The conference covered innovative regulatory policies, accelerated institutional funding entering the market, and the deep integration of AI and blockchain.

Key Points

Clearer regulations: The Hong Kong Securities and Futures Commission (SFC) approved cryptocurrency derivatives and margin trading, providing more options for professional investors and further consolidating Hong Kong's position as a global crypto financial center.

Accelerated institutional entry: Hong Kong has issued 9 licenses for digital asset trading platforms, with more licenses under review, indicating that traditional financial institutions are accelerating their entry into the crypto market.

AI empowering blockchain: Artificial intelligence is enhancing the security and execution efficiency of smart contracts, driving the development of the Web3 ecosystem, and facilitating the implementation of more decentralized applications.

DePIN and asset tokenization reshaping financial markets: Decentralized Physical Infrastructure Networks (DePIN) and asset tokenization are changing the investment landscape, allowing physical assets to more easily enter the blockchain and increasing market liquidity.

In an era of rapid development in blockchain, Web3, and digital assets, Consensus Hong Kong 2025 set a historical record, marking an important milestone as CoinDesk's flagship conference expanded into Asia for the first time. Over 5,000 participants from finance, technology, entrepreneurship, and public policy gathered in Hong Kong, an international financial center, to witness a series of groundbreaking announcements, engage with industry experts, and discuss future trends in decentralized technology.

As the Hong Kong government actively promotes Web3 and strives to become the center for cryptocurrency and digital assets in Asia, this conference covered innovative regulatory policies, accelerated institutional funding entering the market, and the deep integration of AI and blockchain. Next, we will delve into the daily highlights to analyze this industry event that impacts the global crypto market.

Five Major Highlights Review

Expansion of Regulatory Policies

The Hong Kong Securities and Futures Commission (SFC) approved cryptocurrency derivatives and margin loans, providing more financial options for professional investors and further consolidating Hong Kong's position as a global cryptocurrency hub.

Accelerated Institutional and Web3 Adoption

Financial Secretary Paul Chan announced 9 licenses for digital asset trading platforms, with more licenses under review. Additionally, the regulatory framework for DeFi and stablecoins is continuously improving, promoting the institutionalization of the Web3 economy.

Meme Coins and Web3 Culture

Meme coins have evolved from internet jokes into community-driven digital economies, while platforms like Memeland are combining NFTs, social networks, and gamified interactions to drive innovation in Web3 culture.

AI and Blockchain Integration

AI is enhancing blockchain security, optimizing smart contracts, and accelerating the development of decentralized governance. The conference also sparked important discussions about the risks of AI automation and trust mechanisms.

DePIN and Asset Tokenization Reshaping Financial Markets

Decentralized Physical Infrastructure Networks (DePIN) are connecting data, infrastructure, and real-world resources more closely, while asset tokenization allows traditional financial assets to be transformed into highly liquid digital investment tools on the blockchain.

Laying the Foundation: Why Choose Asia? Why Choose Now?

Hong Kong is vigorously promoting the development of digital assets at a time when traditional financial institutions and tech entrepreneurs are increasingly interested in the Web3 industry. With its advantageous geographical location, comprehensive legal framework, and status as an international financial center, Hong Kong is rapidly emerging as an important hub for blockchain innovation.

This backdrop makes Consensus Hong Kong 2025 an unmissable annual event, attracting policymakers, corporate executives, venture capitalists, and developers from around the world to discuss the future direction of Web3.

- "As the Web3 ecosystem continues to evolve, Hong Kong will maintain a stable, open, and vibrant digital asset market." — Paul Chan, Financial Secretary of Hong Kong

