Author: Ice Frog

I. Good Direction, Good Timing: Reshaping the AI Economic Ecosystem, It's the Right Time to Enter

A good direction is the prerequisite for project success

Algorithms, computing power, and data are the three foundational pillars of generative artificial intelligence. Due to the dazzling brilliance of Nvidia and OpenAI, computing power and algorithms have developed rapidly. However, with the continued effectiveness of the large model Scaling Law, data has shifted from being cost-dominated to a higher-value asset type. Consequently, issues such as the scarcity of high-value data and data privacy security are receiving significant attention from the industry. Yet, a more obvious and overlooked fact is that projects similar to large models enjoy the capital dividends brought by data, while the interests of data creators, owners, and model feedback providers in this ecosystem are often neglected.

In the AI sector, public data is not particularly difficult to obtain, and the entire data market lacks unified standards. Additionally, users, as the most fundamental data providers, do not receive substantial benefits. How to ensure that users can enjoy the rightful benefits of data provision while meeting the high-quality data needs of model providers is the original starting point for the Sahara AI project. It targets the key pain points that have been widely overlooked due to rapid development in the current AI ecosystem, namely the core proposition of AI assetization.

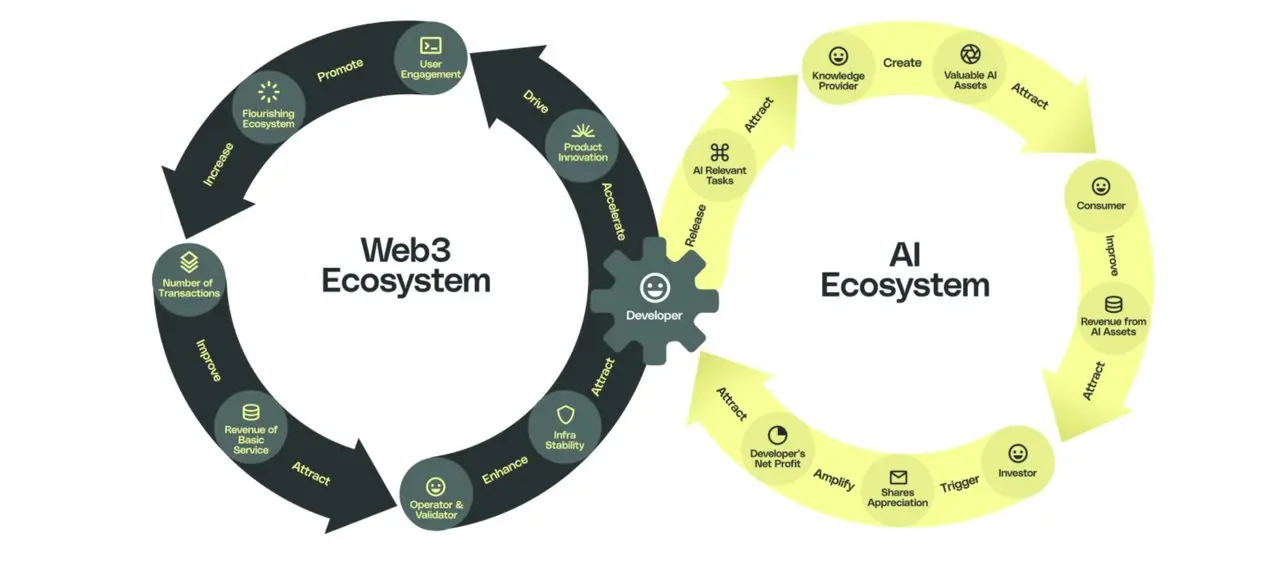

As AI Agents are experiencing an explosion and the AI industry is transitioning from 1 to 100, the supply of high-quality data that can ensure privacy protection will become increasingly important. This is because AI is moving from generalization to a more vertical, specialized, and personalized era. The transparency, security, and trustworthiness of blockchain provide excellent support for realizing this concept. On one hand, blockchain technology can allow every participant on both the supply and demand sides of AI to clearly measure their value contributions while ensuring reasonable profit distribution. On the other hand, the decentralized nature of blockchain can effectively link both sides, efficiently establishing more customized and personalized AI products. This is an essential stage in AI development following general artificial intelligence.

