Cryptocurrency is a game for the brave.

Written by: Pzai, Foresight News

The sentiment of panic in the crypto market is spreading. According to data from Alternative.me, on February 27, the cryptocurrency Fear and Greed Index dropped to 10, the lowest since June 2022, indicating that the market is in a state of "extreme fear." As of the time of writing, Bitcoin has fallen below the $80,000 mark, reaching a new low since November 2024; seeing this situation, Strategy CEO Michael Saylor tweeted: "If you need money, sell a kidney and keep your Bitcoin."

On February 27, U.S. President Trump reiterated on social media that tariff measures against Mexico and Canada will be implemented on March 4, and the looming tariffs are raising concerns about a "trade war" as the dollar strengthens, increasing uncertainty about the economic outlook and heightening investors' risk-averse sentiment. Additionally, a South Dakota lawmaker postponed a vote that could allow the state to invest in Bitcoin, adding further uncertainty to the policy outlook for cryptocurrencies in the U.S.

Aside from the cryptocurrency market, Asian stock markets have also been hit hard: the blue-chip Nikkei index fell by as much as 3.7%, marking the largest intraday drop since September last year. Foreign investors net sold KOSPI stocks worth 1.55 trillion won on Friday, the largest single-day sell-off since January 27, 2022.

Market Performance

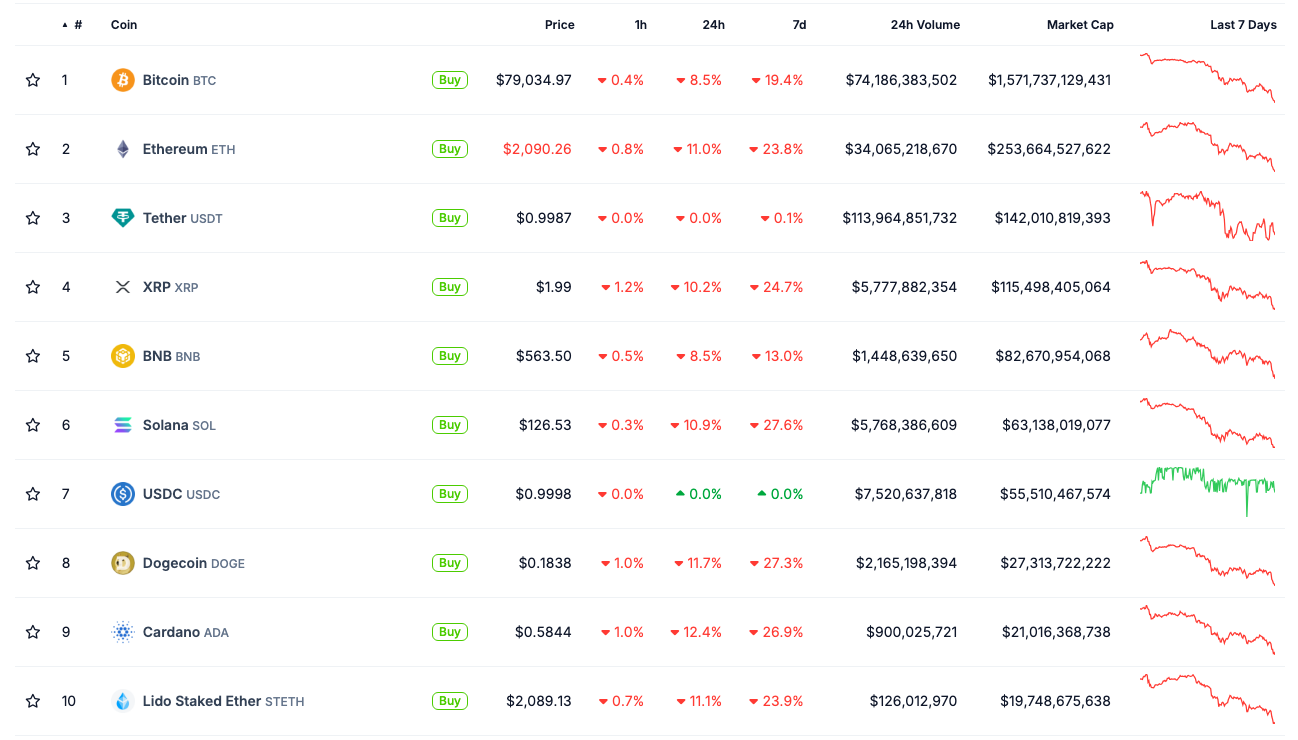

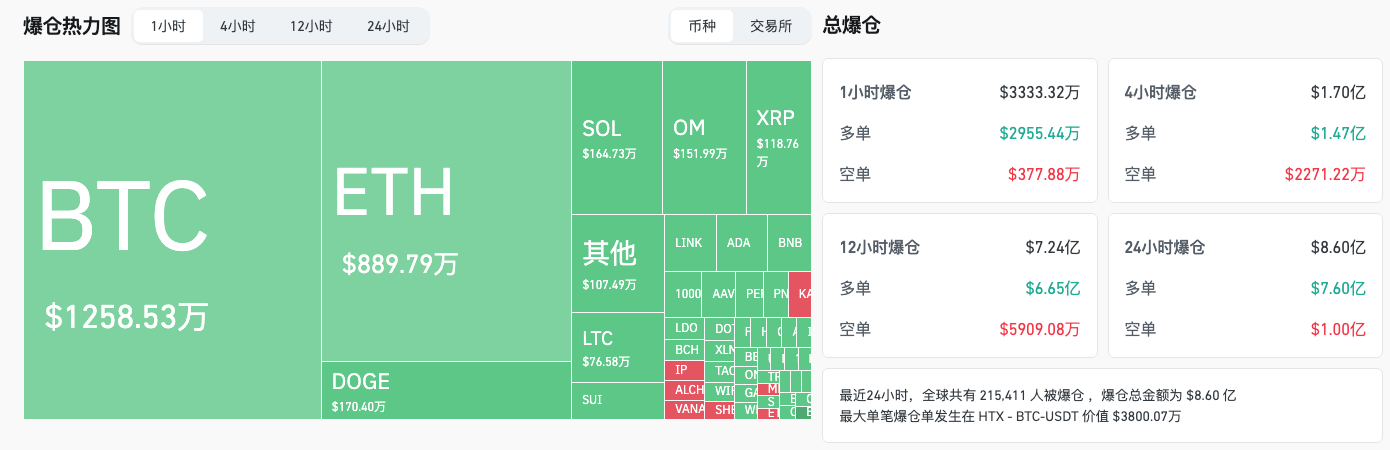

This week, the global cryptocurrency market has evaporated over $800 billion, dropping below $3 trillion. Ethereum is approaching the $2,000 mark, reaching a new low in nearly a year. Such a volatile market has also led to a total liquidation of $860 million across the network in 24 hours. In terms of mainstream coin performance, the top ten crypto assets saw an average weekly decline of over 20%. Solana has fallen from a new high of $293 on January 19 to $126, and DOGE has also dropped below $0.2 to $0.18.

