Investors unknowingly fall into the "Celebrity + Meteora + Big Truck" capital harvesting trap.

Written by: @m7_research

Recently, with Trump issuing $TRUMP on the Solana chain, a wave of celebrity token launches has emerged. Tokens like $MELANIA, $RYAN, $ENRON, and $LIBRA have appeared one after another, and the Meteora platform has quickly become the preferred issuance platform for such high-profile projects. These token projects exhibit astonishing similarities: extremely high FDV, exaggerated trading volumes, and drastic price fluctuations. On the surface, these tokens gain market popularity due to celebrity effects, but in-depth analysis reveals that there is actually a carefully designed wealth harvesting mechanism behind them.

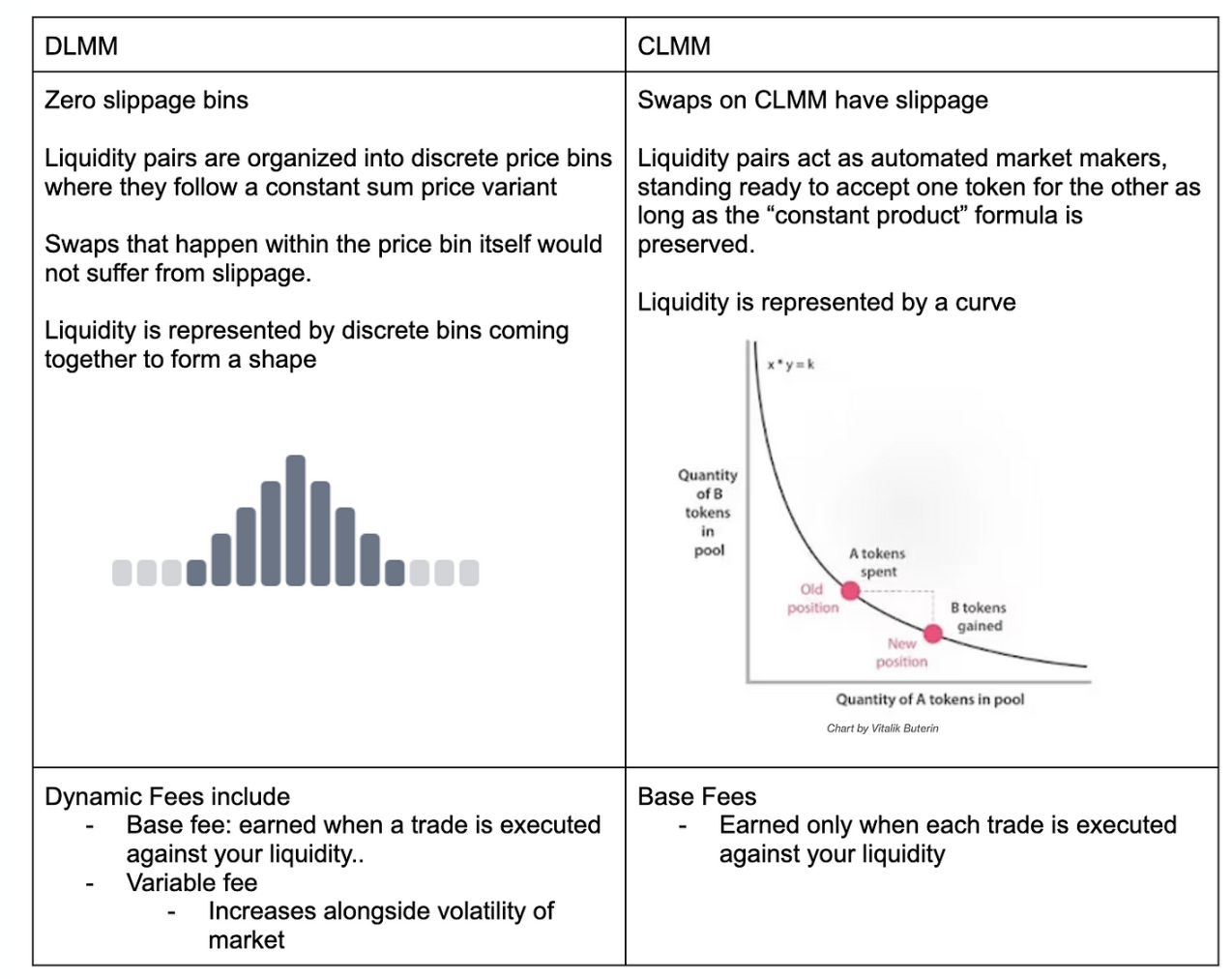

Meteora Platform: Innovative Mechanism Becomes a Manipulation Tool

The Meteora platform is favored for its DLMM model, which features lower trading slippage and flexible liquidity management mechanisms. However, these innovative characteristics, originally intended to improve capital efficiency, have been misused, becoming profit tools for project parties and insider traders.

