Author: Nianqing, ChainCatcher

Editor: TB, ChainCatcher

In August last year, a hasty and massive sell-off by Jump Trading pushed the crypto market into a deep abyss, further triggering the "805 crash." At that time, rumors about "this big guy" Jump collapsing grew increasingly intense.

In the six months that followed, the few news reports about Jump were almost entirely centered around its internal and external lawsuits and legal battles.

Recently, CoinDesk cited informed sources reporting that Jump is currently fully restoring its cryptocurrency business. The Jump Trading official website shows that Jump is recruiting a group of cryptocurrency engineers for its offices in Chicago, Sydney, Singapore, and London. Additionally, another insider added that Jump plans to begin filling U.S. policy and government liaison positions at the appropriate time.

Jump was once referred to as the "absolute king" of the trading world. With ultra-low latency trading systems and complex algorithm designs, Jump became one of the key liquidity providers in traditional finance. As the scale of the crypto market continued to expand, Jump began to market cryptocurrencies and invest in crypto projects, officially establishing its crypto business division, Jump Crypto, in 2021.

However, the gamble that accompanied the birth of Jump Crypto also laid the groundwork for its later tragedy.

The Rise and Fall of Jump Trading: The Secretive Giant's Crypto Gamble

In the early days, traders in the trading hall would call out prices through shouting, gestures, and jumping. This was also the inspiration behind the name Jump Trading.

Headquartered in Chicago, Jump Trading was founded in 1999 by two former Chicago Mercantile Exchange (CME) floor traders, Bill DiSomma and Paul Gurinas. Jump quickly grew to become one of the largest high-frequency trading firms in the world, active in futures, options, and securities exchanges globally, while also being a major trader of U.S. Treasury bonds and cryptocurrencies.

Due to the need to protect trading strategies, Jump has always maintained a low profile, and as a market maker, it has always operated behind the scenes, shrouded in a layer of mystery. Jump rarely discloses its financial data, and its founders have kept tight-lipped about its operational status. Since 2020, perhaps to reduce exposure, Jump adjusted its strategy and business restructuring, no longer needing to submit 13F filings to the SEC, instead continuing to submit them through its parent company, Jump Financial LLC. According to the latest 13F filing submitted by the latter, Jump Financial's assets under management exceed $7.6 billion, with approximately 1,600 employees. Additionally, Jump Trading has offices in the U.S., Europe, Australia, and Asia.

