Ethena faces short to medium-term price pressure, but the core business of the project has long-term value.

Author: 0xCousin

1. Who is behind Ethena?

Ethena's Team Members

The Ethena team has a rich background, possessing deep expertise and practical experience in fields such as Crypto, finance, and technology.

Founder G (Guy Young) previously worked at a hedge fund with a market value of $60 billion and established Ethena after the collapse of Luna; COO Elliot Parker was previously a product manager at Paradigm and also worked at Deribit; Jane Liu, the head of institutional growth in the Asia-Pacific region, has served as the head of investment research at Fundamental Labs and as the head of institutional partnerships and fund relations at Lido Finance.

Ethena's Financing Situation

According to Rootdata, Ethena has completed three rounds of financing, raising a total of $119.5 million. The leading investors include Dragonfly, Maelstrom Capital, and Brevan Howard Digital.

Ethena has attracted the attention and investment of many well-known investment institutions, which not only brings considerable funding for Ethena's development but also provides valuable industry resources for Ethena's business growth. Ethena's investors include exchanges (YZi Labs, OKX Ventures, HTX Ventures, Kraken Ventures, Gemini Frontier Fund, Deribit, etc.), market makers (GSR, Wintermute, Galaxy Digital, Amber Group, etc.), and investment institutions with a traditional finance background (Paypal Ventures, Franklin Templeton, F-Prime Capital, etc.).

2. What is Ethena?

In summary, Ethena is a Synthetic Dollar protocol that has launched the USDe stablecoin and the sUSDe savings asset. The stability of USDe is supported by crypto assets and corresponding delta-neutral hedging (short futures) positions.

