Yield-bearing stablecoins may rise, and "domestic" cryptocurrencies in the U.S. will benefit from policy dividends.

Written by: Poopman

Translated by: Luffy, Foresight News

I am a cryptocurrency enthusiast who was fortunate enough to profit from Memecoin investments. Now, I am exploring reliable investment opportunities for 2025 so that I can explain to my father that I am engaged in a serious industry. You won't find any statistics or charts in this article, just intuition and brainstorming.

Therefore, this article is merely my personal shallow insights into the market and does not represent any views of my team. I will mention the following topics in the article:

- The cryptocurrency market in 2024

- The development direction after the Memecoin craze

- Areas I will focus on if the crypto market continues to be bearish in 2025

2024: The Year of Bitcoin and Solana

2024 will be a brutal year for cryptocurrency investors, unless you are a staunch Bitcoin maximalist and holder. Venture capital firms, liquid funds, long-term holders (diamond hands), and true believers have all been severely impacted, and with the explosion of artificial intelligence, the future of cryptocurrency looks even bleaker.

Bitcoin reaches $100,000, Bitcoin exchange-traded funds (ETFs) are approved, Bitcoin's market dominance reaches 60%, and the pace of traditional finance's adoption is accelerating. 2024 is undoubtedly the year of Bitcoin.

Solana is another main character. At its peak, the daily trading volume of the SOL token reached $36 billion, accounting for about 10% of Nasdaq's daily trading volume, which is a huge number for the cryptocurrency space. Memecoins and AI concept coins contributed to this boom.

Hyperliquid is a dark horse in this market. They made a bold move by rejecting venture capital funding, and their user adoption after the token airdrop proves that there is a strong demand for perpetual trading platforms with sufficient liquidity that do not require real-name authentication.

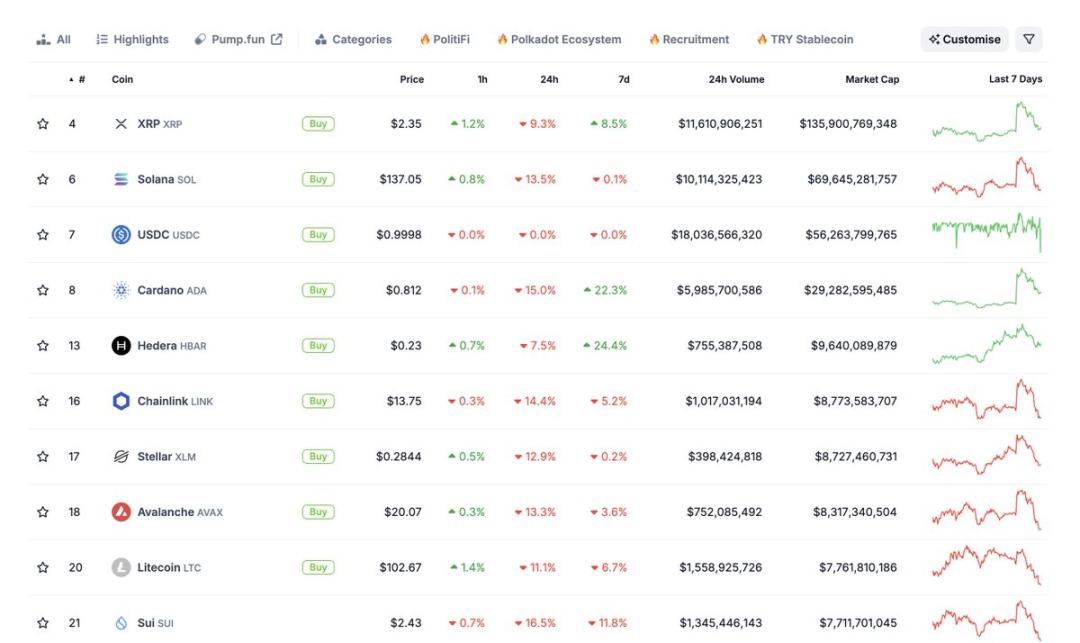

Some established cryptocurrencies like XRP and ADA seem to have gained favor with Uber drivers and the U.S. government.

