Author: @0xtaetaehoho

Compiled by: Lyric, ChainCatcher

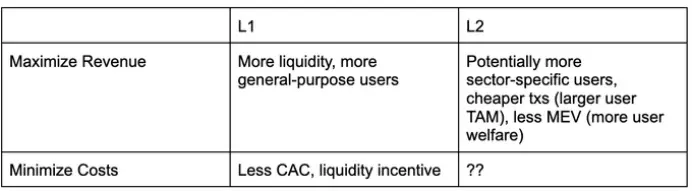

In the cryptocurrency ecosystem, discussions about L1 (Layer 1) and L2 (Layer 2) often focus on transaction speed, fees, and security. However, from the perspective of dApps (decentralized applications), what is truly thought-provoking is how to choose between the two to maximize revenue and minimize costs.

This article will outline the latest viewpoints and explore the competition and game theory between L1 and L2 in dApp economics.

From Technology to Economics: The Fundamental Differences Between L1 and L2

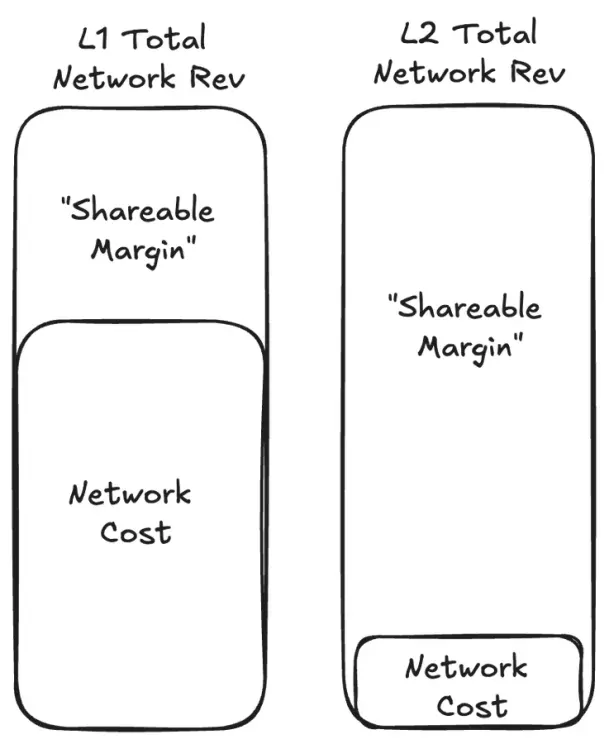

In traditional understanding, L1 blockchains represent decentralized underlying networks, such as Ethereum and Solana, bearing all transaction and validation responsibilities. However, this also means that their validators must bear high operational costs and capital requirements, thereby limiting the distributable profits shared with dApps. In contrast, L2, as an extension built on top of L1, has its network operating costs primarily derived from a small number of sequencers, without the high capital costs. This structural advantage allows L2 to have a lower breakeven threshold when maximizing profits and enables more value to flow into the dApp ecosystem.

Fee Distribution and MEV: A New Lever for dApp Revenue

The key pillar driving dApp revenue maximization lies in the distribution of fees and MEV (Miner Extractable Value). Currently, by enabling MEV taxes or fee sharing, dApps can internalize part of the MEV opportunities in a pre-agreed manner. For example, some projects have achieved this by redirecting a portion of the base fee from EIP1559 to users interacting with dApps (such as the mechanisms of Canto CSR or EVMOS), which to some extent breaks the traditional transaction fee model. Additionally, L2's centralized block proposers—whether through reputation proof or TEE-based "honest" proposers—can execute fee sharing and prioritization more efficiently, achieving optimal revenue redistribution without significantly modifying the underlying protocol.

The Balancing Act of Validator Costs: Structural Limitations of L1

The existence of L1 relies on the participation of a large number of validators, but this also brings significant cost issues. To ensure the continuous operation of the L1 network, the following inequality must be satisfied:

Total number of validators × Operating costs + Staking capital requirements × Capital costs TEV (Inflation + Total network fees + MEV tips)

From the perspective of a single validator,

Validator operating costs + Capital requirements × Capital costs > Inflation gains + Fees and MEV

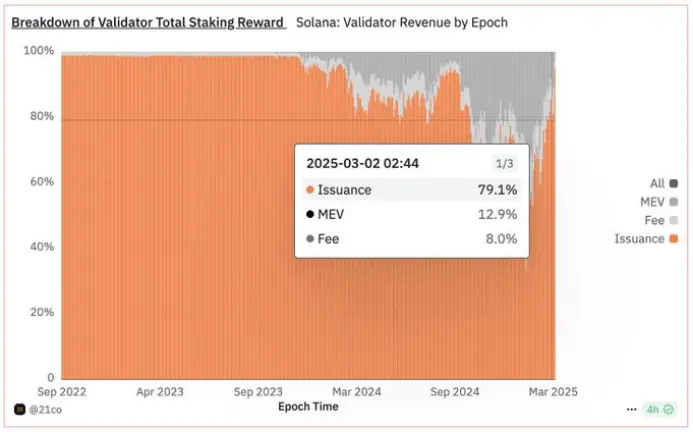

If operating costs and capital costs are too high, even with subsidies from inflation and fee income, some validators may still struggle to be profitable. Taking Solana as an example, its high validator operating costs mean that, in the case of declining inflation, the profit margin shared with dApps will be severely compressed.

This structural contradiction forces L1 to maintain a high network acceptance rate to achieve profitability balance across the network, but this directly limits the revenue ceiling for dApps.

L2's Innate Advantages and Future Potential

Compared to L1, L2's network operating costs are merely the expenses of a few sequencers, without the burden of high staking capital requirements, making the overall profit needed for breakeven minimal. This characteristic allows L2 to return more revenue to dApps at a lower cost, helping developers maximize revenue while maintaining the same profit levels.

More importantly, L2 gains security by periodically borrowing some block space from L1, further compressing network fee expenditures. This cross-layer collaborative mechanism will become a highlight in the future competition of dApp economics.

At the same time, L2's centralized block proposer structure also gives it a unique advantage in exploring breakthroughs in throughput and optimizing fee sharing. Whether through builders like flashbots for fee sharing or using infrastructure like Jito to redistribute MEV income based on CU usage, L2 is continuously testing and validating new profit models, bringing more economic benefits to dApps.

The Future of dApp Economics: Competition Drives Innovation

As projects like Solana continue to enhance throughput and gradually introduce mechanisms such as ASS, MCP, and MEV taxes, the future competitive focus will shift from purely technical parameters to dApp economics. The competition between non-OCAproof TFM-enabled L2 and L1 enabled with CSR or MCP + MEV taxes will directly determine the revenue distribution, cost structure, and long-term competitiveness of dApps.

This competition not only drives infrastructure towards profit-driven models but also lays a solid foundation for regulatory transparency and institutional capital deployment. As more capital flows into infrastructure development, the industry will usher in a new wave of technological innovation—from applied cryptography to performance engineering, and to entirely new consensus mechanisms, the competition between chains will undoubtedly trigger an unprecedented transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。