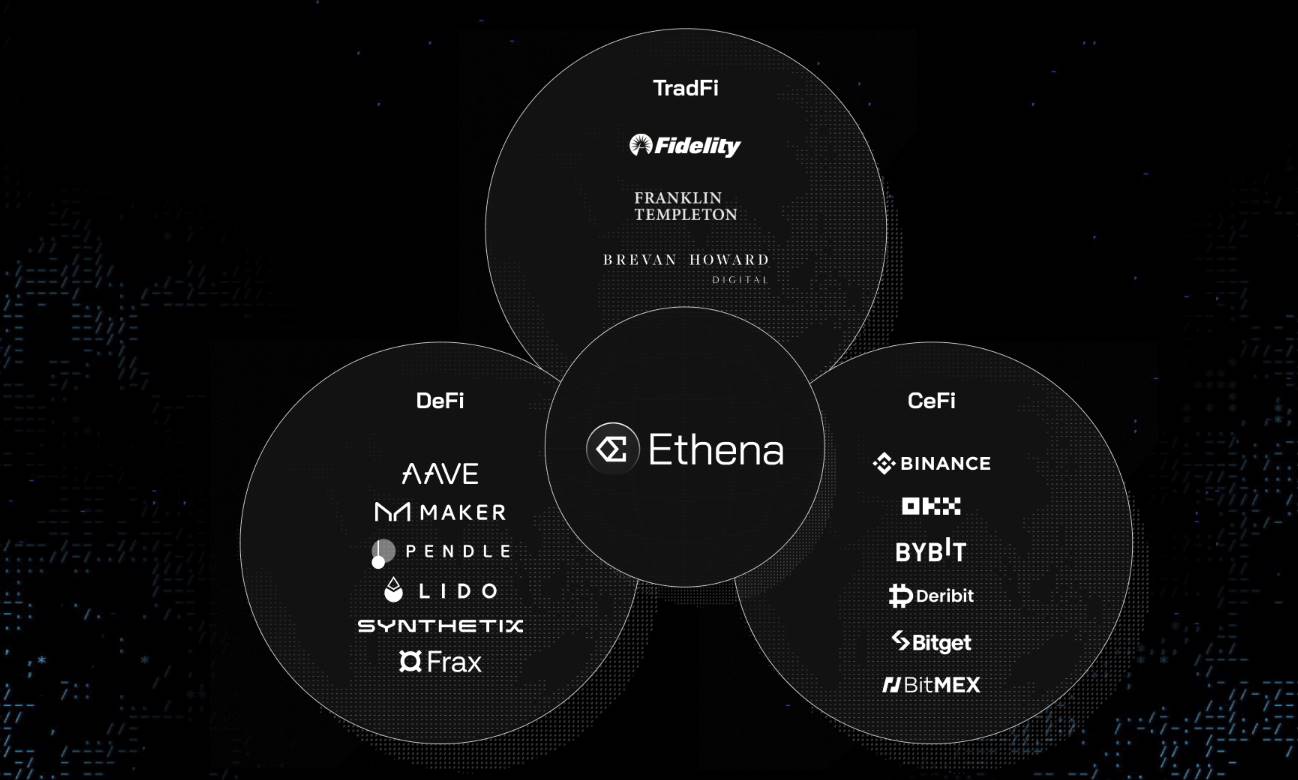

From the project's mission perspective, Ethena aims to connect funds across CeFi, DeFi, and TradFi through the USDe stablecoin, while capturing the interest rate differentials across these three sectors (exchanges, on-chain, traditional finance) to provide customers with more returns. If the scale of USDe develops sufficiently large, it may also promote the convergence of capital and interest rates between DeFi, CeFi, and TradFi.