Systematic Manipulation Operation Model

In a typical celebrity token issuance, project parties usually take the following steps:

- Create tokens in advance

- Establish a DLMM trading pool on Meteora

- Inject trading liquidity

Observations show that project parties often create the DLMM pool for the token and USDC trading pair in advance, injecting only one-sided liquidity. This means that at the opening, a large number of limit sell orders have been preset waiting for liquidity to flow in, while the zero slippage feature of the DLMM trading bin further amplifies the profit space for the project parties.

Insider Trading Analysis: Precise Timing and Systematic Operations

In cases like $MELANIA, $ENRON, and $LIBRA, insider traders had prior knowledge of the contract address (CA), trading pool information, and opening time. Specifically:

- $LIBRA created the token on the 14th and established the trading pool only 20 minutes before opening on the 15th https://solscan.io/tx/3vtogCe5Q52iUYbY6CLRTV3RUf2ggSDoAkPtCYpJrvpvdoqx71mJbS5zgwvze7CDHTBzNohbg4eJiFPw5kUnu5Dh

- $ENRON created the token on January 25 and only set up the Meteora pool one hour before trading on February 4 https://solscan.io/tx/ydzeZfhtfM4vwU2dH7ALB3acavcNBh5oTSuPgCCBPonoQvm4AbCo5P2Rw4WqyWUvRJj4D3mUN68JzTK1uwqF8Ej

