The Altcoin Index Hits a New Low Since Last September, Replaying the BTC Bloodsucking Market, with Crypto Market Trading Volume Down Nearly Threefold from Its Peak

Macro Interpretation: Today, we see Goldman Sachs analyzing that U.S. stocks may continue to underperform overseas markets. This macro-level unease hangs over the entire risk asset market like the Sword of Damocles. Interestingly, while traditional markets are teetering on the seesaw of economic growth and inflation concerns, crypto funds are staging a mass exodus, with Bitcoin's market cap share increasing. We will discuss this in conjunction with the altcoin index shortly.

The Federal Reserve's monetary policy dance is becoming increasingly perplexing. The chief economist at BMI observes that although March's inflation data has receded, commodity prices may rise again due to the return of tariff policies from the Trump era. This "inflation boomerang" effect has thrown market expectations into chaos. Russell Investments bluntly states that the U.S. economy's fundamentals are as robust as a fitness coach, and there is no need to rush into interest rate cuts before May or June. Amid this policy fog, Bitcoin seems to have found a new narrative pivot—when the pricing logic of traditional assets is challenged, the safe-haven properties of digital gold are being revalued.

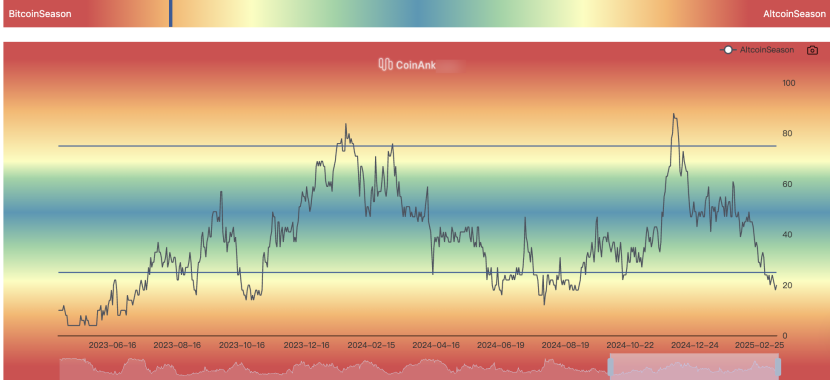

In the winter of altcoins, Coinank's Altcoin Season Index has dropped to an annual low of 13 points, marking a new low since September 2024. This cold number starkly announces that only 13 of the top 100 cryptocurrencies have outperformed Bitcoin, and the market is witnessing a spectacle of "all coins returning to one."

DeFiance Capital points out that the "Fat Protocol Theory" has entered its final chapter, with infrastructure projects valued at a thousand times their income, akin to meteors wearing the emperor's new clothes, rapidly falling under the pull of reality. This structural shift has made the market realize that the blockchain world may not need so many flashy infrastructures but rather applications that genuinely create value.

The technical aspect of the ETH/BTC exchange rate is akin to a horror movie, with the RSI value hitting a historic low. More critically, there is a fundamental crisis—Solana has completed a reversal against Ethereum in DEX trading volume, and this "new wave pushing the old wave" scenario has worsened ETH's situation. When VanEck shows that the spot Bitcoin ETF has siphoned off $129 billion in liquidity, we seem to see the market voting with its feet: in times of uncertainty, investors prefer the blunt instrument of Bitcoin over the flashy moves of altcoins.

Interestingly, the surge in USDT wallet activity is like fireflies in the dark, hinting at the lurking interest of off-exchange funds. Coupled with a 2.8% drop in core CPI, this "ammunition accumulation" phenomenon resonates subtly with the Fed's potential policy shift. Like the calm before the storm, the market is waiting for the March 18 FOMC meeting to unveil the mystery—will it be a "hawkish comeback" or a "dovish delaying tactic"? This monetary policy game will be a key variable in determining the direction of risk assets.