Understanding the above content, we can roughly glimpse Sahara AI's foresight in its directional choice. The project's direction directly addresses the key issues and bottlenecks in AI development, and it does not attempt to make significant innovations in blockchain technology itself but rather leverages blockchain technology to enhance AI development. From the perspective of pain points, the issue of benefit distribution in the AI ecosystem not only genuinely exists but will increasingly become a core pain point hindering market development as AI continues to commercialize. After all, regardless of how the times develop, people's demands for fairness, transparency, security, and benefits remain unchanged. In terms of scale limits, the scale limit of AI will be several orders of magnitude larger than that of blockchain, and Sahara will link to a trillion-level large market.

A good entry timing ensures the project's sustainable growth

A project's direction is important, but timing is equally crucial. Good timing should neither be too early nor too late; it is a triple resonance of industry, market, and cognition.

Imagine a scenario where ChatGPT has not yet been released, and large models have not yet amazed the world. At this moment, raising the issue of data benefit distribution would clearly be too ahead of its time and would struggle to gain market recognition. However, if one waits until these issues have become explicit and highly heated, by then, there will likely be many mature solutions already operating in the market.

Looking at Sahara AI's current situation, there is no dispute about the technological trends in the AI industry. Large models have already passed the initial stage of 0-1. Whether on the enterprise side or the user side, people's understanding and acceptance of AI are strengthening. People have shifted from "What is AI?" to the second stage of "How to use AI well?" In this stage, commercialization will generate more discussions, and naturally, people will gradually realize the importance of data. Thus, data assetization, and even AI assetization, will quickly gain market recognition.

Whether it is the industry's trend, market applications, or customer understanding, at least from the timing perspective, it is indeed just right for Sahara AI.

II. Good Team, Strong Capital: A Triad of an Excellent Team, Backed by Top Traditional and Crypto VCs

Systematic cooperation in technology, operations, and ecology, combining technical vision with practical entrepreneurship

From the description of direction and opportunity, we can infer that a team capable of launching a project with such forward-thinking innovative ideas at this favorable time must have profound insights into the AI industry and also possess top-level understanding of blockchain. The resumes of the project team confirm this.

Sean Ren (Co-founder & CEO): Before founding Sahara, he served as a tenured professor in the Computer Science Department at the University of Southern California (USC) for seven years, primarily researching AI and NLP. While pursuing his PhD in Computer Science at the University of Illinois at Urbana-Champaign, he had successful entrepreneurial experience, founding StylePuzzle (a fashion recommendation e-commerce platform) which successfully secured Series C funding from Plug and Play. Additionally, he has served as a data science advisor for Snap and a visiting scientist at the Allen Institute for Artificial Intelligence, and he is also a recipient of Samsung's annual AI researcher award. From the founder's resume, it is evident that he not only has a deep understanding of AI but also possesses impressive commercial experience, ensuring a forward-looking and pragmatic grasp of the project.

Tyler Zhou (Co-founder & COO): The project COO graduated from UC Berkeley and previously worked in investment banking and private equity. In 2022, he joined Binance Labs as an investment director, primarily responsible for investments in the U.S. market. Tyler Zhou's background not only guarantees the project's investment but also, due to his experience at Binance Labs, suggests that the entire project's operations will have a more commercial attribute.

Lara Avedissian (Ecosystem Director): Graduated from UCLA and Columbia University, she previously served as Chief of Staff at Comm and was also the head of the ecosystem at Stability AI. This means that Lara Avedissian's addition will allow the Sahara project to reach the broadest range of projects in both the crypto and AI industries.

Guang Han (Vice President of Engineering): Previously an engineer at Microsoft, he was also the CTO and co-founder of a startup, with a very rich technical background.

From the publicly available core executive team of four, in addition to the standard of graduating from top traditional universities and having experience in large companies, the most crucial aspect is that the founding team has past successful experiences in their respective fields, many of which include entrepreneurial experience. This means that the project team can deeply grasp industry development trends while also pragmatically executing project implementation, undoubtedly enhancing the chances of success.

