Hotspot conversion, will opportunities come in with hot money?

As the market is in a chaotic period of disorderly fluctuations, Sonic, formerly known as Fantom, has re-entered the market spotlight through its old business of DeFi. The main token $S surged this week, and the overall TVL of the ecosystem doubled within a week, with various DeFi tokens in the ecosystem experiencing astonishing increases. The leading project $Shadow saw a maximum increase of over 500% in a week, and similar gains occurred in almost every quality project within the Sonic ecosystem over the past week.

The revival of the Sonic ecosystem is undoubtedly due to the quality of its own DeFi ecosystem bringing in many external increments, a significant portion of the heat can also be attributed to Sonic's spiritual pillar—founder AC (Andre Cronje)—who has been actively promoting projects, surfing intensely for 24 hours, and responding to almost every project within its ecosystem, whether DeFi or Meme, with fervent retweets.

As the sentiment in Solana and BSC wanes and on-chain liquidity has yet to find a new outlet, we have compiled some noteworthy projects in the Sonic ecosystem to see how the Fantom OGs can participate in the Sonic ecosystem that has been building up for three years.

DeFi

- $SHADOW (@ShadowOnSonic)

Contract Address: 0x3333b97138D4b086720b5aE8A7844b1345a33333

Current Market Cap: $38 million

Highest Market Cap: $45 million

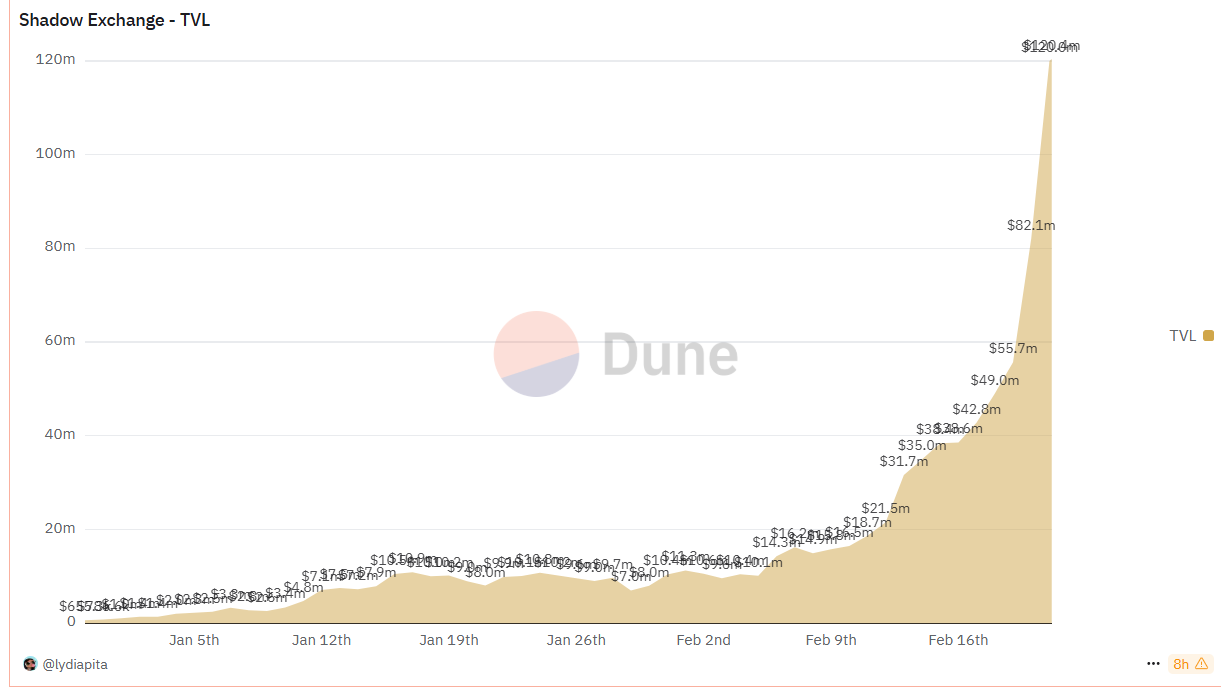

Recently, the DeFi heat of Sonic is closely related to the token $SHADOW. Shadow is a DEX in the Sonic ecosystem based on the x(3,3) model, with an innovative highlight of transforming the traditional locking mechanism for earning yields ve(3,3) into a mutual aid model of x(3,3) "early withdrawal penalties, shared profits."

