Introduction

The Layer 1 blockchain space is no longer dominated solely by Ethereum, as various Layer 1 public chains such as Solana, BNB, and Sui continue to emerge, each vying for a share of the market. Berachain, as an emerging public chain built on the Cosmos SDK and compatible with the Ethereum Virtual Machine (EVM), stands out with its unique incentivized pre-deposit vault activities, innovative Proof-of-Liquidity (PoL) mechanism, and three-token system. This not only fundamentally enhances on-chain liquidity utilization but also establishes a multi-party win-win incentive system for the entire ecosystem, quickly becoming the sixth-largest blockchain network by Total Value Locked (TVL) and securing its place in the emerging public chain arena.

However, in the context of increasingly fierce competition among Layer 1 public chains, can Berachain maintain its momentum? Will the PoL mechanism bring a qualitative leap in on-chain security and liquidity? How will the performance of various protocols and tokens within the ecosystem affect the overall development prospects of the chain? This article will conduct a comprehensive analysis from multiple perspectives, including technological innovation, on-chain data, ecosystem token review, market opportunities, and challenges, to explore Berachain's growth potential and future development path.

Berachain's Market Performance and Innovative Mechanisms

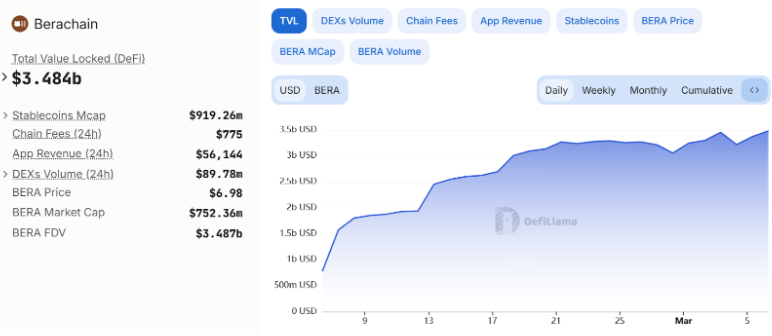

Berachain launched its mainnet on February 6. Despite the turbulent and sluggish cryptocurrency market, the on-chain TVL of Berachain has steadily increased over the past month. According to DefiLlama data, as of March 6, Berachain's on-chain TVL has reached $3.484 billion, making it the sixth-largest public chain ecosystem, following Ethereum, Solana, Bitcoin, BSC, and Tron.

Source: https://defillama.com/chain/Berachain

The most striking aspect of Berachain is its reconstruction of the traditional public chain economic model through multiple innovations, enabling liquidity, governance, and security to interact positively within the same system. Its main innovations can be summarized in the following three aspects:

1. Pre-deposit Activities: Building a Sustainable Liquidity Support System

During the testnet phase, Berachain launched the incentivized Boyco market pre-deposit vault activity, aimed at providing users with maximum reward opportunities before the mainnet launch. By collaborating deeply with protocols such as Concrete, Lombard, StakeStone, Ethena, and Etherfi, Berachain introduced the incentivized pre-deposit vault, allowing users to lock in subsequent rewards of BERA, BGT, and other ecosystem tokens before the official launch, while combining Berachain ecosystem incentives with partner tokens (such as STONE, BAB, USDe, Concrete points, etc.) to achieve diversified yield stacking. Its key values include:

Gathering Liquidity Before Mainnet Launch: Reducing the initial "capital scarcity" issue for new public chains, and naturally integrating with the PoL mechanism to lay a solid foundation for security and economic vitality.

Multi-party Collaborative Incentive Distribution: By collaborating with multiple DeFi protocols, users can receive more diverse token rewards; at the same time, protocol parties can leverage this opportunity to attract popularity and funds.

Consolidating Community Consensus: The "pre-deposit" model attracted a large number of users and funds, driving continuous community discussion and secondary creation, laying the groundwork for the popularity and capital of Berachain's ecosystem after its official launch.

For DeFi users, this is a low-threshold way to participate and receive multiple rewards; for the protocols themselves, it is an excellent opportunity to quickly attract attention and funds. The Boyco "pre-deposit + mining + ecosystem airdrop" model further stimulated community discussion and enthusiasm, with the number of active addresses during the testnet period exceeding tens of millions at its peak, and the liquidity of staked crypto assets reaching $1.57 billion, forming a considerable capital scale and user base.