Top-tier capital, not limited to crypto VCs, with a super luxurious advisory team

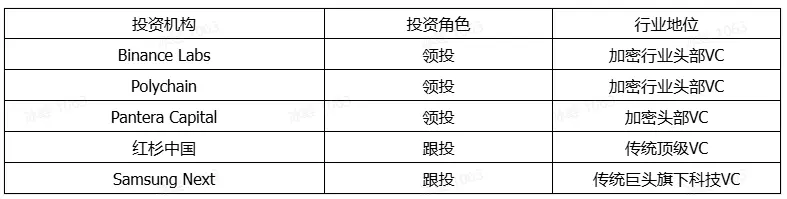

Sahara AI's investment team is undoubtedly one of the rare luxuries in the industry, with the most notable feature being that the investment team includes not only top crypto VCs known for investing in the crypto industry but also top traditional VCs known for traditional investments. The main investment institutions are as follows:

In addition to the aforementioned top institutions, there are also numerous star investment institutions in the industry participating, as well as endorsements from industry veterans such as Sandeep Nailwal (co-founder of Polygon).

Another rare additive element is the super luxurious advisory team, which includes: Laksh Vaaman Sehgal (Vice Chairman of Motherson Group), Rohan Taori (Human Research Scientist), Teknium (Co-founder of Nous Research), Vipul Prakash (CEO of Together AI), Elvis Zhang (founding member of Midjourney), etc.

From the team to capital to advisors, all configurations are top-notch in the industry, which not only signifies the strength of the team but also indicates the vast resources behind the team, capital, and advisors. From a practical business perspective, it must be acknowledged that such projects indeed have a higher probability of success.

III. Technologically Sound, Tangible Results: A Solid and Clear Development Roadmap, Trust from Top Partners

Technological implementation demonstrates strategic foresight

From the previous content, we can clearly see that the project team, whether in terms of directional choice, timing grasp, or the support of capital and team, showcases the qualities of a top-tier star project. Further examination of the actual implementation reveals the project's disruptive aspects and broad prospects.

