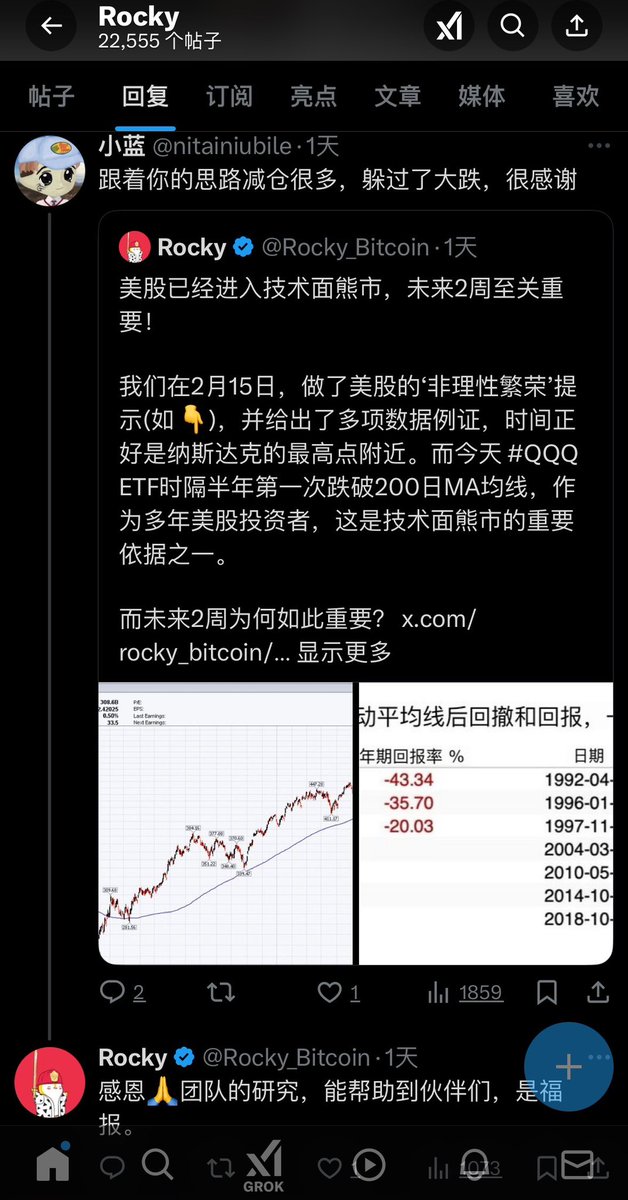

Recently, I've received many thanks from partners 🙏 "Effectively controlled the positions and avoided the big drop." With USDT in hand, there's no panic; we will soon welcome the best bottom-fishing opportunity! 🧐

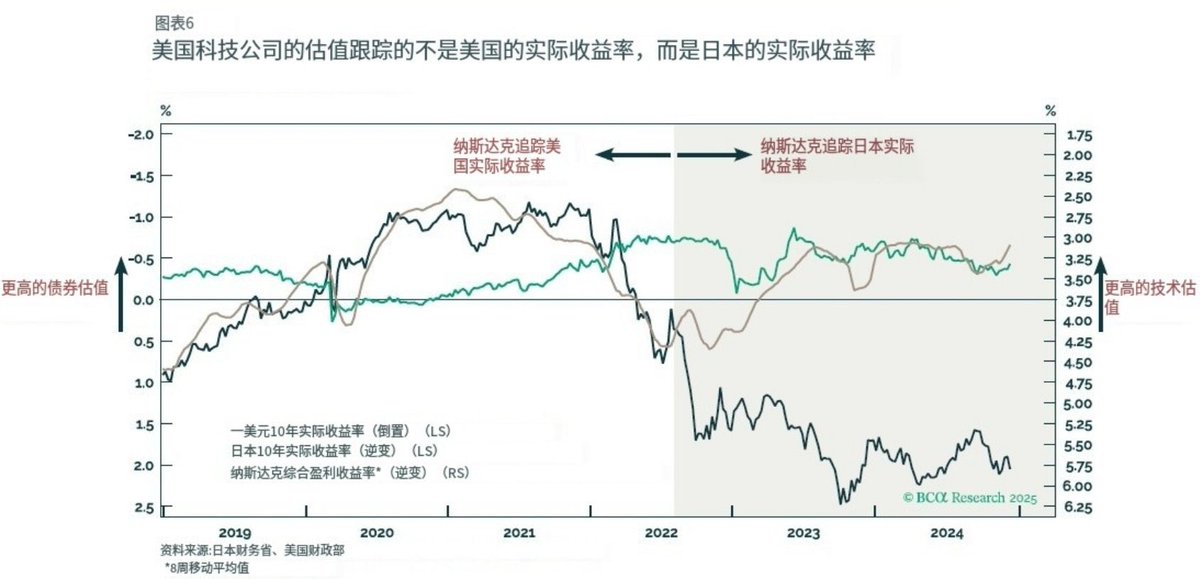

With March 12 approaching, the 5th anniversary, the biggest uncertainty this month is the Japanese interest rate decision on the 19th. Since 2022, the valuation of US tech stocks has no longer followed the US 10-year Treasury yield but has instead followed Japan, which has also led to a huge impact from the yen carry trade. As shown in Figure 2, #BTC can essentially be understood as the eighth golden flower of US stocks, moving in sync with the ups and downs of US tech stocks!

We warned about risks around 103,000 and continuously highlighted macro uncertainties later, suggesting proper position control, compressing positions to a 46% ratio, with 40% in coins and 60% in USDT (although there were some bottom-fishing actions in between, the positions were not large), and redirected some funds to Hong Kong stocks to gain asymmetric value recovery! One day, when global capital starts to withdraw from Hong Kong stocks, we will re-enter the US stock and #BTC markets!

Currently, Nvidia has retraced about 30% from its peak, Tesla about 50%, and the Nasdaq 100 index about 10%. We expect the Nasdaq 100 index to retrace around 20%, which would be a reasonable range, with a point around 17,500, and opportunities will emerge here (DYOR).

Pay close attention to the unusual movements of the Japanese 10-year Treasury yield, as well as whether the decline of the US stock QQQ exceeds 3.5% in the next two weeks! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。