Day 1: Policies, Bitcoin, and the Future of Web3

Key Conference Highlights

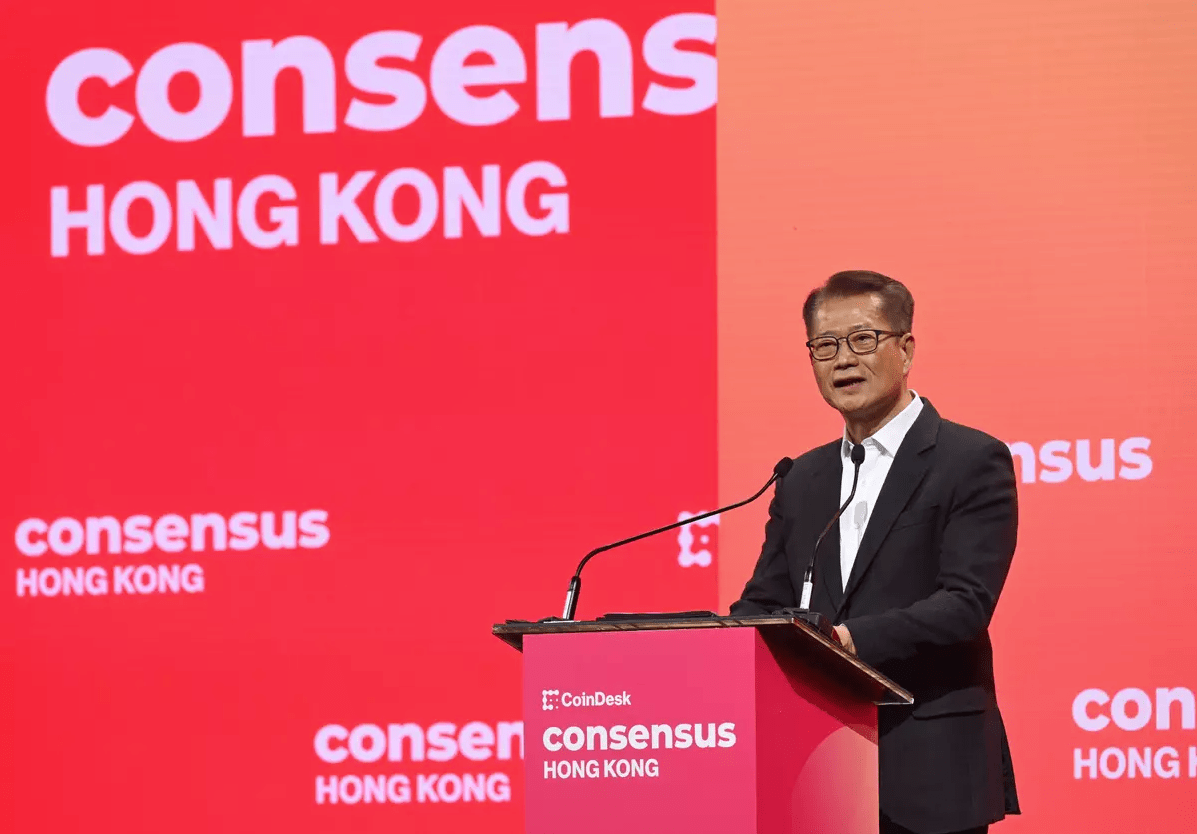

Opening Speech by Financial Secretary Paul Chan

Paul Chan kicked off Consensus Hong Kong 2025 with a vibrant speech, reaffirming Hong Kong's goal to become a leader in the global cryptocurrency and Web3 industries. He emphasized that the government is actively simplifying the cryptocurrency licensing system and expanding public funding for blockchain R&D.

- "We are making significant investments in related infrastructure and talent development." — Paul Chan, Financial Secretary of Hong Kong

Progress in Regulatory Policies

SFC CEO Ashley Alder shared Hong Kong's latest cryptocurrency regulatory policies at the conference. She stated that the SFC plans to approve trading in cryptocurrency derivatives and allow specific investors to use margin loans, opening up more financial tools for professional investors.

- "We are considering opening derivatives trading for professional investors and allowing specific clients to engage in margin loans." — Ashley Alder, CEO of the Hong Kong Securities and Futures Commission

Bitcoin and the Global Financial System

A high-profile panel consisting of Blockstream CEO Adam Back, JAN3 CEO Samson Mow, and Babylon co-founder David Tse discussed Bitcoin's potential as a global reserve asset and analyzed how institutional investors are adopting Bitcoin to develop Bitcoin-based decentralized finance (DeFi) solutions.

Image Credit: Bastille Post

Networking Events and Social Gatherings

Rolling Stone China-HK VIP Party Powered by XT.COM#BeyondTrade

What happens when music, culture, and blockchain collide? At the Rolling Stone China-HK VIP Party held at The Iron Fairies, participants enjoyed live music performances, exchanged the latest trends in Web3 applications, and explored how blockchain is transforming the entertainment industry.

