Market sentiment is high in the short term, with new high-flying coins continuously emerging and the battle between bulls and bears intensifying. Today, I will discuss the key levels and potential trends of various popular cryptocurrencies.

🚀 BTC: The 98,500 Level is a Watershed, Breakthrough or Pullback?

BTC is currently challenging the 98,500 key resistance level. If it breaks through, market sentiment will enter a new round of FOMO, targeting 100,000 USD. However, if it fails to reach a new high, it may pull back to 95,625 to form new support. Market funds are active, and the upcoming directional choice will determine whether BTC can continue to strengthen.

🔥 ETH: Insufficient Volume, Short-term Challenge at 2,885

ETH has recently faced multiple obstacles at the 2,780 key resistance level, indicating strong selling pressure above. An ascending wedge has formed on the 1-hour chart, but volume is decreasing, so caution is needed regarding the risk of a failed breakout. On the 12-hour chart, it is in an ascending channel, with the current price approaching the neutral position of the channel. If it can break out with volume, it may aim for 2,885, with support below at 2,630.

📈 SOL: Unlocking Approaches, Short-term May Rise Then Fall

SOL will face a large unlock in early March, and the market may first push prices up before a correction. From a technical perspective, the 8-hour MACD has formed a bullish divergence, and if it can hold above the 171 support, the target above is 180~185. If it breaks out with volume, it may aim for 205. However, the selling pressure after the unlock should not be ignored, with 160 as the key support; if it falls below this, caution is advised.

