Author: Scof, ChainCatcher

Editor: TB, ChainCatcher

Today, a whale with 50x leverage on Hyperliquid re-entered the market, opening a long position of approximately $300 million in ETH, with a peak floating profit of $8 million. However, he quickly withdrew most of the principal and profits, actively compressing the liquidation price, ultimately leading to the liquidation of 160,234.18 ETH (total value of $306 million), leaving the market with a "regretful" $1.8 million USDC.

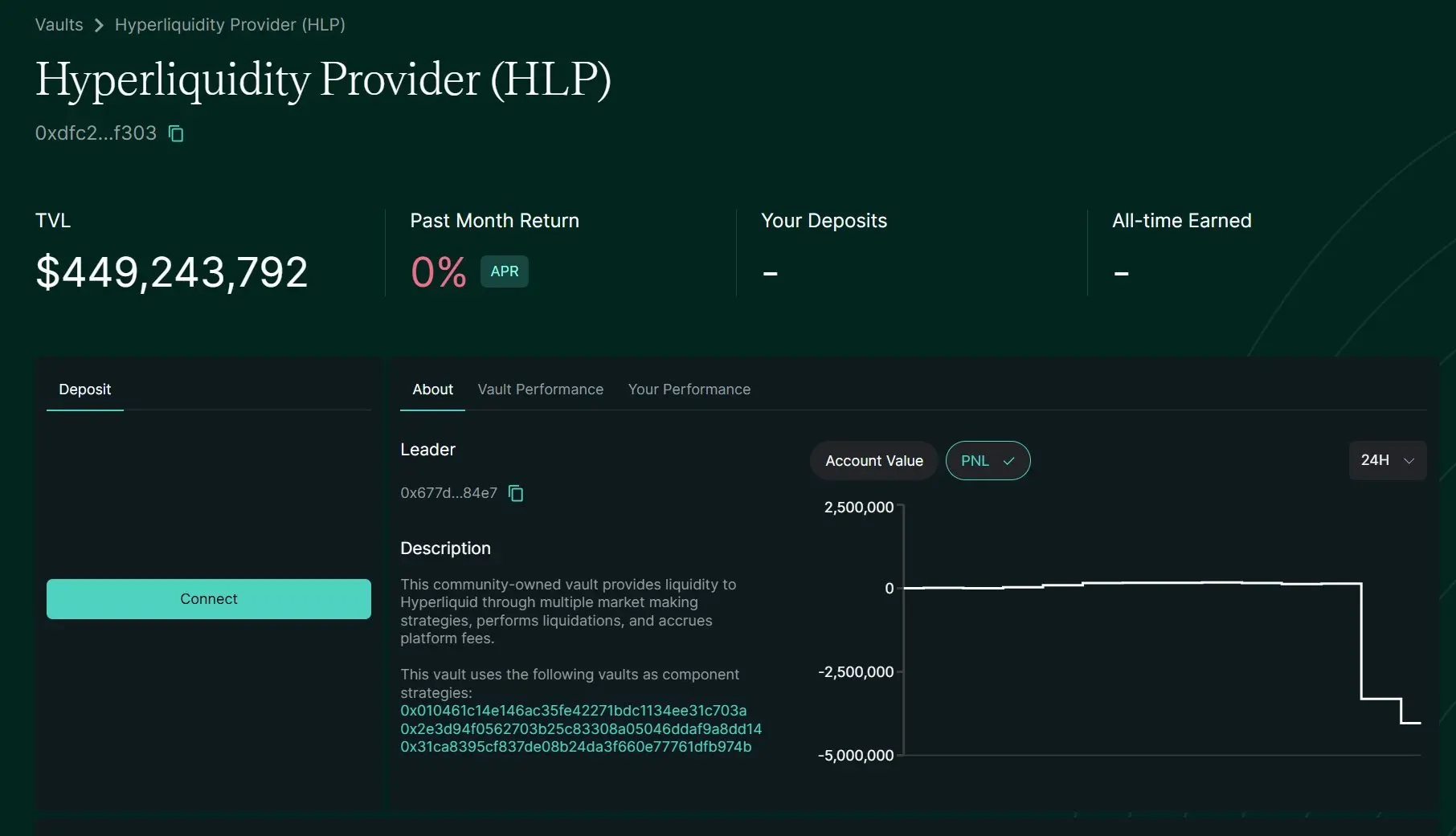

In contrast to the whale's profits, Hyperliquid's HLP insurance fund suffered significant losses during this event. According to official data from Hyperliquid, the HLP lost approximately $4 million within 24 hours to cover the losses caused by the massive liquidation of this position.

Using Stress Testing to Exploit Exchange Profits

Before this highly publicized operation, the whale had achieved a remarkable record of four wins in four battles:

- March 2 - Long BTC and ETH with 50x leverage, earning $6.83 million within 24 hours.

- March 3 - Short BTC with 50x leverage before the US stock market opened, accurately capturing the market downturn, profiting $300,000.

- March 10 - Changed direction, long ETH with 50x leverage, quickly earning $2.15 million in just 40 minutes.

- March 11 - Long ETH with 50x leverage in an extreme two minutes, making a small profit of $5,000, but the holding time was very short, suspected to be a market test.

However, this time, the profit method was different from the previous precise openings; it was through stress testing to exploit the exchange's profits. The basic steps were as follows:

Step 1: High Leverage to Raise Position and Price:

