CME Futures Market Premium Shrinks Significantly, ETH/BTC Exchange Rate Drops to New Low Since June 2020

Macro Interpretation: When U.S. Secretary of Commerce Gina Raimondo firmly stated on camera that "it is worth it even if tariffs lead to a recession," global markets seemed to hear a thunderclap. This seemingly contradictory rhetoric actually reveals the deep game of the current economic landscape, where the collision of Trump's tariff stick and Biden's policy legacy is quietly brewing a new breakout situation in the crypto market. Interestingly, the dramatic nature of this policy struggle is comparable to the famous "pizza incident" in the crypto community, except this time the stakes have changed to the future direction of the entire global economy.

The Federal Reserve's interest rate cut expectations are becoming an invisible thread pulling the market. According to QCP Capital, market expectations for rate cuts in 2024 have surged from one at the beginning of the year to four, and this dramatic shift is backed by futures traders betting real money on a recession script. The premium on two-year U.S. Treasury call options has soared to its highest level since last September, resembling a real-life sequel to "The Big Short." Tickmill's analysis warns that the upcoming CPI data could become the "Schrödinger's cat box" that ignites yields; whether inflation rises or cools could cause U.S. Treasury yields to suddenly enter "frenzy mode," much like the volatility in the crypto market.

In this macro storm, Bitcoin has shown surprising resilience. LMAX Digital analysis points out that despite price corrections, the support in the $69,000-$74,000 range acts like the "Maginot Line" of the crypto world, with technical indicators quietly building a bottom. The dissipation of the "Trump premium" in the CME futures market is even more enlightening: as the price difference between the next month and near-month contracts shrank from a peak of $1,705 to $490, the market has declared the retreat of the "presidential effect" with real money. This return to value is reminiscent of the market reaction when Satoshi Nakamoto disappeared—after the noise, the fundamentals once again dominate the narrative.

The glimmer of light in the fog of regulation is also worth pondering. The SEC has postponed the approval of mainstream crypto ETFs to May, a "dragging tactic" that recalls the long journey of Bitcoin ETFs. However, the prophecy of "Cathie Wood" injects a strong dose of optimism into the market: as the Gary Gensler era comes to an end, Washington's "digital asset revolution" may be more intense than expected. This subtle shift in regulatory attitude coincides with Ansem's proposed "Golden Age of Builders"—when the market enters a cooling period, it is the perfect time for DeFi protocols to break through and seize ecological high ground.

Interestingly, the market is playing out a "Game of Ice and Fire." On one side, there is a capital exodus with GBTC selling 641 BTC in a single day, while on the other side, institutional investors are persistently maintaining futures premiums in the CME futures market. This divergence reflects the cognitive dissonance among market participants: traditional capital is still interpreting crypto assets through old paradigms, while smart money has begun to position itself for a value reassessment in the post-halving era. Although Wood's rhapsody about 7.3% GDP growth has faced skepticism, the trend of technological integration she reveals—the "trinity" evolution of AI, blockchain, and genetic technology—may be brewing a productivity leap comparable to the internet revolution.

The crypto market is undergoing the most philosophically significant questioning: as the traditional financial system wobbles on the tightrope of tariff wars and monetary policy, can Bitcoin make the daring leap from a risk asset to "digital gold"? The answer may lie in the contango structure of the CME futures curve—this futures-spot structure suggests that the current adjustment is more about clearing spot leverage rather than a systemic collapse. Just as DeFi, born after the winter of 2018, exploded in 2020-2021, the current market cooling may be nurturing more disruptive innovations.

In this collision of the global economy and crypto civilization, savvy investors have begun to hedge risks with "recession options." Ansem's notion of the "best era for builders" is essentially an innovative Darwinism under the capital winter—only protocols that truly create value can traverse cycles. When the expectations of Fed rate cuts resonate with regulatory easing, the crypto market may welcome a narrative revolution even more grandiose than in 2017. After all, as the traditional financial system begins to doubt its resilience, the anti-fragile system designed by Satoshi Nakamoto is quietly waiting for its historical moment.

BTC Data Analysis:

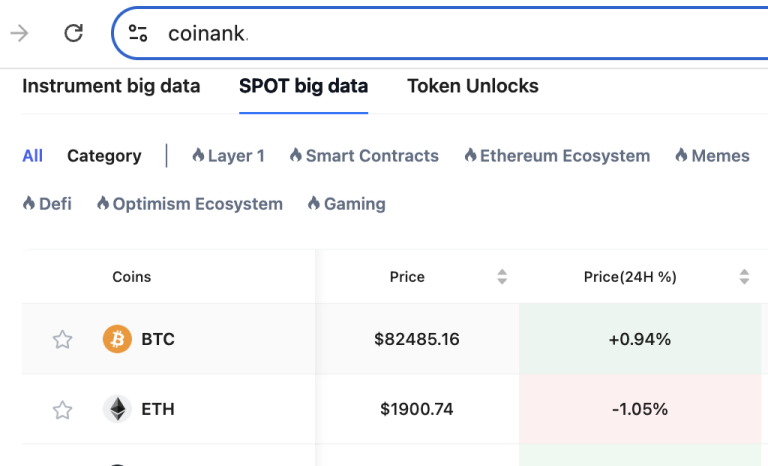

According to the latest market data from Coinank, the ETH/BTC exchange rate has dropped to 0.022676, down 3.71% in 24 hours, marking a new low since June 2020.

We believe that the drop in the ETH/BTC exchange rate to a new low since June 2020 reveals the deep challenges facing the Ethereum ecosystem and the reconstruction of capital preferences. In terms of short-term liquidity squeeze, the accelerated balance sheet reduction by the Federal Reserve, combined with rising geopolitical risks, has prompted funds to concentrate from high-beta assets to safer assets like Bitcoin. The funding rate for ETH perpetual contracts in the derivatives market remains negative (-0.15%), while Bitcoin maintains a neutral stance, indicating that hedge funds are arbitraging by shorting ETH/BTC.

The differentiation of ecological narratives is the core driving force: the institutional capital accumulation in Bitcoin spot ETFs (holding over 6%) reinforces its "digital gold" status, while the delay in Ethereum spot ETF approvals, the decline in staking yields (from 5.2% to 3.8%), and the competitive pressure from L2 solutions weaken the capital attractiveness of its "world computer" narrative. On-chain data shows that the median Ethereum gas fee has dropped to 5 gwei (compared to 150 gwei during the same period in 2020), indicating a decline in ecological activity and exposing weak value support.

The structural selling pressure transmission is also significant, with on-chain whales like James Fickel continuously reducing their ETH holdings in exchange for WBTC, having sold a total of 43,600 ETH (approximately $118 million) over the past two months, exacerbating market expectations of a collapse in confidence in ETH. Additionally, the SOL/ETH exchange rate has reached an all-time high, diverting funds towards high-growth competitive public chains and further weakening ETH's capital siphoning ability.

Historical cycle warnings: The current exchange rate level is similar to that of June 2020, but at that time it was on the eve of the DeFi explosion, while the current Ethereum ecosystem lacks equivalent innovative catalysts. If the exchange rate falls below the historical support level of 0.02275, it may trigger programmatic selling, forming a negative feedback loop. Future reversals will depend on two key variables: first, Ethereum must rebuild ecological barriers through technological upgrades such as account abstraction and parallel EVM; second, macro liquidity improvements must drive a rebound in capital risk appetite. The current price level may enter a long-term allocation window, but a trend reversal still requires multiple signals to resonate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。