The prosperity of memecoins is ultimately a reflection of the natural selection of the market, or an indication of the immaturity of the cryptocurrency industry?

Author: Jen Albert

Translation: Baihua Blockchain

As the host of Blockchain Banter, I recently led a discussion on memecoins—a topic that has sparked intense controversy throughout the industry. Whether you love them or hate them, their influence cannot be denied. Some believe they are ruining the cryptocurrency industry, while others see them as a natural evolution of decentralized market development.

To delve deeper into this debate, I invited Justin Havens (Head of DeFi Ecosystem Growth at Polygon) and Dr. Mark Richardson (Head of Bancor & Carbon DeFi projects) to explore the topic together. We had an in-depth discussion around the following core topics:

- The origins and roles of memecoins

- Regulatory challenges

- Investor vs. gambler mentality

- Influencers vs. Key Opinion Leaders (KOL)

- The possibilities and limitations of DYOR (Do Your Own Research) This conversation revealed the multifaceted impact of memecoins in the crypto market, and you are welcome to join the discussion!

1. The Memecoin Controversy

Memecoins have caused significant divisions in the crypto space. Some view them as a fun and community-driven way to participate in the market, while others believe they undermine the legitimacy of the industry. On one hand, prominent figures like Benjamin Cowen have bluntly stated, “Memecoins are ruining the crypto industry.”

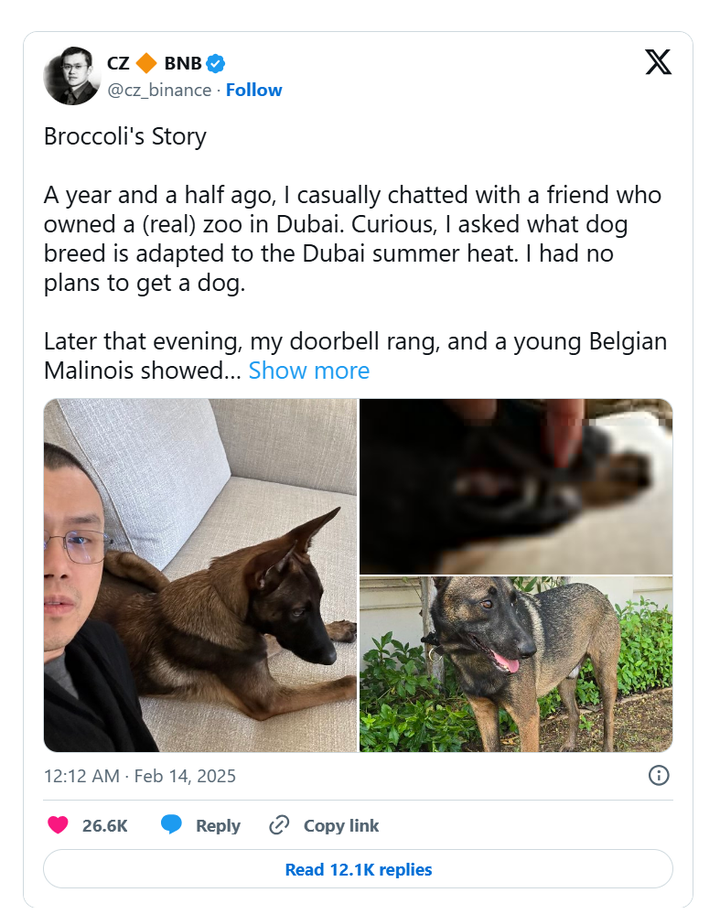

On the other hand, we also see some industry heavyweights taking the opposite stance, such as CZ (Changpeng Zhao), co-founder and former CEO of Binance, who seems to encourage (or perhaps not 😏) the birth of more memecoins by posting a photo of his pet dog Broccoli along with a whole page of backstory.

**“I just posted a photo of my dog and his name. I am *not* issuing a memecoin myself; whether to create one is entirely up to the community (or not to create one). However, I might interact with some popular memecoins on the BNB Chain (BSC). The BNB Foundation may provide rewards for top memecoins on the BNB Chain, such as LP support or other incentives. The details are still under discussion, so stay tuned.”**

Justin believes that memecoins are not a product of chance, but rather an inevitable result of regulatory crackdowns on structured token issuance. Due to concerns over legal risks, project teams have had to choose from the following options:

- Completely avoid any discussions related to token utility

- Opt for fundraising, excluding retail investors

- Issue tokens with no clear purpose

So, what happens when the only viable way to issue public tokens is through tokens with no actual utility? The answer is— the rise of memecoins.