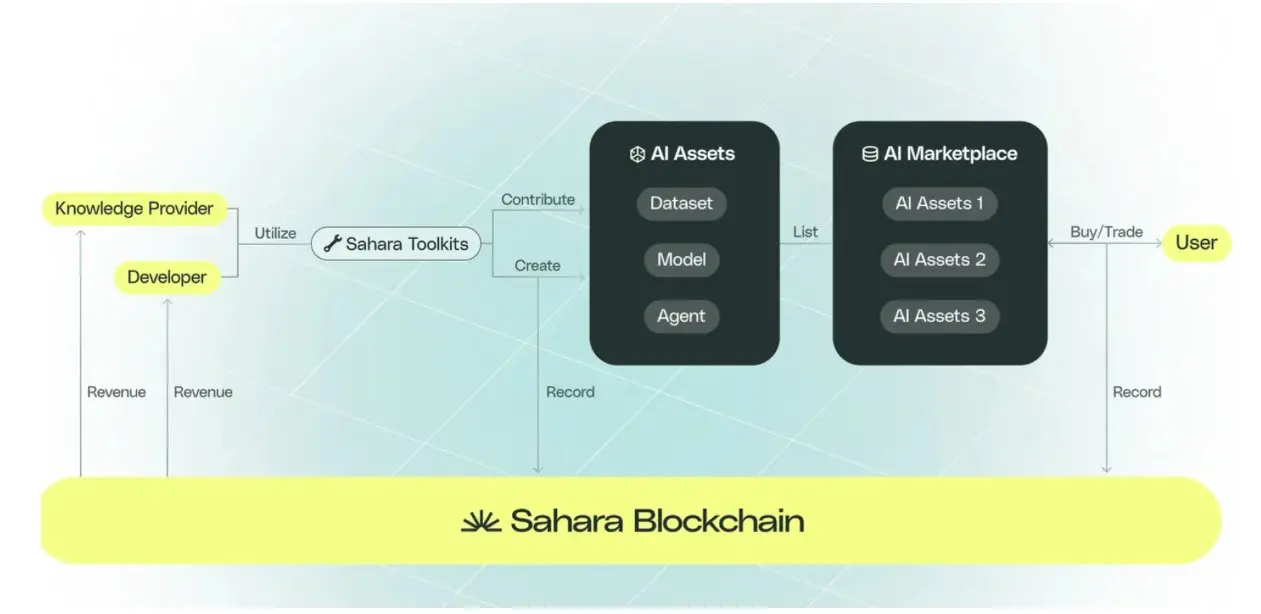

As mentioned at the beginning, Sahara AI primarily utilizes blockchain technology and related privacy protection measures to empower the entire AI ecosystem. In terms of specific product construction, the developed Sahara AI platform almost covers the entire lifecycle of AI development needs in a one-stop manner, while utilizing blockchain technology to ensure contributors' ownership of their assets.

As shown in the figure above, the implementation logic is not complex. From the tools for developers/knowledge/data contributors to the creation and transaction of assets, everything will be accurately recorded through blockchain, providing corresponding fair returns.

From the core logic of this product framework, the platform mainly relies on three major pillars:

Emphasizing sovereignty and provenance: This means that from the very beginning of data collection, annotation, model deployment, and application, everything will operate on the blockchain, ensuring high transparency and inclusivity. This prevents Web2-style monopolies while ensuring that all stakeholders have a voice and that profits are distributed according to contributions.

Providing AI tools: In addition to supporting cutting-edge AI paradigms, it also provides users with a complete set of highly available toolkits, equipped with the most advanced security measures and privacy protection.

Shared economy: Rewards are proportionally given based on contributions throughout the entire AI development process, allowing individuals, small and medium enterprises, and large corporations to participate inclusively, while also making the monetization of AI assets more transparent.

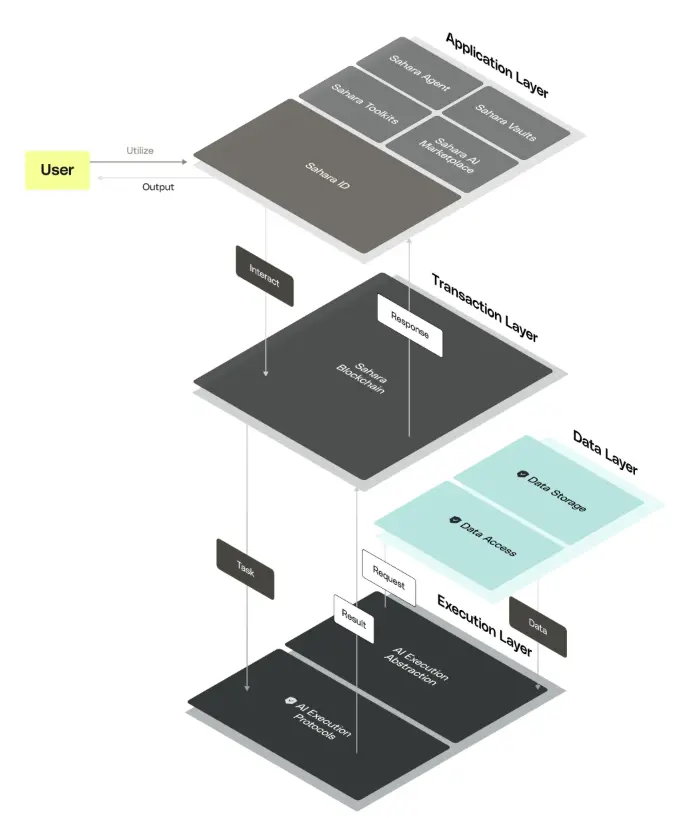

These three pillars are interlinked, providing a solid foundation for the healthy operation of the entire platform. In terms of specific implementation, the entire platform is divided into four layers, with the main features as follows:

Application layer: This is the user interaction interface for accessing, building, and monetizing AI assets.

Transaction layer: A layer of blockchain that manages all AI-related transactions in the AI lifecycle (such as provenance, access control, ownership, etc.).

Data layer: The abstraction and protocol for data storage, access, and transmission, integrating both on-chain and off-chain components for convenient lifecycle data management.