Source: https://dune.com/zero_labs/berachain-pree-deposit-overview

2. Three-Token Mechanism: Balancing Security and Liquidity

To further achieve role separation and incentive balance, Berachain adopts a three-token model:

BERA: As the core gas token, it is used for transaction fees, staking operations, and internal ecosystem incentives. Similar to Ethereum's ETH or BNB Chain's BNB, it is primarily used to pay transaction fees and ensure network security. Validators need to stake BERA to ensure the network's operation and earn block rewards.

BGT: BGT is mainly used for on-chain governance, proposal voting, and reward distribution. The acquisition of BGT depends on users providing liquidity to the ecosystem, and the amount held directly determines the user's voice in network governance. BGT can be exchanged for BERA at a 1:1 ratio, but BERA cannot be exchanged back for BGT. In other words, BGT cannot be bought or sold; it can only be obtained by contributing liquidity, serving as the ecosystem's "voting rights + reward points."

HONEY: Berachain's native stablecoin, pegged 1:1 to the US dollar. Users can mint HONEY by collateralizing other assets on the Berachain platform. HONEY serves as an in-chain stable currency, providing a stable medium of exchange for decentralized applications, increasing the platform's usability and attractiveness.

The advantages of this three-token model include:

Optimizing network security and liquidity: The staking mechanism of $BERA ensures network security; at the same time, the design of $BGT incentivizes users to provide liquidity, avoiding the liquidity shortage issues that may arise in traditional PoS systems.

Refined governance structure: The non-transferability of $BGT ensures a fairer distribution of governance rights, truly empowering users who contribute to the ecosystem, enhancing governance efficiency and decision-making quality.

Enhancing ecosystem stability: $HONEY, as a stablecoin, provides a stable value scale for transactions and applications within the platform, reducing users' transaction costs and risks.

3. PoL Mechanism: Building a Liquidity-Driven Consensus Model

Traditional public chains mostly adopt Proof-of-Stake (PoS) or Proof-of-Work (PoW) mechanisms to ensure network security through staking or computational power competition. Berachain, however, is the first to propose the Proof-of-Liquidity (PoL) mechanism, with the core design philosophy being "liquidity equals security," allowing the chain's security and liquidity to grow in tandem, avoiding the traditional blockchain issues of "secure but unused" or "used but insecure." The PoL mechanism operates as follows:

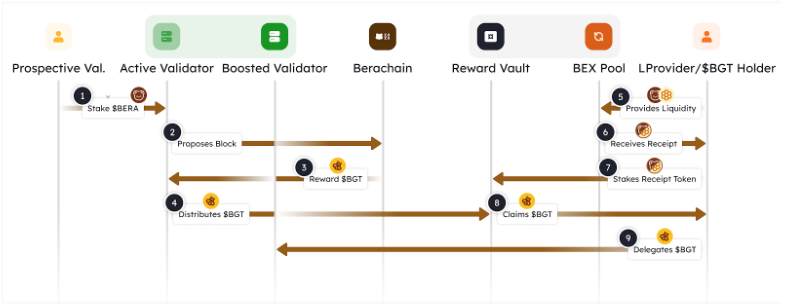

Validators: Validators first stake at least 250,000 $BERA to become candidate nodes. The more $BERA staked, the higher the probability of winning the block production opportunity (similar to lottery weight). For each block produced, validators receive fixed and floating rewards; the fixed reward is a portion of $BGT, while the floating reward is distributed based on the proportion of BGT that users vote for the validator.

Users: Users deposit liquidity into on-chain applications to receive LP tokens, which they can then deposit into the official "reward pool" to earn BGT daily based on their deposit proportion.

Voting: Users use the earned BGT to vote for their preferred validators, which directly increases the validator's Boost value, allowing them to earn more $BGT rewards when proposing blocks. To attract more $BGT delegations, validators will share incentives obtained from the reward pool with users, creating a positive feedback loop that enhances the entire ecosystem's synergy.

The core design idea is that validators want to earn more → need to attract users to vote $BGT for them → users will only vote for validators that can help them earn more → validators must distribute earnings to users and ecosystem applications → ultimately forming a community of shared interests among users, validators, and applications.