First, using 50x high leverage, a massive long position was established in a short time, leveraging a relatively small amount of capital to move a huge market position. Essentially, by continuously increasing the position and injecting funds, the market was guided in a direction favorable to the whale, laying the foundation for subsequent arbitrage.

Step 2: Extract Profits Decisively at High Levels When Floating Profits Occur:

When the position showed significant floating profits, the whale decisively converted the floating profits into realized profits—by withdrawing the profit portion from the margin and even the principal, removing these funds from the exchange's risk. This act effectively "locked in" the profits without closing the position. After the account assets significantly decreased, the risk rate of the remaining position soared, pushing the liquidation price closer to the current price.

Step 3: Actively Trigger Liquidation to Transfer Losses:

Finally, the whale chose not to close the position himself but to let the platform's forced liquidation mechanism take over the position. Since Hyperliquid's HLP insurance fund would take on the position at the liquidation price, the whale effectively sold the remaining position at the liquidation price without worrying about slippage losses caused by market sell pressure, and these losses were ultimately borne by the HLP fund.

However, the community clearly does not believe that such a whale would only accept $1.8 million in profits.

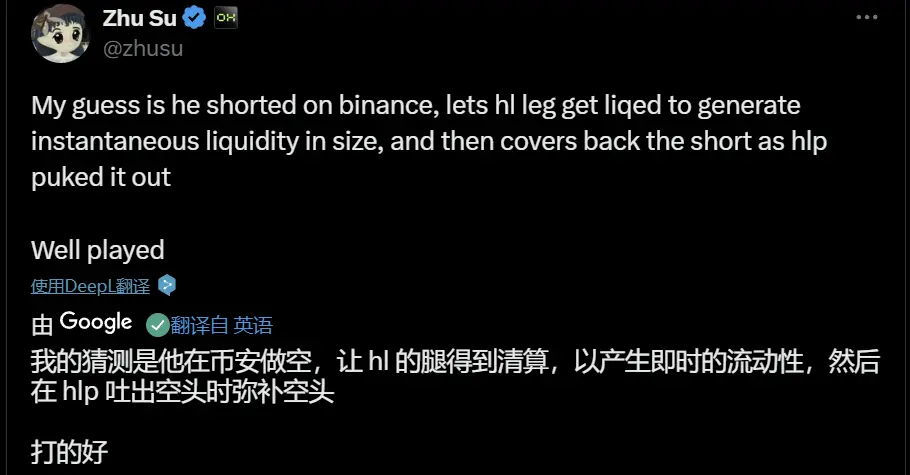

According to speculation from Zhu Su, founder of Three Arrows Capital, the whale opened a position on-chain while simultaneously opening a large short position on a centralized exchange (CEX), triggering ETH price through on-chain liquidation to create instant liquidity for profit.