In the ETF market, the recent decline has manifested as a significant outflow of funds, with major Bitcoin spot ETFs experiencing a net outflow of $1.14 billion on February 25. Overall, cryptocurrency ETFs saw a fund outflow of $544 million last week, indicating that pessimistic sentiment is spreading in the market. Since the Bybit theft incident, concerns regarding asset custody have raised worries among some industry insiders, potentially contributing to the intensified outflow of funds.

Image source: SoSoValue

Market Views

From a market perspective, Matt Hougan, Chief Investment Officer of cryptocurrency asset management firm Bitwise, summarized the previous market performance: "Cryptocurrency is currently digesting the end of the MEME coin craze. The market will continue to be dragged down until institutional interest in cryptocurrencies recovers."

CryptoQuant CEO Ki Young Ju tweeted that Bitcoin will remain in a range for a while, stating, "I think we might see a long-term consolidation in a wide range (e.g., $75,000 to $100,000), similar to early 2024. This situation may last until good news for Bitcoin brings new liquidity."

Arthur Hayes, co-founder of BitMEX, tweeted, "The current downtrend is continuing to decline. This morning (February 28), I intended to increase risk (positions), but based on the price trend, I believe we will face another wave of sharp declines below $80,000, likely over the weekend, and it will last for a while." Previously, on February 25, he predicted that Bitcoin's price could drop to $70,000.

Geoff Kendrick, an analyst at Standard Chartered, stated that Bitcoin could drop 10% to $80,000, but a decline in government bond yields could lead to a rebound. He pointed out that $90,000 is a key support level for Bitcoin, and although Bitcoin's price has remained above this support level due to favorable policies from the Trump administration, the appeal of cryptocurrencies has been weakened as expectations for the fulfillment of presidential commitments slow down and macroeconomic uncertainty rises.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。