Performance Lineup:

– MC Jin (Chinese rap legend)

– SHUZO (emerging Japanese electronic music artist)

This event, sponsored by XT.COM, marks the deepening application of blockchain in the entertainment industry, particularly in the combination of NFTs, music copyrights, and fan economy.

OKX Web3 Night

OKX Web3 Night is a high-end social gala that provides opportunities for in-depth discussions with OKX executives, top traders, investors, and blockchain developers. The event takes place in a relaxed atmosphere, allowing participants to gain insights into OKX's latest technological developments, upcoming collaboration plans, and the direction of Web3 ecosystem development.

Core Highlights:

– Future platform updates: OKX shared upcoming Web3 solutions.

– In-depth discussions on DeFi and NFTs: OKX executives analyzed how NFTs and DeFi impact the Web3 ecosystem.

– High-end networking: Face-to-face interactions with thought leaders, investors, and developers in the Web3 space.

Image Credit: OKX

Day 2: DePIN, Web3 Growth, and the Lightning Payment Revolution

Key Conference Highlights

Keynote Speech: Binance CEO Richard Teng

In a keynote speech titled "Digital Assets: The Currency of the Future," Richard Teng praised the growing presence of institutional investors in the crypto market and emphasized how Hong Kong's increasingly clear regulatory framework is driving the influx of large institutional funds.

Keynote Speech: Financial Secretary Paul Chan

Paul Chan reaffirmed Hong Kong's strong commitment to digital assets, announcing that the government has issued 9 licenses for digital asset trading platforms and revealing that more license applications are under review, which will further promote Hong Kong's development in the Web3 space. He also stated that Hong Kong is preparing to launch a regulatory framework for stablecoins to support safer and more efficient digital payments globally.

- "We recognize the potential of stablecoins in global transactions, and Hong Kong is committed to creating an environment conducive to such innovations." — Paul Chan, Financial Secretary of Hong Kong

