Overall, the 10% annualized BTC, ETH, and USDT 7-day fixed-term products launched by Huobi HTX can bring the highest estimated returns.

The recent incident where Bybit was hacked for nearly $1.5 billion shocked the entire cryptocurrency industry. In response to the trust crisis, several mainstream exchanges have successively increased the annualized interest rates for mainstream cryptocurrencies, especially ETH wealth management products, to boost user confidence in centralized exchanges.

At the same time, the cryptocurrency market is accelerating its downward trend. According to CoinGlass data, on February 25, the total liquidation amount across the network approached $1.15 billion. The volatile market significantly increases the trading risks for investors; rather than entering hastily, it is wiser to seek more stable hedging strategies. The newly launched high-yield wealth management products have become a good choice. Especially for holders of mainstream cryptocurrencies and users holding USDT on the sidelines, earning stable interest to hedge against cryptocurrency price losses while keeping cash on hand for the next bull market is clearly a more prudent approach.

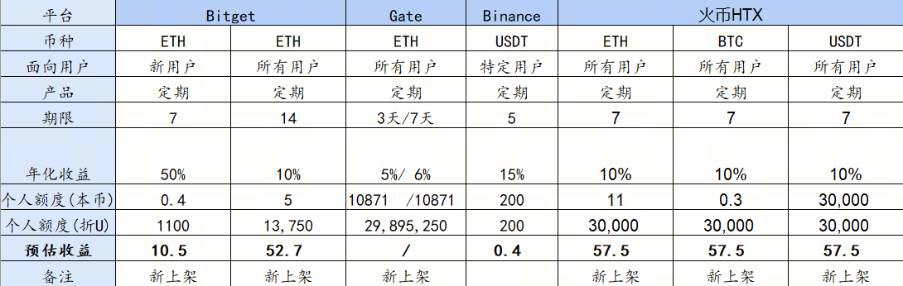

Recently, Binance, Huobi HTX, Bitget, and Gate have all launched new wealth management products. Each of the four exchanges has its own focus in terms of cryptocurrencies, annualized rates, and limits. Which one offers the most significant interest rate increase and the most sincerity?

Comparison of New Wealth Management Products

Overall, the 10% annualized BTC, ETH, and USDT 7-day fixed-term products launched by Huobi HTX can bring the highest estimated returns. Huobi HTX provides each user with a subscription limit of 30,000 USDT for three different products, enhancing the annualized interest rate while maintaining sufficient practicality. If a user fully subscribes to one of the 7-day fixed-term products, they will receive 57.5 USDT in returns upon maturity.

In addition, Huobi HTX is the only exchange among the four to launch a high-yield BTC wealth management product, excelling in product diversity.

Bitget's ETH 14-day fixed-term product has the same interest rate of 10% as Huobi HTX, but the limit is only 5 ETH, which is inferior to Huobi HTX's 11 ETH; its 7-day fixed-term ETH product boasts an annualized interest rate of up to 50%. However, this product is only available for new users, and the limit is just 0.4 ETH, resulting in an estimated return of only 10.5 USDT.

Gate also focuses on ETH products, with the annualized interest rates for the 3-day and 7-day fixed-term products raised to 5% and 6%, respectively. Although there is no limit, the annualized interest rates are lower compared to Huobi HTX and Bitget.

Binance has launched a limited-time activity for USDT, ETH, and SOL's flexible products, but compared to other exchanges, its ETH flexible product's interest rate is slightly less attractive, with a maximum of only 2.1%; the USDT flexible product has seen a significant increase in interest rates, adding a second tier compared to before the activity, with this part's yield at 4.15%. However, compared to other exchanges, Binance's USDT flexible product does not have a competitive interest rate.

Comparison of Stablecoin Flexible Products

In addition to the aforementioned wealth management products, the earning capacity of USDT flexible products is also an important indicator of the attractiveness of wealth management services across major exchanges. Binance's USDT flexible product has been mentioned above and will not be repeated here; Bitget and Huobi HTX's USDT flexible products are relatively close in level, with the former having a better interest rate, offering an annualized rate of 12.9% within the tier (500 USDT) and 4.9% outside the tier; the latter has a higher tier limit (1,000 USDT), with an annualized rate of 10% for the portion within the tier and 4% for the portion outside. Gate's current USDT flexible product has an annualized rate close to 4%, with an additional 10% annualized reward for amounts within 500 USDT.

In terms of other stablecoin flexible products, Binance's FDUSD and Bitget's USDC also have certain competitiveness; meanwhile, Huobi HTX is currently providing up to 20% annualized yield subsidies for the decentralized stablecoin USDD, making it a noteworthy stablecoin wealth management product.

Note: This article does not constitute investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。