Author: Pzai, Foresight News

In the cryptocurrency market over the past few months, emerging projects have been springing up one after another. It seems that after the MEME wave, the market has shifted back towards ecological projects, which in turn has warmed up altcoins. In terms of market performance, new projects such as KAITO, IP (Story Protocol), and Berachain have all received widespread attention, with varying degrees of price increases. Can the revival of these "VC coins" break the market's dilemma of being in a transitional phase? This article will analyze from the dimensions of community-driven initiatives and market trends.

KAITO

KAITO is an InfoFi attention distribution layer based on cryptocurrency, where Yaps utilizes AI algorithms on Twitter to extract attention signals and quantify them. This advanced model has also set a new standard for cryptocurrency projects. Before KAITO issued its tokens, several projects (such as Berachain, ANIME, and Story Protocol) had already provided corresponding airdrops to KAITO Yappers, reflecting its strong influence.

On February 20, KAITO AI officially opened token claims. As of the time of writing, 28.75% of the 100 million KAITO tokens have been claimed. During this airdrop frenzy, KOLs (Key Opinion Leaders) benefited the most. According to Lookonchain monitoring, well-known crypto KOL Ansem received an airdrop of 215,113 KAITO tokens and sold them for 76 ETH (approximately $206,000). KAITO has a total supply of 1 billion tokens, with 25% allocated to core contributors; 32.2% allocated to ecosystem and network growth; 10% allocated to initial community and ecosystem claims; 7.5% allocated to long-term creator incentives; 5% allocated to liquidity incentives; 8.3% allocated to early supporters; and 10% allocated to the foundation, with an overall circulation of 241 million tokens at launch.

KAITO's popularity also quickly earned it the favor of Binance, leading to its listing on the Binance HODLer airdrop (accounting for 2% of the total). As of the time of writing, KAITO tokens are priced at $1.60, with a market cap of $386 million, nearly doubling from its low.

Story Protocol

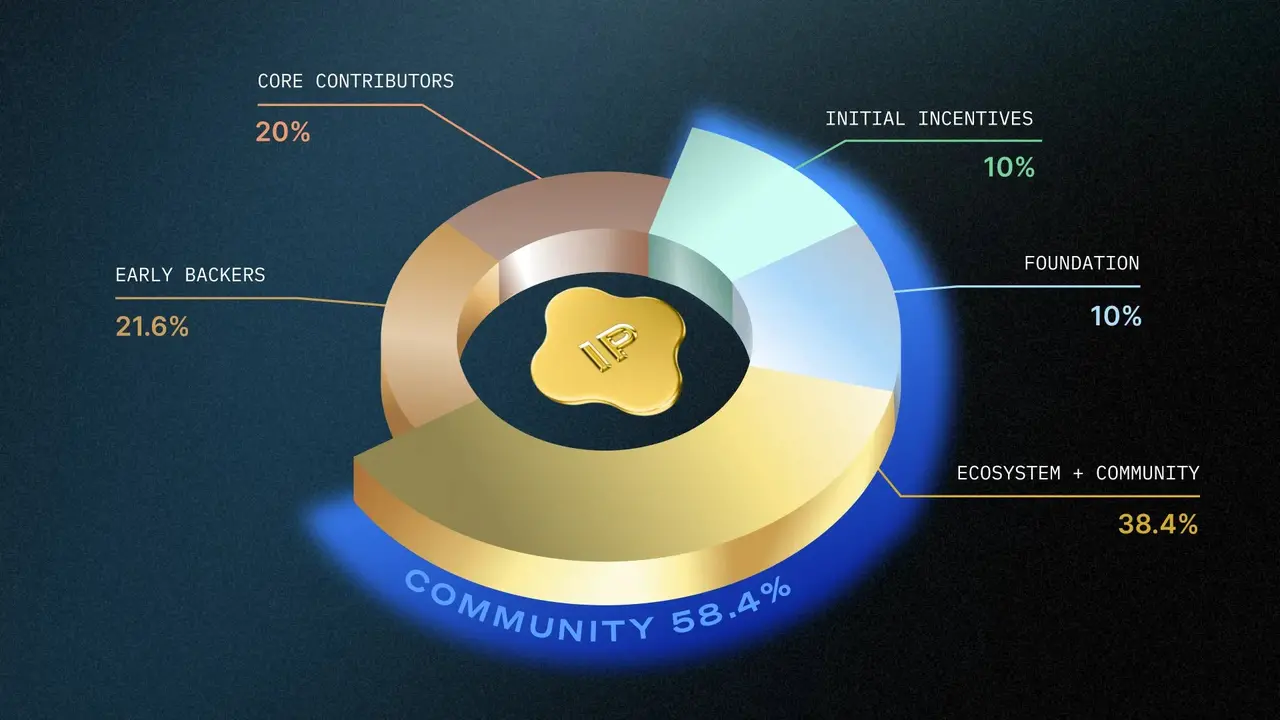

Story Protocol is a blockchain for intellectual property that allows creators to create, manage, and license on-chain IP, providing a simplified framework to manage the entire lifecycle of IP development, supporting features such as source tracking, frictionless licensing, and revenue sharing. In its recent technical roadmap, Story indicated that it is collaborating with Stanford FDCI to explore cutting-edge technologies such as performance optimization and on-chain storage, promoting the blockchainization of intellectual property. In terms of token economics, 38.4% is allocated to the ecosystem and community, with an initial incentive of 10%. In terms of circulation, the community has received a relatively broad allocation.

