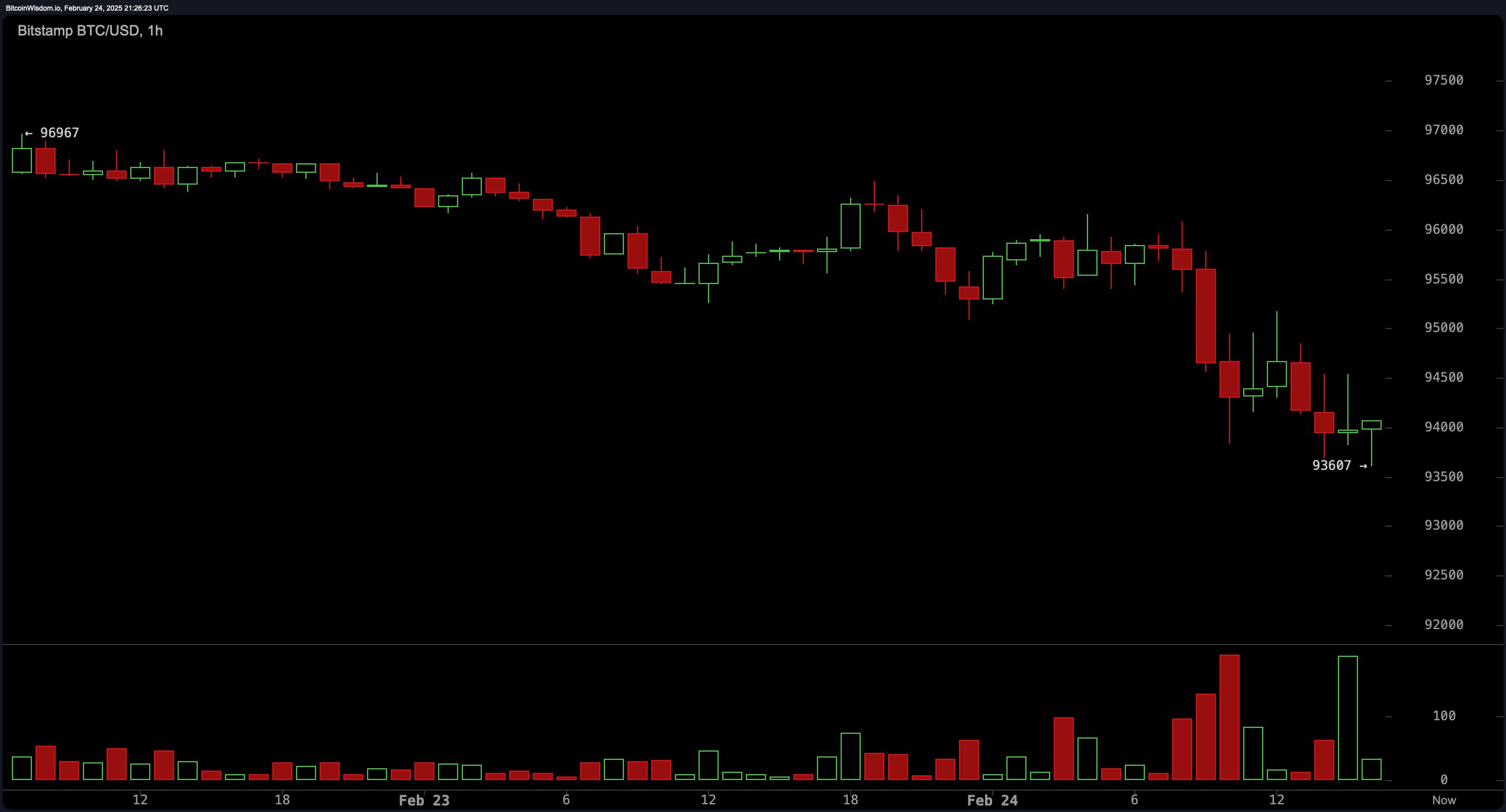

On the BTC/USD 1-hour chart, fleeting fragility persists as bitcoin carves successive troughs and wavers near the $93,607 support. Bears maintain their grip, with red candles swelling alongside elevated volume—a testament to the intense downward drive. Erratic price swings mirror trader indecision, while futile efforts to recapture $95,000 solidify this barrier as a formidable ceiling. A meaningful push above $95,500 demands a crescendo of buyer participation; conversely, slipping below $93,000 may invite a descent toward $91,000.

BTC/USD 1H chart on Feb. 24, 2025.

The 4-hour bitcoin chart paints a clear downward trajectory, marked by diminishing peaks and valleys. A swift reversal from $99,508 ignited a plunge to $93,340, cementing seller dominance. Volume patterns reveal fleeting recoveries smothered by eager profit-taking. Should bitcoin falter at $96,500, the path may tilt toward the psychological anchor of $90,000. Optimists must forge a stabilizing base and sustain an upward thrust to rewrite the narrative.

BTC/USD 4H chart on Feb. 24, 2025.