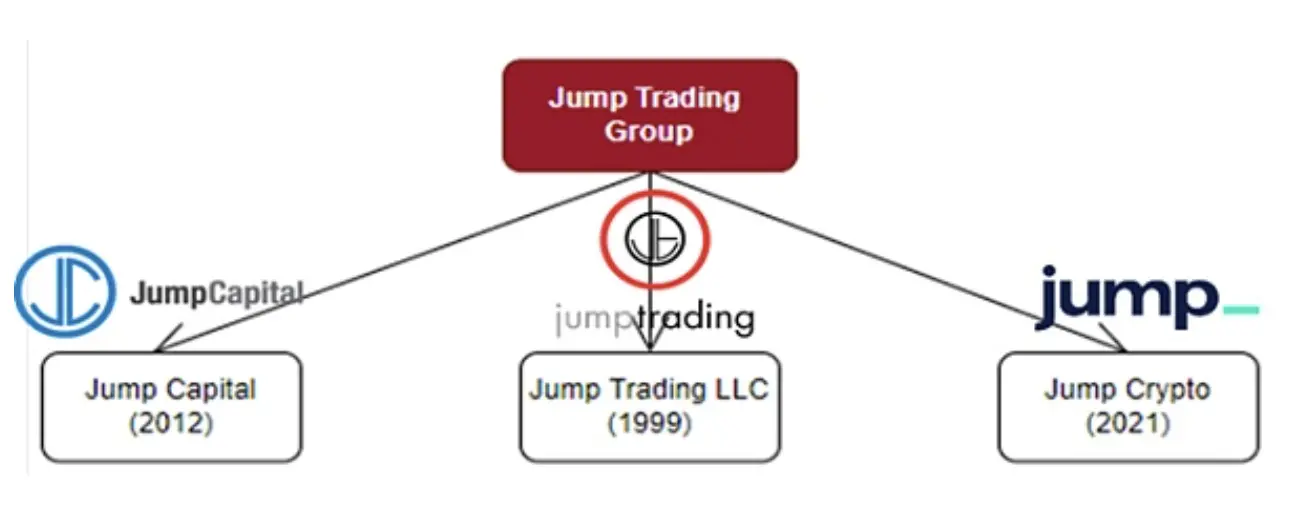

Jump Trading also has two subsidiary business units: Jump Capital and Jump Crypto.

Jump Capital

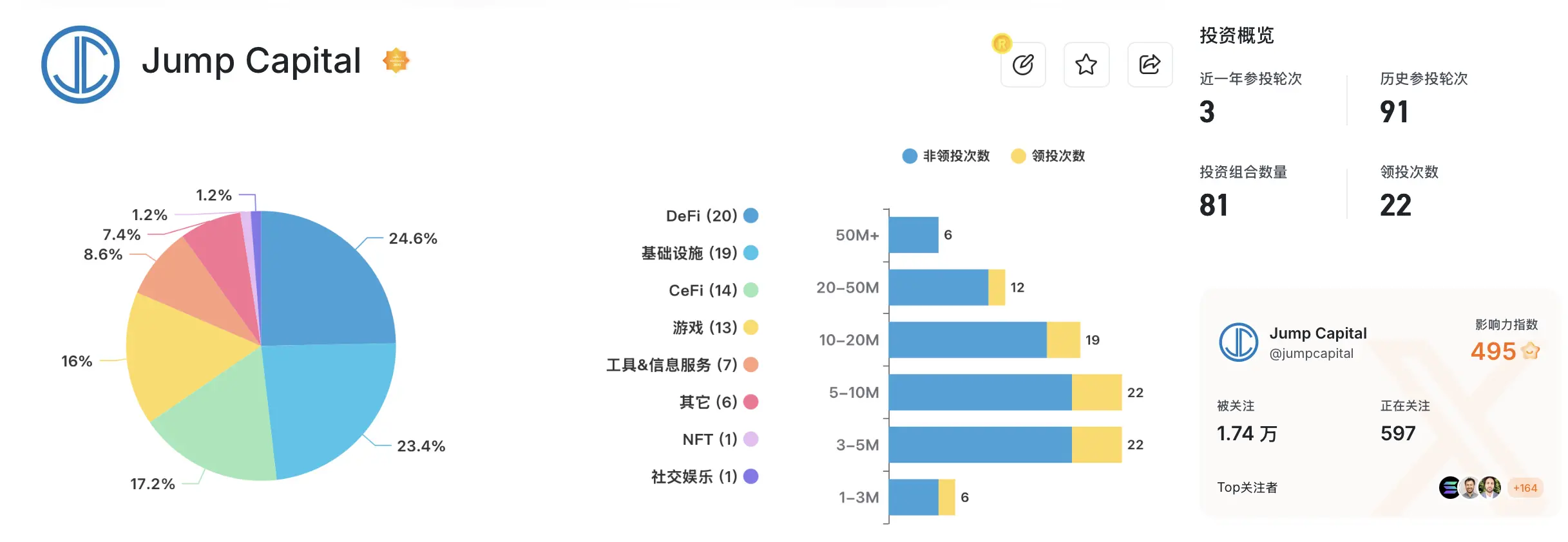

Jump Capital, headquartered in Chicago, was established in 2012. Although Jump's crypto division was officially established in 2021, Jump Capital had long been involved in investments in the crypto space. One of its partners and heads of crypto strategy, Peter Johnson, revealed that the company had been secretly deploying crypto strategies for years.