Crypto KOL @CryptoApprenti1 even directly stated that this address was using wash trading for money laundering, reminding the community not to "blindly follow."

Analysis of Hyperliquid's "Vulnerability" Mechanism

Since the incident, the most discussed question in the community has been: how did this whale complete the "self-explosive profit" trading operation? How did Hyperliquid's contract mechanism allow for such exploitation?

1. No Position Limit, Leverage Can Be Amplified Indefinitely

Before this incident, Hyperliquid had no restrictions on position size, only imposing constraints on the order amount for market orders.

This means that theoretically, as long as the account funds are sufficient, users can continuously expand their position size through high leverage, even manipulating market sentiment in a short time. The whale took advantage of this, continuously increasing the position size in a short time, rapidly pushing the position value to $300 million, creating a market FOMO effect.

2. The Uniqueness of the HLP Mechanism: Active Market Making vs. Passive Counterparty

Compared to GMX's GLP, which adopts a passive counterparty strategy, Hyperliquid's HLP is actively market-made by the platform, profiting through market-making spreads, funding fees, and liquidations.

This model operates stably under normal market conditions, but when a single account's position size is too large and highly concentrated, the liquidity of the HLP bears immense pressure. The whale exploited this loophole of no position limit, rapidly building an oversized position, causing the platform's liquidity to lag behind trading demand, ultimately resulting in extreme market volatility.

3. Oracle Price Mechanism vs. Traditional Matching System

Hyperliquid's contract prices use the marked prices provided by oracles, rather than determining prices through gradually matching market orders like centralized exchanges. This brings two key issues:

- Inability to rely on order book depth to buffer large trades—In CEX, large market orders need to sequentially consume limit orders, leading to slippage, while Hyperliquid's prices are calculated by oracles, allowing the whale to build positions directly at this price, unaffected by market depth.

- High leverage accelerates market price fluctuations—Since the liquidation mechanism is also based on oracle prices, when the whale holds a high-leverage position, even slight market fluctuations can quickly trigger liquidation, creating a chain reaction that further exacerbates market turmoil.

4. Bug in the Liquidation Mechanism: Self-Explosive Liquidation Transfers Losses to the Platform

After floating profits, the whale chose to withdraw most of the principal and profits, actively pushing up the liquidation price, making the remaining position highly susceptible to triggering liquidation.

Once liquidation occurs, the HLP must take on the position at the liquidation price, resulting in some losses being transferred to the platform. In this model, the whale effectively arbitrages using the platform's mechanism, obtaining substantial profits in the early stages and ultimately offloading the final losses onto the platform and remaining liquidity providers.

Where Do On-Chain Derivatives Exchanges Go from Here?

The Hyperliquid incident undoubtedly exposed the systemic risks of on-chain derivatives exchanges in a high-leverage environment.

While decentralized exchanges provide a permissionless and transparent trading environment, allowing users to trade with leverage freely, the existing mechanisms also give whales the opportunity to manipulate the market. The combination of high leverage and oracle pricing not only allows whales to leverage the market but may also transfer the final losses to the platform and liquidity providers.

After this turmoil, although Hyperliquid has adjusted its rules, it currently seems to be a stopgap measure that does not address the fundamental issues.

We can't help but ask, can active market-making models like HLP really counter whale strategies? Or does the future liquidity provision model need a complete overhaul, introducing stronger risk hedging mechanisms?

How to better balance safety risk control mechanisms with the advantages brought by decentralization may be the real problem that "Hyperliquids" need to solve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。