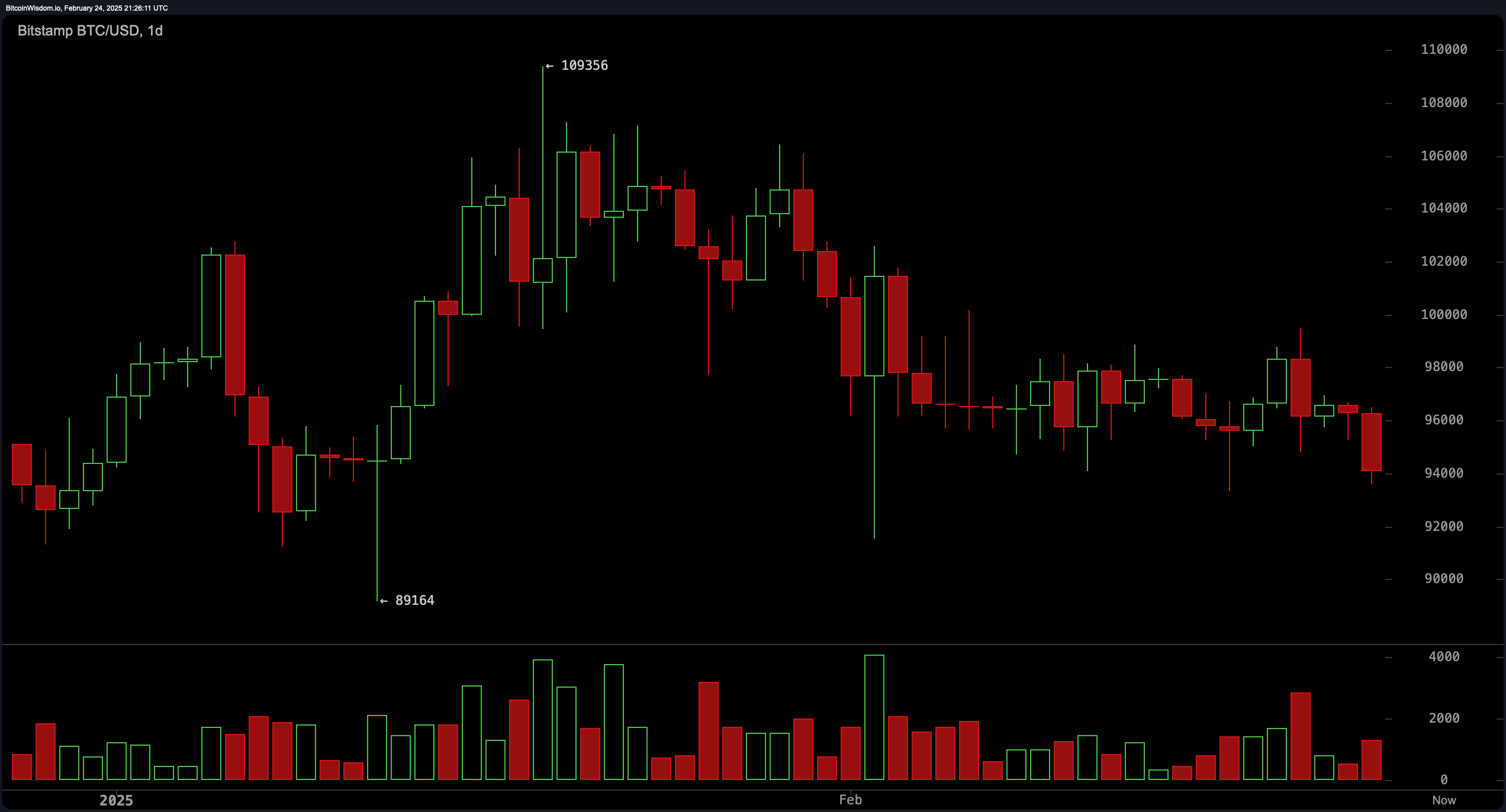

Zooming out, bitcoin’s daily chart illustrates a wider bearish consolidation since bitcoin’s $109,356 pinnacle. Prices persistently adhere to a downward-sloping resistance zone, with botched breakout bids amplifying the overarching decline. Though the $93,000 support clings to relevance, unrelenting selling activity looms as a potential wrecking ball. A rebound here might spark a fleeting rally toward $96,500, yet rejection at this juncture could validate deeper retracements. The bearish mantle remains until bitcoin storms past $97,000 with conviction.

BTC/USD 1D chart on Feb. 24, 2025.

The daily’s technical oscillators from the BTC/USD chart present conflicting signals: The relative strength index (RSI) (40), Stochastic (37), and CCI (-210) linger in neutral zones. However, the momentum indicator (-3,475) and moving average convergence divergence (MACD) (-964) emit bearish alerts, bolstering a negative outlook. The awesome oscillator (-2,568) further affirms the market’s downward inclination. While neutral readings hint at tentative equilibrium, absent bullish divergence keeps the door ajar for further slides.

The 24-hour moving averages (MAs) fortify the bearish thesis, with all short- and mid-term metrics—10, 20, 30, 50, and 100-period EMAs and SMAs—looming above current prices, signaling a continued downward trajectory. The 200-period EMA ($85,656) and SMA ($81,502) linger as distant safety nets, potential havens should downward velocity intensify. Until bitcoin surpasses crucial moving average thresholds, rallies will likely meet staunch opposition, leaving bears in command.

Bull Verdict:

Despite the current bearish structure, bitcoin remains above key support at $93,000, suggesting potential for a relief bounce toward $96,500 if buyers step in. Neutral oscillator readings indicate a possible stabilization phase, and if volume supports a breakout above $97,000, a short-term bullish reversal could take shape. Additionally, long-term moving averages at $85,656 and $81,502 continue to provide a solid foundation for a potential recovery. Until a decisive move below $93,000 occurs, bulls still have an opportunity to reclaim control.

Bear Verdict:

Bitcoin remains in a clear downtrend across all major timeframes, with lower highs and lower lows defining the market structure. The rejection from $99,508 on the 4-hour chart and persistent selling pressure reinforces the likelihood of further downside. With the moving average convergence divergence (MACD) and momentum indicators signaling continued bearish momentum, bitcoin risks breaking below $93,000, which could open the door to a deeper correction toward $90,000 or lower. Unless buyers can reclaim $97,000 with conviction, the prevailing trend favors the bears.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。