L2 is smarter than L1 because it only needs a single sequencer.

Author: 0xtaetaehoho, Chief Security Officer of EclipseFND

Compiled by: zhouzhou, BlockBeats

Editor's Note: L2 has an advantage over L1 in operational costs because L2 only needs to pay for the cost of a single sequencer, while L1 has to pay for the security of all validators. L2 has unique advantages in speed and reducing MEV, and can support dApp revenue maximization through innovative economic models. Although L2 cannot compete with L1 in liquidity, its potential in the dApp economy will drive the crypto industry to transform from infrastructure to profit-driven long-term business models.

The following is the original content (reorganized for readability):

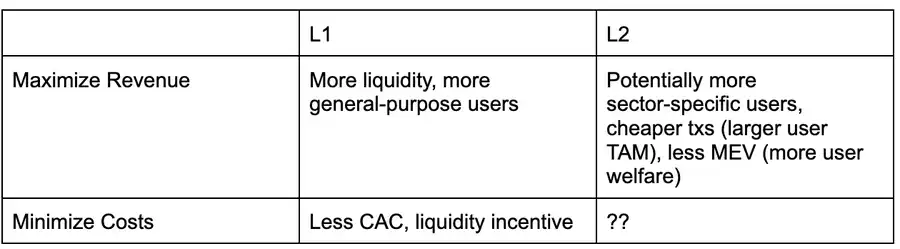

Here is a decision matrix from the perspective of dApps, analyzing whether to deploy on L1 or L2 in the current environment, assuming both support similar types of applications (i.e., L1/L2 are not customized for specific application types).

In addition to relatively low MEV (Maximum Extractable Value) due to the centralization of block producers, L2 has not yet fully leveraged other advantages. For example, although L2 has the potential for lower transaction costs and faster throughput, Solana currently still leads L2s in the EVM ecosystem in terms of performance and transaction costs.

As Solana continues to enhance throughput and advance MEV taxation mechanisms (such as ASS and MCP), L2 needs to explore new ways to help dApps maximize revenue and reduce costs. My current view is that L2 has a structural advantage over L1 and can execute dApp revenue maximization strategies more quickly.

One of the key roles of the execution layer in maximizing application revenue is the distribution of fees/MEV.

Currently, the premise for achieving MEV taxation or fee sharing is "honest block proposers," meaning those willing to follow prioritization rules or share revenue with applications according to preset rules. Another approach is to allocate a portion of the base fee from EIP1559 to the dApps interacting with users; Canto CSR and EVMOS seem to have adopted this mechanism. This at least allows dApps to enhance their bidding capacity for MEV revenue, making them more competitive in the transaction inclusion market.

In the L2 ecosystem, if block proposers are operated by a team (i.e., a single block proposer), they are inherently "honest" and can ensure the transparency of the block construction algorithm through reputation mechanisms or TEE (Trusted Execution Environment) technology. Currently, two L2s have adopted fee sharing and prioritized block construction, and Flashbots Builder can also provide similar functionality for the OP-Stack ecosystem with minimal changes.

In the SVM (Solana Virtual Machine) ecosystem, infrastructure like Jito can proportionally redistribute MEV revenue to dApps (for example, calculated by CUs, Blast uses a similar mechanism).

This means that while L1 is still researching MCP and built-in ASS solutions (Solana may advance work in this area, but there are no similar revival plans like CSR in the EVM ecosystem), L2 can enable these features more quickly. Since L2 can rely on trusted block producers or TEE technology without the need to enforce OCAproof mechanisms, it can adjust the MRMC (revenue, cost, MEV competition) model of dApps more rapidly.

However, the advantages of L2 are not just in development speed or fee redistribution capabilities; they are also subject to fewer structural constraints.

The survival conditions of the L1 ecosystem (i.e., the conditions for maintaining the validator network) can be described by the following equation: total number of validators × validator operating costs + staking capital requirements × capital cost TEV (inflation + total network fees + MEV tips)

From the perspective of a single validator: validator operating costs + staking capital requirements × capital cost > inflation revenue + transaction fees + MEV revenue

In other words, L1 faces a hard constraint when trying to reduce inflation or decrease fees (through revenue sharing with dApps) — validators must remain profitable!

If validator operating costs are high, this constraint becomes even more apparent. For example, Helius pointed out in the SIMD228 article that if inflation is reduced according to the proposed issuance curve, under a 70% staking rate, 3.4% of current validators may exit due to declining profitability (assuming REV maintains volatility levels of 2024).

