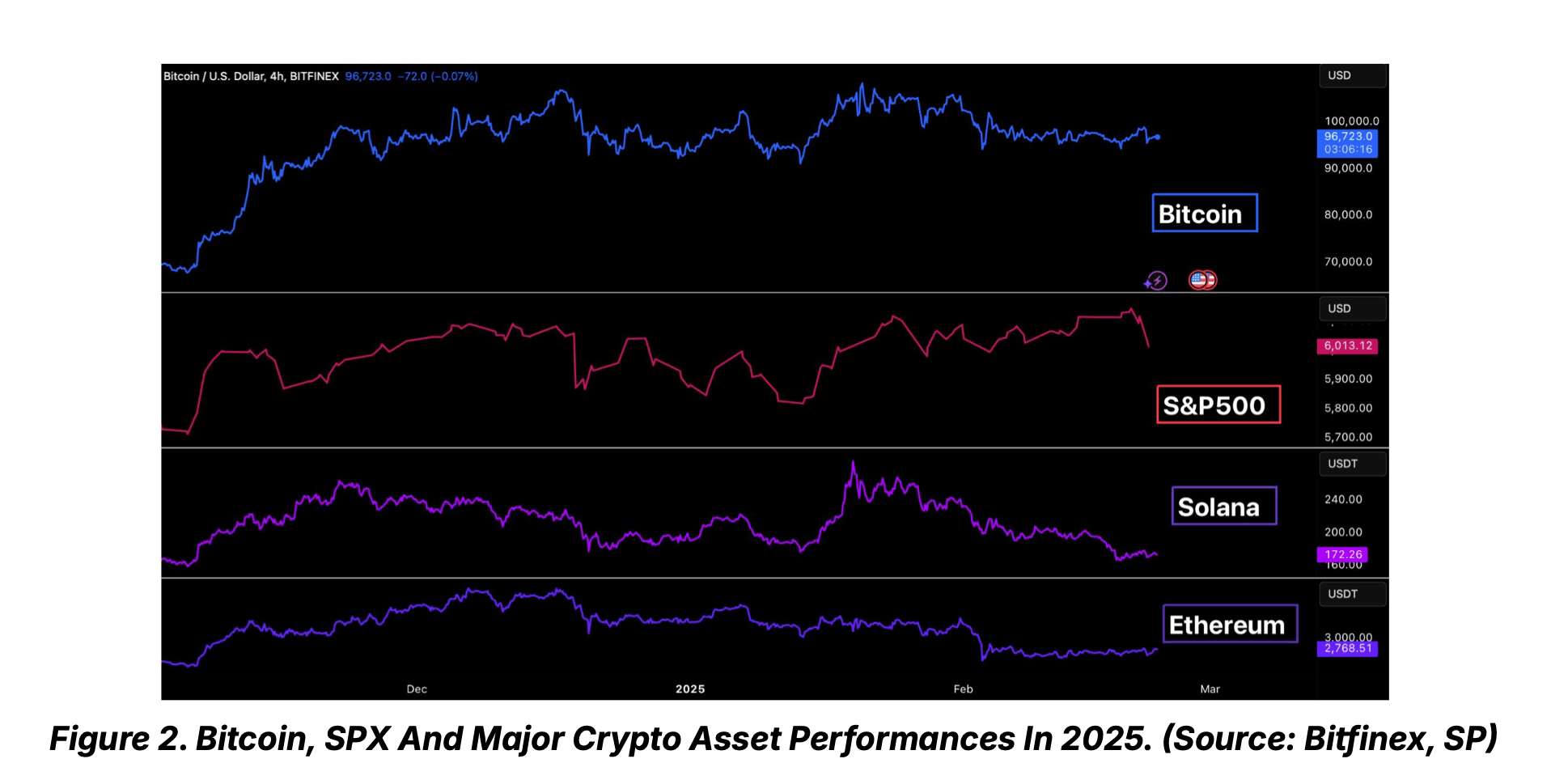

Bitfinex analysts noted bitcoin’s (BTC) volatility spiked briefly on Feb. 21 amid a $1.5 billion hack of crypto exchange Bybit and equity market turbulence, triggering a 4.7% intraday drop before a partial recovery. The report highlighted a broader crypto market correction, with ethereum (ETH), solana (SOL), and meme coins plunging between 16.9% and 37.4% in February after late-2024 rallies.

Institutional participation has cooled sharply, with U.S. spot bitcoin ETFs seeing net outflows of $360 million on Feb. 20 alone, reversing November’s peak inflows of 18,000 BTC daily. The Bitfinex report noted that macroeconomic uncertainty is compounding crypto’s challenges. The University of Michigan’s consumer sentiment index fell to a 15-month low in February, while one-year inflation expectations jumped to 4.3%, complicating the Federal Reserve’s disinflation efforts.

Proposed U.S. tariffs and an 8.4% January drop in new home construction—driven by material costs and high mortgage rates—add to economic headwinds, the Bitfinex market strategists wrote. Bitfinex further emphasized BTC’s correlation with traditional markets, noting the S&P 500’s struggle to hold above 6,000 has dampened risk appetite.

Declining leveraged trading activity, evidenced by yearly lows in open interest for bitcoin (-11.1%) and ethereum (-23.8%), signals a “broader market contraction,” the analysts wrote. Crypto-specific developments include Strategy’s $2 billion convertible notes offering to fund bitcoin acquisitions and Howard Lutnick’s confirmation as U.S. Commerce Secretary, which Bitfinex suggested could ease crypto regulations. However, the Bybit hack—attributed to North Korea’s Lazarus Group—fueled persistent security worries and market suppression, though Bitfinex noted potential ETH buybacks might offset selling pressure.

The Bitfinex market analysis wrapped up by noting bitcoin’s next decisive move hinges on macro trends, urging caution as markets await catalysts. “The cooling demand on the spot side has triggered a significant drop in perpetual open interest (OI) across all major assets, indicating a reduction in speculative activity and lower cash-and-carry yields,” the analysts wrote.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。