Original Title: "Coinbase + Robinhood: Financial Performance Overview"

Author: insights4vc, substack

Translation by: Shan Ouba, Golden Finance

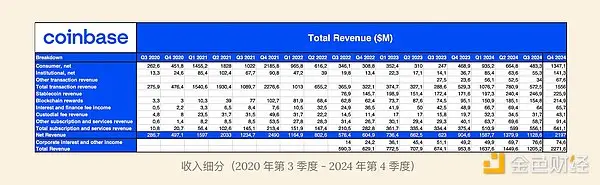

Coinbase reported strong financial performance for 2024, with annual revenue reaching $6.6 billion (up 111% year-on-year) and net income of $2.6 billion. The company also reported an adjusted EBITDA of $3.3 billion, demonstrating robust profitability despite the volatility in the cryptocurrency market.

Fourth-quarter revenue reached $2.3 billion, an 88% increase quarter-on-quarter, primarily driven by increased trading volume and strong participation in subscription and service revenue.

The financial performance was mainly attributed to the following factors:

- Trading revenue increased by 172% quarter-on-quarter, reaching $1.6 billion in the fourth quarter.

- Subscription and service revenue grew by 15% quarter-on-quarter, reaching $641 million.

- By the end of 2024, cryptocurrency asset prices are expected to rise, particularly Bitcoin and Ethereum.

- Strategic expansion in U.S. derivatives trading, institutional adoption, and regulatory clarity.

Coinbase also strengthened its balance sheet, ending the fourth quarter with $9.3 billion in dollar assets, an increase of $1.1 billion quarter-on-quarter. A significant portion of its profits came from unrealized gains on cryptocurrency investments ($687 million for the year), highlighting the market volatility Coinbase faces.

Core Team of Coinbase:

- Co-founder and CEO: Brian Armstrong

- Co-founder and Board Director: Fred Ehrsam

- President and COO: Emilie Choi

- CFO: Alesia Haas

- Chief People Officer: L.J. Brock

- Chief Legal Officer: Paul Grewal

Regulatory Environment

The regulatory environment in the U.S. is shifting, with the Trump administration prioritizing cryptocurrency leadership and moving away from restrictive "enforcement-based" policies. This opens the door for stablecoin and market structure legislation, improving the operating environment for centralized exchanges (CEXs) and reducing uncertainty for institutional compliance.

Coinbase also received significant international approvals, including VASP registration in the UK and Argentina, as well as progress in obtaining a MiCA license in the EU, facilitating its expansion in Europe. Additionally, Coinbase won an interim appeal in its lawsuit with the SEC, a key step in shaping U.S. cryptocurrency regulation.

Growth Strategy

Coinbase aims to increase trading volume and expand market share, particularly in the following areas:

- Institutional trading, with a year-on-year growth of 139% in 2024.

- Derivatives market, with Coinbase adding 92 new assets on its international exchange.

- Subscription-based services, such as Coinbase One, with over 600,000 users in the fourth quarter.

- Adoption of stablecoins, with USDC remaining a focus, facilitating over $12 billion in on-chain USDC payments in 2024.

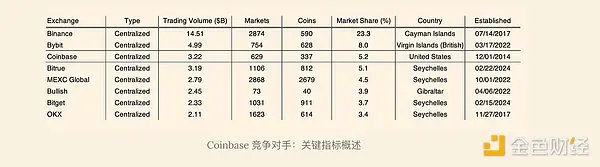

Market dependence and competition: As one of the top three cryptocurrency exchanges, Coinbase's revenue is highly dependent on market sentiment, while increasing competition from DEXs forces CEXs to innovate.

Regulatory uncertainty: Despite progress in U.S. regulation, Coinbase still faces global risks, particularly in Asia and Europe, where policies remain unpredictable.

Institutional Adoption and Cryptocurrency ETFs

Coinbase is successfully building an institutional flywheel, benefiting from:

- ETFs driving record inflows, pushing Coinbase's assets under custody (AUC) to $93.2 billion.

- 7% of RIAs currently investing in cryptocurrency ETFs, a 41% increase since Q1 2024.

- Growing derivatives trading volume, particularly in perpetual contracts and structured products.