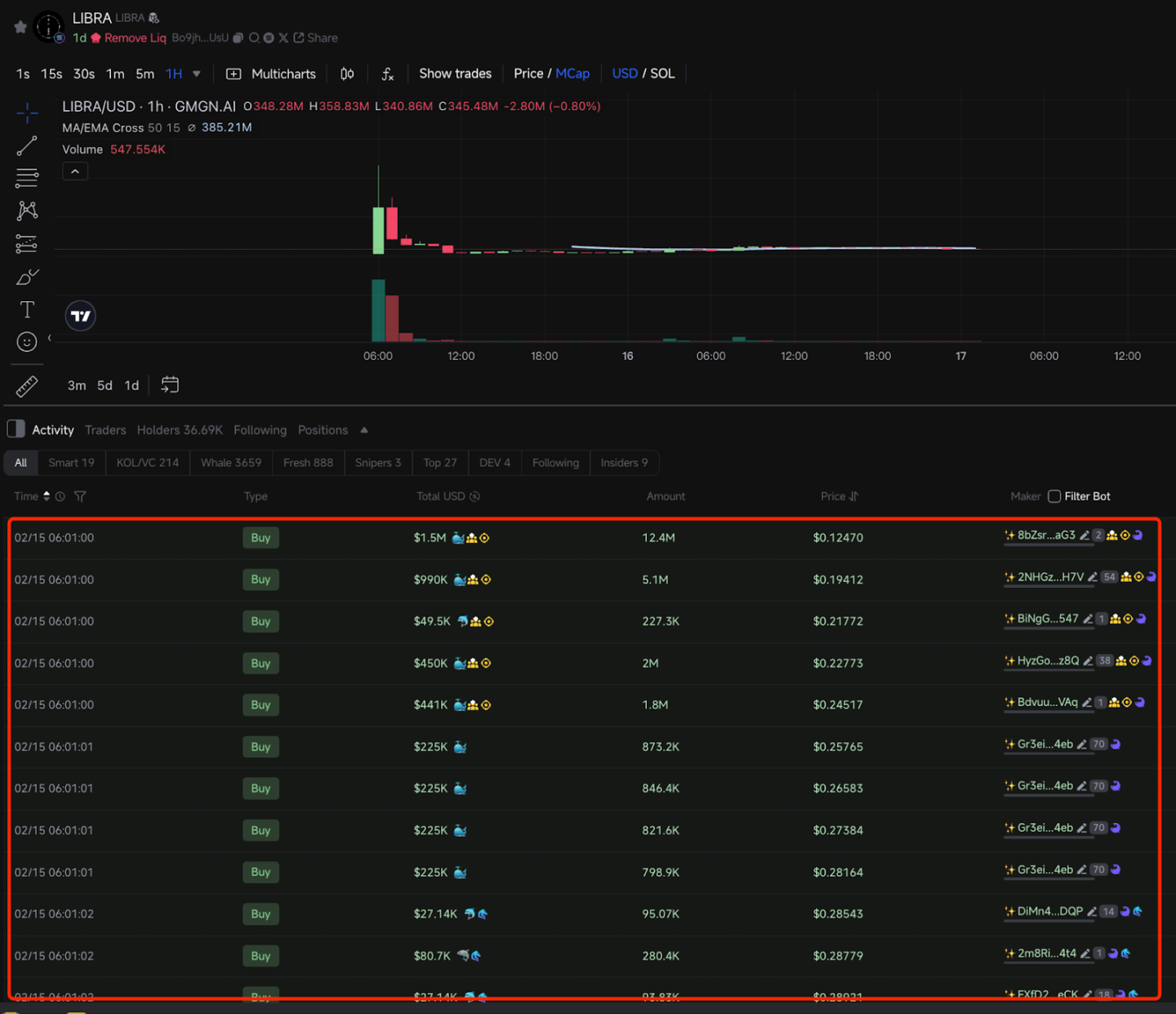

According to GMGN data, nearly $4.5 million flowed into $LIBRA within just 2 seconds after opening.