Beyond that, I can't recall any other price increases in this market that lasted more than two weeks.

2025: From Casino-like Speculation to New Decentralized Finance and Domestic Cryptocurrencies

After the cryptocurrency craze related to Trump subsided, I noticed that profits in the market did not flow back into AI tokens. So, I converted all my assets into stablecoins, except for a portion of my SOL position (which may be foolish).

It has become increasingly evident that after months of intense PVP, people are exhausted by the "nihilistic products" of Memecoins and AI concepts.

The entire AI cryptocurrency sector is rapidly collapsing, with most tokens down 70% to 80% from their peak. The Libra coin incident has effectively sealed the fate of this concept.

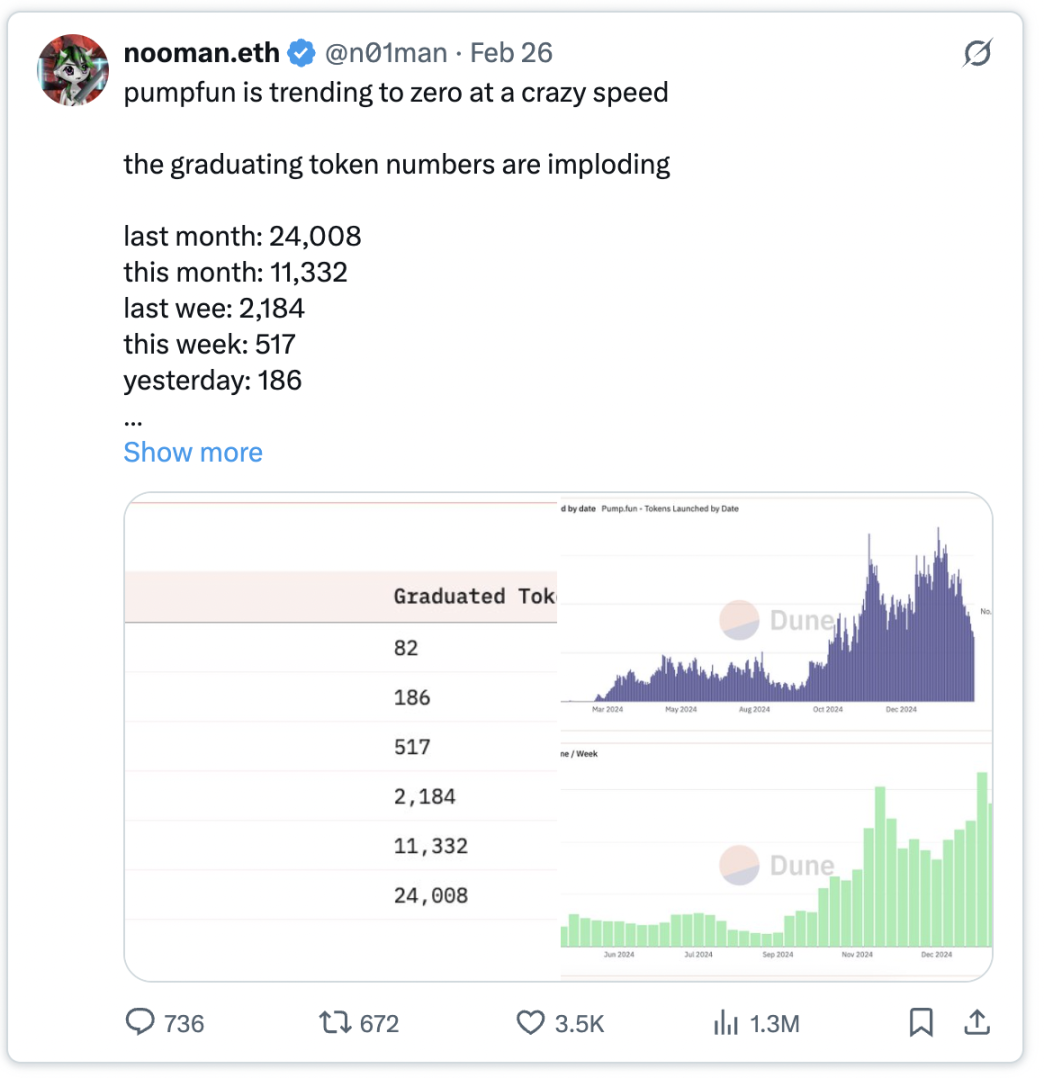

In short, Pump.fun is heading towards a decline.