Berachain Ecosystem Potential Project Review

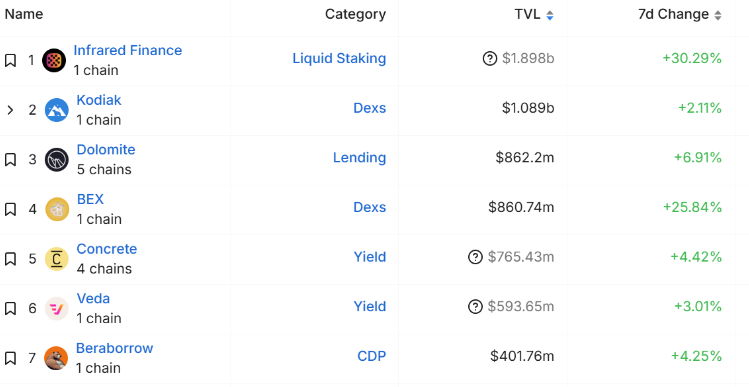

Although there are currently few projects launched in the Berachain ecosystem, its impressive asset scale and user base lay a solid foundation for the subsequent development of ecosystem projects. Below is an analysis of the top projects in Berachain's ecosystem by TVL:

Source: https://defillama.com/chain/Berachain

1. Infrared Finance

As the liquidity and staking infrastructure platform of the Berachain ecosystem, Infrared Finance utilizes its proprietary Proof of Liquidity (PoL) mechanism to provide users with simple and efficient liquidity staking and yield optimization solutions through the issuance of iBGT (liquid version of BGT) and iBERA. By staking various liquidity assets, users can participate in governance while earning high rewards. Currently, Infrared manages over $1.8 billion in TVL and plays the role of a "value capture" within the ecosystem. In the future, as the mainnet matures and the ecosystem expands, Infrared is expected to further unlock greater growth potential by introducing more innovative products and cross-protocol incentives.

2. Kodiak

Kodiak is the native liquidity hub within Berachain, achieving centralized liquidity management through the "Island" mechanism, reducing risks while improving capital efficiency. By collaborating with projects like Infrared and Boyco, Kodiak can attract significant liquidity from the very beginning of the mainnet launch. It manages approximately $1 billion in assets, and xKDK, as its non-circulating governance token, is expected to unlock during the future mainnet launch, aiding community governance. As an important platform for trading and liquidity provision, Kodiak's design and cross-project incentives will continue to attract users, demonstrating high growth potential.

3. Dolomite

Dolomite is a new lending and leveraged trading platform on Berachain, drawing on traditional lending protocols and integrating the PoL mechanism to provide users with diversified financial services. Dolomite has demonstrated market interest by participating in ecosystem incentive programs, with a current TVL of $860 million. In the future, leveraging mainnet promotion and user base expansion, Dolomite plans to issue governance or incentive tokens to attract more lending and leveraged trading demand, thereby achieving significant value appreciation.

4. BEX

BEX is Berachain's flagship decentralized exchange, becoming an important entry point for user trading due to its low slippage and high liquidity characteristics. Recent data indicates that BEX's trading volume continues to rise, with its deep liquidity contributing significantly to the ecosystem's TVL, attracting approximately $860 million. The platform may launch a dedicated incentive token in the future and deeply integrate with other core products like Infrared to jointly promote the prosperity of Berachain's trading ecosystem.

5. Concrete

Concrete focuses on efficient lending and liquidity optimization, maintaining stable TVL performance while reducing liquidity loss through its innovative mechanisms—currently managing assets of approximately $760 million. Concrete collaborates with Kodiak and Infrared to build a complementary and efficient DeFi ecosystem.

6. Veda

As a new project, Veda is dedicated to asset management and lending services, relying on the technical support of Ether.fi, emphasizing multi-asset integration and leveraged trading. Currently, Veda's TVL is approximately $600 million. In the future, by introducing governance tokens and leveraging multi-chain interoperability, Veda is expected to achieve steady growth by meeting cross-asset management demands, further consolidating its market position on Berachain.

7. Beraborrow

Beraborrow is the first CDP collateral debt position protocol within Berachain, allowing users to pledge various assets to borrow NECT stablecoins. Its innovation lies in adopting a Continuous Protocol Incentive (CPI) mechanism, which rewards liquidity providers not just once but continuously based on users' long-term participation. Currently, Beraborrow's TVL exceeds $400 million, and NECT has become the second-largest stablecoin within the ecosystem.

Opportunities and Challenges in the Berachain Ecosystem

Opportunities

First-Mover Advantage from Technological Innovation: Berachain provides a new solution for on-chain security and liquidity through the PoL mechanism, three-token model, and incentivized pre-deposit vault activities. Compared to traditional PoS chains, Berachain's "liquidity equals security" concept not only effectively enhances capital utilization but also attracts numerous high-quality projects in DeFi, NFT, GameFi, etc., forming an early ecological advantage.

Cross-Chain Collaboration and Ecosystem Interconnectivity: Berachain has unique advantages in cross-chain asset circulation and has collaborated with mainstream public chains like Ethereum and Solana to build cross-chain bridges and multi-chain liquidity pools. This cross-chain interoperability not only enhances user experience but also creates opportunities for the ecosystem to attract more liquidity and capital.

