Source: Cointelegraph Original: "{title}"

Despite all valuation indicators for Bitcoin leaning bearish and a recent decline in demand in the U.S., the price of Bitcoin still rose by 7% in the past 24 hours.

On March 11, on-chain analysis platform CryptoQuant released a market report stating: "All valuation indicators for Bitcoin indicate that we are in a bearish range."

Demand is declining at the "fastest pace" since July.

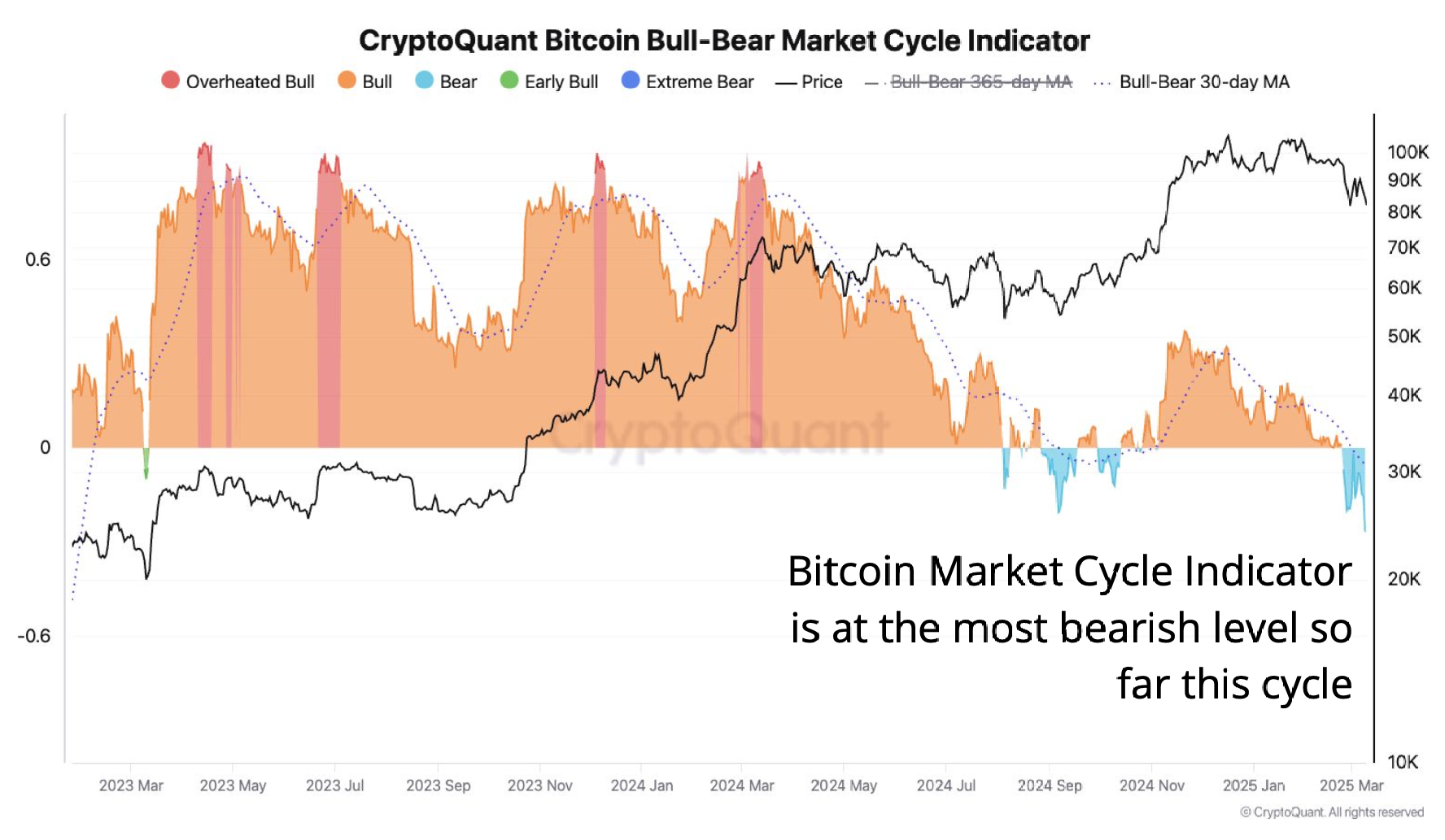

CryptoQuant noted that its Bitcoin long-short market cycle indicator is at the "most bearish level" of this cycle, and the Market Value to Realized Value (MVRV Ratio Z-score, a key indicator for assessing whether Bitcoin (BTC) is overvalued or undervalued) has fallen below the 365-day moving average, "indicating that the price uptrend has lost momentum."

According to CoinMarketCap, at the time of this article's publication, Bitcoin was trading at $82,910, up from a low of $79,356 in the past 24 hours.

CryptoQuant's Bitcoin long-short market cycle indicator is at the "most bearish level" of this cycle. Source: CryptoQuant

On March 11, the U.S. market stabilized after a significant drop the previous day due to President Trump not ruling out the possibility of an economic recession, with Bitcoin soaring 7.5% in the past 24 hours.

Most of Bitcoin's gains occurred after Senator Cynthia Lummis reintroduced the "Bitcoin Bill," which proposes that the U.S. government purchase 1 million Bitcoins over five years.

At the time of this article's publication, Bitcoin was trading at $82,910. Source: CoinMarketCap

However, some traders do not believe the downtrend has ended.

Cryptocurrency analyst Bitcoin Rachy stated in a post on X on March 11: "This is a fake rally, right?" Similarly, cryptocurrency trader BitcoinHyper also expressed in a post on X: "Every time there’s a rally, it feels like a new beginning. That’s how the market takes your money."

Meanwhile, CryptoQuant reported that Bitcoin demand fell by 103,000 coins last week compared to the previous week, "marking the fastest contraction since July 2024."

Bitcoin demand is in a "contradictory range."

CryptoQuant stated that the recent decline in Bitcoin demand in the U.S. is due to uncertainty regarding U.S. inflation rates and President Trump's tariff policy implemented on February 1. On March 7, Federal Reserve Chairman Jerome Powell reiterated that he is not in a hurry to adjust interest rates.

The agency stated: "Bitcoin demand remains in a contraction range, with whales slowing down their accumulation of Bitcoin, and U.S. spot ETFs have become net sellers of Bitcoin."

Bitcoin's price has still fallen by 14% over the past month, and CryptoQuant noted that this pullback is not "unusual in terms of the magnitude of the decline, as similar pullbacks have occurred in past bull markets."

However, the agency warned that if Bitcoin falls below the current support level of $75,000 to $78,000, its next target price could drop as low as $63,000, a price level not seen since October 14.

Cory Klippsten, CEO of Swan Bitcoin, recently told Cointelegraph that his prediction is "that by the end of June this year, we have over a 50% chance of seeing Bitcoin reach a new all-time high." Bitcoin's current all-time high is $109,000, reached on January 20.

Related: Bitwise launches Bitcoin Corporate Reserve ETF

This article does not contain investment advice or recommendations. Every investment and trading activity carries risks, and readers should conduct their own research when making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。