Recently, the market has been volatile, with BTC briefly dropping below $83,000, a decline of 5.48%. The net outflow of Bitcoin ETF in the U.S. reached 10,391 BTC. Although market sentiment has reached extreme panic, some institutions have increased their BTC holdings at different levels of decline. By analyzing on-chain data and position reports, we can observe some interesting market phenomena and gain insights into the strategy changes of institutional investors.

On February 17, BTC fell below $96,000, and El Salvador no longer adhered to the rule of accumulating 1 BTC daily, instead accumulating about 1.6 BTC per day. Since December 22, 2024, the government has purchased a total of 93.417 BTC at an average price of $98,579, currently holding 6,081 BTC (approximately $579.9 million).

Related: The board of a Hong Kong investment company approves the purchase of more Bitcoin.

On February 19, Grayscale Bitcoin Trust increased its holdings by 66.467 BTC.

On February 20, Japanese listed company Metaplanet increased its holdings by 68.69 BTC, currently holding 2,100 BTC, which accounts for 0.01% of the total BTC supply.

On February 22, BTC fell below $95,000, and Bitdeer increased its holdings by 50 BTC, bringing its total holdings to 911 BTC.

On February 25, BTC fell below $91,000, and Metaplanet again increased its holdings by 135 BTC, raising its total to 2,235 BTC.

In the early hours of February 25, El Salvador increased its holdings by 7 BTC during the decline, bringing its total to 6,088.18 BTC. Over the past 30 days, El Salvador's account has increased by a total of 41 BTC.

On February 26, Bitcoin rewards financial service company Fold announced an increase of 10 BTC.

Large institutions are increasing their holdings, and the Trump administration's friendly attitude towards cryptocurrencies, along with some countries facing fiat currency devaluation, are also increasing their reserves of BTC. This indicates that BTC is gradually detaching from the cryptocurrency circle and becoming a value storage tool for institutional investors, with reduced correlation to other crypto assets.

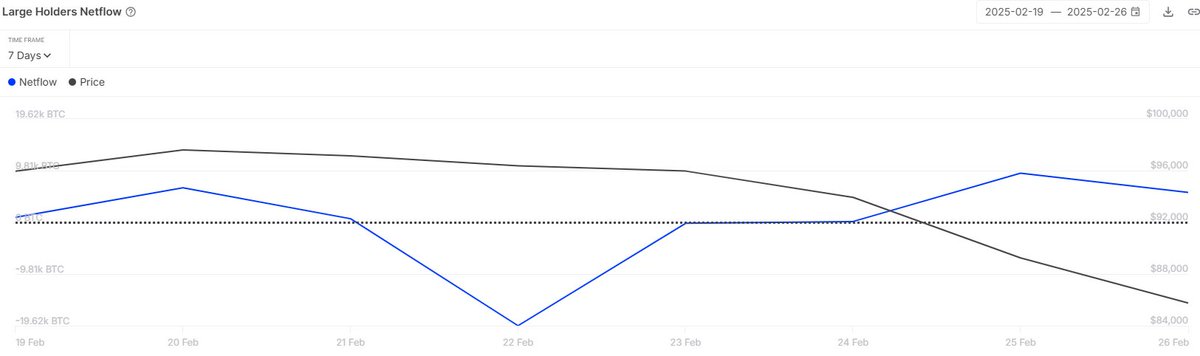

According to IntoTheBlock data, wallets holding at least 0.1% of the circulating supply have increased their total balance by nearly 15,000 BTC, with purchase prices below $90,000.

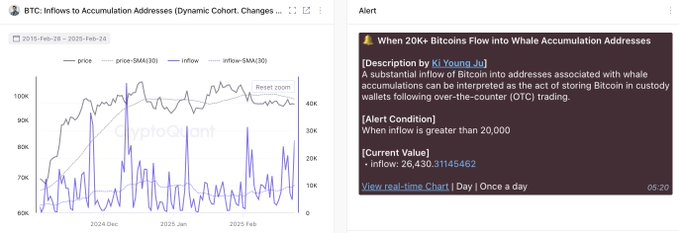

According to CryptoQuant data, whales are buying during the market downturn, with 26,430 BTC flowing into whale accumulation addresses.