Mechanism of the USDe Stablecoin

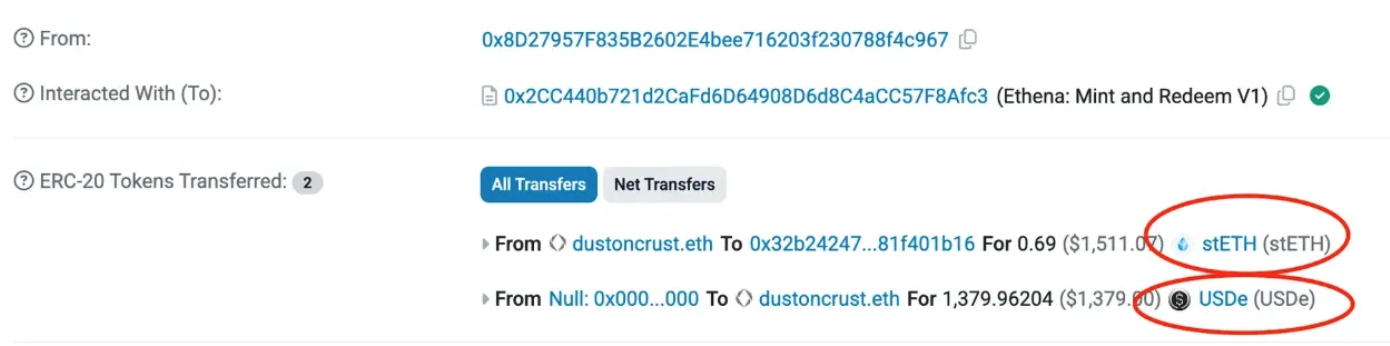

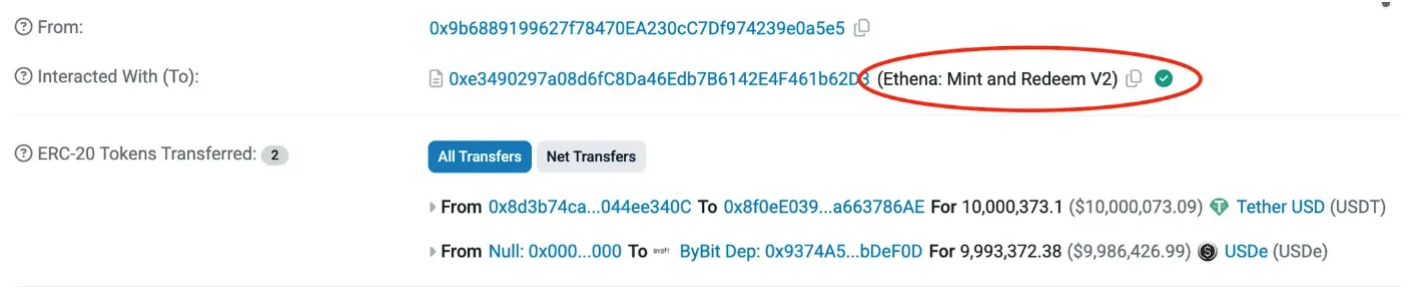

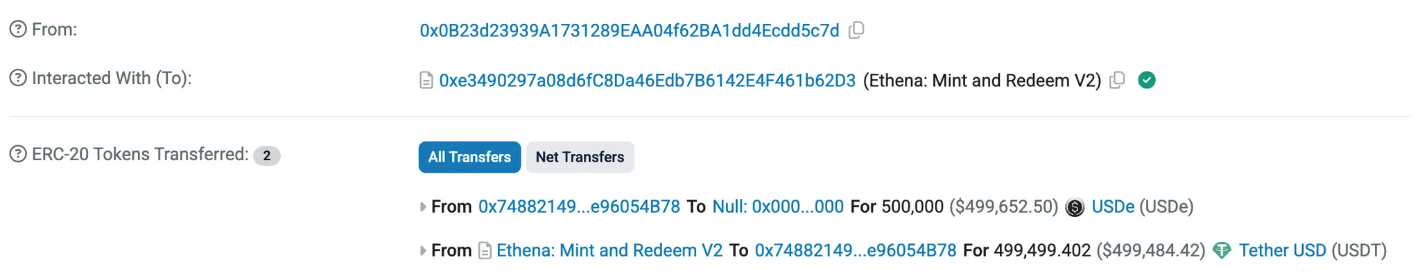

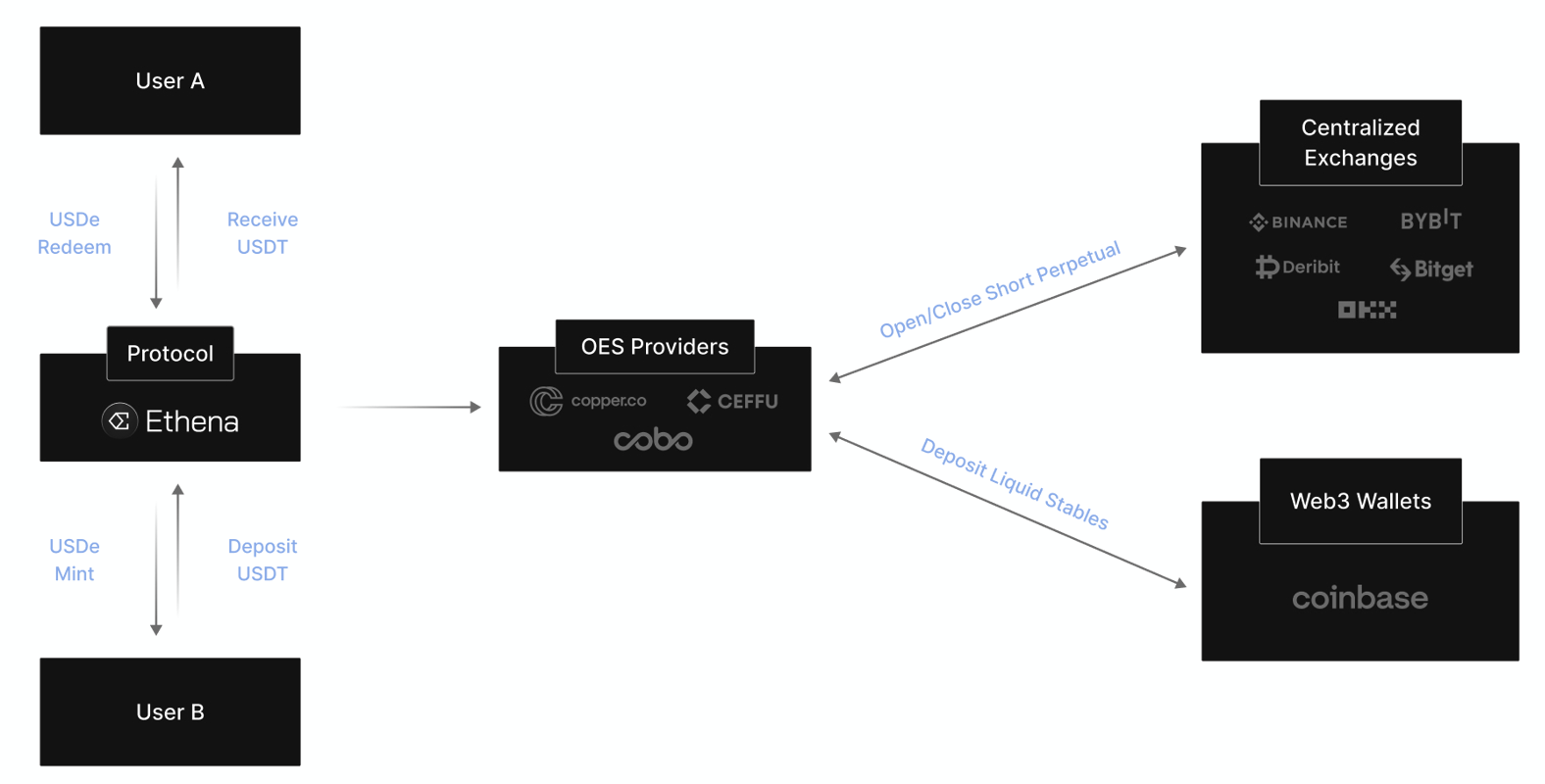

Minting/Redeeming Mechanism: Only two whitelisted independent legal entities (Ethena GmbH, Ethena BVI Limited) are eligible to mint and redeem USDe. The minters need to use BTC/ETH/ETH LSTs/USDT/USDC as collateral and interact with the USDe Mint and Redeem Contract. As shown below:

The first USDe minting transaction of the Ethena protocol's USDe Mint and Redeem Contract V1

A recent USDe minting transaction based on the Ethena protocol's USDe Mint and Redeem Contract V2

This is a record of redeeming USDe for USDT

During the minting/redeeming process, the pricing of Backing Assets is obtained and continuously verified from multiple different sources, including CeFi Exchanges, DeFi Exchanges, OTC Markets, and Oracles like Pyth and RedStone, to ensure accurate and reasonable pricing.

USDe Stability Maintenance Mechanism: To ensure the stability of USDe, the key is to hedge against the price fluctuations of Backing Assets. Ethena adopts an automated, programmatic delta-neutral strategy.

Sources of Income for sUSDe

The income from sUSDe comes from Ethena's management of the collateral.

When Ethena receives collateral, it can hold it as stablecoins to earn a fixed deposit interest rate;

It can also delegate to selected CEXs through custodians, establishing short futures positions in CEXs to hedge against the price fluctuations of Backing Assets while earning funding rates;

If the Backing Assets are ETH, they can also be staked to earn ETH Staking APR.

These earnings will be distributed to users in the form of returning more USDe when they unstake sUSDe to redeem USDe.

Uses of Stablecoins (USDe/sUSDe/iUSDe)

In the DeFi sector:

USDe/sUSDe as collateral for lending protocols like AAVE, Spark, etc.;