Image Credit: Consensus Hong Kong 2025

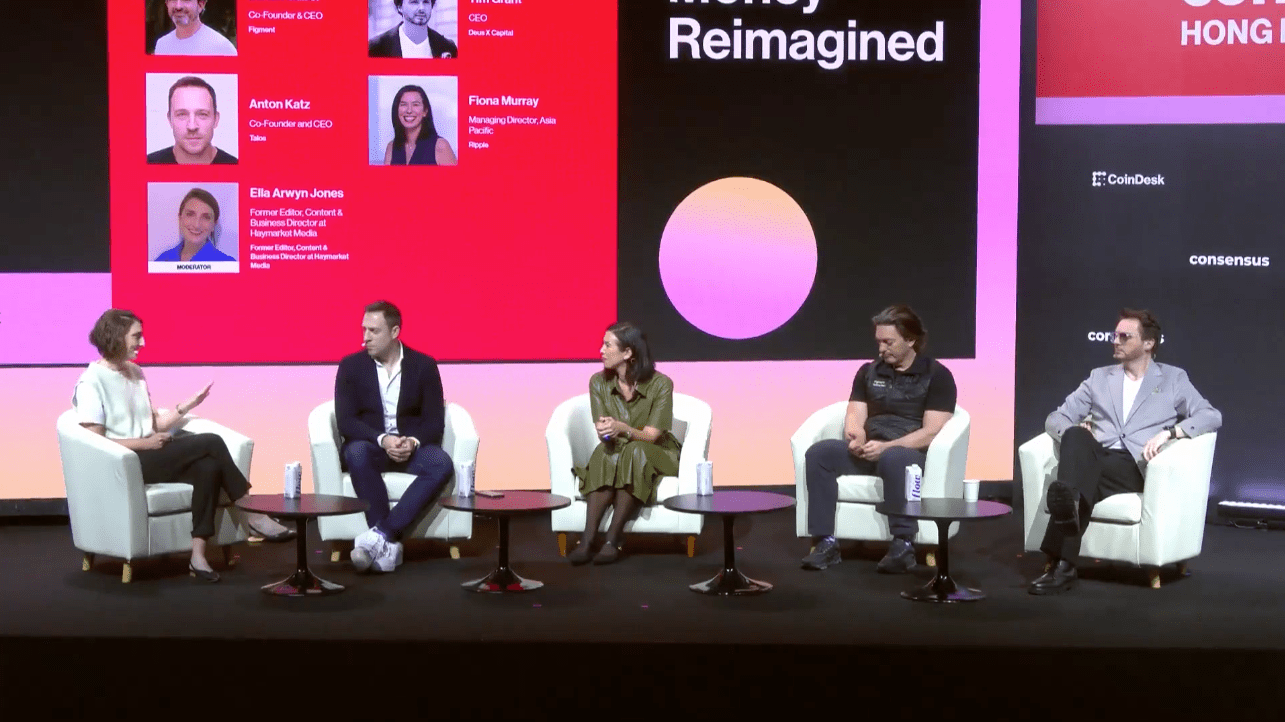

Money Reimagined Stage

Cryptocurrency Derivatives and Institutional Investors

Financial analysts discussed risk management strategies for cryptocurrency derivatives and analyzed how traditional financial institutions are entering this market as regulations become clearer.

Image Credit: Consensus Hong Kong 2025

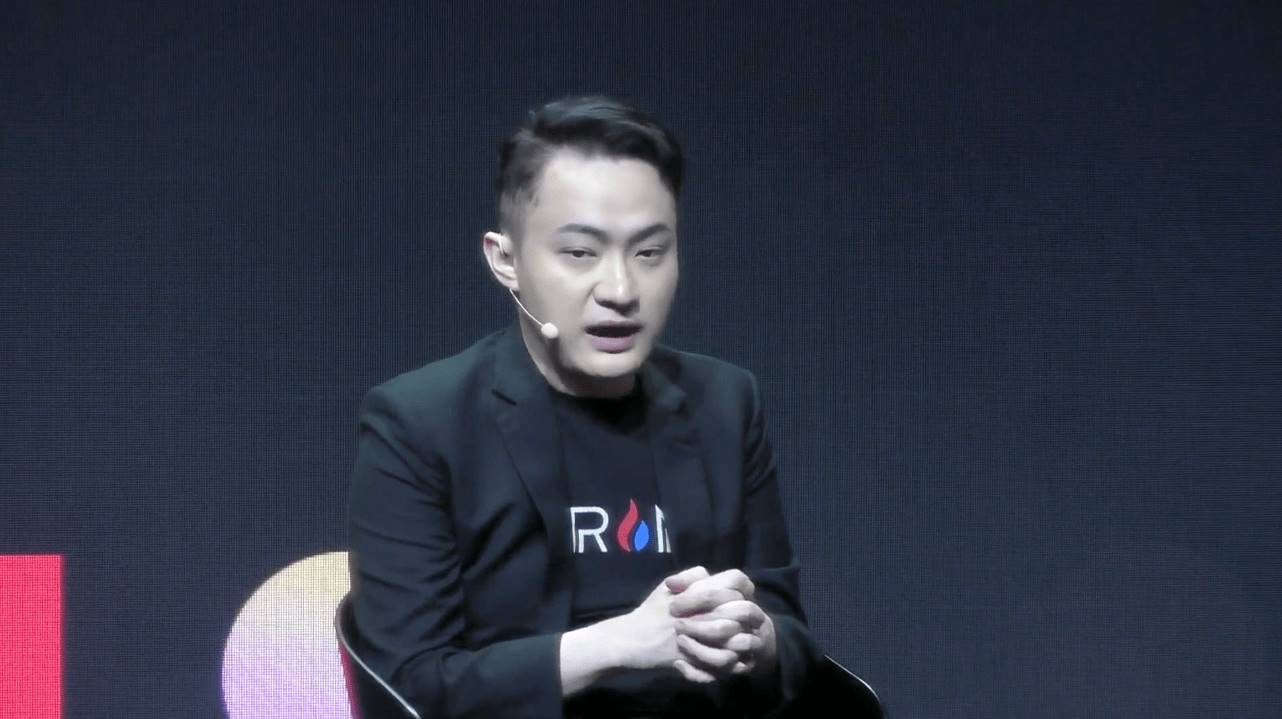

Builders Stage

TRON and T3 FCU: The Challenge of Global Adoption — Balancing Decentralization, Security, and Scalability

The technical discussion delved into TRON's role in the global Web3 ecosystem and how T3 FCU (a blockchain-based financial credit union) finds a balance between decentralization, security, and scalability to drive global financial innovation.

