Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

In the early hours of today, the U.S. White House Crypto Summit officially kicked off, with the White House providing about 25 minutes of live coverage. Despite high expectations from the outside world, the live content did not reveal any new policies or significant information.

U.S. President Trump’s speech at the summit was relatively brief, serving more as an opening host. The remarks from attendees were mostly ceremonial, focusing on the progress of crypto policies since the Trump administration took office and expressing support for Trump himself.

Although the summit temporarily lacked substantial policy updates, the market is still closely watching for potential signals behind it. This article will summarize all the noteworthy information from the summit and focus on reviewing the interview content of White House AI and Crypto Director David Sacks prior to the summit.

Summit Agenda: Focusing on Policy Vision and Industry Standards

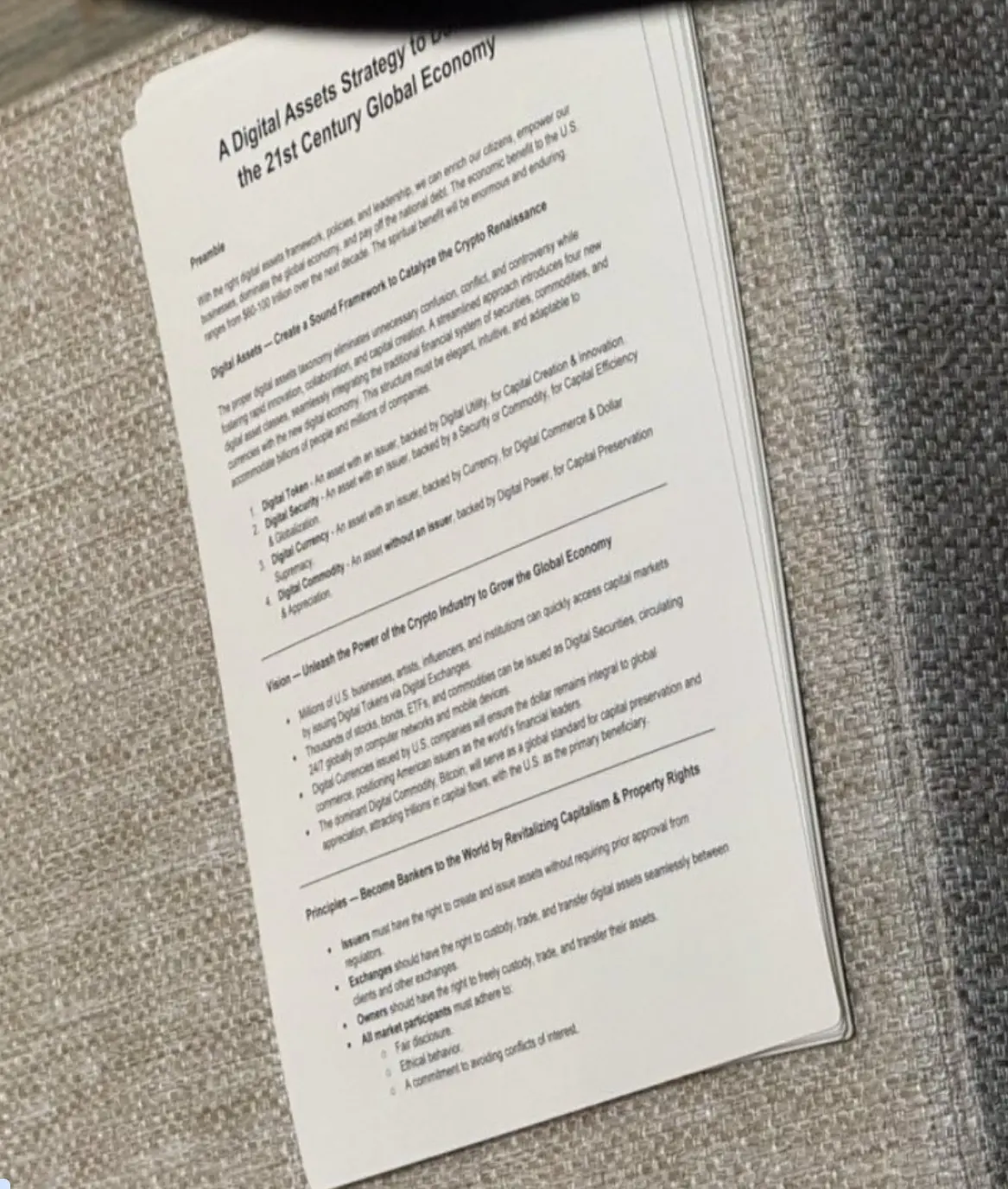

According to Fox reporter Eleanor Terrett, the summit agenda primarily revolves around digital asset terminology, policy vision, and goals for educational purposes.