Users can deposit $SHADOW to receive staking certificates $xSHADOW to earn income from various protocols. They can also exit staking at any time, but a certain percentage of tokens (varying based on holding time) will be deducted as an early withdrawal penalty, and the deducted tokens are distributed to users who maintain their staking.

This innovation brings high staking yields to $xSHADOW holders and also causes Shadow's TVL to rise sharply:

- Beets.fi (@beets_fi)

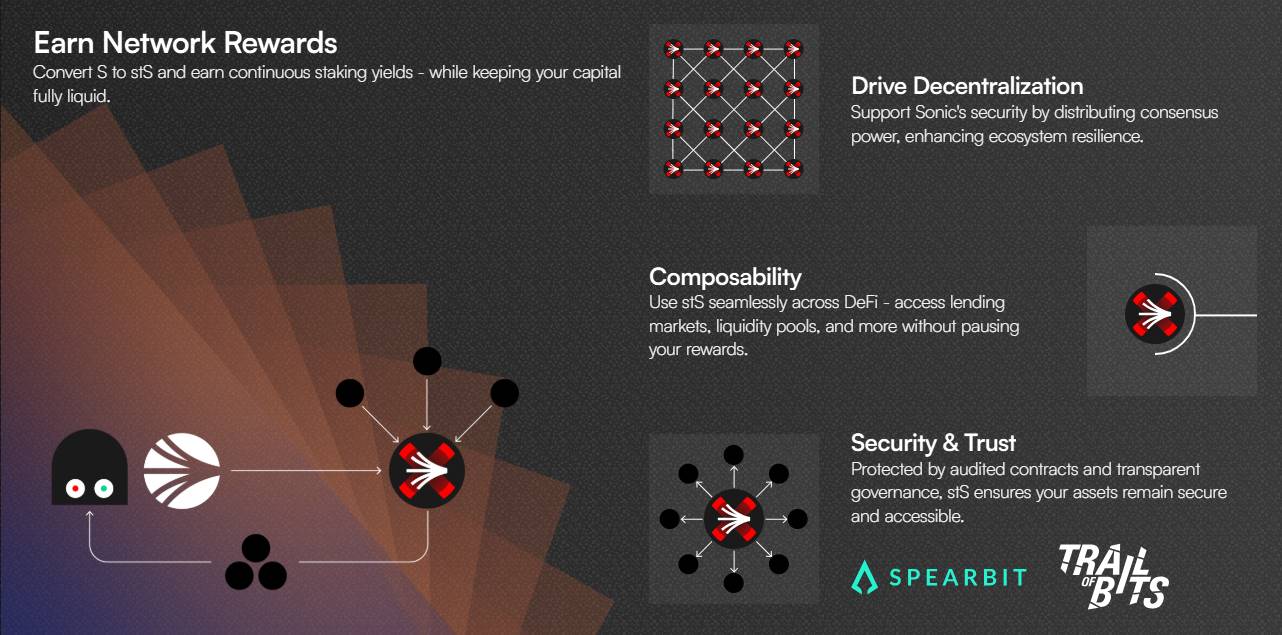

Beets.fi (shortened to Beets) is the LST hub in the Sonic ecosystem, developed and upgraded by the Beethoven X team. As Fantom transitioned to Sonic, Beets transformed from a DEX to a core staking and liquidity infrastructure project for Sonic, becoming a pillar project in the Sonic ecosystem, suitable for users seeking stable returns and long-term participation.

Users can stake $S to receive liquid staking certificates $stS, retaining network staking rewards while maintaining asset liquidity. Its designed automatic compounding mechanism allows for continuous accumulation of returns. The platform builds a diverse liquidity pool matrix through $stS, such as the $wOS/$stS pool in collaboration with Origin Protocol, allowing users to capture multiple yields while maintaining exposure to $S.

