Today's homework is easier to write. Once we make a judgment on whether the trend is a reversal or a rebound, our mindset can become more peaceful, especially when there are clear reasons for a decline. The judgment between a rebound and a reversal becomes easier. If the reasons for the decline have been resolved, then a reversal will occur; if not, it will be a rebound. Moreover, the rebound is likely to continue transforming into fluctuations until the issue is resolved or ignored.

This principle applies to both cryptocurrencies and U.S. stocks right now. The day before yesterday, it was mentioned that when the VIX broke 30, it was an opportunity to buy the dip. Although it has been very close to 30 for two consecutive days, today we indeed saw a rebound. On one hand, the decline was too steep, and on the other hand, there were political positives, such as Ukraine agreeing to a 30-day ceasefire yesterday and the two parties reaching a preliminary agreement on a temporary budget today. The CPI data was better than expected, all of which provided the market with a breather.

But whether this is a rebound or a reversal is something for everyone to judge. However, another piece of information today that contributed to the rise in #Bitcoin prices is that #Binance has invested in MGX. I tweeted from different angles about MGX having a $30 billion fund specifically for investing in AI and data centers, with partners including BlackRock and Microsoft. MGX's investors include Mubadala, which was the first sovereign fund to announce indirect holdings of $BTC ($IBIT).

This also gave the market a shot in the arm, slightly stabilizing the cryptocurrency market, but we still need to assess whether these developments can lead to a reversal.

Looking back at BTC's own data, today's turnover rate has started to decline, and the VIX in U.S. stocks is also falling, indicating that market panic is gradually reversing, but it has not completely ended yet. Both the turnover rate and the VIX are still at relatively high levels.

I just took a look at the CME's BTC price, and there is less than $150 left to fill the last short-term gap. If the sentiment remains good and there are no new negative data, it should be filled tomorrow. Today's closing in U.S. stocks was quite good, with the Nasdaq index rising by 1.13% and the S&P 500 rising by 0.49%. After the U.S. stock market closes, I hope there won't be any surprises.

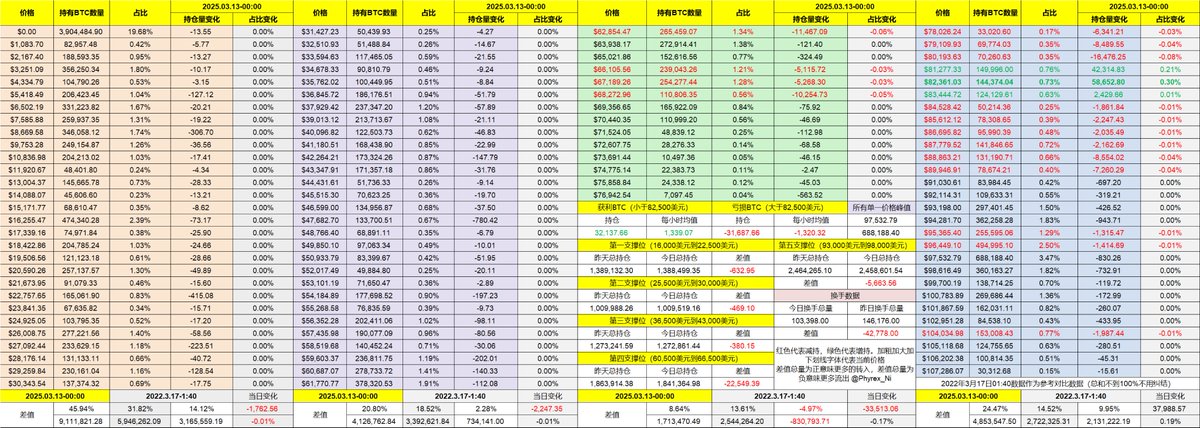

Although the price performance has not been great recently, the dense chip area between $93,000 and $98,000 has not shown signs of collapse. The number of investors leaving this part is decreasing. I was discussing this topic with friends today because some loss-making investors have passively become long-term holders, so the price decline will not lead more of these investors to surrender.

While there may be some pressure when returning to $95,000, the impact on the price before that is still mainly from ultra-short-term investors, as can be seen from the turnover data.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。