The core objectives include:

- “Establish a sound framework to promote crypto revival.”

- “Unlock the potential of the crypto industry to foster global economic growth.”

- “Become the world’s banker by revitalizing capitalism and property rights.”

Additionally, the bottom of the agenda emphasized industry standards, requiring all market participants to adhere to fair disclosure principles, uphold ethical behavior, and commit to avoiding conflicts of interest.****

Focusing on Overturning Biden Policies, No Tax Issues

Senior White House officials confirmed before the meeting that this summit would not involve tax issues, but rather focus on overturning unfavorable policies of the Biden administration.

The official stated that the summit aims to provide a platform for industry leaders to give regulatory feedback, emphasizing: “The president promised during his campaign to form a cryptocurrency committee, and he wants to hear suggestions and feedback from the industry, which is the core purpose of the summit.”

Stablecoin Legislation Goal: Plan to Complete Before August Congressional Recess

At the summit, Trump stated he would push for stablecoin legislation and plans to complete it before the August congressional recess. The initial goal was to submit the legislation within the first 100 days of his term, but this timeline has now been extended by four months.

U.S. Treasury Secretary Scott Bessent stated at the meeting: “We will conduct an in-depth examination of the stablecoin system. As President Trump has indicated, the U.S. will maintain its position as the global dominant reserve currency and utilize stablecoins to achieve this goal.”

Trump Calls for Ending “Operation Choke Point 2.0”

Trump not only discussed stablecoin legislation but also expressed views on the issue of de-banking, calling for an end to the policy known as “Operation Choke Point 2.0.”

Trump stated at the summit: “They (the Biden administration) are forcing banks to close the accounts of crypto businesses and entrepreneurs, effectively hindering certain fund transfers to and from exchanges, and weaponizing the government against the entire industry.” He added: “But I also deeply empathize, perhaps more than you all understand.”

Meanwhile, the Office of the Comptroller of the Currency is withdrawing guidance issued in 2020 that restricted banks' interactions with the crypto industry and prohibited banks from custodying crypto assets. The withdrawal of this policy is a long-awaited signal for the crypto industry and banks, which may encourage banks to engage more actively in the digital asset space.

ADA, SOL, etc. Mentioned Only Due to Their Top Five Market Capitalization, Trump’s Crypto Projects and Policies Unrelated

Before the White House crypto summit began, White House AI and Crypto Director David Sacks stated in an interview that Bitcoin holds significant strategic importance for the U.S. due to its scarcity and long-term store of value.

When discussing strategic Bitcoin reserves and digital asset reserves, he mentioned that ADA, SOL, and XRP were referenced because they rank in the top five by market capitalization, and this does not indicate any special preference or policy inclination from the government towards these assets.

In response to concerns about potential policy conflicts of interest regarding Trump’s personal crypto assets (such as meme coins), Sacks clearly stated that these projects are “unrelated” to government crypto policy and will not affect industry regulation. He further clarified: “This will not have any impact and is unrelated to our work.”

No Plans to Sell Gold to Purchase Bitcoin

When asked whether Trump has personal investments in Bitcoin or other crypto assets, Sacks sharply refuted, stating: “There is no evidence to support these claims.”

Regarding whether the U.S. would sell gold or other reserve assets to purchase Bitcoin, Sacks stated that the Trump administration has not yet discussed this, but the Treasury and Commerce Departments may weigh this option in the future, with the final decision still resting with these two agencies.

As the crypto industry rapidly develops and market demand grows, the interaction between the government and the industry will become increasingly important. Although the White House crypto summit did not bring direct breakthroughs at the policy level, it indeed provided an important dialogue platform for the crypto industry. In the future, finding a balance between regulatory compliance and industry innovation remains a key challenge.

ChainCatcher will continue to monitor the disclosure of information related to the summit, as well as subsequent policy trends and industry developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。