This momentum indicates stronger demand for institutional-grade crypto products, which may further drive the adoption of derivatives and major brokerage services.

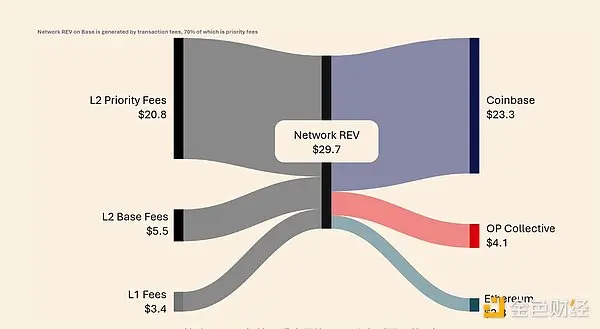

The Role of Base and On-Chain Expansion

Coinbase's Layer 2 scaling solution, Base, continues to achieve outstanding success:

- Base assets surged 89% in the fourth quarter, reaching $14 billion.

- Stablecoin trading volume surpassed $25 billion.

- An increasing number of developers are building on Base, reinforcing its role as a foundational layer for on-chain finance.

Coinbase's BTC-backed loan program is another significant innovation, allowing users to borrow USDC against their BTC holdings without selling their assets. This could create a new type of DeFi-native lending model directly integrated with the Coinbase ecosystem.

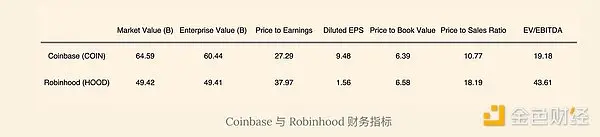

Coinbase (COIN) vs. Robinhood (HOOD)

Coinbase has solidified its position as a leading regulated exchange by continuously investing in infrastructure, compliance, and global expansion, thereby navigating the cryptocurrency bear market and regulatory challenges. Robinhood has balanced its role as a brokerage by taking a more cautious approach—focusing on cost-effectiveness, achieving profitability, and delisting certain assets like Solana and Polygon to address regulatory issues.

Despite these differing strategies, Robinhood has strengthened its position in cryptocurrency trading. As the 2024 U.S. presidential election reignites retail trading interest, Robinhood is well-positioned. In the fourth quarter of 2024 alone, its customers traded $71 billion in cryptocurrencies, nearly equivalent to the total trading volume of the first three quarters. Unlike Coinbase, Robinhood leverages its established brokerage customer base to integrate cryptocurrency into its broader trading ecosystem.

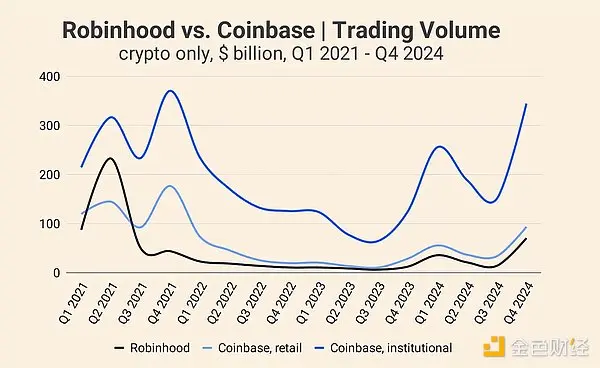

Trading Volume

In 2024, Robinhood's cryptocurrency trading volume soared to $143 billion (up 259% year-on-year), while Coinbase's retail trading volume was $221 billion (up 195% year-on-year). Historically, Robinhood's trading volume has occasionally surpassed Coinbase's, such as in Q2 2021, when a surge in DOGE trading drove its activity. At that time, Robinhood supported only seven cryptocurrencies, but DOGE trading accounted for 62% of its cryptocurrency revenue. A key distinction for Robinhood is its ability to cross-sell cryptocurrency trading to its brokerage customers, nearly half of whom (12 million out of 25 million) participated in the cryptocurrency market.