USDe/sUSDe as margin collateral for platforms like Perps DEX;

USDe/sUSDe as collateral for Stablecoin protocols;

USDe/sUSDe as underlying assets for interest rate swap agreements;

USDe as the pricing currency in Spot DEX (forming trading pairs);

In the CeFi sector:

- USDe as the pricing currency in CEXs (forming trading pairs);

In the TradFi sector:

- iUSDe is a stablecoin launched by Ethena for the TradFi market, allowing regulated traditional companies to subscribe, thereby providing traditional clients with high yields from the Crypto market without direct exposure to Crypto.

3. Innovations of Ethena

Delta-Neutral Strategy to Hedge Price Fluctuations of Backing Assets

Many stablecoin projects backed by Crypto Assets ultimately become insolvent, leading to a decoupling of exchange rates, primarily due to the lack of hedging against price fluctuations of Backing Assets. Ethena is the first project to implement an automated, programmatic delta-neutral hedging strategy using a Delta-Hedging algorithm and execution model on Backing Assets, keeping the portfolio's Delta value close to 0. Although the early Delta-Hedging algorithm and execution model of Ethena were a black box, the potential risk point is whether it can sustain delta-neutral results in the long term; this stability maintenance mechanism is an innovation. In the future, it may shift to an open RFQ model, allowing various market makers to compete for the execution of hedging tasks.

Under normal circumstances, when redeeming USDe, it is redeemed at a benchmark of 1 USDe = 1 USDC; if the hedging mechanism does not function or if there are losses in the funding rates of the hedging futures positions, leading to a decrease in the value of asset reserves, the quote for USDe holders during redemption will reflect a proportional reduction in the redemption price, and the displayed quote to users will include a compensation fee of 10 basis points.