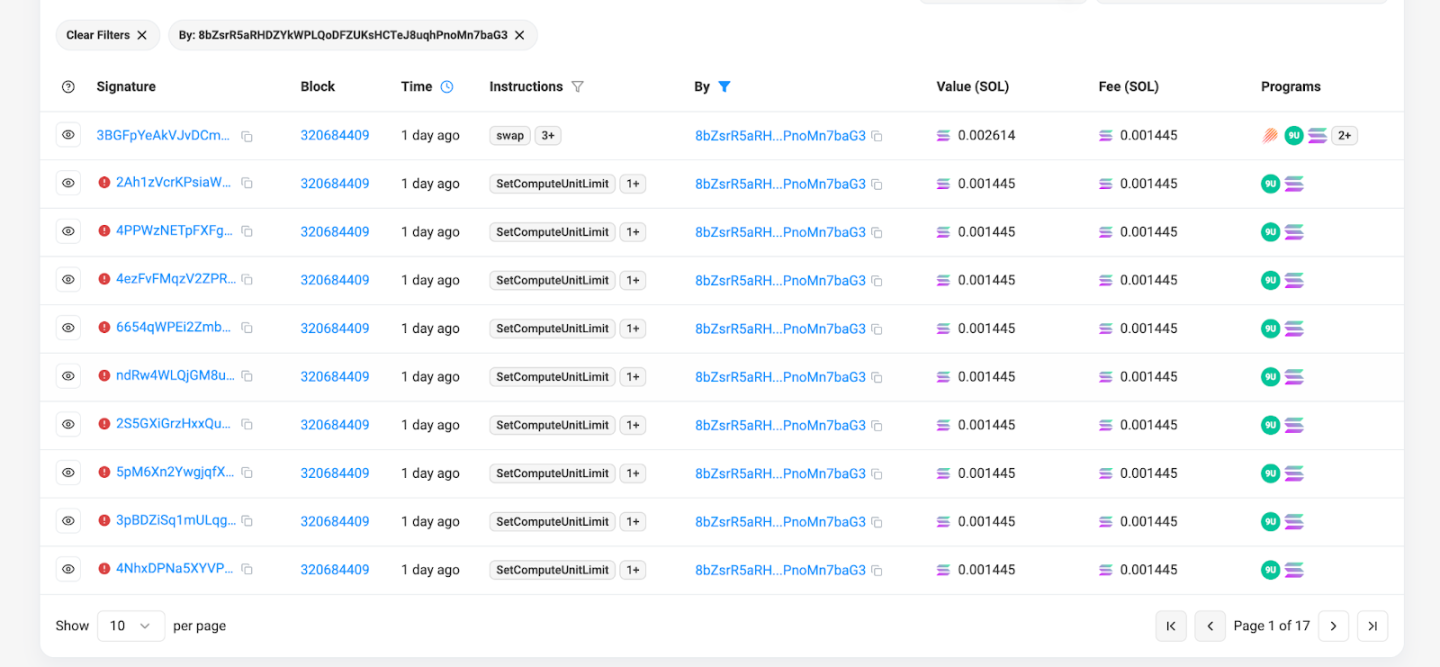

A trader (address: 8bZsrR5aRHDZYkWPLQoDFZUKsHCTeJ8uqhPnoMn7baG3) seized the first position with a single $1.4 million sniper trade, initiating 170 transactions in the opening block, successfully executing only at the moment trading began. Considering that there are pools opening daily on Meteora that only add one-sided liquidity, such a large and precise investment clearly stems from insider information.

Profit Model Explained

This sniper trader adopted a systematic profit strategy:

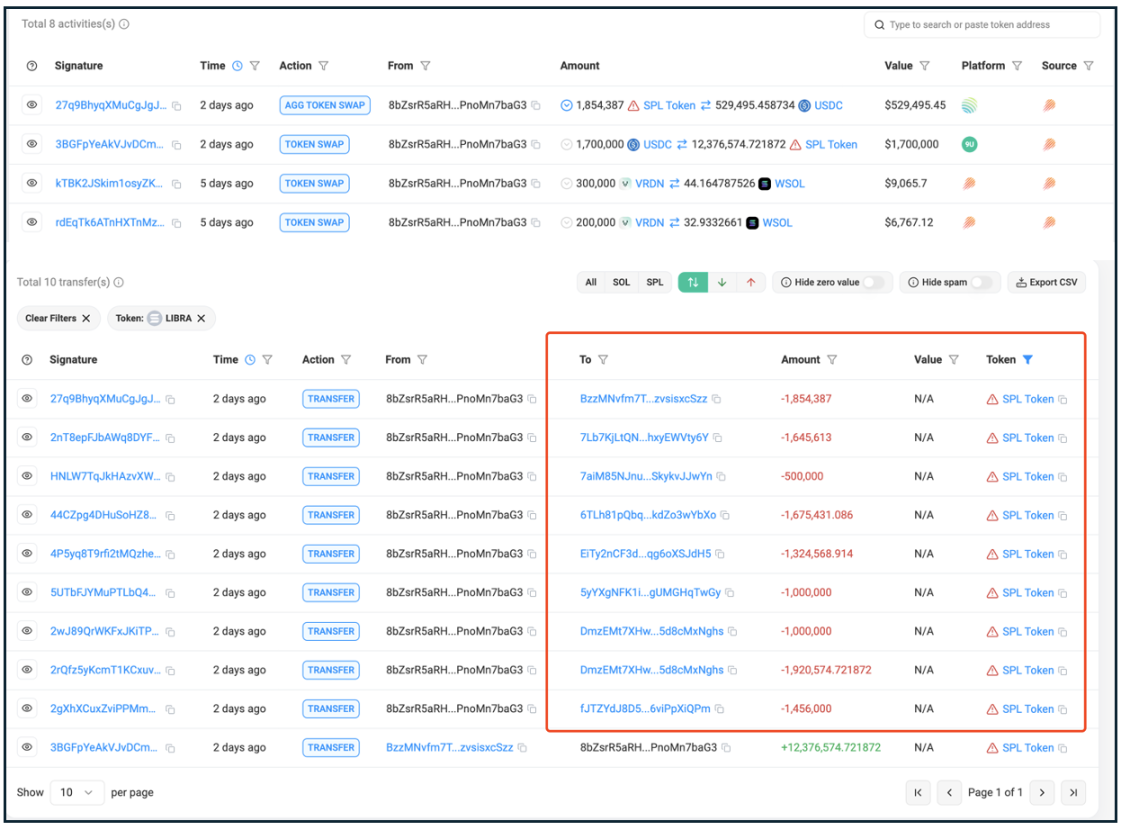

- Quickly exchanged 1.8 million tokens for $530,000

- Distributed the remaining tokens across 8 sub-accounts

Taking the largest sub-account (DmzEMt7XHwA1tZM5d1XBGvTFWoUpTLutpR5d8cMxNghs) as an example: sold 750,000 tokens every 20 seconds, operating continuously for 14 times.

The remaining tokens were added as one-sided liquidity to the $LIBRA-$SOL trading pair, and just 7 minutes later, 5,500 SOL were harvested.