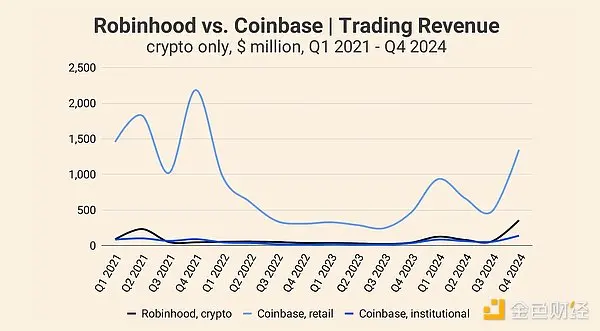

Revenue Comparison

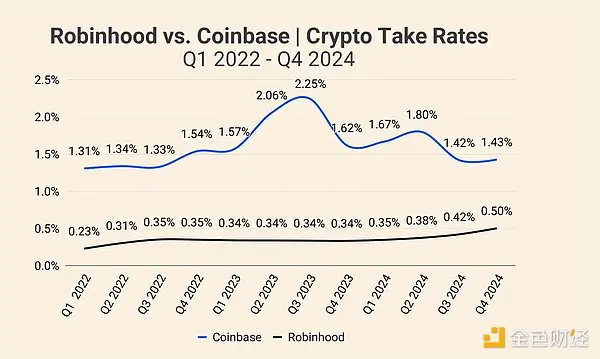

While Robinhood's cryptocurrency trading volume has increased, its cryptocurrency-related revenue reached $626 million in 2024 (up 363% year-on-year), significantly lower than Coinbase's $3.43 billion (up 157% year-on-year).

This difference is primarily due to lower fee rates—Robinhood's fee rate in Q4 2024 was 0.50%, up from 0.23% in Q1 2022, while Coinbase's fee structure is higher. Robinhood has room to adjust its pricing model without compromising its competitive advantage in affordability.

Bitstamp Acquisition

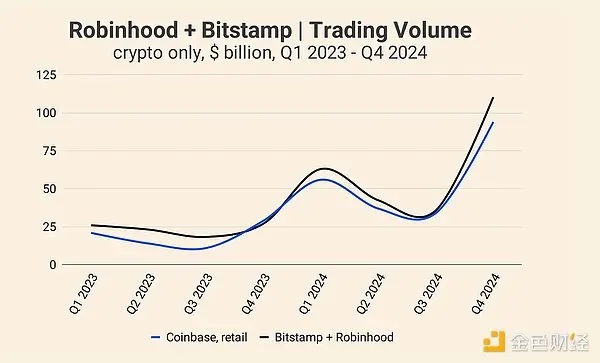

Robinhood plans to acquire Bitstamp, expected to be completed in the first half of 2025, representing Robinhood's strategic expansion into international and institutional markets. The combined trading volume of both in 2024 ($252 billion) is very close to Coinbase's retail trading volume. Bitstamp's presence in institutional trading provides Robinhood with a new growth avenue, complementing its existing retail-focused approach. However, Coinbase remains the dominant platform for institutions, with institutional trading volume of $941 billion in 2024 (up 140% year-on-year).

Robinhood's acquisition indicates that the company is striving to transition from a U.S.-centric retail broker to a more diversified global cryptocurrency exchange. The success of this expansion will depend on regulatory conditions and Robinhood's ability to effectively integrate Bitstamp's operations.

Institutional trading remains a stronghold for Coinbase, with institutional revenue reaching $346 million in 2024, despite its operating commission rates being lower than retail. Institutions prioritize liquidity, regulatory compliance, and market depth, areas where Coinbase excels. While Bitstamp enhances Robinhood's institutional positioning, it will take time for Robinhood to gain meaningful market share in this sector.

Blockchain Strategy: Base vs. Robinhood's Approach

Coinbase has been investing in blockchain infrastructure through Base (its Layer 2 blockchain launched in Q3 2023). Although Base currently contributes only a small portion of revenue, Coinbase views it as a long-term driver of profitability and a pathway to deeper integration with decentralized finance (DeFi). Robinhood has yet to launch a blockchain initiative, which may limit its competitiveness in the emerging DeFi and on-chain finance sectors.

