Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Outflow of $739 Million

Last week, the U.S. Bitcoin spot ETFs experienced a net outflow over four days, totaling $739 million, with a total net asset value of $98.48 billion.

Nine ETFs were in a net outflow state last week, with outflows primarily from FBTC, ARKB, and IBIT, which saw outflows of $201 million, $163 million, and $129 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Outflow of $93.9 Million

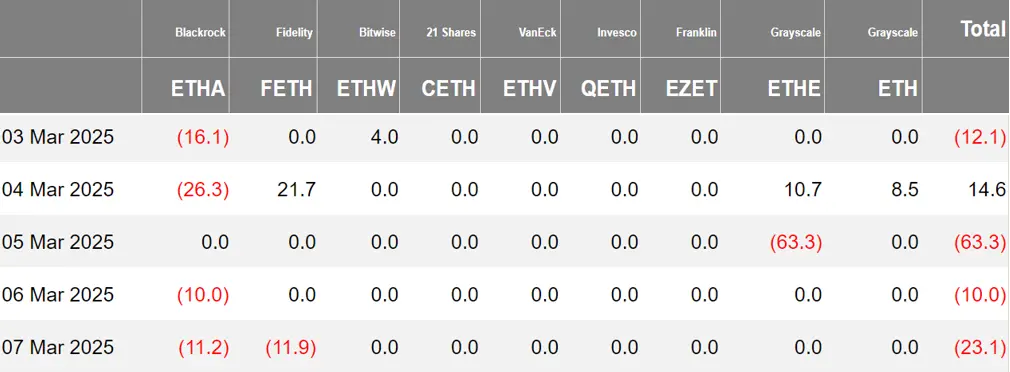

Last week, the U.S. Ethereum spot ETFs had a net outflow of $93.9 million, with a total net asset value of $7.76 billion and an average daily trading volume of $433 million.

The outflow last week was mainly from BlackRock's ETHA, which had a net outflow of $63.6 million. Four Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 0.94 Bitcoin

Last week, the Hong Kong Bitcoin spot ETFs had a net outflow of 0.94 Bitcoin, with a net asset value of $375 million. The issuer, CSOP Bitcoin, maintained a holding of 357 Bitcoins, while Huaxia's holdings decreased to 2,270 Bitcoins.

The Hong Kong Ethereum spot ETF had a net inflow of 0.02 ETH, with a net asset value of $4.314 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of March 7, the nominal total trading volume of U.S. Bitcoin spot ETF options was $1.24 billion, with a nominal total long-short ratio of 2.07.

As of March 6, the nominal total open interest of U.S. Bitcoin spot ETF options reached $11.17 billion, with a nominal total long-short ratio of 2.02.

The market's short-term trading activity for Bitcoin spot ETF options continues to decline, but overall sentiment remains bullish.

Additionally, the implied volatility is at 54.24%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Canary Capital Applies to SEC for ETF Tracking Cross-Chain Protocol Axelar

Canary Capital, an investment firm focused on digital assets founded by former Valkyrie Funds co-founder Steven McClurg, is planning to launch an ETF that tracks the price of Axelar (AXL).

The firm submitted an S-1 filing to the U.S. Securities and Exchange Commission (SEC) on Wednesday, initiating the process to launch such a fund. This hedge fund has previously submitted filings for several other ETFs, some of which have been confirmed by the SEC and are awaiting approval.

It is reported that Axelar is a cross-chain protocol that connects blockchains and has been integrated by major players such as JPMorgan, Microsoft, Uniswap, and MetaMask. Former Coinbase legal chief Brian Brooks has joined Axelar's new institutional advisory board.

BlackRock Becomes the 1,100th Institution to Hold Bitcoin ETF

According to Cointelegraph, the world's largest asset management company, BlackRock, has become the 1,100th institutional investor to hold a Bitcoin ETF, indicating a shift in investment advisors' views on cryptocurrencies from "speculative assets" to serious asset classes.

Nasdaq Submits 19b-4 Application for Grayscale Hedera ETF

According to Cointelegraph, Nasdaq has submitted a 19b-4 application for the Grayscale Hedera ETF.

21Shares Submits Updated S-1 Application for Its Spot Polkadot ETF to SEC

Market News: CANARY SUI ETF Registered in Delaware

NYSE Submits 19b-4 Application for Bitwise Dogecoin ETF

Bitwise Submits S-1 Filing for Its Aptos ETF

Views and Analysis on Crypto ETFs

State Street: Predicts Crypto ETFs Will Surpass North American Precious Metals ETFs by Year-End

According to State Street, the world's largest ETF service provider, the demand for crypto ETFs is surging, and it is expected that by the end of this year, their total assets will surpass those of North American precious metals ETFs. This change will make digital token ETFs the third-largest asset class in the $15 trillion ETF industry, following stocks and bonds, surpassing real estate, alternative investments, and multi-asset funds.

Frank Koudelka, head of global ETF solutions at State Street, stated, "The growth rate of cryptocurrencies has surprised us. I expected there would be pent-up demand, but I didn't anticipate it would be this strong." He expects that crypto ETFs will continue to grow rapidly this year and noted that data shows an increasing number of investment advisors are interested in cryptocurrencies and incorporating them into their portfolios. Precious metals ETFs have a 20-year head start, with the world's first physically-backed gold ETF—the $85 billion SPDR Gold Trust (GLD)—launched in 2004, and it remains the largest precious metals ETF to date. However, State Street expects that the total assets of North American precious metals ETFs, currently at $165 billion, will be surpassed by crypto ETFs this year.

State Street also predicts that the SEC will approve more digital asset ETFs this year. In addition to the existing Bitcoin and Ethereum ETFs, fund management companies have applied to launch ETFs based on various tokens such as SOL, XRP, and others. State Street expects that by 2025, ETFs based on the top ten tokens by market capitalization will be approved.

Matrixport analysis indicates that since the launch of Bitcoin ETFs in January 2024, the outflow of funds this month has reached a new high, which may be related to hedge funds closing basis trades (going long on ETFs and shorting futures). This trend aligns with the $8 billion reduction in open interest for Bitcoin futures on the CME after the Federal Reserve's December 2024 FOMC meeting, which exceeded the total fund inflow into ETFs by 20%.

Additionally, the expiration of February futures contracts may also be a source of selling pressure, but this factor has now been digested by the market. Matrixport believes that as the impact gradually diminishes, hedge funds may reduce ETF selling and reassess arbitrage opportunities in late March. Currently, ETF selling pressure seems to have temporarily halted.

According to pymnts, after Trump announced the inclusion of XRP, ADA, and even SOL in the crypto strategic reserve, he faced strong criticism from industry insiders. However, Chris Chung, founder of the Solana ecosystem DEX Titan, stated that the current question is whether we will see some actual details regarding crypto legislation in the foreseeable future.

He further explained, "It is clear that U.S. President Trump is now a driving force behind the crypto market's movements, and he is certainly favoring certain crypto tokens. But I believe that the U.S. government's confidence vote may accelerate the approval of altcoin ETFs, including Solana, XRP, and other tokens awaiting SEC decisions."

Seoul Mayor Supports Crypto ETFs and STOs, Calls for Regulatory Framework

According to Yonhap News Infomax, Seoul Mayor Oh Se-hoon expressed support for crypto ETFs and security token offerings (STOs). In a Facebook post, he stated that South Korea should establish a regulatory framework that integrates virtual assets with the real economy, similar to the models in the U.S. and Europe.

He emphasized the importance of establishing foundational legislation for virtual assets, which would make crypto ETFs, corporate crypto trading, and STOs possible, noting that these practices have been widely accepted in leading countries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。