Compared to many tokens with strong VC backgrounds in this cycle, which have received significant support from a16z in previous funding rounds, despite being affected by a market downturn prior to the token TGE, its narrative as the "on-chain Disney" seems to have sparked considerable market enthusiasm recently. After its launch on February 13, the IP token dropped to around $1.4 at its lowest, then rose steadily. As of the time of writing, IP is priced at $5.20, having reached a high of $9, with a market cap of $1.3 billion, reflecting a threefold increase from its low.

Berachain

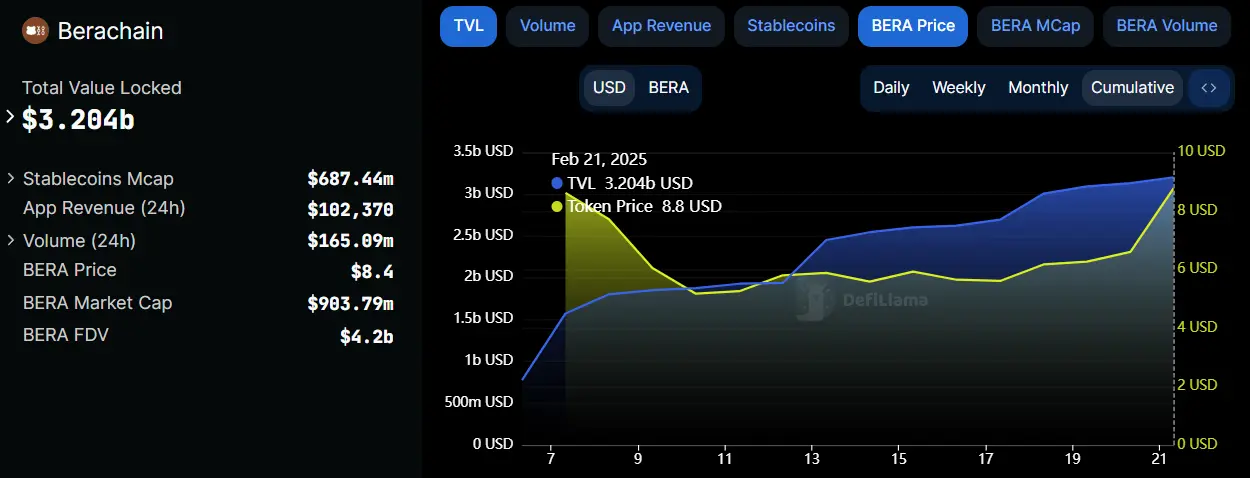

Berachain is a high-performance EVM-compatible chain built on a proof of liquidity consensus (PoL). Its unique consensus mechanism provides users with a closed-loop flywheel for DeFi yields and governance, directly rewarding users who contribute to trading liquidity. This mechanism not only optimizes the DeFi user experience but also allows ordinary users to earn yields by providing liquidity while participating in Berachain's governance. In terms of data, Berachain's TVL has shown a steady upward trend, accumulating $3.2 billion in TVL as of the time of writing.

In terms of token economics, 16.8% is allocated to initial core contributors; 34.3% is allocated to investors; 28.9% is allocated for current and future community incentives; and 20% is allocated to ecosystem and R&D. In terms of price performance, although the BERA token dropped to around $4.7 due to previous market trends, the steady increase in TVL since February 13 has stabilized the price of the BERA token and accelerated capital inflow as the market warms up. As of the time of writing, BERA has reached a high of $9.62, with a market cap of $900 million, nearly doubling from its low.

Conclusion

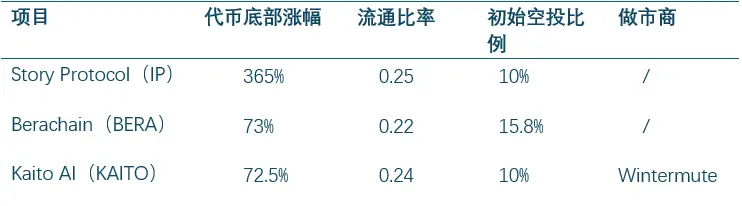

From the analysis above, it can be seen that the circulation ratios of various tokens are relatively small (less than 25%), and most of the initial airdrop portions will be released, leading to significant selling pressure in the early stages. However, as the token economy is implemented (such as the launch of staking features and TVL driving the token economic flywheel), the true value of the tokens will be reflected through market sentiment. The presence of market makers may also influence token trends; for example, Wintermute serves as a market maker for KAITO, creating certain expectations in the market.

In recent months, in a market dominated by MEME, traders have shown little interest in similar VC-backed projects, leading to price declines after listing on exchanges, which in turn undermines user confidence and creates a vicious cycle. However, recent projects seem to be breaking this cycle and striving to find a more sustainable development path. These project teams are beginning to consciously emphasize the core concepts of community governance and decentralization; they are focusing more on incentive compatibility in token design to ensure long-term consistency of interests among all parties; and finally, project parties are placing greater emphasis on deep interaction with the community to establish genuine trust with users. We also hope to see more projects take further steps.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。