EigenLayer's proof of the need for Ethereum's security space ≠ monetization of Ethereum's security space.

Babylon's competitor is actually the BTC Spot ETF, which does not promise the same level of security and returns as off-chain.

After a year of intense scrutiny and sudden collapse, we have finally reached a consensus: the demand for BTC is simply the demand for BTC itself, which cannot be extended to BTC staking assets, BTC L2, and BTC-based DeFi.

Replicating Ethereum's Success and Failure

Babylon is not a new project; it has long struggled to secure funding and remains in the realm of academic research.

Solv is also not the original entrepreneurial direction; it emerged as a timely response after multiple directional adjustments, soaring to Binance.

Are Bitlayer/BEVM/Merlin and other BTC L2 projects considered new? One could say they have a 50% chance, as most were established around the same time as WBTC. The fact is, the paths that did not succeed have not witnessed miracles in their second attempts.

Even Runes did not replicate the miracle of inscriptions, ultimately leaving people disheartened, yet it is said that autumn is a pleasant season.

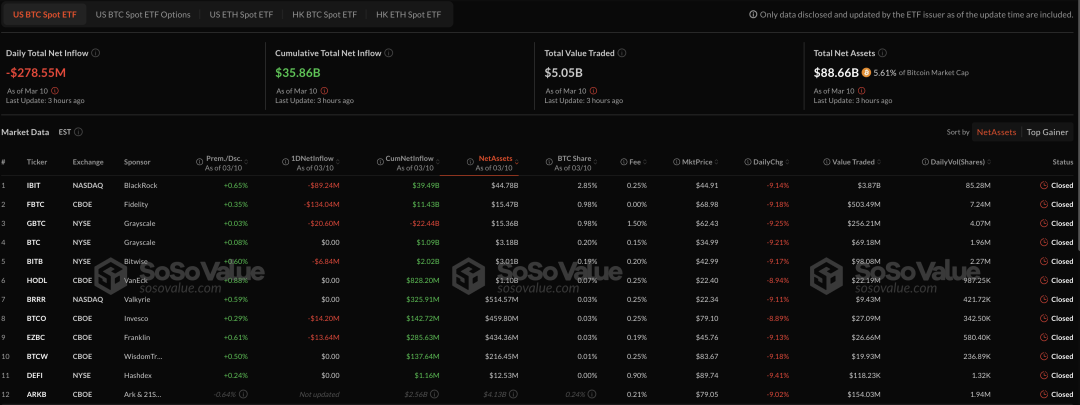

Image caption: BTC ETF image source: @sosovalue

In the Q1 2025 report, only the BTC Spot ETF succeeded. Aside from Bitcoin itself, the ETF is the most reliable investment tool, contrasting sharply with the ETH ETF, where the Ethereum on-chain ecosystem is flourishing while BTC off-chain transactions are booming.

It must be acknowledged that BTC does not need L2 and staking scenarios that reinvent the wheel; the absence of smart contracts is not a market space for Babylon but a necessary choice for robustness.

Although people currently mock Vitalik and Ethereum, most of the innovations from BTC and Solana are imitations and modifications of Ethereum. Solana takes DeFi and memes, while BTC adopts the staking system and income-generating scenarios, playing the role of digital gold in RWA.

However, Solana has at least achieved phased success, while BTC remains strong. An $80,000 drop is painful, and a SOL starting with 100 is even more distressing, especially with the phase of BTCFi being discredited.

ETH L2 is not a failure; it has at least nurtured successors like Base. The failure of price does not equate to a lack of practical scenarios, but BTCFi's staking layer, L2, and DeFi only face failure and further failure.

In summary, BTCFi has not replicated Ethereum's success but rather followed the entirety of Ethereum's failures.

The Pain of Mainnet Security Monetization

As mentioned earlier, Eigenlayer aims to monetize Ethereum's security space, subsequently splitting it into segments to rent out to projects with security needs. Essentially, Eigenlayer does not provide security; it merely acts as a mover of security.

Why can't this model be transferred to other public chains?

Products like LSD/LRT, memes, and DEX can all be learned from various public chains without showing signs of incompatibility, yet BTC cannot be replicated?