Strong Community and Developer Support: Berachain has attracted a large number of developers and community members to actively participate due to its open and transparent technical roadmap and innovative incentive mechanisms. During the testnet phase, the number of independent addresses and daily active users experienced exponential growth, demonstrating strong community vitality and user stickiness, laying a solid foundation for rapid ecosystem expansion after the mainnet launch.

Capital Backing and Strategic Partnerships: In terms of financing, Berachain has received investments from well-known institutions including Polychain Capital, OKX Ventures, and Framework Ventures, along with strategic partnerships with leading protocols like Stakestone, Ethena, and Lombard, providing strong financial and resource support for ecosystem development. This capital and collaboration will help facilitate the smooth implementation and expansion of various incentive mechanisms within the ecosystem.

Challenges

Gap in Ecosystem TVL Compared to Mature Public Chains: Although Berachain's TVL reached $3.4 billion in March 2025 data, there is still a significant gap compared to mature public chains like Ethereum and Solana. Attracting more DeFi protocols and users to participate and further increasing locked asset scale will be the main tasks Berachain faces in the future.

Technical and Security Risks: As an emerging consensus mechanism, the security and stability of the PoL and three-token model need to be tested by the market and time. Potential vulnerabilities during the technical deployment process, the long-term effectiveness of liquidity incentive designs, and issues related to cross-chain interoperability all need to be continuously optimized and improved in actual operation.

Market Competition and User Education: Facing established ecosystems like Ethereum, Solana, and BNB Chain, Berachain needs to invest significant effort in user habits, developer tools, and community governance. Especially, the concepts and advantages of the new mechanisms need to gain market recognition through user education and transparent communication to avoid market fluctuations or FUD sentiments caused by misunderstandings.

Token Inflation and Investor Sell Pressure Risks: The long lock-up periods and large supply releases of tokens held by early private investors, combined with the increased circulation of some tokens under the incentive mechanism, may lead to certain sell pressure risks in the market. Balancing incentive distribution with market circulation and ensuring the interests of long-term holders is a pressing issue for Berachain to address.

Outlook and Summary of Berachain Ecosystem Potential

In the ongoing exploration and innovation process, Berachain's future development prospects are filled with opportunities but also face numerous challenges. The following are outlooks on several key development directions:

Ecosystem Diversity and Application Expansion: In the future, Berachain will continue to attract high-quality application projects in DeFi, NFT, GameFi, and other fields, promoting the diversified development of the ecosystem. At the same time, by continuously improving incentivized pre-deposit vault activities and cross-chain cooperation mechanisms, Berachain is expected to break the short-term liquidity dispersion of funds, achieving efficient capital integration and long-term accumulation.

Capital Market Integration and Strategic Partnerships: Berachain will continue to deepen cooperation with leading blockchain projects and traditional financial institutions to build a cross-chain liquidity network and enhance market competitiveness. Strategic partnerships can not only bring more TVL and users to the ecosystem but also help promote Berachain's recognition in the global financial market, facilitating the long-term stable growth of token value.

Economic Model Optimization and Incentive Balance: In response to potential inflation and sell pressure risks, Berachain will explore innovative designs such as iBGT liquidity certificates in the future to further balance incentive distribution within the ecosystem. Through technical means and governance mechanism optimization, it aims to ensure that the token economic model remains healthy in long-term operation, fostering a solid consensus and cooperation mechanism among participants.

Community Building and Expansion: Building an open, inclusive, and technology-driven community is key to Berachain's long-term success. In the future, the project team will increase user education efforts, eliminate market doubts through transparent governance processes and active communication mechanisms, and attract more retail and institutional investors to participate, thereby enhancing the overall ecosystem's activity and innovation.

Conclusion

In summary, Berachain is redefining the relationship between security and liquidity within the blockchain ecosystem through its innovative PoL mechanism, three-token model, and incentivized pre-deposit vault activities. Although there are still gaps in TVL and market maturity compared to mainstream public chains like Ethereum and Solana, its potential in capital utilization, incentive transmission, and ecosystem diversity cannot be overlooked. As stated in its white paper: "Berachain is not just another EVM chain, but a new continent of economic collaboration."

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a "trend assessment + value mining + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluations of potential projects, and all-day market volatility monitoring, combined with weekly live strategy broadcasts of "Hotcoin Selected" and daily news updates of "Blockchain Today," providing precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

[Mail: labs@hotcoin.com](mailto:Mail: labs@hotcoin.com)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。