Image Credit: Consensus Hong Kong 2025

Networking Events and Social Gatherings

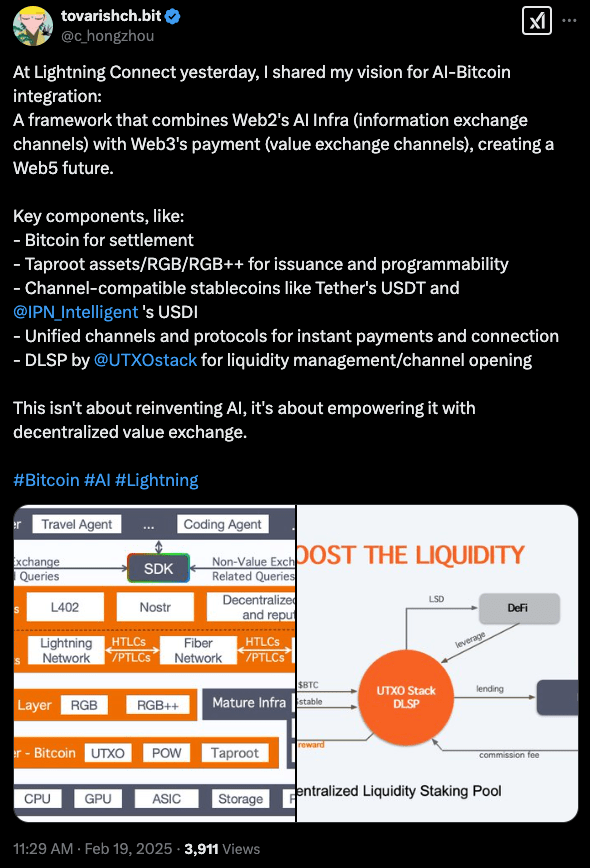

Lightning Connect: The Transformation of Global Payments

The Lightning Network is changing the landscape of global payments. This session, co-hosted by CKB Eco Fund, Breez, and UTXO Stack, explored how to leverage the Lightning Network to enhance the speed and scalability of Bitcoin transactions, enabling instant and low-cost global payments.

Highlights Review:

– Lightning Network use cases: How businesses around the world use Bitcoin for cross-border remittances, merchant payments, and micropayments.

– Technical integration: How developers can integrate the Lightning Network into their applications to achieve a seamless payment experience.

– Hands-on demonstrations: Attendees could experience the operation of Lightning Network applications and payment channels on-site.

Image Credit: tovarishch.bit

Day 3: Memecoins, AI, and the Tokenization Economy

Key Conference Highlights

How Memecoins Evolved from Internet Jokes to Digital Economies in 2024

This discussion analyzed how memecoins have transformed from internet humor into digital assets with real utility and community cultural impact. Industry experts deeply examined how community-driven initiatives, social media trends, and speculative trading shape the growth path of memecoins. Core topics:

– How memecoins have evolved from speculative assets to blockchain projects with governance mechanisms, staking functions, and DeFi integration.

– How community-driven efforts and KOL marketing have become key to the success of memecoins.

– How Layer-2 scaling solutions reduce transaction costs for memecoins, making them more sustainable.

"Memes are more than just memes": How Memeland is Reshaping Web3 Community Culture

A panel hosted by the Memeland founding team discussed how NFTs, Web3 social platforms, and gamified experiences can transform meme culture into a sustainable digital economy. Discussion points:

– How Memeland combines content creation with blockchain reward mechanisms to provide users with a new experience.

– The power of decentralized narratives: How memecoins build strong community consensus beyond mere speculative hype.

– The future development of memecoins, NFTs, and brand collaborations, and how Web3 culture attracts mainstream market attention.

