Author: Castle Labs

Compiled by: Felix, PANews

The last two months have been one of the most challenging periods in the crypto space, with players exiting and liquidity becoming the scarcest commodity in the field.

Similarly, individual ecosystems are facing growth challenges, but Sonic has been fighting through this "bloody slaughter."

From Fantom to Sonic

From a technical perspective, the transition from Fantom to Sonic has made the chain one of the best-performing EVM L1s, featuring:

- 10,000 TPS

- Sub-second finality

- Solidity/Vyper support

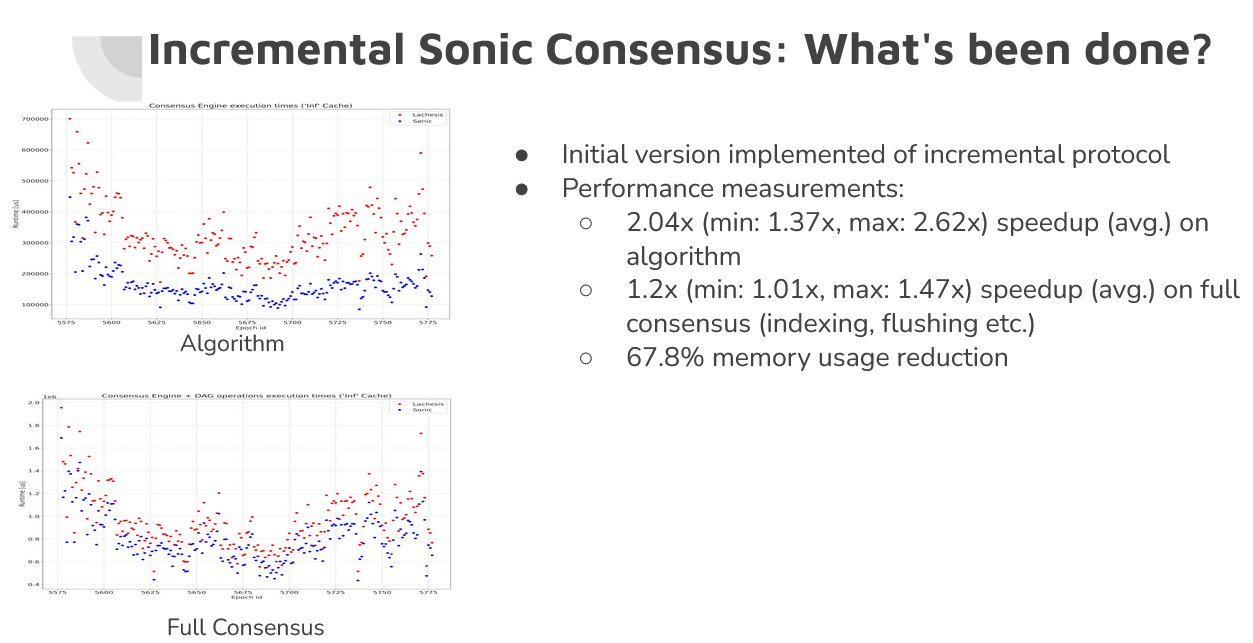

Thanks to incremental Sonic consensus, these features are continuously improving rapidly: average speed will increase by 2.04 times, and memory usage will decrease by 67.8%.

In addition, several incentive programs help solidify the community and attract new developers and users:

- FeeM (Fee Monetization): Applications can earn 90% of the fees they generate

- Innovators Fund: $200 million to support applications and drive new initiatives

- Airdrop: Approximately $200 million to reward users

Ecosystem Updates

TVL Growth: Among the top 25 chains by TVL, only three chains saw an increase last month, with Sonic showing the largest growth.

Source: DeFiLlama

FeeM: Over 900,000 $S tokens, worth over $500,000, have been allocated to projects generating fees on the network.

Evolving Ecosystem

Aave has deployed its lending market on the Sonic network. Users can borrow, supply, and earn incentives on Aave. Initial assets include $USDC, $WETH, and $wS. Additionally, Sonic and Aave are offering $15 million and $800,000 in incentives, respectively, to attract users. The new market reached its supply cap on the first day.

Llamaswap: DefiLlama has added Sonic Labs to its list of supported chains. Users can exchange tokens more efficiently using DefiLlama.

Trust Wallet has also announced the integration of Sonic (S), allowing users to manage assets on the Sonic chain within the wallet, including sending, receiving, and storing native S tokens and tokens issued based on Sonic.

Additionally, Jumper has launched on Sonic, allowing users to bridge tokens to Sonic through Jumper.

Native Projects

Shadow Exchange: Shadow Exchange is a DEX platform that adopts the popular (3,3) model from the last cycle, allowing users to earn above-average APY returns in its pools. Shadow is also the 5th ranked DEX by revenue in the past 7 days.

Stream Finance: Stream Finance is a yield product that has seen its TVL grow from $0 to $25 million in 10 days, thanks to its treasury, where users can choose USDC pools with APY up to 25%.

SwapX: SwapX is a DEX built on Algebra and is the first modular AMM with a V4 plugin. Key features include:

- Algebra Integral as the main engine

- Support for modular upgrades, adding new features without disrupting liquidity while retaining user self-custody.

- VE(3,3) token model

Hand of God: Hand of God is an AI-driven DeFi protocol inspired by the original Tomb Finance model, optimizing governance through real-time data analysis. Its current TVL is approximately $19 million.

Eggs Finance: Eggs Finance is a DeFi protocol where users can mint $EGGS using $S, use $EGGS as collateral to borrow more $S, and maximize leverage strategies.

Related: What other wealth codes are worth paying attention to in the Sonic ecosystem?

Metropolis: Metropolis is a DEX powered by DLMM, combining AMM and order book features for zero slippage trading and high APY returns.

Related: After a glamorous renaming, a comprehensive overview of the latest status of the Sonic ecosystem

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。