Organized by: Jerry, ChainCatcher

Important News:

- U.S. SEC announces it has lifted the civil enforcement action against Coinbase

- Insiders: BitMEX seeks to sell, has hired investment bank Broadhaven to assist with the transaction

- SEC Commissioner: Dismissal of the case against Coinbase does not mean abandonment of enforcement, future regulation will focus on policy-making

- U.S. SEC characterizes: Memecoins are not securities, investors must bear their own risks

- Vitalik: Loss of crypto assets is not only due to theft but also loss; social recovery mechanisms should be promoted

- Zhao Changpeng: Corrections are part of a free market; if feeling pressure, reduce investment scale

- RED opens at 0.4 USDT in Binance Pre-Market, hitting the first-day limit up

“What important events occurred in the past 24 hours”

U.S. SEC announces it has lifted the civil enforcement action against Coinbase

The U.S. Securities and Exchange Commission (SEC) announced that it has lifted the civil enforcement action against Coinbase (COIN.O).

The case dates back to June 2023 (two years after Coinbase's listing), when the SEC sued Coinbase, accusing it of merging the typically separate functions of broker, exchange, and clearinghouse, violating U.S. securities laws.

Insiders: BitMEX seeks to sell, has hired investment bank Broadhaven to assist with the transaction

According to CoinDesk, the crypto trading platform BitMEX is seeking to sell and has hired boutique investment bank Broadhaven Capital Partners to assist with the sales process at the end of last year. BitMEX, established in 2014, is known for launching perpetual contract trading. Insiders revealed that the exchange is looking for buyers, which is expected to spark interest in mergers and acquisitions in the industry.

Currently, the crypto derivatives market is actively consolidating, with Kraken and Coinbase competing to acquire Deribit, while FalconX has acquired Arbelos Markets to expand its derivatives business. BitMEX was previously charged in 2020 for insufficient anti-money laundering measures and later pleaded guilty. Co-founders Arthur Hayes, Ben Delo, and Samuel Reed subsequently resigned.

SEC Commissioner Hester M. Peirce issued a statement saying that the SEC has officially dismissed the civil enforcement lawsuit against Coinbase and will not take further action on the case. Peirce made it clear that she never supported the case and criticized the SEC's previous reliance on enforcement actions to regulate the crypto industry, arguing that it harmed the public interest in the U.S., hindered industry development, and obstructed the normal functions of the SEC's professional policy team.

Peirce pointed out that the SEC's broad application of the Howey test has led to regulatory ambiguity, making it difficult for compliant companies to operate while wrongdoers exploit regulatory gray areas to evade legal responsibility. Additionally, due to the lack of a clear regulatory framework, many crypto companies are forced to spend significant resources on legal responses rather than product innovation. She believes that the SEC's previous approach of making policy through enforcement not only misled the industry but also prevented the policy team from effectively participating in the formulation of industry rules.

She emphasized that the SEC has now established a "Crypto Task Force," empowering the policy team to take the lead in collaborating with the public to develop a regulatory framework applicable to the crypto industry. The dismissal of the case does not mean the SEC is abandoning enforcement but indicates that future regulation will focus on policy-making rather than solely relying on enforcement actions.

U.S. SEC characterizes: Memecoins are not securities, investors must bear their own risks

The SEC's Division of Corporation Finance has issued guidance on memecoins, stating that they are not considered securities but are akin to collectibles.

The division believes that the trading of memecoins described in the guidance does not involve the issuance and sale of securities as defined by federal securities laws. Therefore, individuals participating in the issuance and sale of memecoins are not required to register their transactions with the commission under the Securities Act of 1933, nor do they need to comply with the registration exemption provisions in the Securities Act. As a result, buyers or holders of memecoins are not protected by federal securities laws.

Ethereum co-founder Vitalik Buterin reminded that many users' losses of crypto assets are not due to theft but rather due to software vulnerabilities, forgotten passwords, lost devices, accidental destruction of paper wallets, and other reasons.

He pointed out that since there are no attackers to hold accountable, many victims are ashamed to discuss these losses, but such incidents occur frequently in reality. Vitalik emphasized that the security solutions for crypto wallets should also consider the issue of asset loss and called for the promotion of social recovery mechanisms to reduce permanent losses of assets due to personal errors.