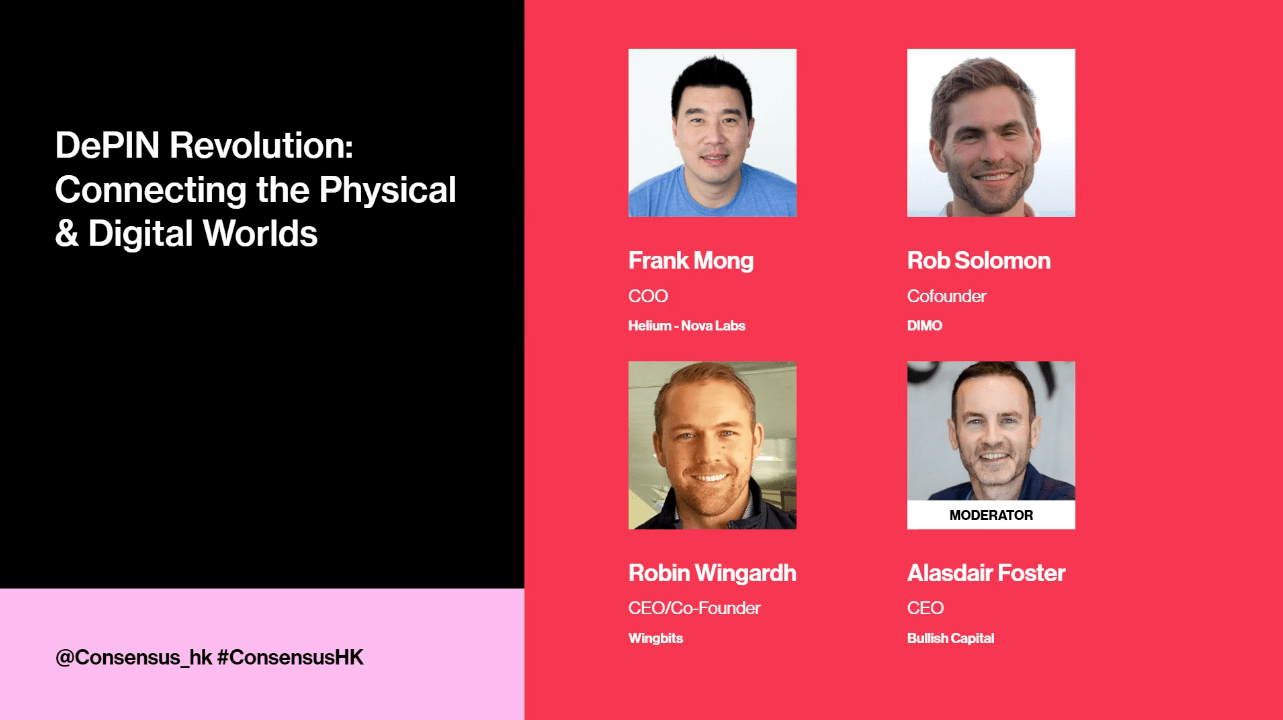

DePIN Revolution: How to Connect the Physical and Digital Worlds?

Decentralized Physical Infrastructure Networks (DePIN) are disrupting traditional industries by introducing blockchain technology into cloud computing, wireless networks, and supply chain management. This discussion invited leading DePIN project teams to share trends in blockchain-driven infrastructure development. Highlight topics:

– How blockchain infrastructure is changing industries such as cloud computing, decentralized wireless networks (DeWi), and supply chain finance.

– How crypto-driven IoT solutions promote smart cities and decentralized logistics systems.

– The investment potential and scalability of DePIN in the Web3 space.

Image Credit: Consensus Hong Kong 2025

Emerging Tech Stage

"Can We Trust AI?" — Challenges and Opportunities in the Integration of AI and Blockchain

As artificial intelligence (AI) technology is increasingly applied in blockchain and Web3, this discussion explored the balance between automation, transparency, and trust mechanisms. Main discussion topics:

– The application of AI in blockchain security: Can it predict fraud and enhance the security of smart contracts?

– The challenges of decentralization vs. AI governance: How to avoid the centralization of AI control and ensure fairness?

– The future of AI-generated assets: From on-chain content creation to AI-driven DAOs (Decentralized Autonomous Organizations), how will this technology change Web3?

Spotlight Stage

From Custody to Liquidity: How Asset Tokenization is Changing Financial Markets?

Asset tokenization is redefining traditional financial markets, allowing previously illiquid assets, such as real estate, artworks, and private equity, to be more easily traded on the blockchain. This discussion deeply analyzed the potential and regulatory challenges of asset tokenization. Core topics:

– How fractional ownership allows retail investors to participate in high-value asset markets?

– How financial institutions embrace the tokenization trend and leverage blockchain technology to enhance market transparency and efficiency?

– The regulatory stance on asset tokenization: How to strike a balance between regulation and innovation?