Execution layer: Supports AI applications, providing necessary off-chain infrastructure, including multifunctional AI computing protocols and dynamically allocating computing resources.

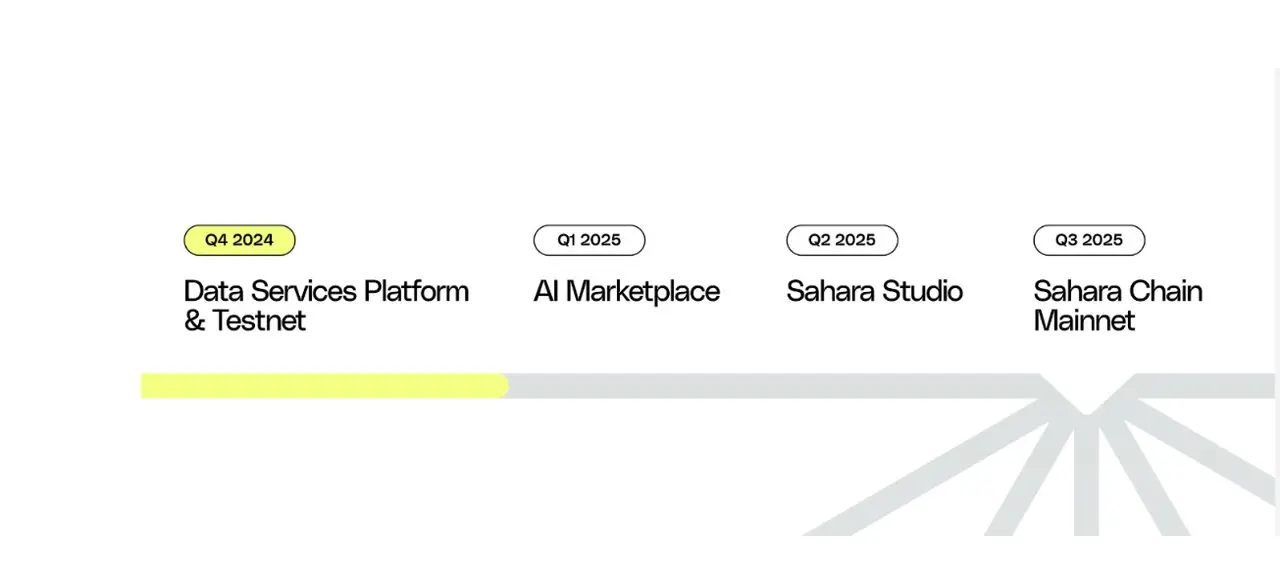

The overall progress of the project currently shows that the testnet has launched its first product: the Data Services Platform, which has garnered significant market attention. According to the project's announced roadmap, 2025 will be the most important year for the project, not only with the mainnet launch but also multiple products set to launch simultaneously.

Trust from Top Partners, Growth Flywheel Initiated

From the currently announced ecosystem partners, the lineup is quite impressive. Over 35 research institutions are already using Sahara AI, including Microsoft, Amazon, Snap, MIT, UCLA, etc. The usage includes not only data annotation and collection through Shara Data but also functionalities for agent construction via Shara Agent. The trust of these top partners will greatly assist and expand the entire ecosystem of the project.

From opportunities, timing, team, capital to technological implementation and ecosystem expansion, we see the flywheel effect formed by Crypao × AI for Sahara AI is rapidly starting.

Once entering a positive cycle, what awaits the market is likely a disruptive game-changer, rather than just another star project.

IV. High Heat, Strong Potential: Market Heat Soars, Potential Returns Expected

Sahara AI is sweeping the market with astonishing momentum, and its development potential will be fully unleashed in 2025. The successful conclusion of the two rounds of testnets has fully demonstrated the community's enthusiasm and the project's attractiveness:

First round of testnet: A total of 800,000 people submitted applications, with only 10,000 users qualifying for participation, distributing 4.5 million points.

Second round of testnet: Approximately 2.2 million people registered on the waiting list, with 1,936,183 data points approved, distributing about 19 million points.