- $EGGS (@eggsonsonic)

Contract Address: 0xf26Ff70573ddc8a90Bd7865AF8d7d70B8Ff019bC

Current Market Cap: $12.7 million

Highest Market Cap: $13.7 million

Eggs Finance (shortened to Eggs) is a leveraged yield protocol on the Sonic ecosystem, combining leveraged yield tools with Sonic's native token $S to create an internal capital circulation system. The goal is to "allow $S holders to amplify their yields while retaining their positions."

The operational mechanism of Eggs Finance can be summarized as "minting, leveraging, yield cycling":

Users can stake $S in Eggs Finance to mint derivative tokens $EGGS, which are pegged to $S but have leveraged properties. The minting cost increases with participation time, with early users facing lower costs, while later users' $S payments partially flow back to early participants, forming a "Ponzi-like" yield cycle. Subsequently, users can use $EGGS as collateral to borrow more $S and invest in other pools (such as ShadowOnSonic or Beets) to earn high yields. It was mentioned on X that the short-term annualized yield of the $EGGS/$S pool once reached as high as 1800%.

Currently, Eggs Finance has been included in DeFi Llama, with trading primarily conducted on Sonic's DEX.

MEME Projects

On February 7, Sonic officially held the Meme Mania competition, selecting 8 Memecoin projects from the Sonic ecosystem as winners from February 7 to March 8, 2025. The top 125 holders of the 8 winning Memecoins will share a total prize pool of 1 million $OS tokens (the liquid staking certificate of the Sonic ecosystem).

Meme Mania event page** has listed the current top 8 Memecoins:**

- $GOGLZ (@GOGLZ_SONIC)

Contract Address: 0x9FDBC3F8ABC05FA8F3AD3C17D2F806C1230C4564 24H Trading Volume: $8 million

Current Market Cap: $15 million

Highest Market Cap: $20.7 million

- $THC (@TinHat_Cat)

Contract Address: 0x17Af1Df44444AB9091622e4Aa66dB5BB34E51aD5 24H Trading Volume: $1 million

Current Market Cap: $7.5 million

Highest Market Cap: $9.5 million

- $fSONIC (@fantomsonicinu)

Contract Address: 0x05e31a691405d06708A355C029599c12d5da8b28 24H Trading Volume: $664,000

Current Market Cap: $1.61 million

Highest Market Cap: $1.97 million

- $Indi (@indi_sonic)

Contract Address: 0x4EEC869d847A6d13b0F6D1733C5DEC0d1E741B4f 24H Trading Volume: $378,000

Current Market Cap: $4.53 million

- $HEDGY (@hedgycoin)

Contract Address: 0x6fB9897896Fe5D05025Eb43306675727887D0B7c 24H Trading Volume: $500,000

Current Market Cap: $2.9 million

Highest Market Cap: $3.6 million

- $TYSG (@tysonicgodd)

Contract Address: 0x56192E94434c4fd3278b4Fa53039293fB00DE3DB 24H Trading Volume: $210,000

Current Market Cap: $977,000

Highest Market Cap: $4 million

- $FROQ (@FROQ_SONIC)

Contract Address: 0x131F5AE1CBfEFe8EFbDf93dA23fa4d39F14a817c 24H Trading Volume: $450,000

Current Market Cap: $1.42 million

Highest Market Cap: $2.2 million

- $SDOG (@sDOG_SONIC)

Contract Address: 0x50Bc6e1DfF8039A4b967c1BF507ba5eA13fa18B6 24H Trading Volume: $243,000

Current Market Cap: $857,000

Highest Market Cap: $1.4 million

Note: The prices of Meme tokens are highly volatile and carry significant risks. Investors should fully assess the risks and participate cautiously. This article is merely a sharing of information based on market trends, and the author and platform do not guarantee the completeness or accuracy of the content. Additionally, this article does not constitute any investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。