Beyond Trading: Subscriptions and Services as Growth Drivers

Coinbase has successfully diversified its revenue sources beyond trading. Its "Subscriptions and Services" segment expanded from $45 million in 2020 to $2.31 billion in 2024, including staking, stablecoin revenue (USDC), custody, and interest income. Staking alone generated $706 million in revenue in 2024. While Robinhood offers staking services in the EU, it faces regulatory restrictions in the U.S. that limit its ability to expand this revenue source. The acquisition of Bitstamp may provide additional international market opportunities in this area, but regulatory considerations remain a key factor.

Stablecoins: Robinhood's Entry into the Digital Dollar Market

Coinbase's partnership with Circle brought in $910 million in stablecoin-related revenue in 2024. In contrast, Robinhood has partnered with Galaxy Digital, Kraken, Nuvei, and Paxos to launch USDG under a global dollar network. The revenue-sharing structure for USDG is unclear, but it indicates Robinhood's ambition to establish a foothold in the stablecoin space. If successful, stablecoins could become an additional revenue source for Robinhood.

Tokenized Securities

Both companies are exploring opportunities in tokenizing real-world assets. Robinhood's background in traditional finance and brokerage gives it a potential advantage in this area, while Coinbase's expertise in crypto infrastructure allows it to enter the market in a blockchain-native way. Although Coinbase has shown limited interest in traditional brokerage, its expansion into tokenized securities may change this stance. The regulatory environment will play a crucial role in shaping the development trajectory of this market.

Coinbase: Q1 2025 Outlook

Coinbase provided guidance for Q1 2025, expecting:

- Trading revenue to reach approximately $750 million by February 11, 2025.

- Subscription and service revenue to be between $685 million and $765 million.

- Higher trading fees, estimated to account for 15% to 20% of net income.

- Technology and development, as well as general and administrative expenses, to be between $750 million and $800 million, reflecting increased market activity and wage expenditures.

- Sales and marketing expenses to be between $235 million and $375 million, influenced by performance marketing programs and the expansion of USDC rewards.

These forecasts highlight Coinbase's confidence in sustained strong market performance while also reflecting its increased spending potential to capture further growth in both institutional and retail sectors.

Coinbase's three main goals for 2025 include:

- Increasing revenue: Expanding trading market share, increasing USDC market capitalization, and boosting subscription and service revenue.

- Expanding cryptocurrency utility: Enhancing stablecoin adoption and expanding on-chain products like Base, SmartWallet, and the Coinbase developer platform.

- Strengthening foundations: Enhancing regulatory engagement and ensuring Coinbase remains the most trusted and scalable crypto platform.

Robinhood: 2025 Outlook

Crypto and Institutional Expansion

In Q4 2024, Robinhood's cryptocurrency trading volume surged 400% year-on-year to $71 billion, with plans to acquire Bitstamp in the first half of 2025 to attract institutional capital inflows. Despite ongoing global regulatory risks, Ethereum's staking in the EU and new listings in the U.S. have solidified its position.

Active Trading and Derivatives Growth

Robinhood is expanding into advanced trading through index options, futures, and Robinhood Legend, competing with Interactive Brokers and Fidelity. With a trading volume of 477 million options contracts in Q4 (up 61% year-on-year), it holds a dominant position in the retail derivatives space, but participation and risk management remain key challenges.

Global Expansion and Monetization

The company is developing in the Asia-Pacific region, establishing Singapore as its regional headquarters and expanding its UK operations through options trading. Robinhood Gold currently has 2.6 million users (10% penetration), while its credit card business has over 100,000 cardholders, requiring improved execution efficiency amid regulatory complexities.

Investment Advisory and Wealth Management

The acquisition of TradePMR (in the first half of 2025) marks Robinhood's entry into investment advisory and RIA services, targeting high-net-worth clients. Retirement AUC surged 600% year-on-year to $13.1 billion, positioning Robinhood as a multi-asset wealth platform, although retention and cross-selling remain significant risks.

Financial Outlook and Risks

Robinhood expects adjusted expenses to be between $2 billion and $2.1 billion, excluding credit losses, regulatory costs, and acquisitions. Strong growth in equities (up 154%), margin loans (up 126%), and cash flow (up 59%) highlights financial strength, but market cyclicality and execution risks persist.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。