According to relevant RootData pages, Jump Capital has a crypto investment portfolio exceeding 80, primarily investing in DeFi, infrastructure, and CeFi, with investments in projects like loTeX, Sei, Galxe, Mantle, and Phantom.

In July 2021, Jump launched its largest fund since its inception, with a total capital commitment of $350 million, attracting 167 investors, marking Jump Capital's seventh venture fund.

Jump Crypto

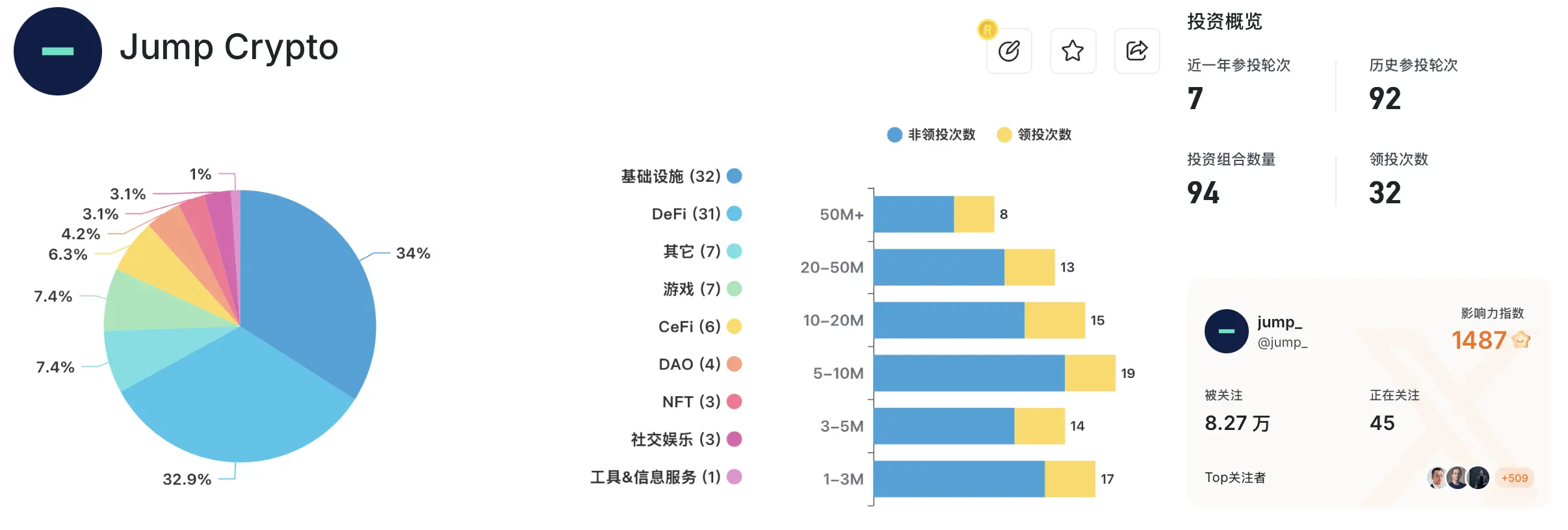

In 2021, while completing fundraising for its seventh investment fund, Jump announced the establishment of its crypto investment division, Jump Crypto, allocating 40% of the seventh fund to the cryptocurrency sector, focusing on DeFi, financial applications, blockchain infrastructure, and stocks and tokens in Web 3.0.

At just 26 years old, Kanav Kariya became the first president of Jump Crypto in 2021. Kariya joined Jump Trading as an intern in early 2017 and was assigned to build the early cryptocurrency trading infrastructure.

Related reading: "Digging into Jump's Past: Intern to President in 4 Months"

In May 2021, Terra's algorithmic stablecoin UST first experienced a de-pegging. In the following week, Jump secretly purchased a large amount of UST to create the illusion of demand and pull UST's value back to $1. This trade earned Jump $1 billion, and its architect, Kariya, was quickly promoted to president of Jump Crypto four months later.

However, this secret trade also laid the groundwork for Jump's fall from grace.