Important Announcements and Industry Impact

New Regulatory Developments

The Hong Kong Securities and Futures Commission (SFC) approved cryptocurrency derivatives and margin loans, further indicating that Hong Kong is accelerating its position as a global digital asset financial center. This policy change not only attracts Asian capital but will also encourage global institutional investors to enter the market, providing more liquidity and stability to Hong Kong's cryptocurrency ecosystem.

Stablecoin Regulatory Roadmap

Stablecoins have become a key development focus for the Hong Kong government. Financial Secretary Paul Chan revealed at the conference that regulators are studying the legal framework for stablecoin issuance, which will promote the use of stablecoins in retail payments and corporate settlements. Impact analysis:

– This will help attract more international financial institutions and stablecoin issuers to establish a presence in Hong Kong.

– It may drive Hong Kong to launch compliant stablecoins backed by fiat currencies, enhancing global market confidence in Hong Kong's Web3 ecosystem.

– Businesses and consumers will find it easier to use stablecoins for payments, cross-border transactions, and financial management.

Accelerated Institutional Entry

As Hong Kong's digital asset regulatory framework continues to improve, institutional investors' interest in the crypto market has reached new heights. Several banks and hedge funds have revealed plans to establish crypto trading departments in Hong Kong, which will further enhance market liquidity and drive mainstream adoption of digital assets. Key developments:

– A Web3-friendly regulatory environment has increased institutional investors' confidence, prompting them to invest more capital and resources into the market.

– The integration of traditional finance and DeFi (Decentralized Finance) will help establish a more stable and transparent Web3 financial ecosystem.

– It is expected that the trading volume of digital assets in Hong Kong will see significant growth in the next 12 months.

AI and Blockchain Integration

This conference focused on how artificial intelligence (AI) enhances the user experience of blockchain, from smart contract automation to data analysis optimization, with AI applications in the Web3 space rapidly expanding. Technology trends for the next 12-18 months:

– AI-driven trading and market forecasting: An increasing number of trading platforms will adopt AI-driven market analysis and trading strategies to improve trading efficiency and risk control capabilities.

– Automated smart contracts: AI will be used for vulnerability detection and fraud identification, enhancing the security and stability of Web3 applications.

– AI-powered DeFi and DAOs (Decentralized Autonomous Organizations) will improve community governance efficiency and user experience through intelligent governance mechanisms.

Summary and Outlook

Consensus Hong Kong 2025 showcased Hong Kong's influence in the global digital asset industry, successfully promoting exchanges and collaborations in blockchain, Web3, and financial innovation between the East and West. With a clearer regulatory framework, active institutional investor entry, and the continuous reshaping of the industry by DePIN (Decentralized Physical Infrastructure) and AI technologies, Hong Kong has firmly established itself as one of the global leaders in cryptocurrency and digital finance.

Future Development Trends: What’s Next for Hong Kong?

Regulatory Evolution

– It is expected that stablecoin regulatory regulations will be further refined, providing a clearer legal framework for the market.

– Licenses for digital asset trading platforms will expand further, attracting more international Web3 projects and institutional investors to enter the Hong Kong market.

Institutional Acceleration

– The nine trading platform licenses are just the beginning; more banks, hedge funds, and fintech companies are expected to accelerate their Web3 business layouts.

– Hong Kong's Web3 ecosystem will welcome more mature financial infrastructure, enabling more institutional investors to participate in the digital asset market safely and compliantly.

AI and DePIN Expansion

– AI will empower blockchain, making smart contracts more secure, efficient, and capable of automatic optimization.

– DePIN (Decentralized Physical Infrastructure) will continue to develop, bringing disruptive changes to finance, logistics, and data security.

Tokenization and DeFi Growth

– Asset tokenization will bring new liquidity to traditional financial markets, with more real-world assets (RWAs) expected to be introduced to the blockchain market.

– The integration of the DeFi ecosystem with institutional investors will become closer, driving further maturation of decentralized finance.

With the joint efforts of financial institutions, large enterprises, innovative startups, and regulatory bodies, Hong Kong is rapidly becoming a global model for Web3 finance. The discussions and innovations from this conference not only shape Hong Kong's future but also lay the foundation for the development of the global digital economy. The impact of Consensus Hong Kong 2025 will continue to expand, accelerating the popularization, regulatory improvement, and industry integration of global digital assets, ushering in a more interconnected digital economy era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。