Capital Efficiency Far Exceeding Most Stablecoin Projects

Centralized stablecoins, such as USDT and USDC, which are fiat-collateralized, are heavily influenced by traditional financial regulations, and their collateral assets are primarily fiat currencies, mainly invested in U.S. Treasury bonds and savings, which also pose centralized single-point risks and have low capital efficiency.

Decentralized stablecoins, like MakerDAO's DAI, generally require 120%-150% over-collateralization; if considering a safety margin to avoid liquidation, the actual collateralization rate may exceed 200%, resulting in low capital efficiency. Additionally, during extreme market fluctuations, if customers' collateral assets are liquidated, it can lead to additional liquidation losses.

Ethena's USDe, in terms of asset collateralization rate, is approaching 1 USD: 1 USDe, while also employing a delta-neutral strategy to hedge against price fluctuations, resulting in high capital efficiency and guaranteed stability.

More importantly, Ethena's positioning allows other projects in the stablecoin space to become partners with Ethena. For example, Sky, Frax, and Usual have already integrated Ethena's products into their own offerings.

OES Custody Model Ensures Asset Security

Ethena currently collaborates with multiple custodians, including Copper, Ceffu, and Cobo. The collaboration adopts the OES (Off-Exchange Settlement) model, where backing assets do not need to leave the on-chain wallet, thus eliminating concerns about CEX risks; there are also no worries about custodian risks, as custodians cannot independently control these custodial assets. For example, when the custodian is Cooper, these backing assets are stored in an off-exchange vault, with Ethena, Cooper, and the off-exchange vault each holding a key, requiring two signatures to execute transactions; alternatively, they may be stored in a bankruptcy-remote trust.

Integrating Traditional Finance to Strengthen USDe

Ethena connects funds across CeFi, DeFi, and TradFi through the stablecoin USDe, capturing the interest rate differentials in these three sectors (exchanges, on-chain, traditional finance) to provide customers with higher returns.

In TradFi, there are generally not many high-yield products, but the low-yield fixed income market is very large. In the Crypto space, due to users' demand for leveraged trading, there is a greater demand for currency (USD stablecoins), leading to frequent "risk-free" high-yield opportunities in the Crypto industry.

Ethena acts as a bridge, integrating traditional finance to strengthen USDe. When the Federal Reserve's interest rates are very low (or during a rate-cutting cycle), trading in Crypto becomes more active, and the funding rates for perpetual contracts in the Crypto market are also relatively high. Ethena's short futures positions used for delta hedging can earn more funding rates. This creates a phenomenon where, when traditional finance yields are low, customers can actually achieve higher yields through Ethena.

Therefore, iUSDe can meet the asset allocation needs of traditional finance clients during low-interest periods. This may also be part of the reason why Franklin Templeton and Fidelity Investments' venture capital arm F-Prime Capital invested $100 million in Ethena's strategic round last December. Additionally, the USDtb launched in collaboration with BlackRock BUIDL may drive significant capital from TradFi into Ethena and subsequently into the Crypto market.

4. Current Development Status of the Project

Ethena's USDe has become the third-largest USD stablecoin. As of March 7, 2025, the issuance of USDe has reached over $5.5 billion, second only to USDT and USDC. It ranks fourth in Transfer Volume, following USDT, USDC, and DAI. However, the number of Active Addresses is relatively low, with only 1,612, indicating that C-end application scenarios need to be expanded. Ethena's revenue is also growing rapidly, making it the second-fastest cryptocurrency startup to reach $100 million in revenue, just behind Pump.fun.

Ethena has become a key cornerstone for many DeFi protocols. Over 50% of Pendle's TVL is attributed to Ethena; approximately 25% of Sky's revenue is attributed to Ethena; about 30% of Morpho's TVL revenue comes from utilizing Ethena assets; Ethena is the fastest-growing new asset on Aave; most EVM-based Perps have integrated USDe as collateral.

Ethena is building an ecosystem around USDe. According to publicly available information on Ethena's official website, two projects will be launched in Q1 2025— the decentralized trading platform Ethereal and the on-chain trading protocol Derive (supporting options, perpetual, and spot trading). In terms of external collaborations, Ethena is also making steady progress, having launched USDtb in partnership with BlackRock and reached an agreement with the Trump family's DeFi project World Liberty Financial.