Within 5 hours after opening, all LIBRA and the obtained SOL were converted to USDC, yielding a profit of $5 million.

Ultimately, this sniper account profited a total of $17 million through this bulk dumping method.

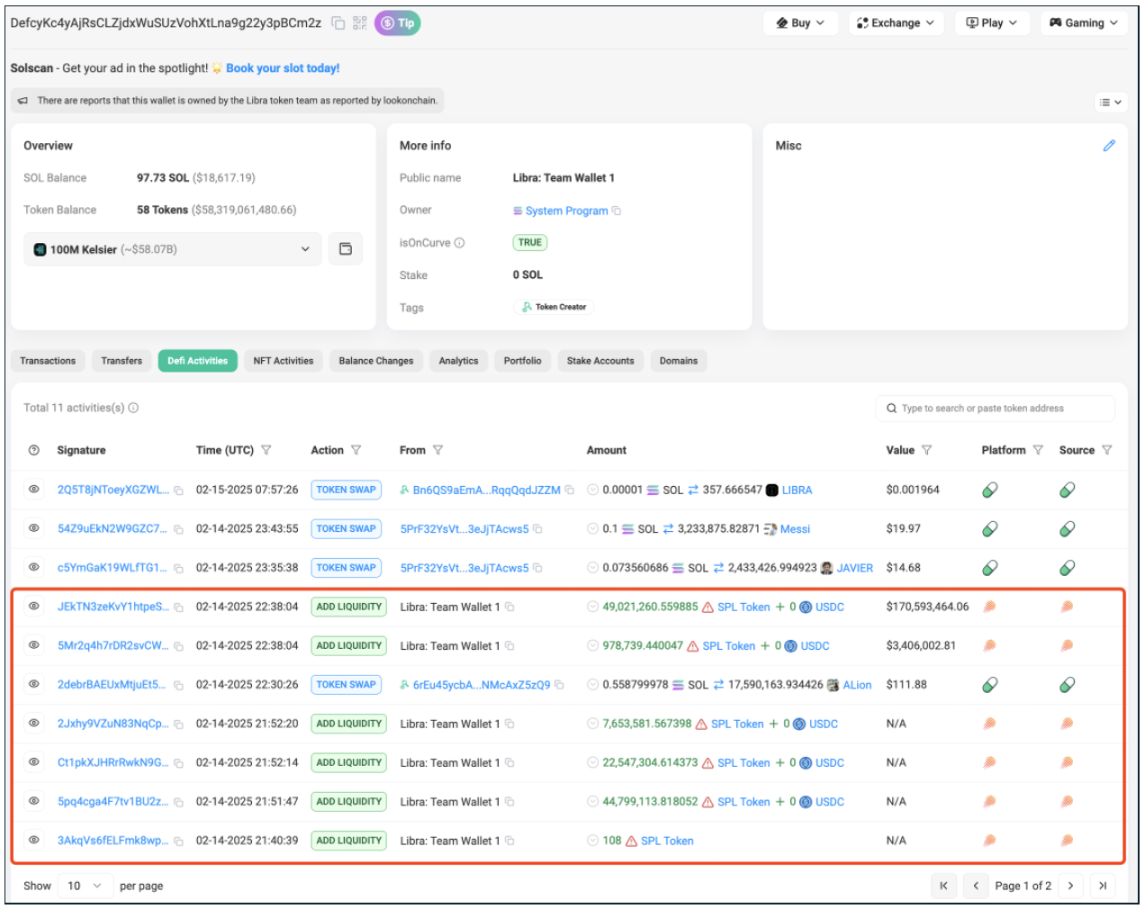

At the same time, the profits for the project parties were even more substantial. The developer's address (DefcyKc4yAjRsCLZjdxWuSUzVohXtLna9g22y3pBCm2z) also utilized the one-sided liquidity mechanism to add tokens to the Meteora pool, with fee income reaching $10 million.

Market Impact and Warning

Although the $LIBRA case has attracted attention due to its high profile, similar operational patterns can be seen from $ENRON, $MELANIA to $RYAN. Investors unknowingly fall into the "Celebrity + Meteora + Big Truck" capital harvesting trap. The high liquidity mechanism of the Meteora platform has been abused by project parties and insider traders, severely overdrawn the liquidity of the cryptocurrency market and investor confidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。