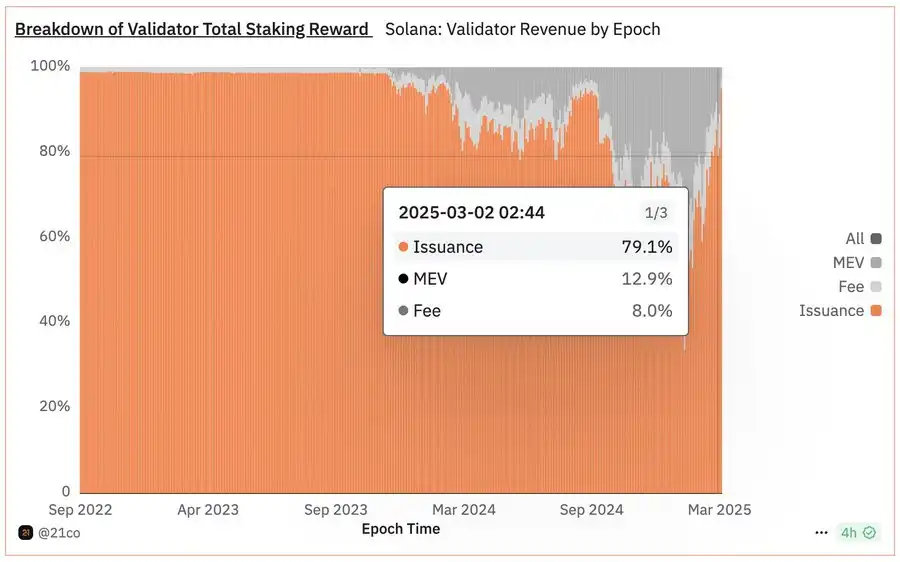

REV (the MEV share in staking revenue) is extremely volatile:

- On the day of the TRUMP event, the REV share reached 66%

- On November 19, 2024, the REV share was 50%

- Currently (at the time of writing), the REV share is only 14.4%

This means that in the L1 ecosystem, due to the profitability pressure on validators, there is a ceiling on reducing inflation or adjusting fee distribution, while L2 is not bound by this constraint, allowing it to explore strategies to optimize dApp revenue more freely.

Solana validators currently face high operating costs, which directly limits the "shareable profit space," especially in the context of declining inflation rates. If Solana validators must rely on REV (the MEV share in staking revenue) to remain profitable, the total proportion available for dApps will be strictly limited.

This brings an interesting trade-off: the higher the validator operating costs, the higher the overall fee percentage (take-rate) the network must maintain.

From the perspective of the entire network, the following formula must be satisfied: total network operating costs (including capital costs) = total network REV + issuance

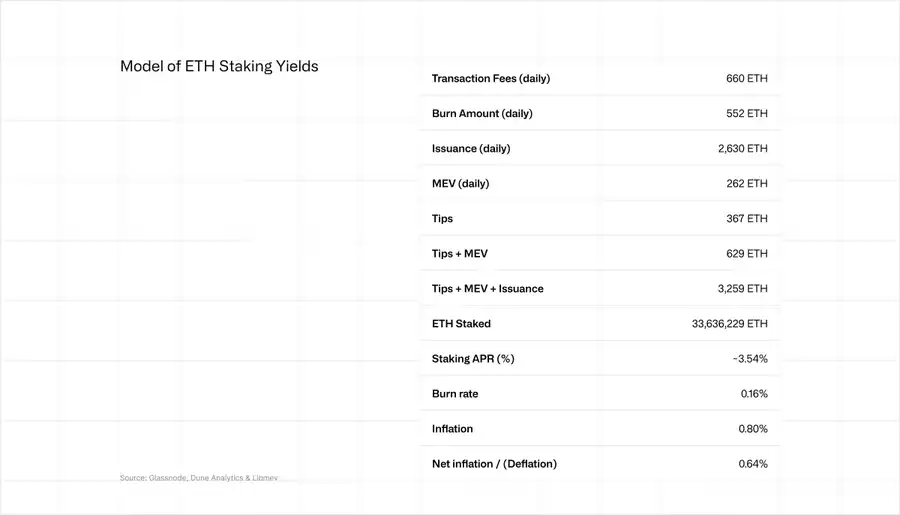

The situation is similar for Ethereum, but with less impact. Currently, the APR (Annual Percentage Rate) for ETH staking is between 2.9% and 3.6%, with about 20% coming from REV. This also means that Ethereum's ability to optimize dApp revenue is similarly constrained by the profitability requirements of validators.

