⚡️First Introduction of Pre-Market Limit Up | Binance Launchpool Phase 64 @redstone_defi Project Full Analysis and Launch Price Estimation!

Binance Launchpool has launched its 64th project @redstone_defi. As a leading mainstream Oracle project, RedStone's direct listing on Binance is undoubtedly a positive signal for the modular oracle track.

This new listing on @binance also features two new highlights—

▶️ Trial implementation of a pre-market tiered limit up mechanism, which can be simply understood as opening price protection. If the price exceeds 200% of the opening price on the first day, trading will be prohibited; on the second day, it will be 300%; on the third day, 400%; and after three days, the price restrictions will be lifted.

Clearly, Binance aims to change the awkward situation where new coins "peak at opening," preventing large holders from immediately driving up and dumping the price.

▶️ This time, not only can you use BNB and FUSD, but USDC is also allowed for participation in the new listing.

Mining has already started and will last for 2 days. Friends holding BNB, FDUSD, or USDC, don’t forget to deposit into Launchpool to share in the early dividends of RedStone!

💡 This article will comprehensively analyze the following aspects—

How RedStone reconstructs the value logic of oracles

The four core advantages of RedStone

The economic token model of RedStone

Launch price estimation

1⃣RedStone—The "Modular Revolutionary" of the Oracle Track

In today’s market, every chain and dApp needs an economically efficient, secure, and flexible oracle; otherwise, they cannot access data from external sources.

As the first oracle to integrate EigenLayer's re-staking security layer, RedStone's modular architecture, AVS scalability, strong security, and ultra-low latency make it one of the most trusted and fastest-growing oracles in the ecosystem.

Traditional oracles are limited by single-chain architecture and high gas verification costs, making it difficult to meet the explosive growth demands of multi-chain ecosystems. RedStone, through its innovative modular design, decouples the three major stages of data collection, verification, and transmission, achieving cross-chain pricing capabilities with "one signature, universally applicable across chains." Its revolutionary breakthroughs include:

✅ AVS Security Verification: First to integrate EigenLayer's $14 billion staked assets, adding a cryptoeconomic security layer for data accuracy through re-staking mechanisms, raising the cost of malicious actions to 100 times that of traditional models;

✅ Arweave Storage Optimization: Utilizing decentralized storage for off-chain high-frequency data updates, ETH/USDC price push speed is 30% faster than Chainlink, with gas costs reduced by 80%;

✅ Full Chain Compatibility: Supports over 100 public chains including Ethereum, TON, Berachain, covering emerging asset classes like LST, LRT, and BTCFi, with total value secured (TVS) exceeding $6.8 billion.

Currently, RedStone has provided key price data for top DeFi protocols such as Spark, Pendle, Ethena, and Etherfi, demonstrating strong stability during the $2 billion liquidation event in 2024, completing 119,000 precise updates within 24 hours, establishing its position as a "safe anchor in crises."

As one of the three leading mainstream Oracle projects (@chainlink @PythNetwork @redstone_defi), RedStone is the only Pull/Push compatible oracle that has not experienced any erroneous pricing events.

2⃣The Four Core Advantages of RedStone—

Compared to Chainlink's EVM limitations and Pyth's reliance on the Perps market, RedStone builds a technological moat with four major innovations:

- Dynamic DA Layer Switching

Innovatively introduces the "DA Supermarket" model, allowing developers to freely choose Celestia, EigenDA, or Arweave as the data availability layer based on cost/security needs, saving 40% in operational costs compared to fixed architectures.

- AVS Enhanced Security

Introduces re-staking economic security through the EigenLayer AVS framework, requiring validation nodes to stake ETH or EIGEN tokens, raising the cost of malicious actions from the million-dollar level to the hundreds of millions, creating a "blast shield" for DeFi protocols.

- High-Frequency Low-Latency Engine

Employs off-chain signing + on-chain on-demand verification mechanism, achieving ETH price update speed of 0.22 seconds, only 5% higher than centralized exchanges, while maintaining complete decentralization.