Mark further points out, “Market incentives determine the final outcome.” Regulators have created an environment where utility tokens fall into a legal gray area, while tokens that explicitly claim to be “useless” face almost no compliance risks. The result is—memecoins quickly dominate the market.

2. Investor or Gambler? The Subtle Line in the Crypto Market

One of the biggest misconceptions in the crypto space is the belief that there is a clear line between investing and gambling. But does this line really exist?

- Investors research fundamentals, assess risks, and make decisions with a long-term perspective.

- Gamblers chase trends, trade impulsively, and accept extreme risks. Justin points out that many retail traders are forced into a “gambling mentality” because they cannot participate in traditional early-stage investments. Unless you are an accredited investor, your only option is speculative trading—which includes memecoins.

Mark believes that this line is blurrier than most people think. After all, some of the historically best-performing crypto assets have been obvious scams. As he puts it:

“People will advise you not to invest in this, saying it’s a scam. While others will say, ‘I know it is.’”

It is this paradox that fuels the frenzy around memecoins—projects that appear most like scams sometimes yield the greatest returns.

3. Do KOLs Fuel the Frenzy of Memecoins?

The conversation naturally turned to KOLs (Key Opinion Leaders) and paid influencers—important drivers in the memecoin ecosystem. So, is the root of the problem memecoins themselves, or those who promote them for profit?

In fact, there is a fundamental difference between true KOLs and paid influencers:

- True KOLs are respected industry builders and experts.

- Paid influencers often promote tokens they are paid to advertise, creating a false impression of “natural market interest.”

This also explains another side of memecoin hype—is it market demand that creates them, or is it artificially driven?

4. Is the Term KOL Misused in the Crypto Space?

Mark believes that the term “KOL” is often misused in the crypto space. Many so-called “opinion leaders” are essentially advertisers who resell token shares behind the scenes. If a project needs to pay people to talk about it, it’s worth questioning: Why does it need to do that?

The core issue? Questioning the incentive mechanisms. If someone is pushing a token hard, ask yourself—What do they stand to gain from it?

5. DYOR: Is It Really Feasible?

“Do Your Own Research (DYOR)” is a phrase often emphasized in the crypto space, but the reality is often much more complex than the slogan suggests. As audience member Mike pointed out, DYOR is easier said than done.

Most people lack both the tools and expertise to analyze correctly:

- Token distribution

- Potential risks of smart contracts

- Key elements like liquidity structure

While true on-chain analysis requires some investment, there are indeed tools that can help, such as Bubble Maps, which visually track token distribution and identify potential scams. But ultimately, if you don’t fully understand what you’re buying, you’re more like a gambler than an investor.

6. Can Memecoins Evolve? Taking Sei as an Example

There was a counterpoint in the discussion: Some memecoins, although initially just a joke, later developed into real projects.

**Seiyan (the memecoin on the Sei chain)** is a typical case—it started as a memecoin but later launched its own aggregator, transforming the community's momentum into more practical products.

**The line between memecoins and utility tokens is not always so clear.** Sometimes, memecoins can grow into real projects and **contribute to the ecosystem far beyond being just a “fun token.”**

7. **Conclusion: Memecoins Are Here to Stay**

--------------------------

Memecoins remain one of the most controversial topics in the crypto industry, and this discussion is far from over.

But one thing is undeniable—**memecoins have become a part of the market and are unlikely to disappear in the short term.** Their demand is **market-driven**, and until regulations are clarified and can support structured token issuance, memecoins may continue to dominate.

So, what is the root of the problem?

* Is it **memecoins** themselves?

* Is it the **KOLs and the speculative mindset of the market**?

* Or is it the **inadequacy of the regulatory system**?

As **Justin** summarized:

> **“If you fix the incentive mechanisms, you can fix the market.”**

Article link: https://www.hellobtc.com/kp/du/02/5686.html

Source: https://medium.com/@Jen_Here2DeFi/memecoins-the-inevitable-path-to-mainstream-adoption-or-the-symptom-of-a-broken-system-d6c2fac81643

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。