Bitcoin's own technical aspect is equally gripping. Matthew Hyland has delineated the $89,000 line of life and death, which serves as both a dividing line for bulls and bears and a litmus test for market psychology. The number hides a mystery: if it can hold, it means the upward channel that started at $69,000 remains valid; if it fails, it could trigger a "long squeeze" chain reaction. Notably, Coinank data shows that Ethereum is facing record sell-offs, and this "abandoning the car to save the emperor" migration of funds may actually become a booster for Bitcoin.

The crypto market is experiencing the growing pains of value return. As speculative bubbles are popped one by one and macro fog envelops the landscape, Bitcoin unexpectedly finds itself in the role of the "hero in chaotic times." However, the market is always full of dark humor—just as analysts debate endlessly, on-chain data shows that whale addresses are quietly accumulating. This may confirm the old saying: when everyone is focused on the charts, the real players have already laid their plans in the shadows. In the future crypto landscape, whether Bitcoin can maintain its throne may lie hidden in the current seemingly chaotic yet logically coherent market pulse.

In this smoke-free capital war, Bitcoin is demonstrating a hardcore narrative of "you are still you." While altcoins tremble in the cold, the luster of digital gold is becoming increasingly radiant in the furnace of macro tightening—after all, in the game of survival, liquidity is king, and Bitcoin remains the fiercest predator in this jungle.

Data Analysis:

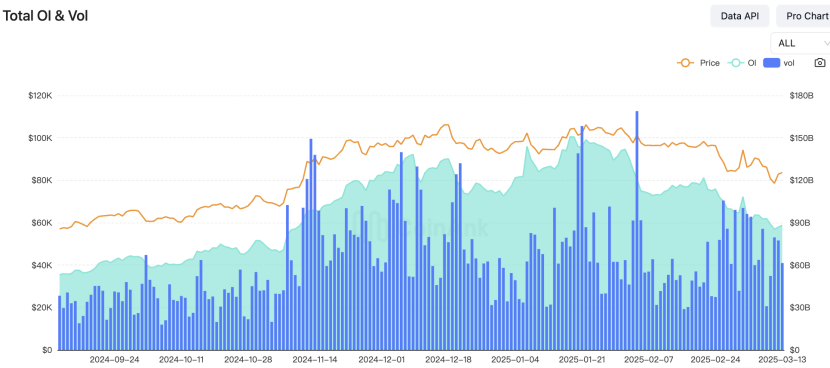

Coinank data shows that the daily trading volume in the crypto market has dropped from a peak of $563 billion on February 4 to just $200 billion currently. #BTC has also seen a significant decline. Recently, the trading volume in the crypto market has continued to decrease since February 26, and prices still face the risk of further declines.

We believe that the current volume-price relationship in the crypto market has triggered structural risks. Since the end of February, the total trading volume in the market has shrunk by over 60%, and it has decreased threefold from the trading volume at the beginning of February. This liquidity contraction shows a significant negative correlation with investor sentiment. From a behavioral finance perspective, the continuous decline in trading volume is not merely a technical adjustment but a tangible manifestation of a collective shift in market participants' expectations.

The synchronized wait-and-see stance of institutional investors and retail investors creates dual pressure. On one hand, institutional funds are more inclined to hold and observe in the absence of clear fundamental support, leading to a lack of large buy orders in the market; on the other hand, after the FOMO sentiment among retail investors fades, risk preferences return to a rational range, making it difficult for any price rebound to achieve sustained breakthroughs due to this collective cautious attitude.

It is worth noting that the market is at potential risk of falling into a liquidity trap. When price volatility and trading volume show an inverse relationship, it often indicates that the market has entered a stalemate phase in the bull-bear battle. Historical cycles show that this volume-price divergence usually requires a significant catalyst (such as a breakthrough in regulatory policy or the application of technological innovation) to break the equilibrium; otherwise, it may evolve into a low-volatility downward trend.

Research models indicate that the current market recovery requires a positive resonance between volume and price. If there is no effective increase in trading volume in the next two weeks, even if there is a technical rebound in prices in the short term, its sustainability will be questioned. Investors are advised to pay close attention to on-chain large transfer data and changes in derivatives market positions, as these leading indicators may provide key validation for trend reversals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。