The third round of testing is currently open for registration: Application link

The number of applicants for the first two rounds reached several million, indicating high interest. The upcoming Siwa public testnet, set to launch in April, is expected to further expand its influence, attract more users, and drive a dual increase in total points and market heat. Coupled with the fact that this is the inaugural year for AI, the potential returns from Sahara AI are highly anticipated.

Funding and Market Recognition: Significant Funding, Market Cap Not Low

From various benchmark projects, it is known that Sahara AI has raised as much as $55 million, placing it at a high level among similar projects. This clearly indicates that the capital market is very optimistic about its development prospects, estimating that the post-TGE FDV of Sahara will be at least around $2 billion+. The following are key factors supporting this estimate:

Track Potential and Unique Positioning: In terms of track potential and project positioning, the current AI sector is still in its infancy. Sahara's positioning as a data service provider for AI models, providing high-value data for AI model training, is crucial. Current mainstream AI models (like GPT-4, Claude) are facing a depletion of training data, with research indicating that high-quality corpora will be exhausted by 2026. As a data service provider, Sahara AI perfectly fills this market gap, and the urgency of market demand brings it tremendous potential, which is a key factor supporting its high valuation.

First-Mover Advantage and Leader Premium: Higher Valuation Ceiling In AI data collection-related projects, no clear leader has emerged yet. With Sahara leading in multiple aspects, it has already become the leader in this track. Typically, track leaders have valuation premium space. This can be seen from Grass, which, with only $4.5 million in funding, achieved a $2.5 billion FDV. Sahara's practical positioning naturally leads to a higher valuation.

Future Growth Potential: Ecosystem Expansion and Market Trends The AI industry is currently in a period of rapid growth. As a data service provider, Sahara AI will directly benefit from industry expansion. With technological advancements and market maturation, its business scale is expected to achieve exponential growth. The scarcity of high-quality data will drive up its value, further enhancing profitability and valuation space. An FDV of $2-3 billion may even underestimate its long-term potential.

Estimated Potential Returns

Since its launch, Sahara has introduced two testnet tasks and one Odyssey task, both of which have clear rewards that may be linked to airdrops:

- Testnet task points, with a total of 23.5 million points distributed over two rounds, allowing users to accumulate points by participating in tasks.

- Sahara Odyssey task, where users complete different tasks to synthesize a final NFT, with a deadline of May 2.

- A public testnet will launch in April, and with the ongoing registration for the third internal test, I estimate that another 50 million points may be released, bringing the total points to approximately 75 million.

- The Odyssey NFT task has a longer deadline and has only opened some tasks, with an expected airdrop ratio of about 2%. Below, only the points from the testnet white list tasks are calculated, with potential returns for each point.

Under different FDV scenarios, the estimated value of each point is about $0.53-$1.60. The above estimates are based solely on the prediction of 75 million points, and subsequent testnets and tasks will increase the total points, which will naturally dilute the value of each individual point. This data is for reference only.

Conclusion

At the beginning of the year, the wave of AI and crypto integration swept the entire market with one wealth myth after another. However, when the hype subsides, the combination of AI and the crypto industry still faces a route issue that cannot be ignored. Many projects aim to empower blockchain with AI, which is easier to achieve and more eye-catching, as it essentially views AI as a tool. Sahara chooses to empower AI with blockchain, aiming to participate in the grand narrative of AI development. The differences in perspective and route not only give Sahara's ecosystem imagination and market a far superior ceiling compared to the former but, in the long run, may also represent the correct approach for blockchain to break into Web2. This could also explain why top investment institutions like Binance, Polychain, Samsung, and Matrix Partners are willing to make substantial investments.

From the overall design of the platform, its modular design based on blockchain cleverly achieves a high degree of unity between the technological stack of the entire AI lifecycle and the interests of various participants. It is not only the only project currently providing this technological solution but also clearly demonstrates that the future vision of AI must be fair, democratic, secure, and easily accessible. This reflects Sahara AI's insights into the entire AI industry and illustrates that empowering AI with blockchain opens up a broader and more promising landscape.

The market potential of Sahara AI is accelerating its release. The current stage is the public test registration phase, and it is recommended to keep an eye on subsequent participation opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。