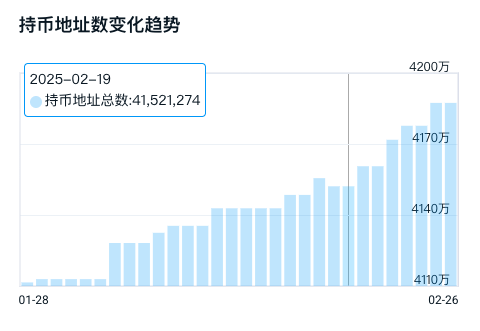

According to statistics from Nonce, the number of BTC holding addresses has been continuously rising since February 19, increasing from 41.52 million to 41.87 million, with an increase of over 350,000 in 7 days. From February 24 to 25, during the market decline, there was a surge of over 100,000 addresses.

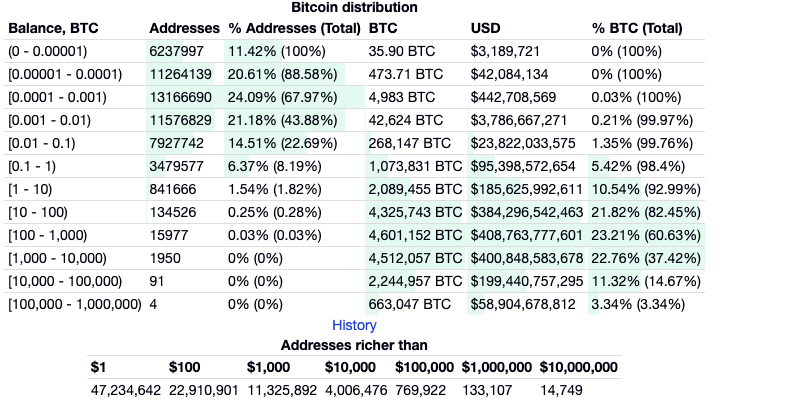

According to bitinfocharts data, the number of addresses holding 1,000 to 10,000 BTC has reached 1,950, setting a historical high. This data indicates that more and more investors are holding Bitcoin for the long term.

On February 26, market data showed that U.S. Treasury yields across all maturities plummeted yesterday. The 2-year Treasury yield fell by 7.41 basis points to 4.0921%, the 5-year Treasury yield fell by 10.07 basis points to 4.1292%, and the 10-year Treasury yield fell by 10.38 basis points to 4.2926%. The 30-year Treasury yield fell by 9.84 basis points to 4.5557%. Against the backdrop of an inverted yield curve, institutional investors are beginning to allocate to crypto assets to cope with uncertainties in traditional markets.

The Bitcoin MVRV ratio has fallen below 1.0, entering a historical bottom zone. This technical indicator suggests that Bitcoin may be undervalued.

Note: MVRV (Market Value to Realized Value) is a metric that measures Bitcoin's market valuation, calculated as MVRV = Market Cap / Realized Cap. A higher MVRV ratio indicates a higher market valuation, which may suggest a bubble; a lower MVRV ratio indicates a lower market valuation, which may suggest undervaluation.

Additionally, Bitcoin ETF applications from institutions like BlackRock have driven the behavior of institutional investors to increase their holdings.

The changes in the behavior of institutional investors in the Bitcoin market reflect their long-term interest in Bitcoin. With the continued attention from institutional investors, the Bitcoin market may experience new changes.

Related: Hong Kong regulators unveil the "ASPIRe" roadmap, aiming to become a global cryptocurrency center.

Cointelegraph Chinese official channels

Telegram Community: https://t.me/cointelegraphzh

Telegram Channel: https://t.me/cointelegraphzhnews

X (Twitter): https://x.com/zhcointelegraph

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。