The number of new Memecoins launched and graduated on Pump.fun is significantly decreasing.

So, where is the money in the Memecoin sector flowing to?

In the absence of foreseeable catalysts in the Memecoin sector, the wealth effect is fading, creating a vicious cycle that drives investors away from this "casino."

Meanwhile, in today's cryptocurrency market:

- There is a lack of groundbreaking innovation in the cryptocurrency space.

- Existing altcoins continue to stagnate, and Ethereum is also in trouble.

- Fundamentals have suddenly become irrelevant.

- Established Memecoins have already perished.

- The survival rate of newly listed tokens is very low, with only a few surviving more than two weeks.

This sounds very bleak, right?

In this context, I believe investors' strategies will lean more towards "risk aversion," which is why I believe that most funds will flow into stablecoins backed by fiat currency in 2025. Moreover, some investors hope to leverage their assets to earn some passive income from stablecoins.

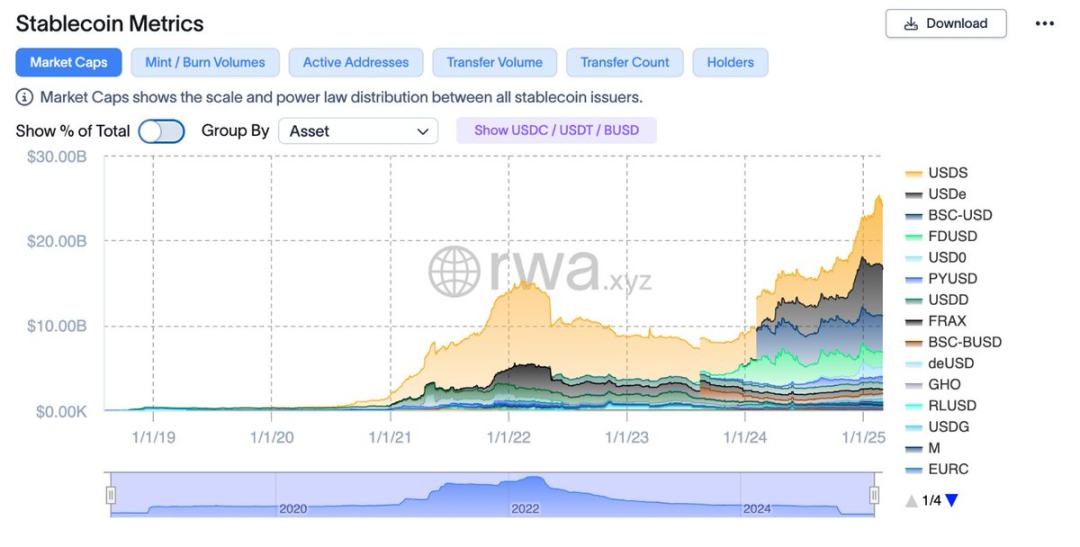

Therefore, yield-bearing stablecoins like USDe or USDS will be very attractive to them.

Stablecoins are the new oil.