In fact, each chain tends to favor one model: asset issuance products, regardless of whether their outer packaging is L2 or a staking/re-staking system.

If everyone has a favorable view of the SVM L2 track, we can predict in advance that a Solana with a market cap of $100 billion cannot support suburban economics; Beijing needs a sub-center, while Tongliao clearly does not.

BTC is similar; the trillion-dollar Bitcoin ecosystem has only one product, which is BTC itself. If it relies on BTC for some marginal arbitrage, like WBTC and ETFs, it will enhance BTC's market value and gain market recognition and rewards.

However, stepping over the line, hoping to transfer BTC's value to its own token, will face an age-old dilemma: how to get people to exchange their big pie for your token, a challenge even harder than getting people to exchange USDT for USDD.

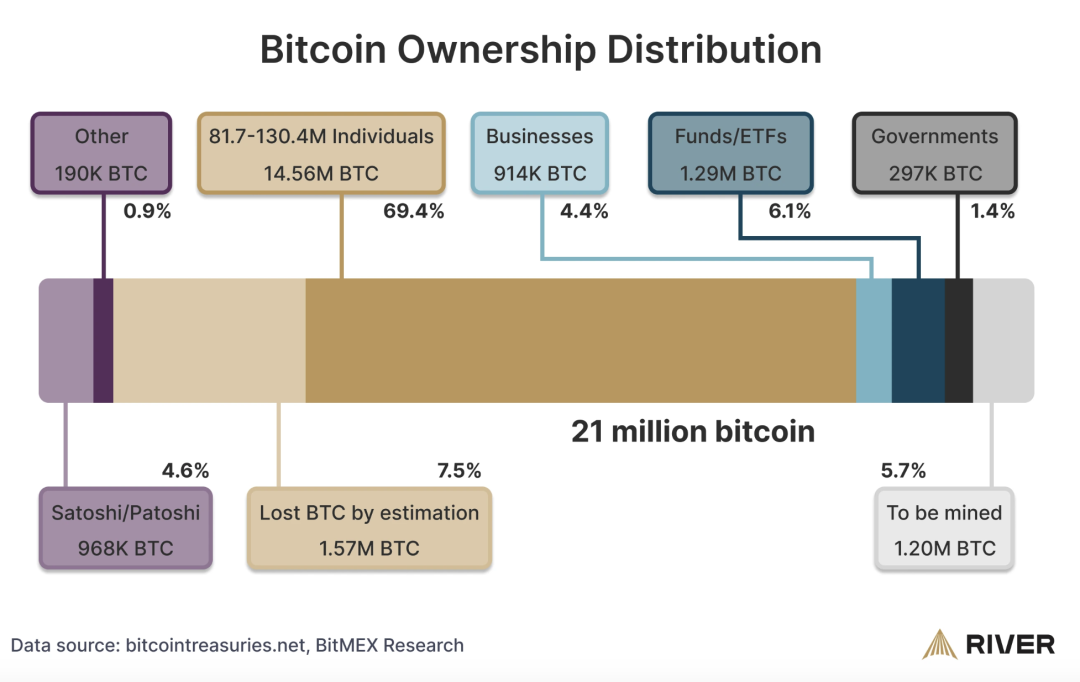

Image caption: BTC holder distribution image source: River.com

Various BTC staking protocols are thriving, but the majority of BTC is held by exchanges and asset management companies globally. The BTC on-chain staking system is merely a term and is hard to be considered a reality.

Ultimately, the Bitcoin staking system cannot equate to the sense of security derived from holding BTC. If the staking system cannot be established, then BTC L2 and BTC DeFi cannot be established either.

Two Dragons Do Not Meet

ETH L1 is congested, leading to large-scale L2 infrastructure, ultimately being exploited by Pump Fun; this is the entirety of the past six months' stories in the crypto world.

Recently, if it weren't for BTC L2 starting to hype up before issuing tokens, the fast-paced crypto community might have forgotten this ancient memory. In my personal view, the only winner is Merlin Chain's rapid token issuance and long-term operation.