- LRT Yield Stacking Protocol

First to link oracle data with re-staking yields, $RED can be wrapped as LRT (Liquid Re-staking Token), capturing dual yields in protocols like Aave and EigenLayer, with expected APY exceeding 120%.

3⃣The Economic Token Model of RedStone—

$RED is the native token of RedStone, serving as the core asset for network operation and ecosystem development. Its main uses include:

① Network GAS: Paying for data service fees, DA layer leasing fees, and cross-chain relay costs, with 30% of fee income used for token burning.

② Governance Token: Users holding $RED can participate in key decisions such as network upgrades and parameter adjustments, determining AVS validation node admission, fee sharing ratios, and new chain integration priorities.

③ Incentive Mechanism: $RED can be staked and distributed to incentivize data providers and service participants, ensuring network stability and activity.

Token Name: RedStone (RED)

Total Token Supply: 1,000,000,000

Initial Circulating Supply: 280,000,000 (28% of total token supply)

Binance Launchpool Allocation: 40,000,000 (4% of total token supply)

Token Distribution: 48.3% for ecosystem and community incentives, 20% for core builders, 31.7% for early supporters

I have played a few mini-games before; I wonder if I can get an airdrop!

4⃣Launch Price Estimation—

As a project positioned to compete with Chainlink and Pyth, RedStone's advantages in technological innovation and multi-chain support give it high market expectations.

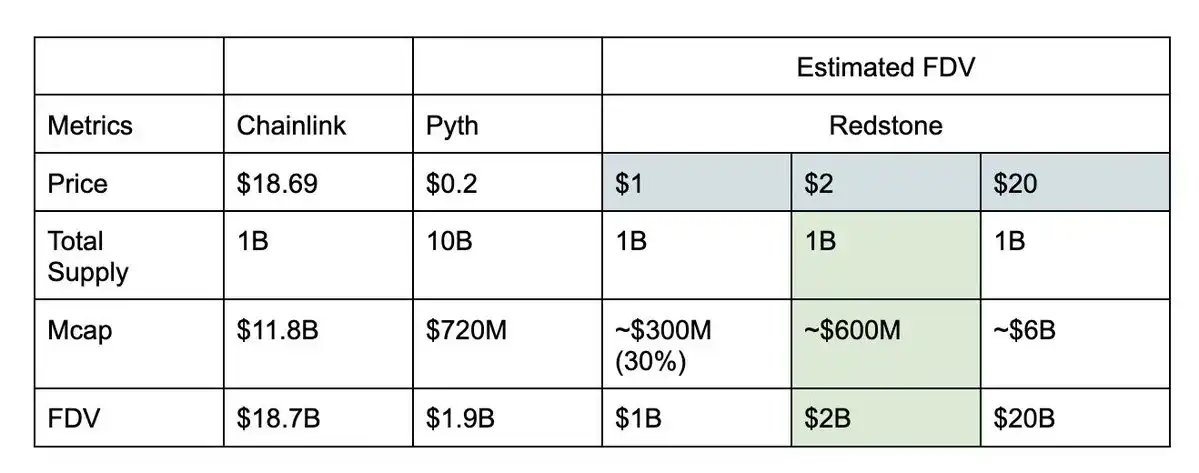

Leading oracle projects in the market have FDVs reaching billions of dollars. Referring to Pyth's current $2 billion FDV, the projected price for $RED is $2, corresponding to a circulating market value of $600 million.

The current price in the whale market is $1.5, and the pre-market price on Gate is $1.

Considering the recent market sentiment is not very high, it may be appropriate to lower expectations a bit; a reasonable opening price should be between $1 and $1.7.

However, with Binance introducing the limit up mechanism this time, it is uncertain whether it will have a significant impact on the price, which is quite interesting and worth observing! Perhaps some opportunities and patterns can be found.

Pre-market trading time: February 28, 2025, 18:00

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。