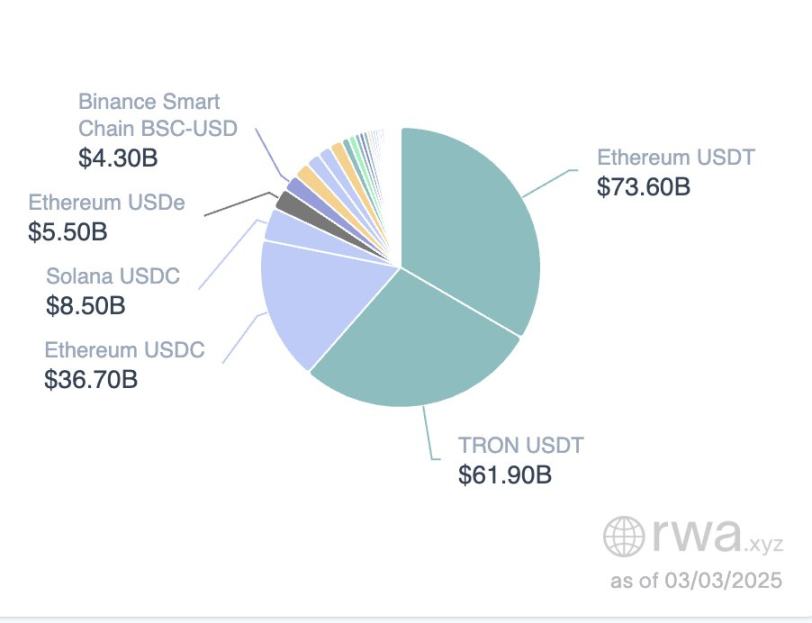

The market segmentation of stablecoins, source: https://app.rwa.xyz/stablecoins

As both the AI and Memecoin markets suffer heavy blows, the total value locked (TVL) in stablecoins continues to grow steadily, increasing by 3% each month. As I write this, the total locked value has exceeded $220 billion.

Investors seeking asset safety will choose stablecoins backed by fiat currency. USDT and USDC account for 90% of the market share, and their dominance is nearly unshakeable due to their widespread adoption across various exchanges and payment platforms.

Investors looking to earn from stablecoins will opt for decentralized stablecoins that can generate yield. For example, USDe, USDS, DAI, USD0, etc. So far, this sector only occupies about 10% of the market share, but it has actually had a very impressive year, with total locked value growing by over 70%.

Alright, I won't ramble on anymore. The current landscape of the stablecoin market is:

- 90% fiat-backed stablecoins

- 10% yield-bearing stablecoins

I believe there is still room for growth for new (yield-bearing) stablecoins for the following reasons:

- Yield-generating "low-volatility options" are always attractive to cryptocurrency investors.

- Innovations may emerge in new stability mechanisms and strategies to improve capital efficiency for higher yields.

- Stablecoins have found a product-market fit (PMF) in the cryptocurrency space, serving both as currency and investment tools.

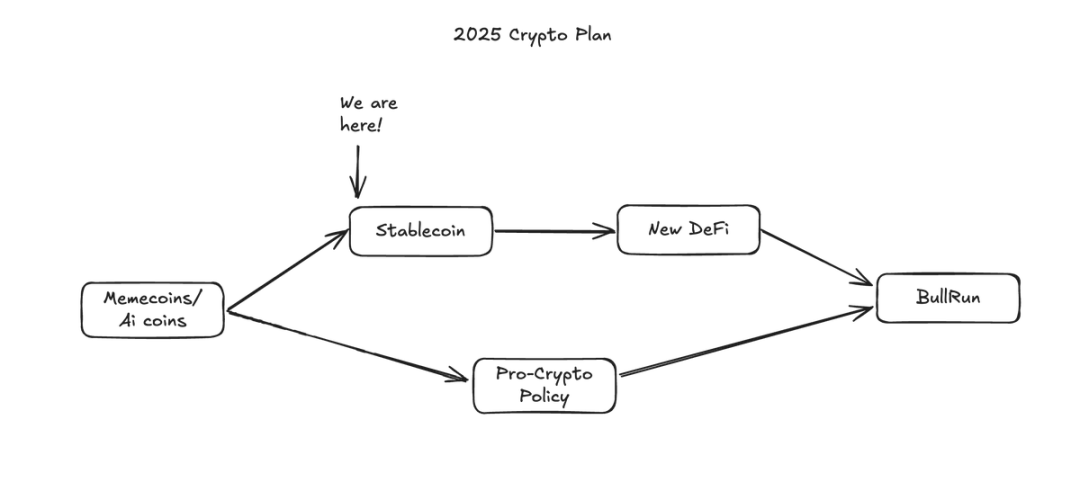

Thus, this forms my cryptocurrency investment plan for 2025.