With the complete collapse of the Terra UST stablecoin in 2022, Jump faced criminal charges for allegedly manipulating the UST price in collaboration with Terra. In the same year, Jump suffered significant losses due to its deep ties with FTX and the Solana ecosystem when FTX went bankrupt.

After the FTX incident, the U.S. tightened regulations on the crypto market, and reports emerged that Jump Trading was being forced to scale back its operations and gradually exit the U.S. crypto market. For example, Robinhood ceased its partnership with Jump after the FTX incident. Jump Crypto's subsidiary, Tai Mo Shan, was once one of Robinhood's largest market makers, responsible for handling billions of dollars in daily trading volume. However, since the fourth quarter of 2022, Robinhood's financial reports no longer mentioned Tai Mo Shan, as Robinhood shifted to collaborating with market makers like B2C2.

Additionally, to reduce its cryptocurrency business, in November 2023, Jump Crypto officially spun off Wormhole, with Wormhole's CEO and COO leaving Jump Crypto. The Jump Crypto team also saw its numbers nearly halved during this period.

Jump Crypto's investment activity significantly decreased after 2023. According to relevant RootData pages, Jump Crypto has a crypto investment portfolio exceeding 90, primarily investing in infrastructure and DeFi, with investments in projects like Aptos, Sui, Celestia, Injective, NEAR, and Kucoin. However, its "participation rounds in the past year" were in single digits.

On June 20, 2024, Fortune reported that the U.S. Commodity Futures Trading Commission (CFTC) is investigating Jump Crypto. A few days later, Kanav Kariya, who had served at Jump Trading for six years, announced his resignation.

A month later, Jump Crypto began a massive ETH sell-off. Within ten days, the total value of ETH sold by Jump Crypto exceeded $300 million, and the panic directly led to the market drop on August 5, 2024, with Ethereum experiencing a maximum single-day drop of over 25%. The community speculated that Jump Crypto's sell-off of ETH might have been under pressure from the CFTC investigation, exchanging for stablecoins to exit the cryptocurrency business at any time. Jump Crypto was once rumored to be "this big guy is going down."

Related reading: "Accused of Crashing the Market, Uncovering the Crypto Market Maker Jump Crypto"

In December 2024, Jump Crypto's subsidiary Tai Mo Shan agreed to pay approximately $123 million to settle with the U.S. SEC. According to later SEC charge documents, Tai Mo Shan was involved in market-making for Terra's UST that year. It is reported that Tai Mo Shan is registered in the Cayman Islands and was established to handle specific market-making and cryptocurrency trading businesses.

The events between Jump and Terra seem to have finally settled after more than three years of painful entanglement.

Jump Fully Restores Crypto Business: A King’s Return or an Ingrained Struggle?

Why has Jump chosen to fully restore its crypto business at this time?

In addition to the judicial resolution of Jump's involvement in the Terra incident, a more critical reason is the Trump administration's friendly attitude towards cryptocurrencies.

Just a few days ago, on March 5, Jump's old rival DRW's crypto division, Cumberland DRW, signed a joint application with the U.S. Securities and Exchange Commission (SEC) to withdraw the lawsuit filed against it by the SEC. The agreement was reached in principle on February 20 and is currently awaiting SEC committee approval. The SEC sued Cumberland DRW in October last year, accusing it of operating as an unregistered securities dealer and selling over $2 billion in unregistered securities.

The new leadership team at the SEC has adopted a more lenient policy towards crypto companies, which has given Jump hope for a comeback. Additionally, the potential approval of spot ETFs for altcoins like Solana this year has made Jump Crypto, which is deeply involved in the Solana ecosystem, eager to get a piece of the action.

At the end of 2023, Jump was in negotiations with BlackRock to "market make for a Bitcoin spot ETF," but perhaps due to regulatory issues, Jump Crypto ultimately did not participate in the market making for Bitcoin or the later Ethereum spot ETFs.