However, Ethena also faces some risk points:

Core earnings of USDe are unstable— As mentioned earlier, USDe has three main sources of income: the deposit interest income from Backing Stablecoins, the funding rate income from short futures positions, and the staking income from ETH in the Backing Assets. The funding rates from futures positions may experience sustained negative rates during bear markets, leading to a deficit in USDe earnings.

CEX's ADL mechanism may cause delta-neutral strategies to fail— Because CEXs have an automatic deleveraging (ADL) mechanism, it may affect Ethena's delta-neutral strategy during specific periods.

Partners may bring liquidity risks— Bybit is the exchange with the highest adoption rate of USDe, holding nearly $700 million in USDe at peak times. Meanwhile, Layer2 Mantle, closely related to Bybit (the merger of BitDAO, co-founded by Bybit's co-founder, and the Mantle ecosystem), is the second-largest chain in terms of USDe supply. The recent hacking incident involving Bybit triggered a redemption demand of over $120 million in USDe. Ethena currently has $1.9 billion in Backing Assets that are Liquid Stables, which is sufficient to cover this sudden surge in redemption demand. However, it cannot be ruled out that there may be a massive concentrated redemption exceeding its Liquid Stables reserves in the future, leading to short-term liquidity risks.

5. Investment Value of Ethena (ENA)

ENA currently has an FDV of $5.6 billion and a circulating market cap of $2 billion. Ethena has completed three rounds of financing, raising $6 million, $14 million, and $100 million, with the second round valuing the company at $300 million. The current token price still offers an 18x+ return.

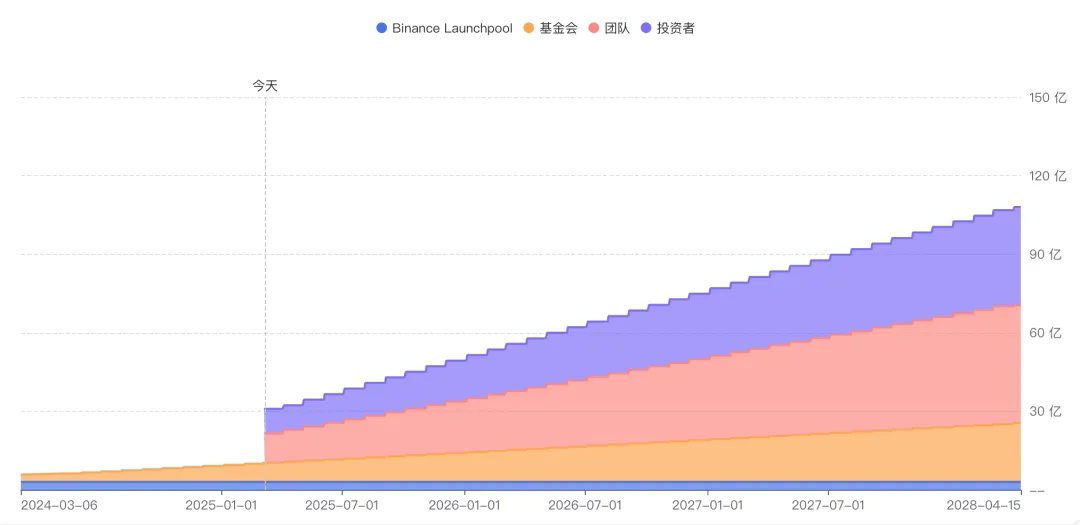

Before May 5, 2025, the circulating tokens will mainly consist of 2% from Binance Launchpool, with additional foundation and team shares undergoing linear unlocking. In April, some shares purchased OTC will begin to unlock, with a cost price of about $0.25; starting May 5, the shares of investment institutions will increase by over 7.8 million ENA per month through linear unlocking.

Recently, the overall Crypto market has retraced, and ENA has performed weakly. BTC has retraced 25% from its peak, ETH has retraced 50%, and ENA has retraced about 70% from its peak. The negative impact of the upcoming ENA token unlock may have already been largely reflected in the current token price.

In summary, Ethena faces short to medium-term price pressure, but the core business of the project has long-term value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。