If the market continues to be bearish in 2025, how will I invest in cryptocurrency?

If 2025 still lacks innovation or new narratives, I believe the market will have two development directions:

- New decentralized finance innovations driven by the growing stablecoin market

- Crypto-friendly policies that promote the development of "domestic" cryptocurrencies

Stablecoins and New Decentralized Finance Innovations

In the next 3 to 6 months, more and more stablecoins will be launched as dollar-based tokenization strategies aimed at generating competitive yields through different types of collateral or strategies.

Given the composability and "price stability" of stablecoins, they can easily collaborate with various decentralized finance protocols and create synergies.

Examples of existing decentralized finance integrations include:

- Products related to interest rate swaps like Pendle and Spectra, which have excellent designs that allow users to speculate on asset yields, effectively creating new markets for yield-bearing assets (including stablecoins).

- Money markets like Morpho and Fluid, which enable leveraged yield farming, bringing significant economic activity to stablecoins.

- Decentralized exchanges like Curve also provide a great venue for launching liquidity for stablecoin trading pairs, and so on.

Among all these innovations, my favorite are those that create new asset classes. For example, Pendle's YT-USDe, which creates a new market based on yield "building blocks," providing an additional layer of yield for investors who favor stablecoins.

In addition to yield optimization, I also hope to see some innovations in the design of collateralized debt positions, especially ideas that can eliminate over-collateralization and minimize liquidation risks, allowing decentralized stablecoins to thrive again.

After all, I look forward to seeing more innovations in the growing stablecoin market, as this is the area where more and more funds will flow into.

Crypto-Friendly Policies Promoting Domestic Cryptocurrency Development

Recently, Trump announced an attempt to advance a cryptocurrency strategic reserve plan, which includes a basket of "domestic" cryptocurrencies such as Solana (SOL) and Ripple (XRP).

Trump announced his executive order on digital assets directing the presidential task force to advance a cryptocurrency strategic reserve plan, which includes XRP, SOL, and ADA.

While it remains uncertain whether the cryptocurrency reserves will receive government approval, Trump's influence on the cryptocurrency market cannot be ignored.

Some examples of Trump's support for cryptocurrencies include:

- Firing former SEC Chairman Gary Gensler on his first day in office.

- Retaining all Bitcoin seized by the U.S. to establish a "national Bitcoin strategic reserve" (e.g., Bitcoin seized from Silk Road).

- Launching the WiFi DeFi fund and issuing Trump Memecoin, which aligns very well with the native characteristics of cryptocurrency.

- The SEC withdrawing charges against exchanges and cryptocurrency projects, such as those against Coinbase, Uniswap, Kraken, etc.

Additionally, Trump's team is likely to support the domestic cryptocurrency industry. Therefore, we can expect more favorable regulatory policies for domestic cryptocurrency portfolios or groups.

This is not investment advice, but due to Trump's significant influence, I will closely monitor these tokens.

Summary

As mentioned earlier, this is merely an article based on personal brainstorming and intuition, and the views expressed are not supported by statistical data, so please do not take it as insider investment information.

Nevertheless, I have prepared a summary of the core points for readers who are unwilling to read a lengthy article:

- Given the lack of innovation in cryptocurrency and the overall market's lack of vitality, if the market remains "bearish" in 2025, I expect demand for stablecoins to increase.

- Assuming investors wish to leverage their stablecoins for yield, I estimate that yield-bearing stablecoin products will significantly grow in the long term, potentially capturing 20% to 30% of the total stablecoin market share (similar to Ethereum's beacon chain staking derivative token stETH).

- This growing stablecoin market will attract more developers and builders, potentially giving rise to new decentralized finance fundamentals originating from this ecosystem.

- Trump's supportive policies for cryptocurrency will be beneficial for the market in the long run. Additionally, his policies may favor the development of domestic cryptocurrencies in the U.S.

Therefore, paying attention to some domestic cryptocurrencies in the U.S. is particularly meaningful, as certain related "news" could cause these tokens' prices to soar.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。