Jump Still Has the Strength to Make a Comeback

A skinny camel is still bigger than a horse. Jump Trading still holds approximately $677 million in on-chain assets, with Solana token holdings accounting for nearly half at 47%, holding 2.175 million SOL. Stablecoins make up about 30%.

Source: ARKHAM

Jump Trading's on-chain capital holdings remain the largest among several crypto market makers. As of March 8, 2025, the comparison of holdings between Jump and other market makers, ranked from highest to lowest, is as follows:

- Jump Trading: $677 million

- Wintermute: $594 million

- QCP Capital: $128 million

- GSR Markets: $96 million

- B2C2 Group: $82 million

- Cumberland DRW: $65 million

- Amber Group: $20 million

- DWF Labs: $10 million

In addition to the capital volume, Jump also has a series of technical advantages. For example, in its deep involvement in the Solana ecosystem, Jump currently participates in various forms such as technical development (developing the Firedancer verification client, providing technical support for Pyth Network and Wormhole), investments (Jump has invested in several Solana ecosystem projects), and market making. The samples provided by Jump for the construction of the Solana ecosystem may bring it more collaboration opportunities.

However, from another perspective, Solana's decentralization is weakened by Jump's dominant position.

Burdened by a Dark History, Jump Fears It May Be Difficult to Recover

Jump has a halo, but it also has a considerable dark history.

The UST incident with Terra clearly shows that Jump Crypto's market-making style in the crypto market is quite aggressive. Although market makers publicly earn profits from trading spreads, colluding with project parties to pump prices in exchange for options and other substantial income is not uncommon in the crypto industry.

In the traditional financial industry, market making is a strictly regulated business, with regulators needing to ensure that there are no conflicts of interest. Market makers do not directly collaborate with companies issuing stocks but work with exchanges under the supervision of regulatory agencies. Market making and venture capital, among other different businesses, are usually physically separated to avoid any possibility of insider trading or market manipulation.

Some researchers have accused Jump of collaborating with Alameda to inflate Serum's fully diluted valuation to exploit investors, but this matter quickly faded away. Additionally, in October last year, video game developer FractureLabs filed a lawsuit against Jump Trading in the U.S. District Court in Chicago, accusing it of fraud and deception by manipulating the price of the DIO token. FractureLabs originally planned to launch the DIO token on the Huobi exchange (now renamed HTX) in 2021 to raise funds. The company hired Jump Trading as the market maker for DIO and lent it 10 million tokens while sending 6 million to HTX for sale. However, Jump Trading systematically liquidated its DIO holdings, causing the token price to drop to about 0.5 cents and pocketing millions of dollars in profits. Subsequently, Jump repurchased about $53,000 worth of tokens at a significant discount and returned them to FractureLabs, then terminated the market maker agreement. Currently, there has been no further development in this lawsuit.

Although Jump Crypto and departments like Jump Trading appear to be independent on the surface, there are clear conflicts of interest in their actual operations. The inability to distinguish between market maker venture capital business and trading business is directly related to the lack of clear regulation in the crypto industry. To some extent, this is not a specific market maker's style but a common style among market makers in the industry, such as the former Alameda and today's DWF. In traditional finance, market making is strictly regulated, and market makers do not directly collaborate with companies issuing stocks but work with exchanges under the supervision of regulatory agencies. To avoid insider trading or market manipulation, market making and venture capital, among other different businesses, are usually physically separated.

Yesterday, a market maker for the GPS token added unilateral liquidity on the exchange, causing the token price to plummet, and the market maker's style and ethical standards were once again brought into discussion. @Mirror Tang believes that market makers and project parties together constitute a shadow banking system. Project parties often provide funding to market makers through unsecured loan credit lines, and market makers use this funding to leverage their market making, thereby enhancing market liquidity. In bull markets, this system can create huge profits, while in bear markets, it can easily trigger liquidity crises.

It is currently uncertain whether Jump will resume its cryptocurrency market-making business. However, if the crypto community still remembers, it may be wise to remain cautious about Jump's new market-making projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。