlike other liquidity staking tokens like iBERA, gBERA's uniqueness lies in its ability to automate the reward claiming process, rolling rewards back into BERA without requiring additional actions from users. The team plans to roll out more integrated features in the coming weeks, allowing users to wrap gBERA for use in various applications within the ecosystem.

GameFi, SocialFi, and MemeFi on Berachain

If DeFi isn't your area of interest, that's okay.

Berachain is not just another DeFi chain; its ecosystem has already shown considerable diversity just one week after the mainnet launch.

Perhaps you just want to bridge to Berachain and take a break, temporarily avoiding dApps while planning your next move. If so, take a look at bera.tv. The team describes it as "the first cross-dimensional AI-generated TV show," airing exclusively on Berachain. If you enjoy watching two AI bear news anchors discuss various topics, you’ve come to the right place.

If you want to place bets but aren't interested in sports? Over/Under has launched on the mainnet, allowing you to bet in real-time on the outcomes of live video games, with the option to set up parlays. Streaming has become one of the most popular ways to attract viewers, and the data doesn't lie—over 7 million unique streamers used Twitch last year, with an average of 2 million concurrent viewers.

If cryptocurrency hopes to break out of its bubble and start attracting more users, catering to their interests is a key potential path to success. Over/Under aims to become the go-to hub for streamers and speculators, and it is exclusive to Berachain.

Memeswap aims to create a top destination for memecoin traders, offering an experience similar to pump dot fun but designed specifically for the Berachain community. If you want to take advantage of the increasingly active on-chain activities without directly purchasing tokens, you can stake your BERA through Memeswap to provide rental liquidity for new token issuances, thereby earning yields.

For users looking to actually trade tokens, they can use Memeswap to track new token deployments, recent bindings, and other details to stay updated. Memeswap has completed over 370,000 BERA in trading volume and has integrated with Infrared, Ooga Booga, and other teams to provide a seamless experience for various types of traders.

Shogun is building a platform that makes it easier for users to go on-chain through gun.fun. With just one click, users can transfer assets from any chain to Berachain. The team launched on February 11, and even though Berachain is an EVM-equivalent chain, Shogun allows anyone to send assets from non-EVM chains to Berachain.

Honey Chat is a native Berachain social networking application designed to redefine social dynamics through on-chain mechanisms. Users can register and connect their existing X accounts to access a network where social reputation truly matters, governed by tokens.

Advancing Proof-of-Liquidity (PoL)

At this point, we can talk about PoL, even though it hasn't officially launched yet.

Instead of waiting for PoL to activate, it’s better to proactively think about how PoL will integrate with existing on-chain liquidity and how you can leverage it. Whether you switch between different dApps based on reward programs or choose to remain loyal to one or two dApps, considering these questions in advance is valuable.

As mentioned earlier, there are currently only five whitelisted reward vaults—what will happen once more protocols start applying for the whitelisting process? The current distribution of BGT capture rates remains relatively balanced, but this situation is unlikely to last long. For more information on how reward vaults actually operate, you can check the documentation.

The tokenomics of Berachain aims to promote a healthy balance between on-chain behaviors, with good reason for separating gas tokens and governance tokens. Unlike the annual release of 10% of the BERA supply, users and dApps can earn BGT, which has a completely different unit dynamics and game theory.

Just to mention, there are already some opportunities on-chain, such as Infrared's iBGT, which currently offers a decent annual percentage yield (even stablecoin yields).

When PoL activates and officially launches, those who have put in early efforts will be rewarded for their patience and diligence, while others will need to catch up and understand why Berachain is so different from PoS chains.

At this point, this article should have provided you with enough food for thought and directions for action, but there is still much content that has not been covered. If you want to stay updated on the latest developments in Berachain, you can start with the foundation's X account and ecosystem page, which will be continuously updated as more teams launch on the mainnet.

Thank you for reading, Beras.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。