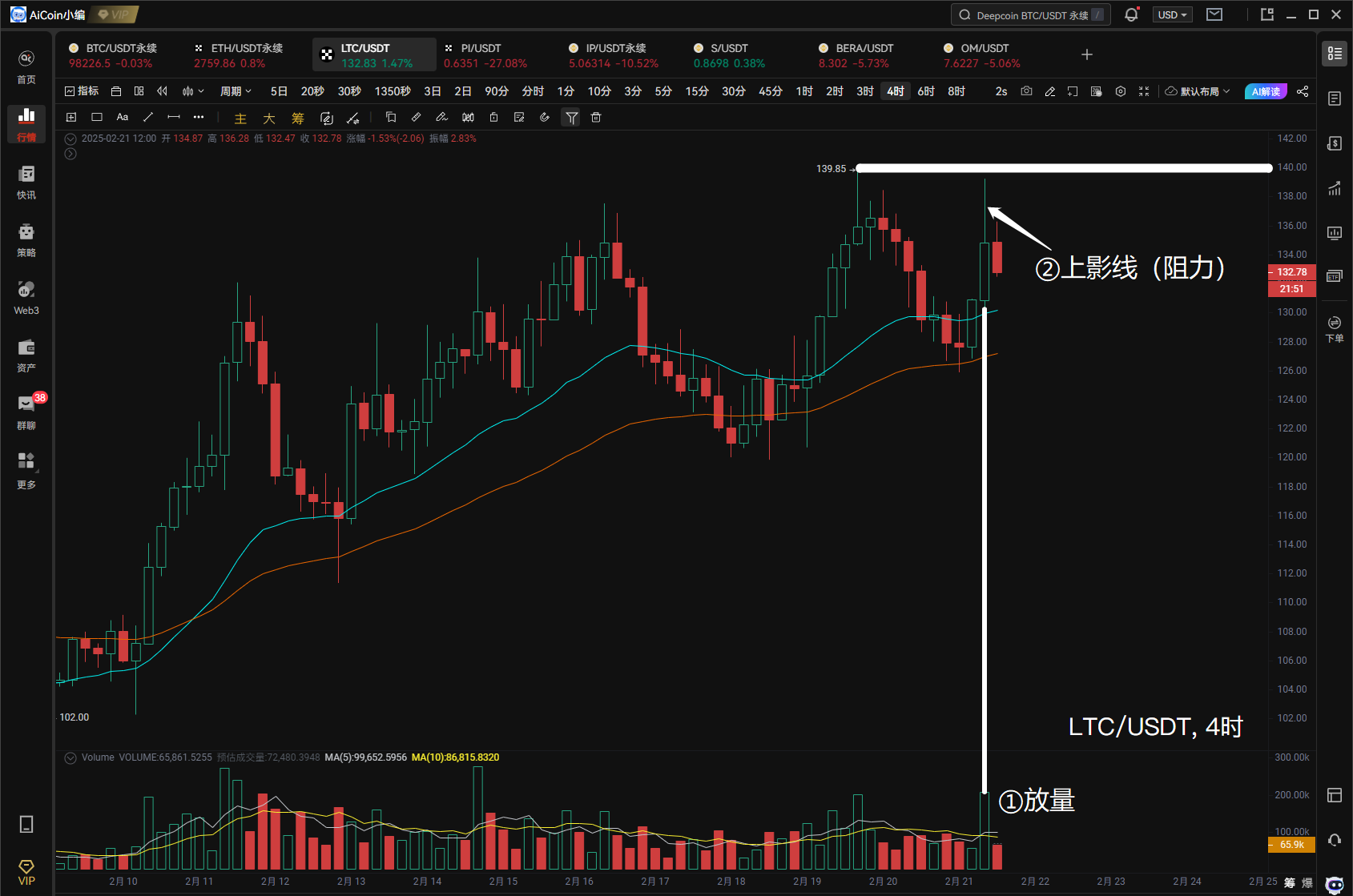

⚠️ LTC: Weakness in Uptrend, 140 is the Key Resistance Level

LTC has recently shown significant weakness in its uptrend. Although there was volume in the morning, it failed to break through the 140 resistance, and a long upper shadow candlestick formed on the 4-hour chart, increasing the risk of chasing highs in the short term. Additionally, the MACD has shown divergence on the 6-hour and 8-hour cycles, indicating weakening upward momentum. If it cannot break through 140, it may pull back to the 120 support, but if it breaks out with volume, it may test 147.

⚡ PI: Peak Upon Launch, Caution Advised for Liquidity Risk

PI has opened for trading on OKX, but is limited by three major hurdles: KYC, mainnet transfer (moving the token to the mainnet), and exchange trading, leading to significant liquidity issues. The price surged rapidly after listing but has since fallen nearly 70% from the high of 2.2 USD. The short-term trend is still under pressure from the EMA52 moving average, and caution is needed before participating effectively.

🩸 IP: The Nature of a Meme Coin, Short-term Volatility After Liquidating Shorts

IP staged a "harvester" market last night, with significant liquidations of short positions. Currently, the 30-minute EMA24 has formed short-term support, and attention can be paid to 5.8 USD, where there is a 360,000 USD order accumulated, potentially forming short-term resistance. If it adjusts downwards, support is at 4.27 USD.

🔥 S: Continues to Set New Highs, But Short-term May Face a Correction

S has been continuously setting new highs recently and remains strong in the short term. However, a double top pattern has appeared on the 45-minute chart, with MACD volume divergence, indicating a high probability of a pullback to 0.87 (EMA24 support). If this support holds, the short-term target looks towards 1.008, but if it falls below the EMA24, attention should be paid to the 0.8 level.

💎 BERA: Testing EMA24 Support, Short-term Target 10 USD

BERA has continued to rise after breaking through the 6.3 resistance, and is currently testing the EMA24 support on the 45-minute chart, showing signs of stabilization. If it can hold steady in the short term, it may continue to push towards 10 USD, with support below at 7.5, allowing for consideration of chasing highs based on personal risk management.

🚀 OM: Clear Control by Main Players, New Breakthrough Brewing Amidst Fluctuations?

OM has shown extremely strong performance recently, with sudden surges following periods of stagnation, indicating deep involvement from main funds. However, there are signs of fatigue in the short term, and the 3-hour chart may form a MACD divergence, so attention should be paid to the 7.56~7.29 support zone. If it pulls back without breaking this level, and the MACD fast and slow lines remain above the zero axis, a new round of upward movement may occur, targeting 9 USD. However, this coin has a high degree of control, posing significant shorting risks, so caution is advised.

Custom 45-minute cycle: https://www.aicoin.com/vip

Common candlestick reversal patterns (Advanced Version): https://www.aicoin.com/link/script-share/details?shareHash=dZJBaGV8bk2OQ3N8

The above content represents the author's personal views and is for reference only, not constituting any investment advice. Traders act at their own risk!

If you have any questions, you can join the 【PRO CLUB】 group to contact the editor~

Please recognize AiCoin's official website: www.aicoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。