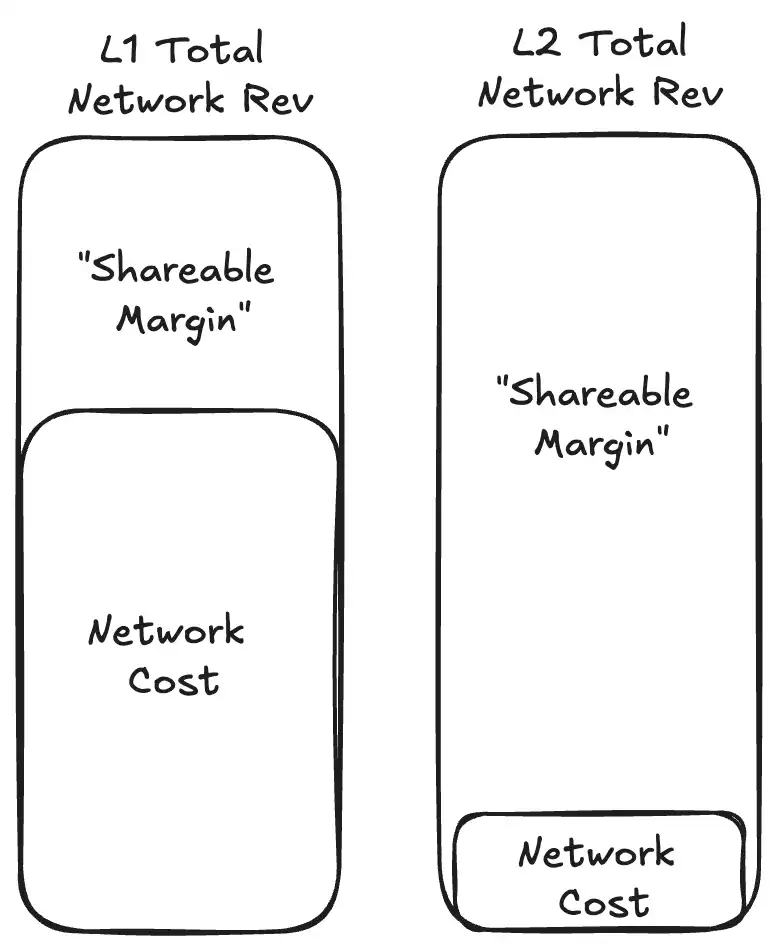

This is precisely where L2 has a natural advantage. On L2, the total operating cost of the entire network is merely the operating cost of a single sequencer, with no capital costs because there are no staking fund requirements.

Compared to L1, which has a large number of validators, L2 requires a very small profit margin to break even. This means that, while maintaining the same profit margin, L2 can allocate more value to the dApp ecosystem, significantly enhancing the revenue potential of dApps.

The network costs of L2 will always be lower than those of an equivalent L1, as L2 only needs to periodically "borrow" L1's security (occupying part of L1's block space), while L1 must bear the full security costs of its entire block space.

L1 vs L2 Battle: Who Will Dominate the dApp Economy?

By definition, L2 cannot compete with L1 in terms of liquidity, and since the user base is still primarily concentrated on L1, L2 has also struggled to directly compete with L1 at the user level (although Base is changing this trend).

However, so far, few L2s have truly leveraged their unique advantages as L2s — namely, the characteristics arising from the centralization of block production.

On the surface, the most discussed advantages of L2 are:

- Mitigating malicious MEV

- Enhancing transaction throughput (some L2s are exploring this direction)

But more importantly, the next battleground in the L1 vs L2 war will be the dApp economic model.

L2's advantage: Non-OCAproof TFM (non-strongly composable TFM)

L1's advantage: CSR (Contract Self-Operating Revenue) or MCP (Minimum Consensus Protocol) + MEV Tax

This competition is the most beneficial thing for the crypto industry

Because it directly brings:

- dApp revenue maximization, cost minimization, thereby incentivizing developers to build better dApps.

- A shift in the incentive mechanism of the crypto industry, from the past infrastructure token premium (L(x) premium) to profit-driven long-term crypto businesses.

- Combined with clearer DeFi regulations, protocol layer token value capture, and the entry of institutional capital, it will prompt the crypto market to enter an era centered on "real business models."

Just as we have seen funds pouring into infrastructure construction over the past few years, driving innovations in areas such as applied cryptography, performance engineering, and consensus mechanisms, the competition between chains today will bring about a significant transformation in the industry's incentive structure and attract the smartest talent to the Crypto application layer.

Now is the true starting point for the mass adoption of crypto!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。