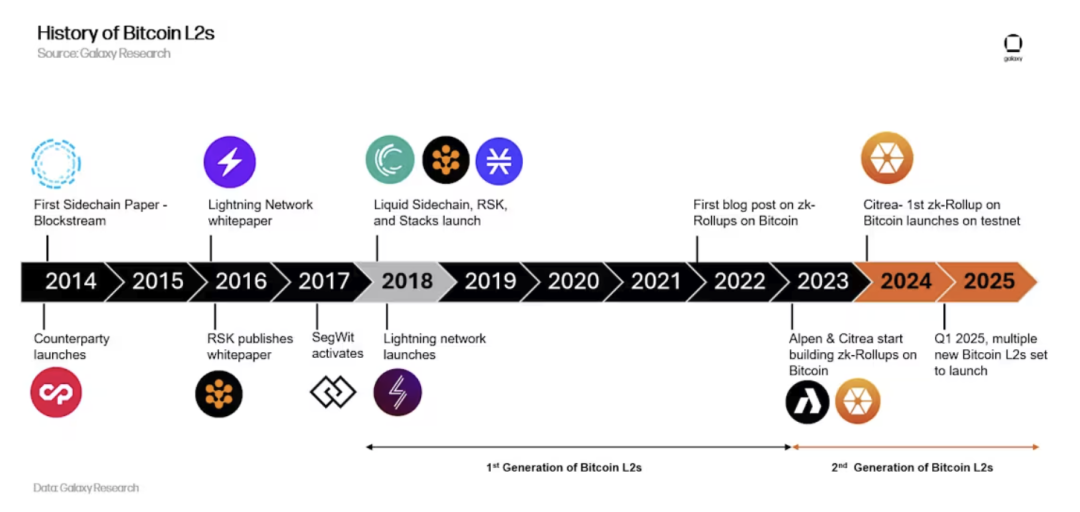

Image caption: History of BTC L2 development image source: Galaxy Research

The earlier the token is issued, the more it damages reputation; the later it is issued, the harder it is to control. If it is destined to be scolded by retail investors, it is better to choose a more profitable method; this is the entirety of the past year's BTC L2 story.

Comparatively, ETH itself needs L2 to share the traffic; the current game is merely a fiscal relationship adjustment between central and local authorities. The EVM ecosystem's weakness is not significantly related to L2s; even if Ethereum collects more taxes from L2s, retail investors will not return to the EVM ecosystem.

The same goes for SVM L2; Pump Fun is at the end of its profit curve, and the chosen way to extend its life is to seize the cash flow of AMM DEX. If it were in the Ethereum ecosystem, it would likely lead to the emergence of Pump Fun Chain.

BTC L2 is the most awkward; compared to the support and guidance from Vitalik and the Ethereum Foundation, BTC L2's technical solutions are chaotic and disordered. There are those who awkwardly imitate the ZK/OP route, those who focus on patching existing opcodes, and reformists who want to add completion functions to Bitcoin scripts.

In contrast to the decentralization of SVM L2, BTC L2 appears to have a heavier "project team + VC" flavor. After all, the co-founder of the public chain, Anatoly, and the Solana Foundation's attitude towards SVM L2 is "not supportive, not opposed, not encouraging, not rejecting." It is unexpected that Solana, long referred to as a machine room chain, is the true OG in the crypto world that implements the concept of decentralization.

Thus, living this way for 365 days, until entering the post-VC, post-market-making era of listing nodes, amidst the confusion and shock of the onlookers, BTC L2 announced their airdrop plans and tokenomics.

Only BTC itself chooses to ignore these disturbances; whether it is $80,000 or $1, digital gold or savior of US Treasuries, it is all external to me.

Conclusion

Since the birth of BTC, people have developed a vast industry around wallets, mining, and asset wrapping, laying the foundation for the Ethereum ecosystem. Even Vitalik himself was a seed nurtured by Bitcoin Magazine.

However, BTC is too unique. Compared to the many competing products that need to face mass adoption and externalities, Bitcoin itself lacks a leading figure and does not need to navigate the political system like its successors, such as Movement.

Just like the intrinsic mechanisms of AI, this absurd world lacks explainability. BTC chooses not to explain, while BTCFi hopes to explore new paths, but results have proven that the old paths are more robust.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。