Zhao Changpeng: Corrections are part of a free market; if feeling pressure, reduce investment scale

Zhao Changpeng stated, "Corrections are part of a free market; this is not financial advice. If you feel pressure from this, you may need to reduce your investment scale (if you view cryptocurrency as an investment). For me, this is a shift in worldview. I exited the old world 11 years ago."

RED opens at 0.4 USDT in Binance Pre-Market, hitting the first-day limit up

RedStone (RED) has opened for trading in the Binance Pre-Market, currently priced at 0.4 USDT, hitting the first-day limit up.

Previous news indicated that the Binance pre-market trading market has introduced a limit-up mechanism. The limit-up mechanism will restrict the highest trading price in the pre-market for the first 72 hours, with the token price increase not exceeding a certain percentage of the initial opening price. After 72 hours of the pre-market opening, there will be no price restrictions, and trading will return to normal.

Currently, this mechanism only applies to RED, with the limit-up restrictions for the first three days set at 200%, 300%, and 400% of the opening price.

“What are some interesting articles worth reading in the past 24 hours”

Creating nearly 30 million tokens in two years, crypto is a huge "token factory"

Exit or wait for an opportunity? Where should the first shot of reform be aimed?

What charm does the rising star of the points trading market, Rumpel, possess?

Its operation resembles a blockchain version of traditional P2P lending.

Nearly 15 large mergers occur each month.

Jack Ma's close friend launched an NFT, what is the entity behind Paradise valued at 33 SOL?

In garbage time, one must find something to do.

These platforms mainly focus on Solana, with unique business models showcasing innovative attempts in security, gameplay diversity, and accessibility, but the core still revolves around MEME.

Meme Popularity Rankings

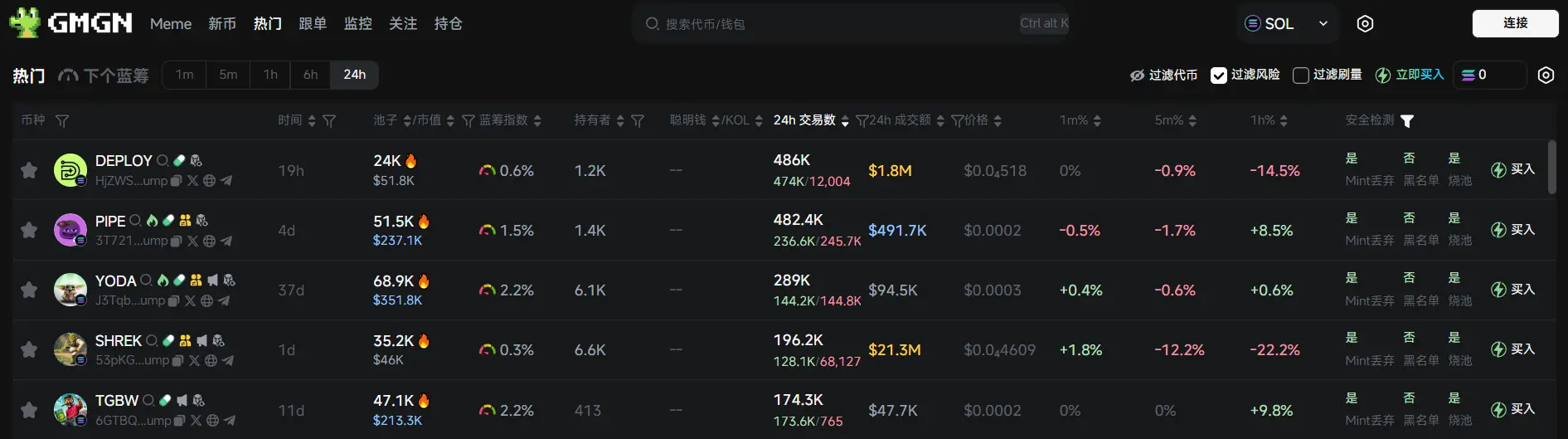

According to the meme token tracking and analysis platform GMGN, as of February 28, 19:50:

The top five popular Ethereum tokens in the past 24 hours are: SPX, MKR, BID, KEKIUS, LINK

The top five popular Solana tokens in the past 24 hours are: DEPLOY, PIPE, YODA, SHREK, TGBW

The top five popular Base tokens in the past 24 hours are: VIRTUAL, KAITO, EURC, USD+, SHREK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。